We will examine AMP's recent KiwiSaver performance using the most recent returns and fund update reports from 31 August 2023.

AMP Wealth Management was founded in the mid-1800s. They have a long history of providing financial solutions to individuals, families, and institutions. AMP is now a specialised provider of general insurance and KiwiSaver Scheme. Their goal is to help Kiwis to achieve a great retirement.

Table of Contents

News about AMP

Performance of AMP KiwiSaver Funds

AMP Conservative Fund

AMP Balanced Fund

AMP Growth Fund

AMP Aggressive Fund

News about AMP

As per recent news (July 2023), over the previous quarter, AMP has implemented an annual strategic asset allocation review. This review has resulted in the introduction of NZ Corporate Bonds to more income-focused diversified funds.

AMP believes that this will benefit the more conservative portfolios as it offers greater diversification within their fixed interest allocations and takes advantage of the improved yields in the market. As part of their review, AMP has also increased their allocation to US and NZ inflation-linked bonds in their diversified funds while decreasing their exposure to cash.

Performance of AMP KiwiSaver Funds

| Funds |

1 year |

5 year |

10 Year |

|

Conservative |

2.66% |

1.43% |

3.26% |

|

Balanced |

5.82% |

3.33% |

5.52% |

|

Growth |

7.62% |

4.47% |

6.81% |

|

Aggressive |

8.36% |

4.79% |

7.36% |

Sourced From AMP Fund Performance Report

These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from the AMP Quarterly Fund update, published in September.

AMP Conservative Fund

AMP Conservative Fund aims to achieve modest to medium returns. It invests mainly in lower-risk income assets with a conservative allocation to growth assets.

The following is sourced from AMP Conservative Fund Update

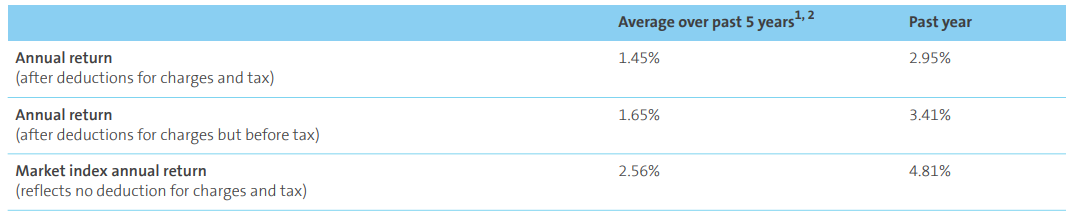

Returns

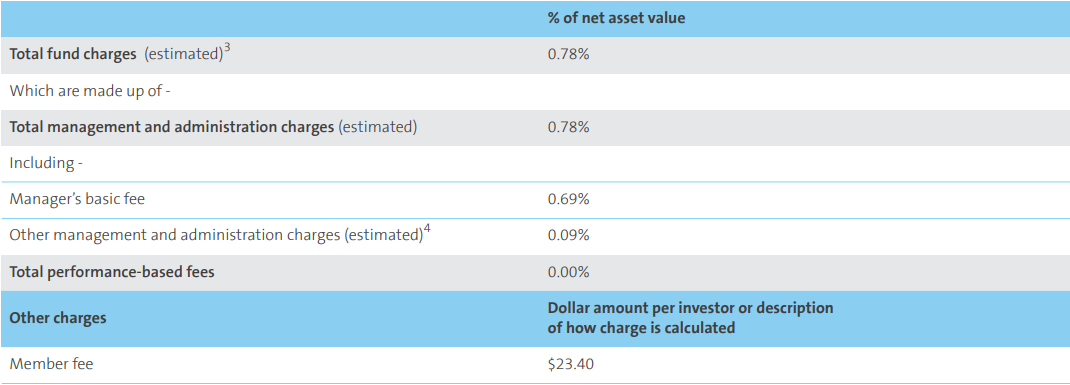

Fees

The total annual fees for investors in the AMP Conservative Fund are 0.78%.

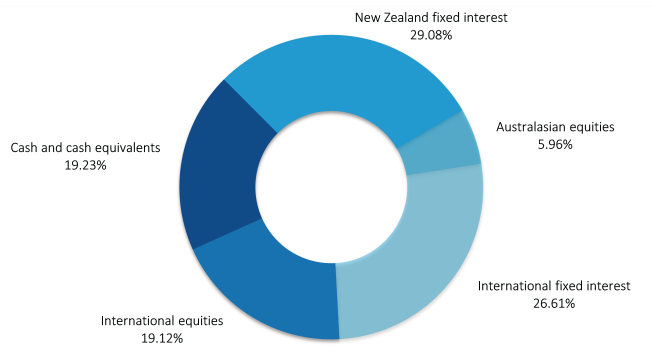

Investment mix

The investment mix shows the types of assets that the fund invests in.

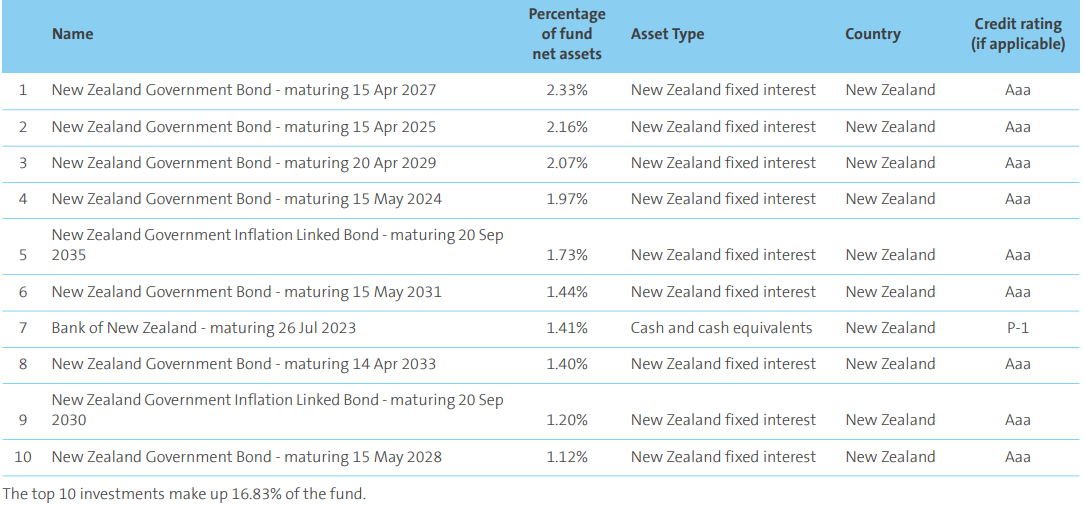

Top ten investments

This table shows AMP´s top 10 investments in the Conservative KiwiSaver Fund, which make up 16.83% of the fund.

AMP Balanced Fund

AMP Balanced Fund aims to achieve medium returns. It invests in a balance of risk through holding growth assets and an allocation to lower-risk income assets.

The following is sourced from AMP Balanced Fund Update

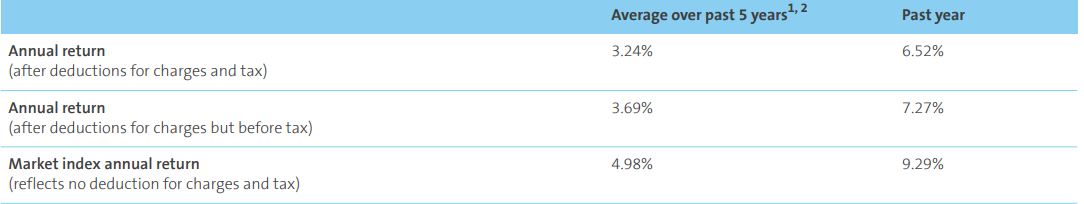

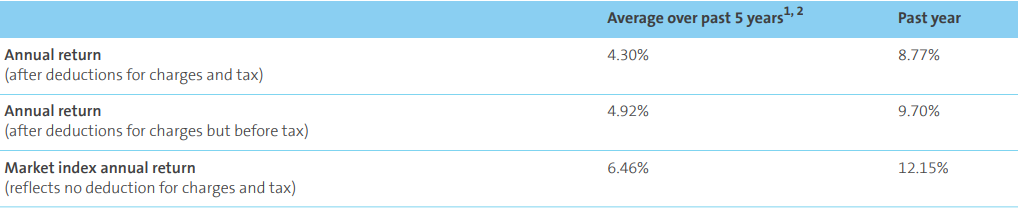

Returns

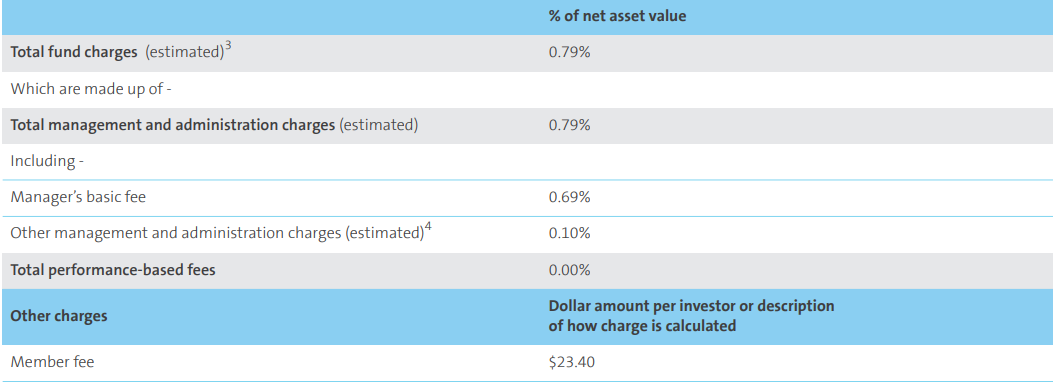

Fees

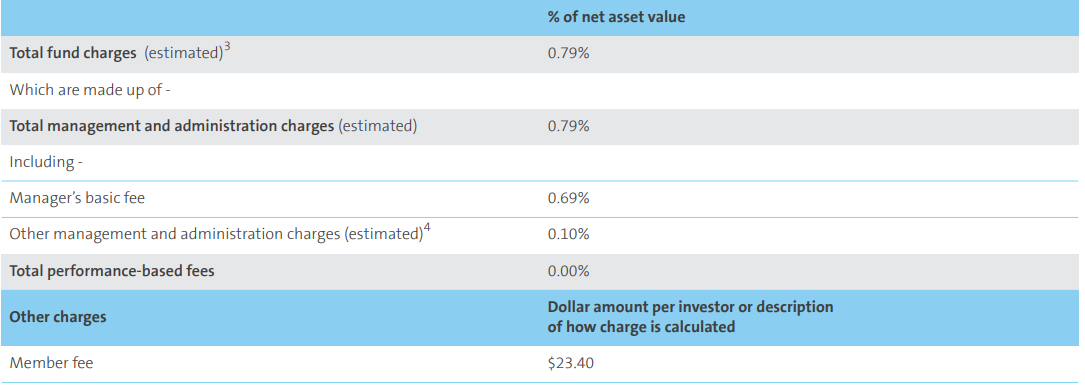

The total annual fees for investors in the AMP Balanced Fund are 0.79%.

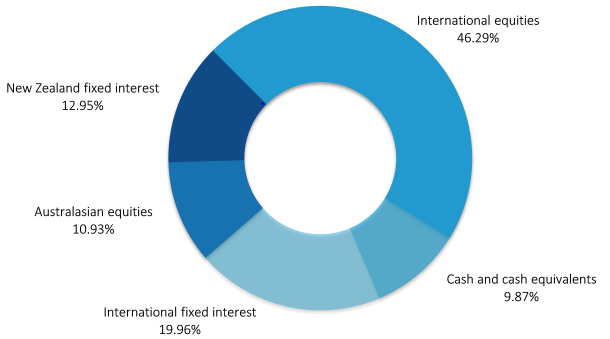

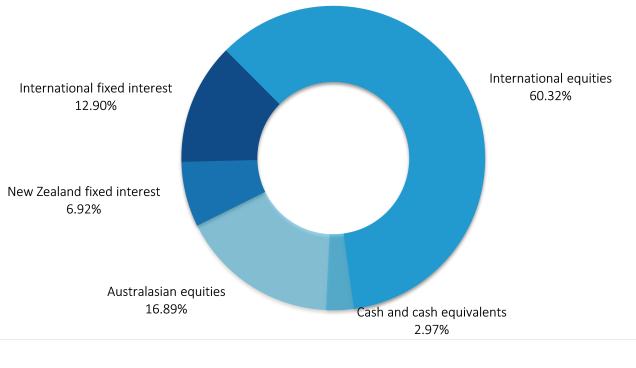

Investment mix

The investment mix shows the types of assets that the fund invests in.

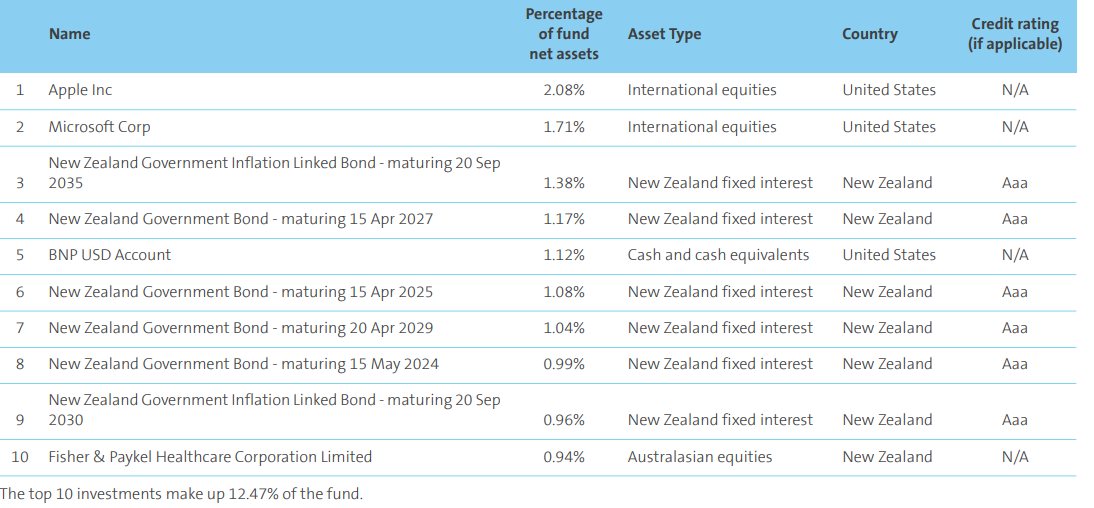

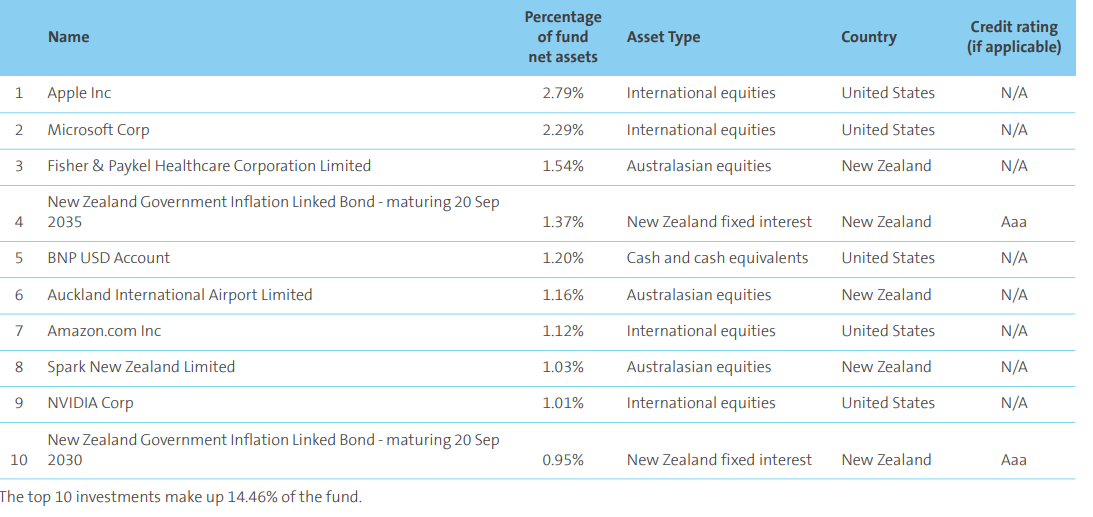

Top ten investments

This table shows AMP´s top 10 investments in the Balanced KiwiSaver Fund, which make up 12.47% of the fund.

AMP Growth Fund

AMP Growth Fund aims to achieve medium to high returns. It invests mainly in growth assets diversified with a lower allocation to lower-risk income assets.

The following is sourced from AMP Growth Fund Update

Returns

Fees

The total annual fees for investors in the AMP Growth Fund are 0.79%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows AMP´s top 10 investments in the Growth KiwiSaver Fund, which make up 14.46% of the fund.

AMP Aggressive Fund

AMP Aggressive Fund aims to achieve high returns. It invests mainly in growth by holding growth assets with a low allocation to income assets.

The following is sourced from AMP Aggressive Fund Update

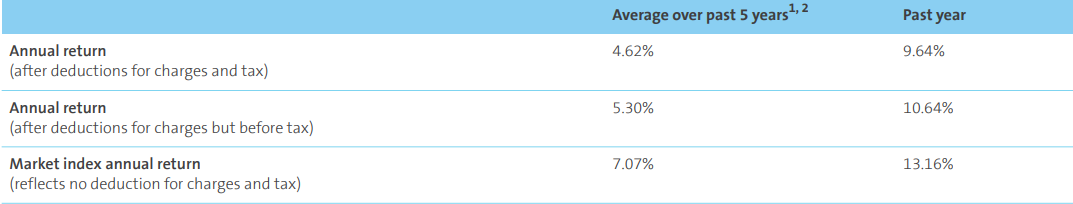

Returns

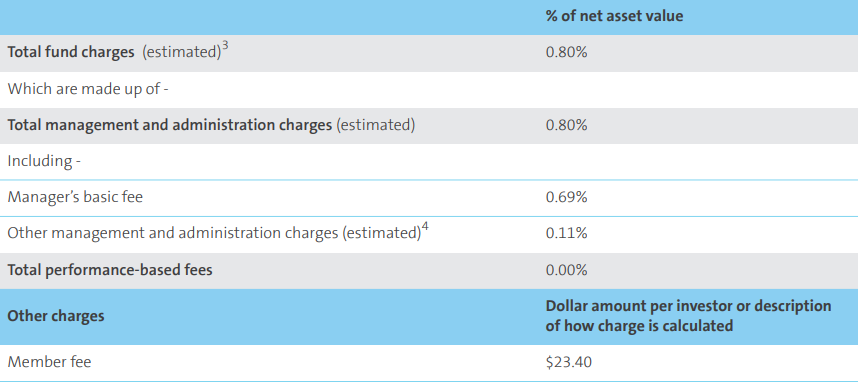

Fees

The total annual fees for investors in the AMP Aggressive Fund are 0.80%.

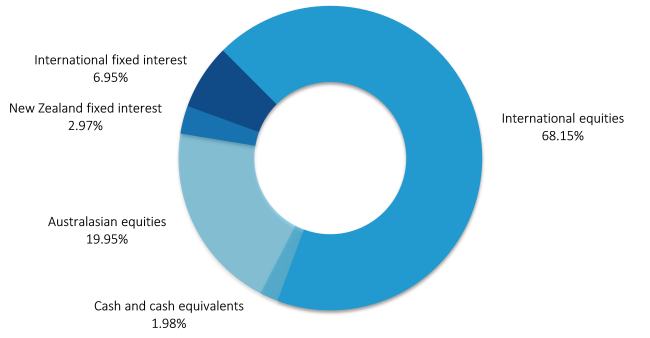

Investment mix

The investment mix shows the types of assets that the fund invests in.

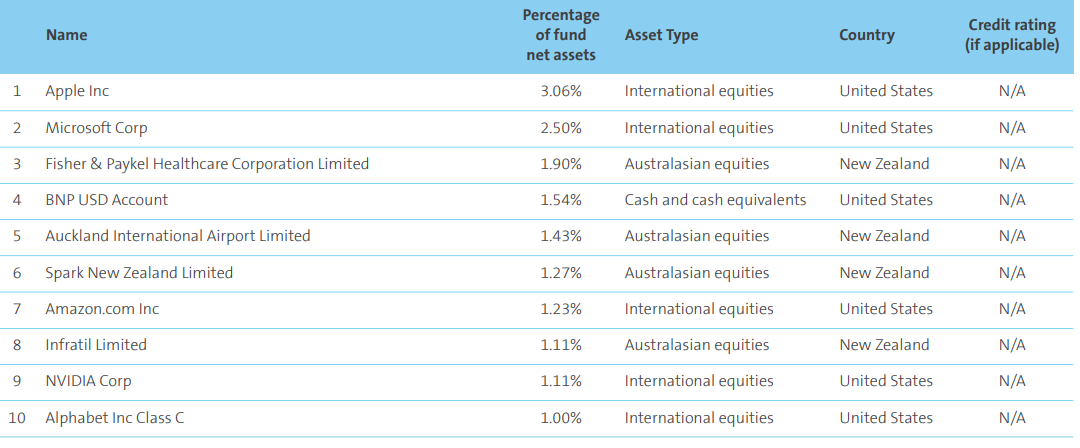

Top ten investments

This table shows AMP´s top 10 investments in the Aggressive KiwiSaver Fund, which make up 16.15% of the fund.

Data for AMP KiwiSaver funds have been sourced from AMP KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if AMP has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.