Using the most recent returns and fund update reports from September 2023, we will examine Nikko AM’s recent KiwiSaver Performance.

Over NZD$8.08 billion in investments are actively managed by Nikko Asset Management. The company’s Auckland-based investment teams look after domestic assets, while our carefully chosen offshore managers look after international assets. In 1994, Norwich Union Fund Management was established in New Zealand, which was the beginning of the company’s journey. One of the biggest asset managers in Asia, Nikko Asset Management, offers high-conviction, active fund management for a variety of equity, fixed income, and multi-asset strategies. Additionally, some of the largest exchange-traded funds in Asia are part of our supplementary spectrum of passive strategies, which spans more than 20 indices (ETFs).

Table of Contents

Performance of Nikko AM KiwiSaver Funds

News about Nikko AM

Four categories of the Asia Asset Management 2022 Best of the Best Country Awards were won by Nikko Asset Management Co., Ltd. (Nikko AM). Nikko AM won awards in Japan for Fund Launch of the Year, Best Retail House, and Best Pension Fund Manager. For the second year in a row, the company won Best Multi-Asset Manager in Singapore. As one of Asia's most important magazines on the asset management sector, Asia Asset Management, The Journal of Investments and Pensions, presented Nikko AM with a country award for the year ending 30 November 2021 for the ninth year in a row.

Performance of Nikko AM KiwiSaver Funds

|

Funds |

1 Year |

5 Year |

10 Year |

|

Conservative |

2.15% |

2.21% |

N/A |

|

Balanced |

2.60% |

2.78% |

N/A |

|

Growth |

4.31% |

3.64% |

N/A |

Sourced from Nikko AM fund performance report

*These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Nikko AM Quarterly Fund updates published on 30 June 2023.

Nikko AM Conservative Fund

The Fund aims to achieve a return which exceeds the benchmark return by 1.00% p.a. over a rolling three year period before fees, expenses and taxes. The Conservative Fund invests across a range of actively managed funds to create a diversified portfolio with a focus on lower risk assets.

*The following is Sourced from Nikko AM Conservative Fund Update

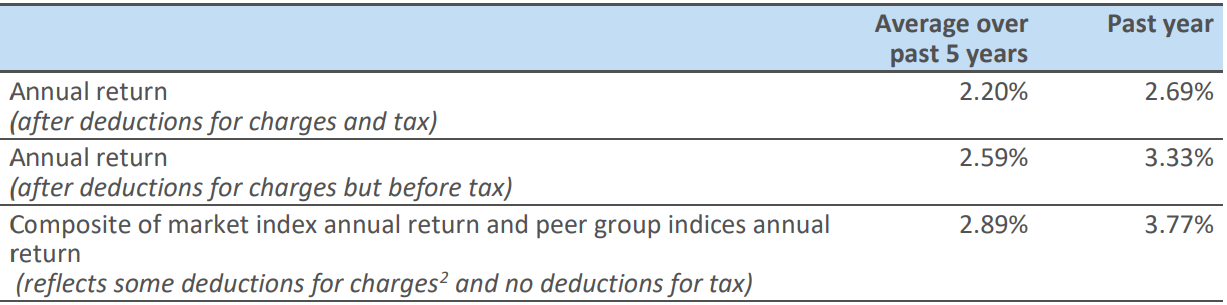

Returns

Fees

The Nikko AM Conservative Fund charges investors a total of 0.70% annual fees with an additional $30 membership fee.

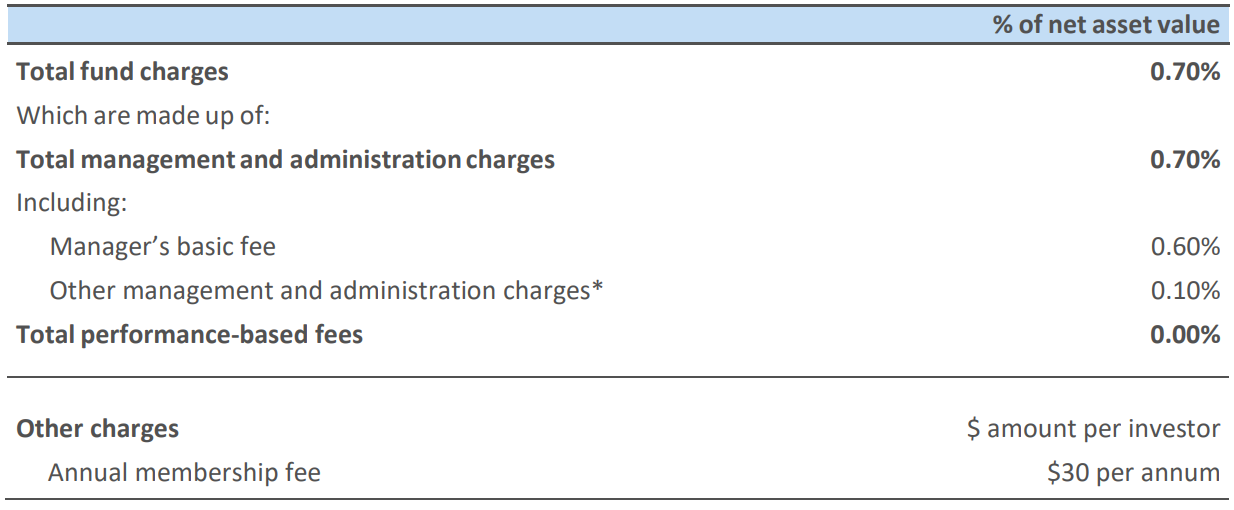

Investment mix

The investment mix shows the type of assets that the fund invests in.

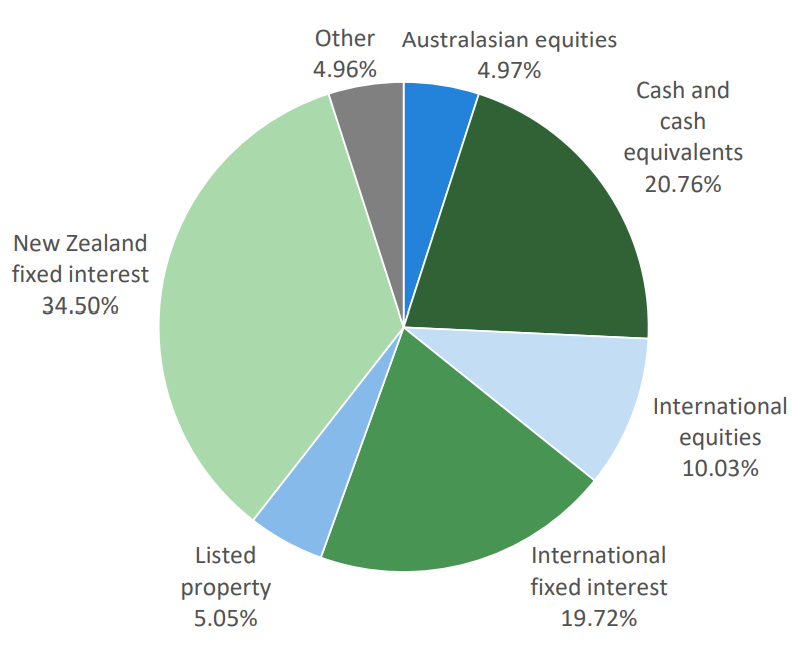

Top ten investments

This table shows Nikko AM’s top 10 investments in the Conservative KiwiSaver Fund comprise 16.62% of the fund.

Nikko AM Balanced Fund

The Fund aims to achieve a return which exceeds the benchmark return by 1.50% p.a. over a rolling three-year period before fees, expenses and taxes. The Balanced Fund invests across a range of actively managed funds to create a diversified portfolio with a balanced mix of lower and higher-risk assets.

*The following is Sourced from Nikko AM Balanced Fund Update

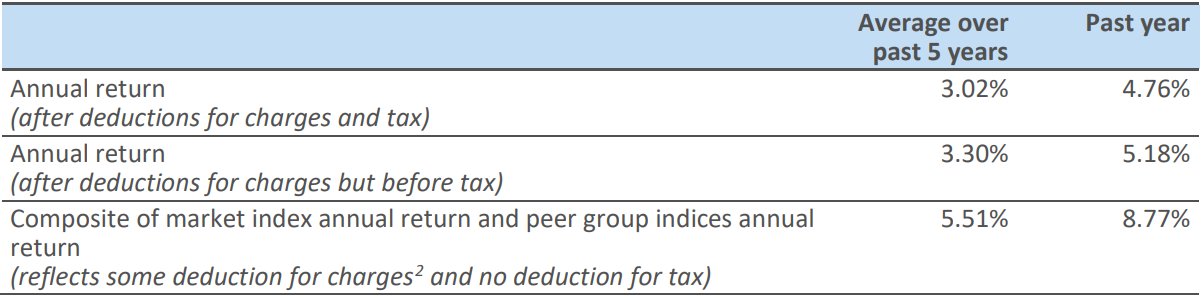

Returns

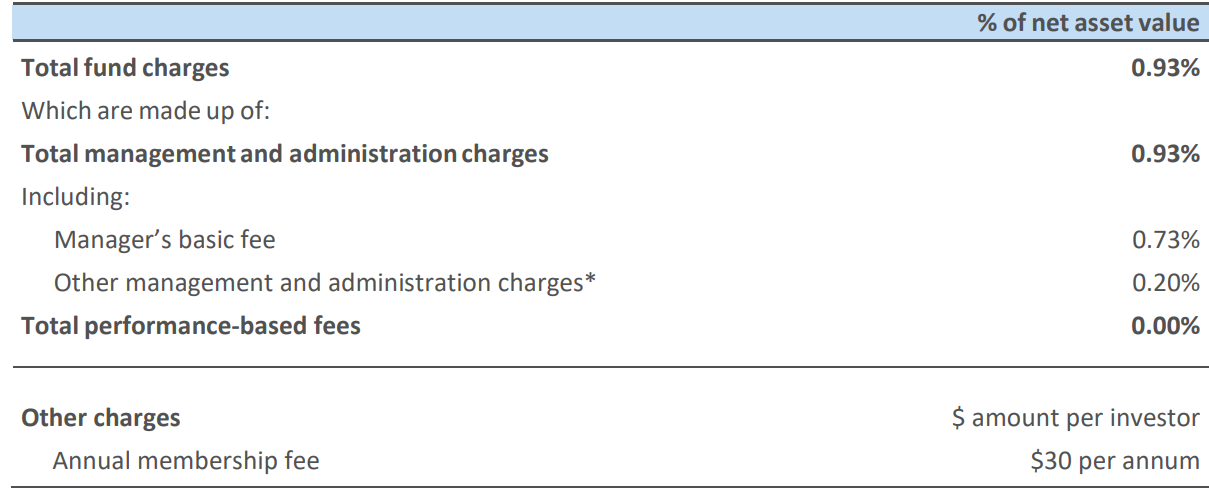

Fees

The Nikko AM Balanced Fund charges investors a total of 0.93% annual fees with an additional $30 membership fee.

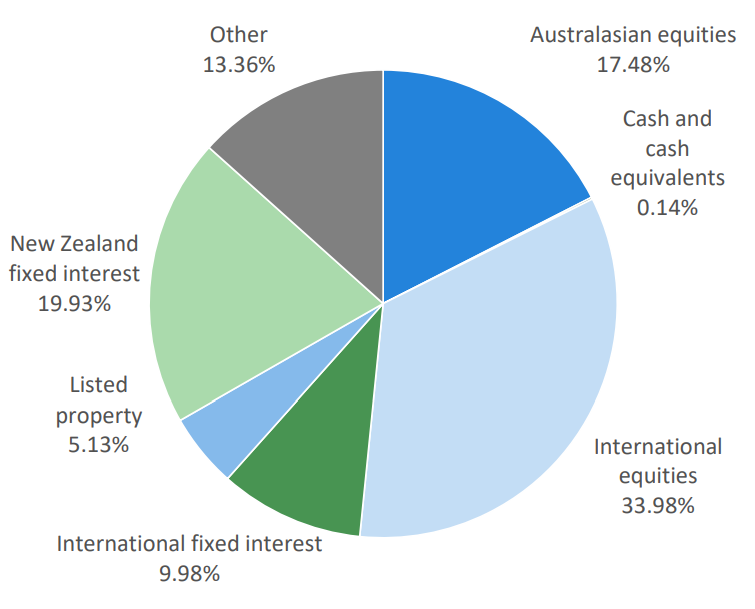

Investment mix

The investment mix shows the type of assets that the fund invests into.

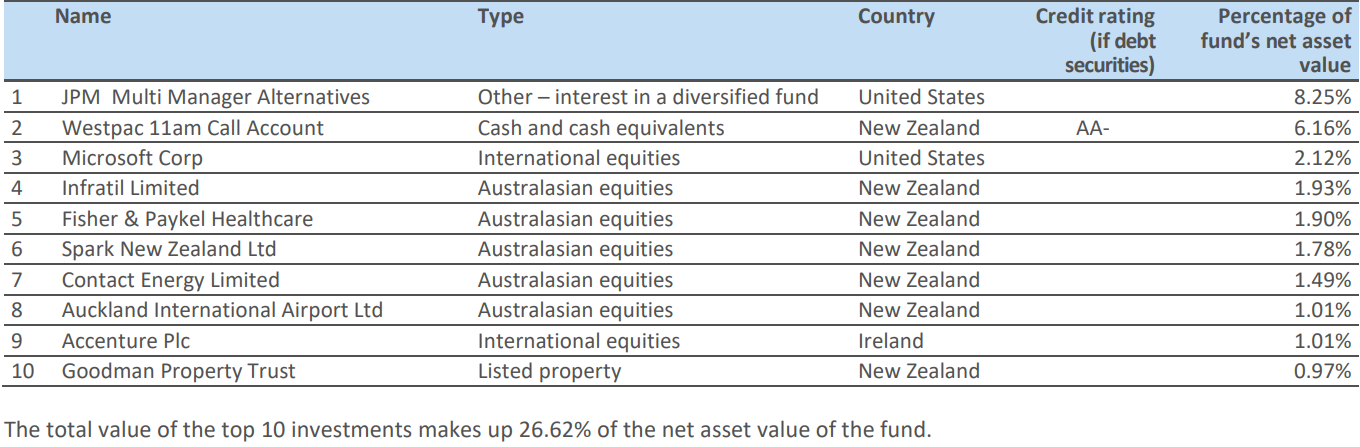

Top ten investments

This table shows Nikko AM’s top 10 investments in the Balanced KiwiSaver Fund comprises 26.62% of the fund.

Nikko AM Growth Fund

The Fund aims to achieve a return which exceeds the benchmark return by 2.00% p.a. over a rolling three-year period before fees, expenses and taxes. The Growth Fund invests across a range of actively managed funds to create a diversified portfolio with a focus on higher-risk assets.

*The following is Sourced from Nikko AM Growth Fund Update

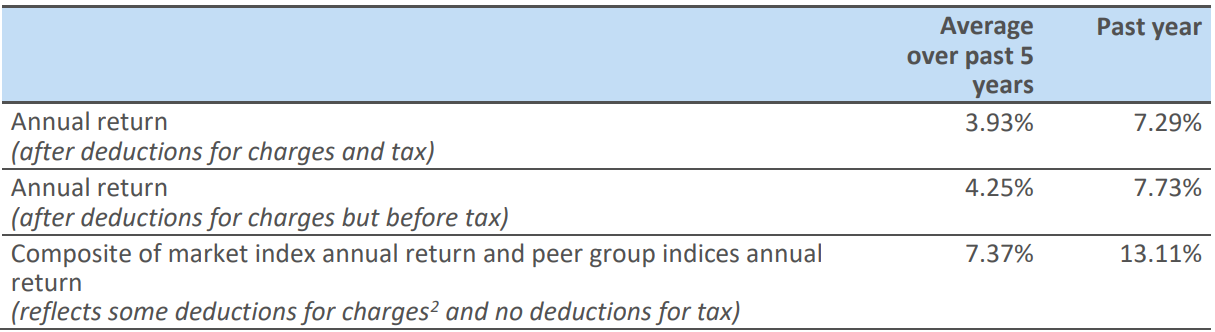

Returns

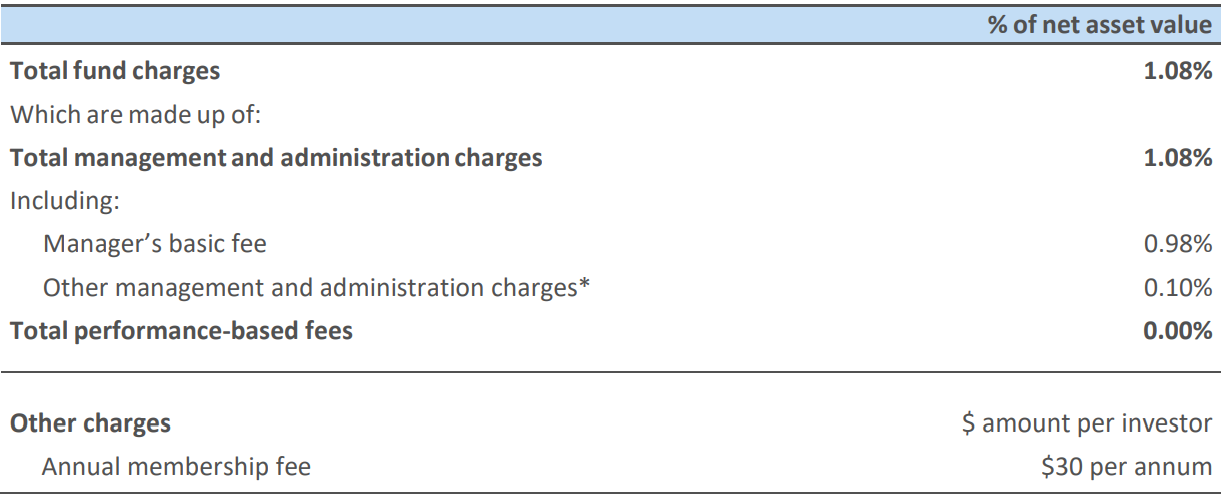

Fees

The Nikko AM Growth Fund charges investors a total of 1.08% yearly fees with an additional $30 membership fee.

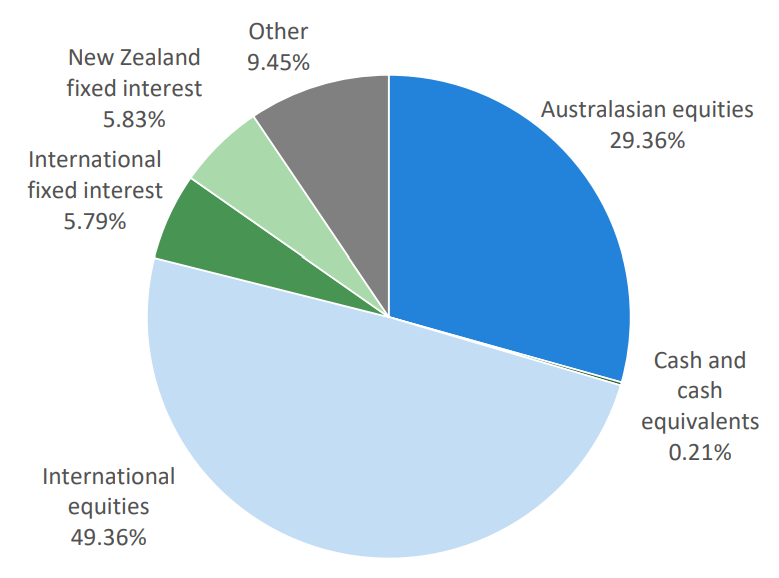

Investment mix

The investment mix shows the type of assets that the fund invests into.

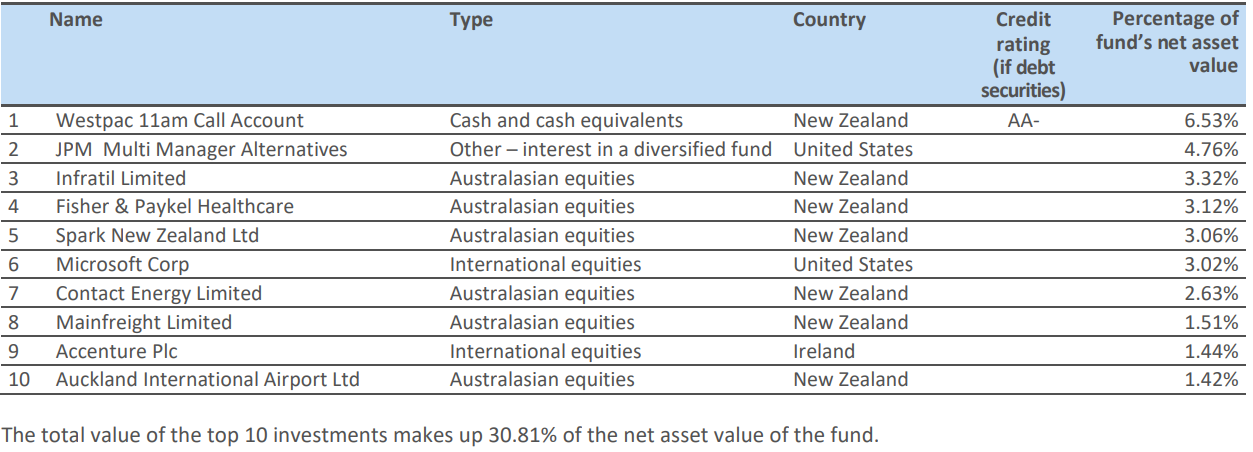

Top ten investments

This table shows Nikko AM’s top 10 investments in the Growth KiwiSaver Fund, which comprise 30.81% of the fund.

Data for Nikko AM KiwiSaver funds have been sourced from Nikko AM KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Nikko AM has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.