Using the most recent returns from September 2021, we will examine Lifestages recent KiwiSaver Performance.

Lifestages is an operating division of Funds Administration New Zealand Limited, a subsidiary of SBS Bank, working with New Zealanders since 1869 and is a registered bank. In 2020 they managed over $1.2 billion for more than 20,000 New Zealanders through providing private wealth services, the Lifestages KiwiSaver Scheme and the Lifestages Investment Funds.

There were negative returns on many funds in September and October due to a slowing global economy, worsening supply chain, and the potential Evergrande bankruptcy in China dented investor sentiment. Despite this, there is a more positive outlook from October and November, with returns on track being positive with the ending of lockdown and the markets readjusting after Covid.

Table of Contents

Performance of Lifestages KiwiSaver Funds

Performance of Lifestages KiwiSaver Funds

|

1 month |

3 months |

1 year |

2 years |

5 years |

|

|

Income |

0.62% |

-0.02% |

-1.76% |

0.72% |

2.06% |

|

High Growth |

3.07% |

5.91% |

16.37% |

11.44% |

11.4% |

Sourced from Lifestages fund performance report

* These returns are to 31st December 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Lifestages Quarterly Fund updates published on the 29th of October.

Lifestages Income Fund

The fund aims to provide investors with a low-risk investment option that invests predominantly in income-producing assets. Most of these assets are cash and fixed interest investments; it may also hold high dividend-yielding equities. The Income Fund has a 1-month return of 0.62% and a 1-year return of -1.76%, below the 5-year return of 2.06%.

*The following is Sourced from Lifestages Income Fund Update

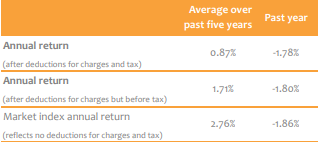

Returns

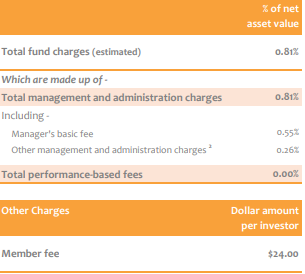

Fees

The total annual fees for investors in the Lifestages Income fund are 0.81% per year with a $24 membership fee.

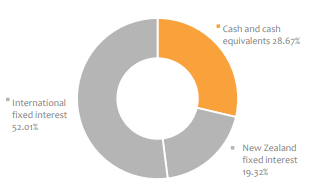

Investment mix

The investment mix shows the type of assets that the fund invests into.

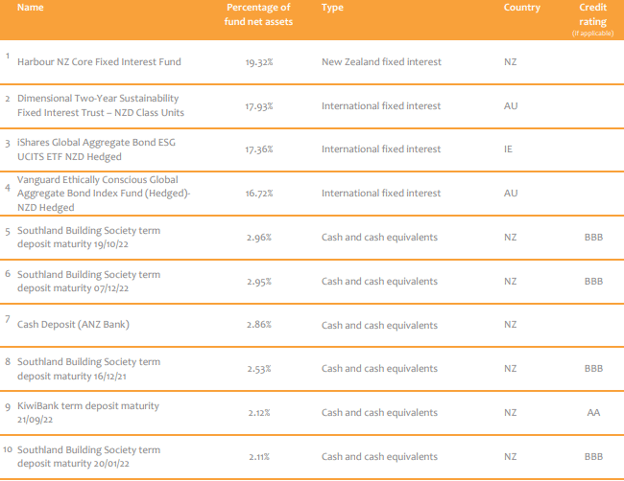

Top ten investments

This table shows Lifestages’s top 10 investments in the Income KiwiSaver fund, which make up 86.86% of the fund.

Lifestages High Growth Fund

The fund aims to provide investors with capital growth over the long term, by investing primarily in a broad spread of New Zealand and international growth assets, with a small amount held in cash. The High Growth Fund had a 1-month return of 3.07% and a 1-year return of 16.37%, higher than the 5-year return of 11.4%.

*The following is Sourced from Lifestages High Growth Fund Update

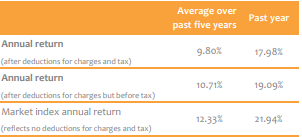

Returns

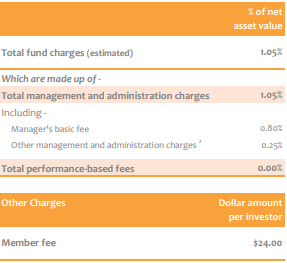

Fees

The total annual fees for investors in the Lifestages High Growth fund are 1.05% per year.

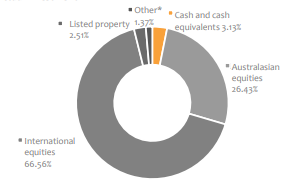

Investment mix

The investment mix shows the type of assets that the fund invests into.

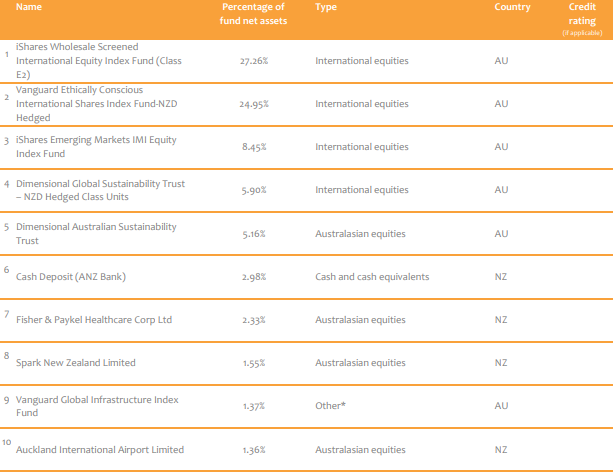

Top ten investments

This table shows Lifestages’s top 10 investments in the High Growth KiwiSaver fund, which make up 81.31% of the fund.

Data for Lifestages KiwiSaver funds has been sourced from Lifestages KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Lifestages has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.