Using the most recent returns and fund update reports from December 2021, we will examine Westpac’s recent KiwiSaver Performance.

Westpac KiwiSaver Scheme is Australia’s oldest bank and company, one of four major banking organisations in Australia, and one of the largest banks in New Zealand. The Westpac’s investment funds are managed by BT Funds Management (NZ) Limited (BTNZ), including the Westpac KiwiSaver Scheme and Active Series, and have more than $15 billion in funds under management.

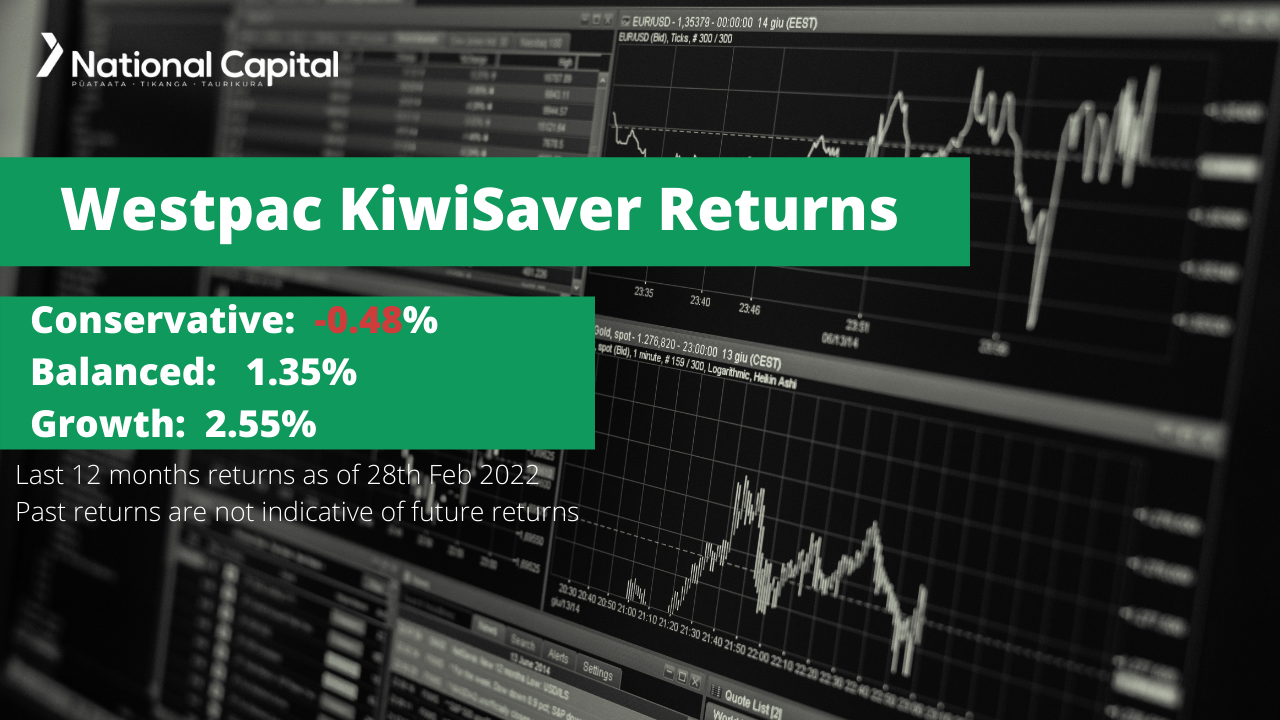

Most of the funds have had negative 3-month returns. This could be due to the surging number of Delta and Omicron cases in New Zealand. However, KiwiSaver investors shouldn’t worry as it’s normal for the market to fluctuate and doesn’t always indicate the fund’s performance in the long term.

Table of Contents

Performance of Westpac KiwiSaver Funds

News about Westpac

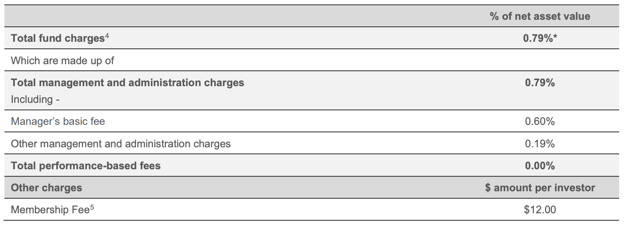

Westpac opt for a low flat rate charge of $12 per year, regardless of the funds you are investing in. From 28 September 2021, they removed the membership fees for all members. Westpac’s fees now range between 0.30% to 0.79%, which is slightly lower compared to the old range of 0.44% to 0.93%.

Performance of Westpac KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years |

5 years |

Since Inception |

|

|

Cash |

0.08% |

0.24% |

0.60% |

1.09% |

1.52% |

2.68% |

|

Conservative |

-0.99% |

-1.97% |

-0.48% |

3.39% |

3.99% |

4.66% |

|

Moderate |

-1.37% |

-2.61% |

0.27% |

4.71% |

5.16% |

5.45% |

|

Balanced |

-1.77% |

-3.47% |

1.35% |

6.48% |

6.79% |

5.92% |

|

Growth |

-2.05% |

-4.15% |

2.55% |

7.79% |

8.05% |

6.49% |

Sourced from Westpac fund performance report

*These returns are to 28th February 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Westpac Quarterly Fund updates published on 14th February 2022.

Westpac Cash Fund

Westpac Cash fund aims to provide stable returns over the short-term. This Fund invests in short-term income assets such as bank deposits, floating rate notes and money market securities. Volatility is to be the lowest of the funds in the Westpac scheme. The Cash Fund has had a 1-year return of 0.60% and 5-years return of 1.52%.

*The following is Sourced from Westpac Cash Fund Update

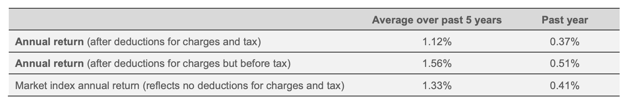

Returns

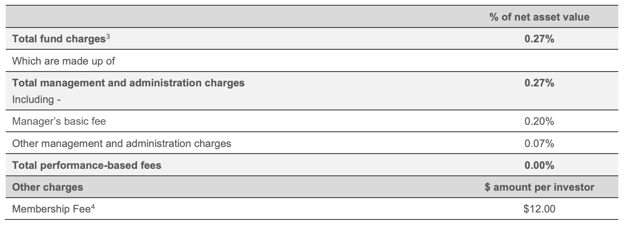

Fees

The total annual fees for investors in the Westpac Cash Fund are 0.27% per year. There are no longer any membership fees for Westpac funds.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

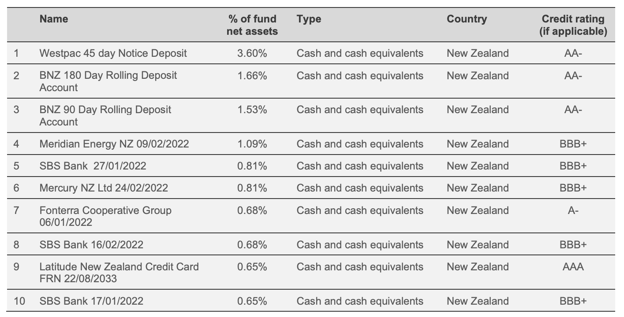

Top ten investments

This table shows Westpac’s top 10 investments in the Cash KiwiSaver Fund, which make up 12.16% of the fund.

Westpac Conservative Fund

Westpac Conservative Fund aims to provide stable returns over short to medium term. This Fund invests primarily in income assets but also has a 25% allocation to growth assets. The Conservative Fund has had a 1-year negative return (-0.48%) and 5-years return of 3.99%.

*The following is Sourced from Westpac Conservative Fund Update

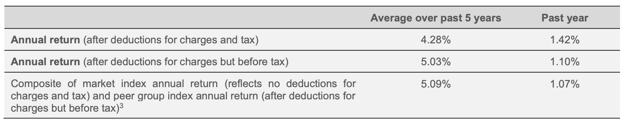

Returns

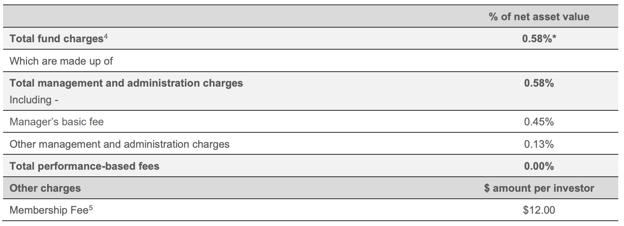

Fees

The total annual fees for investors in the Westpac Conservative Fund are 0.58% per year. There are no longer any membership fees for Westpac Funds.

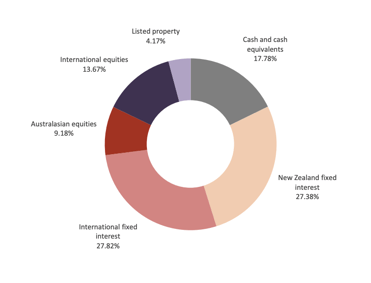

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows Westpac’s top 10 investments in the Conservative KiwiSaver Fund, which make up 7.56% of the fund.

Westpac Moderate Fund

Westpac Moderate Fund aims to provide moderate returns over medium term. This Fund has a higher benchmark allocation to income assets than to growth assets. Volatility is expected to be higher than the Conservative Fund but lower than the Balanced Fund in the Westpac scheme. The Moderate Fund has had a 1-year return of 0.27% and 5-years return of 5.16%

*The following is Sourced from Westpac Moderate Fund Update

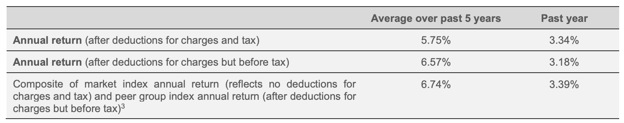

Returns

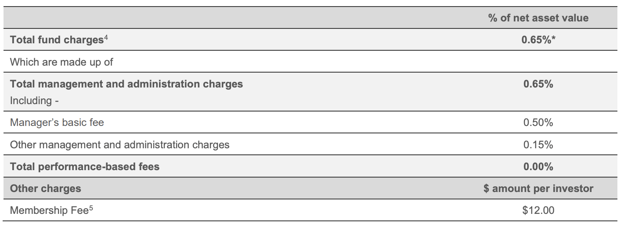

Fees

The total annual fees for investors in the Westpac Moderate Fund are 0.65% per year. There are no longer any membership fees for Westpac Funds.

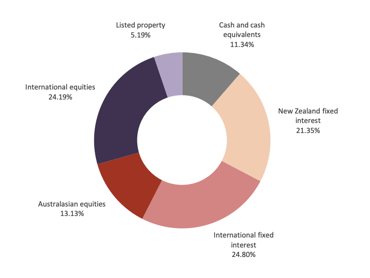

Investment mix

The investment mix shows the type of assets that the fund invests into.

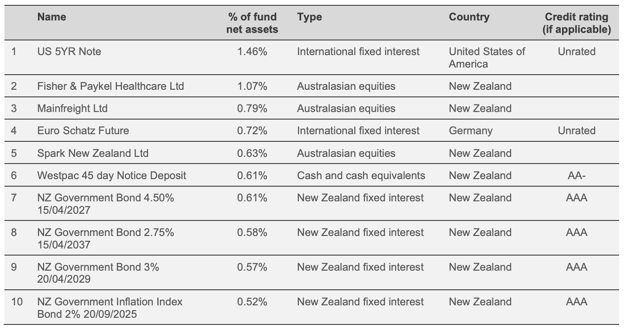

Top ten investments

This table shows Westpac’s top 10 investments in the Moderate KiwiSaver Fund, which make up 8.67% of the fund.

Westpac Balanced Fund

Westpac Balanced Fund aims to provide medium returns over the medium to long term. This Fund has a higher benchmark allocation to growth assets than to income assets. Volatility is expected to be higher than the Moderate Fund but lower than the Growth Fund in the Westpac Scheme. The Balanced Fund has had a 1-year return of 1.35% and 5-years return of 6.79% which is higher than the since inception return of 5.92%.

*The following is Sourced from Westpac Balanced Fund Update

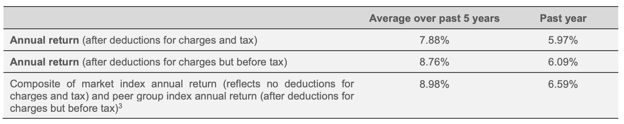

Returns

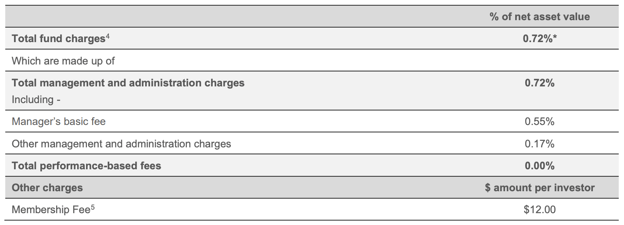

Fees

The total annual fees for investors in the Westpac Balanced Fund are 0.72% per year. There are no longer any membership fees for Westpac Funds.

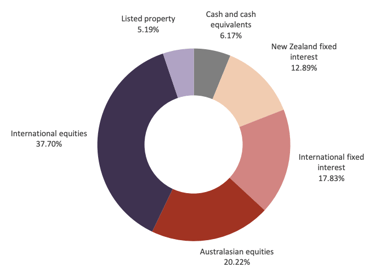

Investment mix

The investment mix shows the type of assets that the fund invests into.

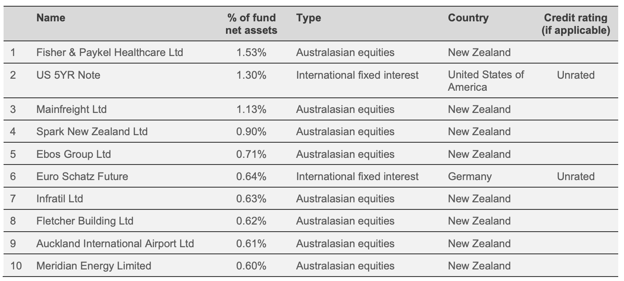

Top ten investments

This table shows Westpac’s top 10 investments in the Balanced KiwiSaver Fund, which make up 12.20% of the fund.

Westpac Growth Fund

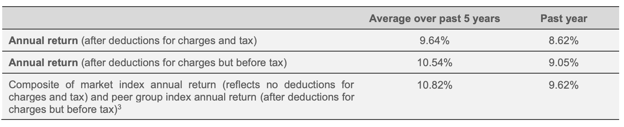

Westpac Growth Fund aims to provide higher returns over the long term. This Fund invests primarily in growth assets but also has an allocation to income assets. Volatility is to be the highest among funds in the Westpac KiwiSaver Scheme. The Growth Fund has had a 1-year return of 2.55% and 5-years return of 8.05% which is higher than the since inception return of 6.49%.

*The following is Sourced from Westpac Growth Fund Update

Returns

Fees

The total annual fees for investors in the Westpac Growth Fund are 0.79% per year. There are no longer any membership fees for Westpac Funds.

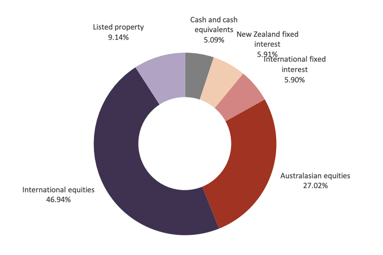

Investment mix

The investment mix shows the type of assets that the fund invests into.

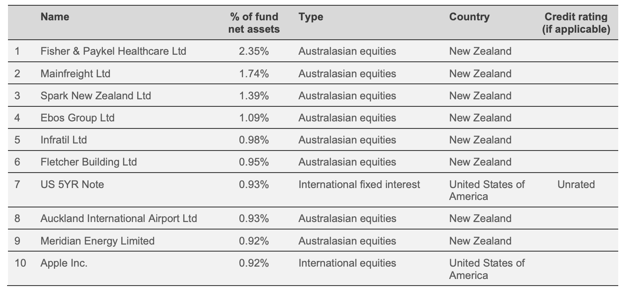

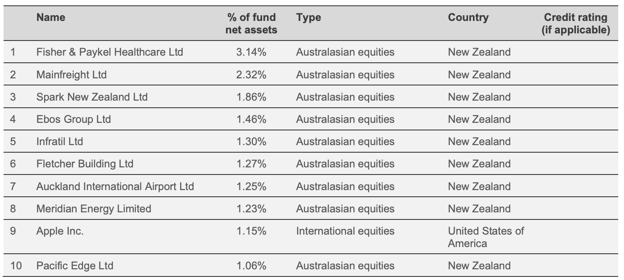

Top ten investments

This table shows Westpac’s top 10 investments in the Growth KiwiSaver Fund, which make up 16.04% of the fund.

Data for Westpac KiwiSaver funds has been sourced from Westpac KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Westpac has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.