Using the most recent returns and fund update reports from September 2022, we will examine Westpac’s recent KiwiSaver Performance.

Westpac KiwiSaver Scheme is one of the biggest banks in New Zealand and one of the four biggest financial organisations in Australia. The bank and firm are the oldest in Australia. The Westpac investment funds, including the Active Series and Westpac KiwiSaver Scheme, are managed by BT Assets Management Limited (BTNZ), which has more than $15 billion in assets under management.

The markets continue to be encircled by inflation and COVID-19's long-lasting economic impacts. The fact that several KiwiSaver providers have had negative returns on funds this quarter is evidence of this. Market turbulence is brought on by these elements. Increasing the official cash rate is still being implemented as part of the Reserve Bank of New Zealand's effort to reduce this volatility and inflation. When these factors are minimised, favourable market trends may develop.

Table of Contents

News about Westpac

Performance of Westpac KiwiSaver Funds

Westpac Cash Fund

Westpac Default Conservative Fund

Westpac Conservative Fund

Westpac Moderate Fund

Westpac Default Balanced Fund

Westpac Balanced Fund

Westpac Growth Fund

News about Westpac

In recent news, despite a volatile year and continued economic uncertainty, Westpac states that a solid year of financials puts them in a great position to support consumers. The firm has created initiatives to show its ability to provide solutions, by opening branches for an additional 370 hours per week, reducing call wait times through increasing contact centre staff, increasing the number of specialist bankers for consumers with complex needs and proactively reaching out to consumers. Westpac also received a platinum rating regarding their KiwiSaver scheme this year. It is the highest rating, which highlights the company’s scheme offers “great value for money.”

Performance of Westpac KiwiSaver Funds

|

1 Month |

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

0.28% |

0.76% |

1.25% |

1.14% |

1.51% |

2.65% |

|

Defensive Conservative |

0.68% |

-3.05% |

-2.82 |

-6.71% |

1.88% |

3.30% |

|

Conservative |

0.78% |

-3.32% |

-7.75% |

-0.34% |

1.87% |

4.05% |

|

Moderate |

1.28% |

-3.56% |

-7.75% |

0.37% |

2.54% |

4.16% |

|

Default Balanced |

1.64% |

-3.63% |

-4.51% |

NA |

NA |

NA |

|

Balanced |

1.87% |

-3.91% |

-11.53% |

1.38% |

3.44% |

5.10% |

|

Growth |

2.48% |

-4.05% |

-13.22% |

2.02% |

4.21% |

5.59% |

Sourced from Westpac Fund Performance Report.

* These returns are to the 31st of October and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Westpac Quarterly Fund updates published on the 30st of September.

Westpac Cash Fund

After the basic fund fee but before taxes, the goal of this Cash Fund is to target a return that is higher than the New Zealand Official Cash Rate. It invests mainly in term deposits, short-term debt securities, and cash in New Zealand. Westpac KiwiSaver Cash Fund has a return over the past three months of 0.76%, and a return over the past year of 1.25%, which is less than the since inception return of 2.65%.

*The following is Sourced from Westpac Cash Fund Update

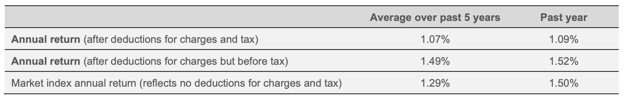

Returns

Fees

The total annual fees for investors in the Westpac Cash Fund are 0.27% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

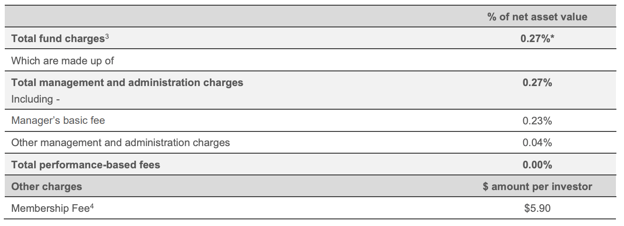

Top ten investments

This table shows Westpac’s top 10 investments in the Cash KiwiSaver Fund, which comprise 9.53% of the fund.

Westpac Defensive Conservative Fund

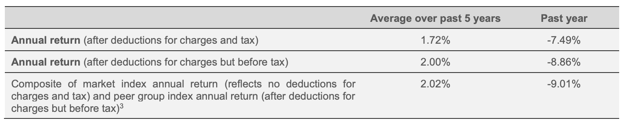

The Defensive Conservative Fund aims to provide stable returns over the short to medium term. The fund invests primarily in income assets but has a 20% benchmark allocation to growth assets. Volatility is expected to be higher than the Cash Fund but lower than the Conservative Fund in the Westpac KiwiSaver Scheme. Westpac Defensive Conservative Fund has a three-month return of -3.05% and a one-year return of -2.82%, less than the return since inception of 3.30%.

*The following is Sourced from Westpac Defensive Conservative Fund Update

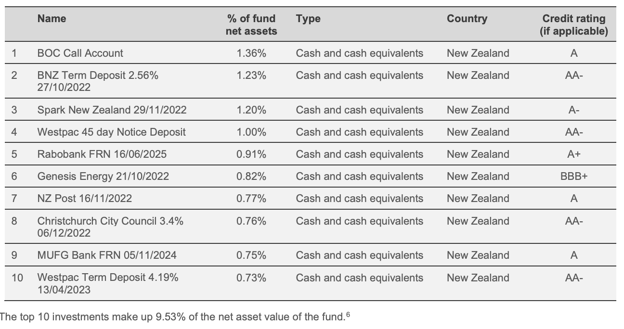

Returns

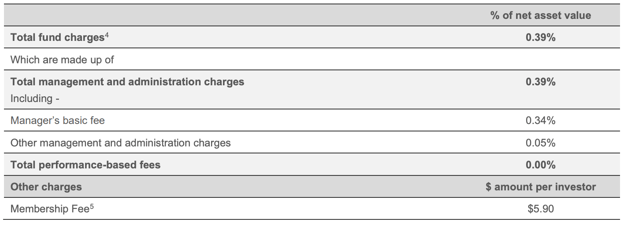

Fees

The total annual fees for investors in the Westpac Defensive Conservative Fund are 0.39% per year.

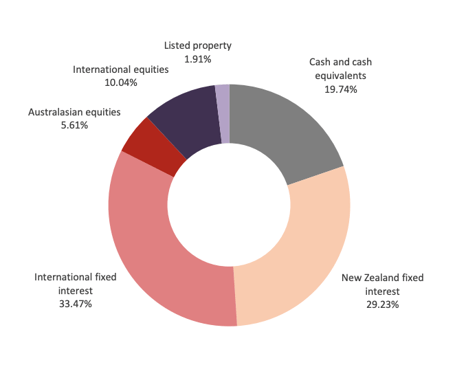

Investment mix

The investment mix shows the type of assets that the fund invests in.

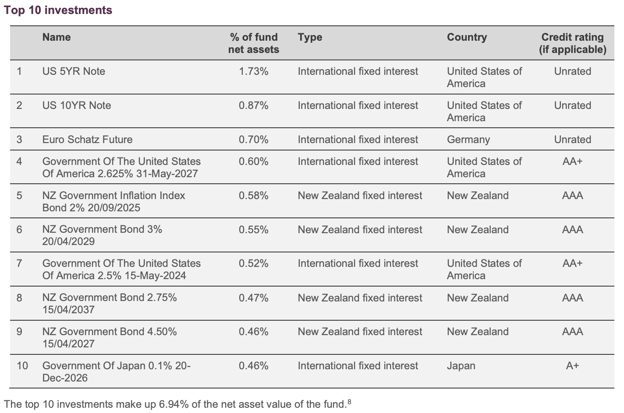

Top ten investments

This table shows Westpac’s top 10 investments in the Defensive Conservative KiwiSaver Fund, which comprise 6.94% of the fund.

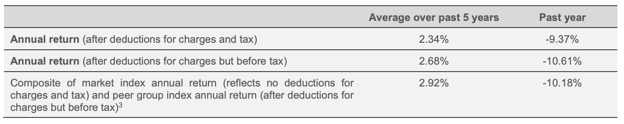

Westpac Conservative Fund

The Conservative Fund aims to provide stable returns over the short to medium term. The fund invests primarily in income assets but has a 25% benchmark allocation to growth assets. Volatility is expected to be higher than the Defensive Conservative Fund but lower than the Moderate Fund in the Westpac KiwiSaver Scheme. As opposed to the return since inception of 4.05%, the Westpac KiwiSaver Conservative Fund has a return over the past three months of -3.32% and a return over the past year of -7.75%.

*The following is Sourced from Westpac Conservative Fund Update

Returns

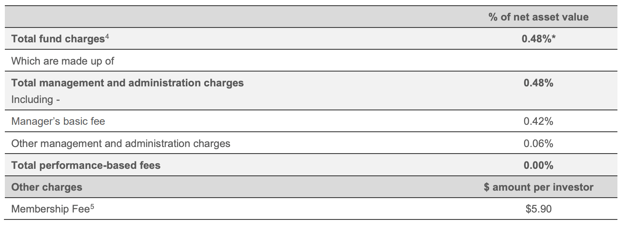

Fees

The total annual fees for investors in the Westpac Conservative Fund are 0.48% per year.

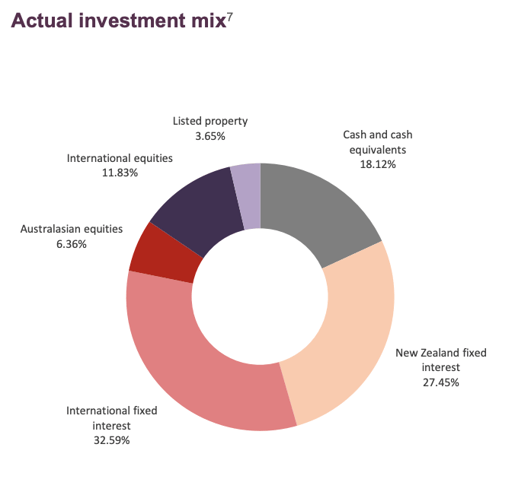

Investment mix

The investment mix shows the type of assets that the fund invests in.

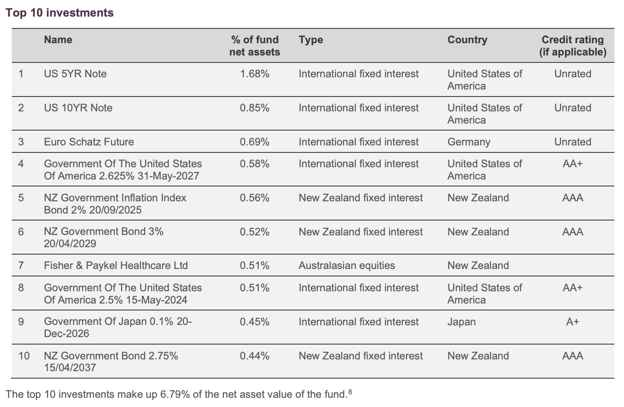

Top ten investments

This table shows Westpac’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 6.79% of the fund.

Westpac Moderate Fund

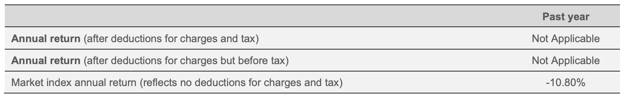

Over the medium term, the Moderate Fund seeks to offer moderate returns. Compared to growth assets, the fund has a higher allocation to income assets. In the Moderate Fund, volatility is anticipated to be higher than in the Conservative Fund but lower than in the Default Balanced Fund. Westpac Moderate Fund has a three-month return of -3.56% and a one-year return of -7.75, less than the return since inception of 4.16%.

*The following is Sourced from Westpac Moderate Fund Update

Returns

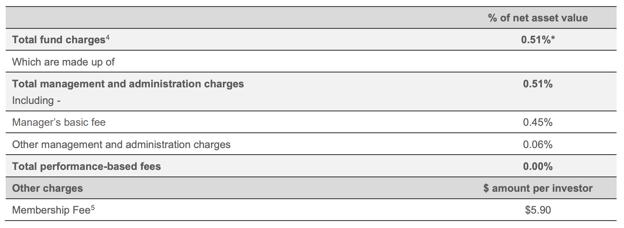

Fees

The total annual fees for investors in the Westpac Moderate Fund are 0.51% per year.

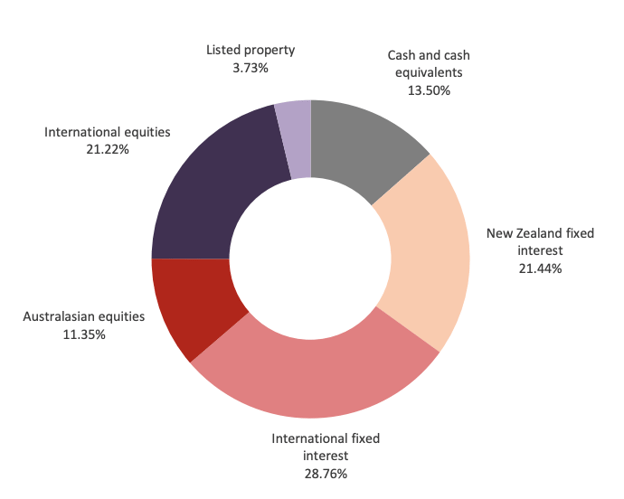

Investment mix

The investment mix shows the type of assets that the fund invests in.

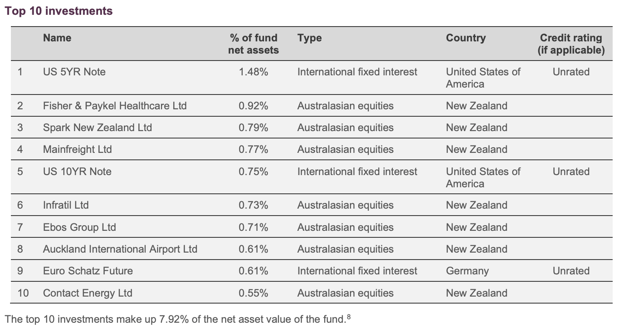

Top ten investments

This table shows Westpac’s top 10 investments in the Moderate KiwiSaver Fund, which comprise 7.92% of the fund.

Westpac Default Balanced Fund

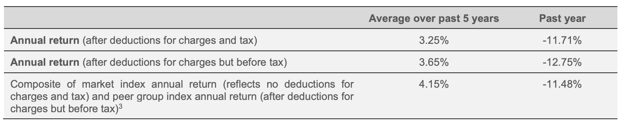

Over the medium to long term, the Default Balanced Fund seeks to offer moderate to medium returns. The fund's benchmark allocation to growth and income assets is equal. In the Westpac KiwiSaver Scheme, volatility is anticipated to be higher than the Moderate Fund but lower than the Balanced Fund. Default Balanced Fund had a three-month return of -3.63% and a one-year return of -4.51%.

*The following is Sourced from Westpac Default Balanced Fund Update

Returns

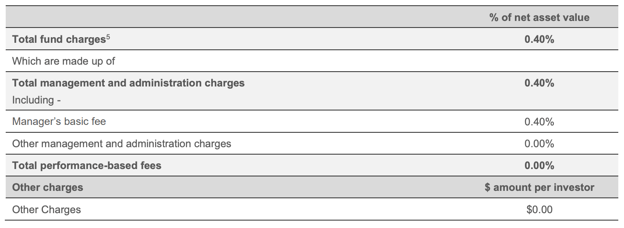

Fees

The total annual fees for investors in the Westpac Default Balanced Fund are 0.4% per year.

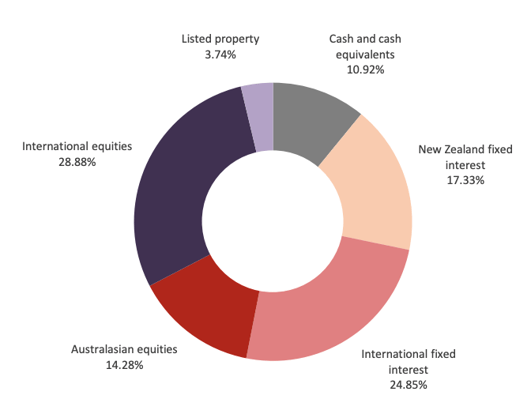

Investment mix

The investment mix shows the type of assets that the fund invests in.

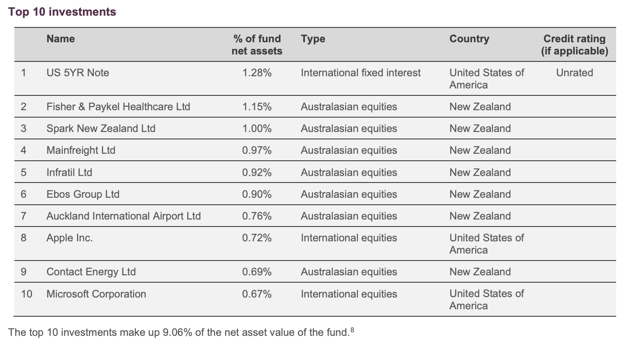

Top ten investments

This table shows Westpac’s top 10 Default Balanced KiwiSaver Fund investments, which comprise 9.06% of the fund.

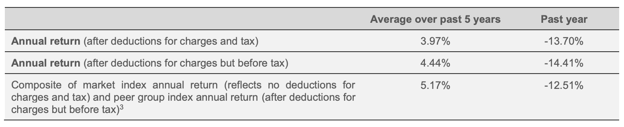

Westpac Balanced Fund

The Balanced Fund seeks to offer medium returns in the medium to long term. Growth assets comprise a more significant portion of the fund's benchmark allocation than income assets. In the Westpac KiwiSaver Scheme, volatility is anticipated to be higher than the Default Balanced Fund but lower than the Growth Fund. The balanced fund had a three-month return of -3.91 and a one-year return of -11.53%, less than the since inception return of 5.10%.

*The following is Sourced from Westpac Balanced Fund Update

Returns

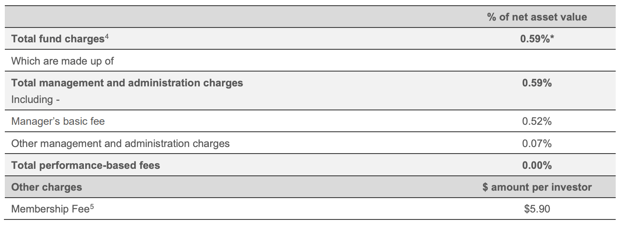

Fees

The total annual fees for investors in the Westpac Balanced Fund are 0.59% per year.

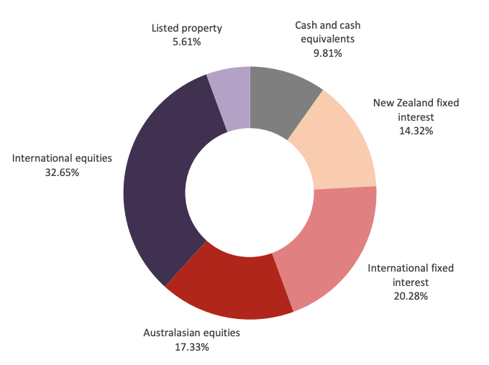

Investment mix

The investment mix shows the type of assets that the fund invests in.

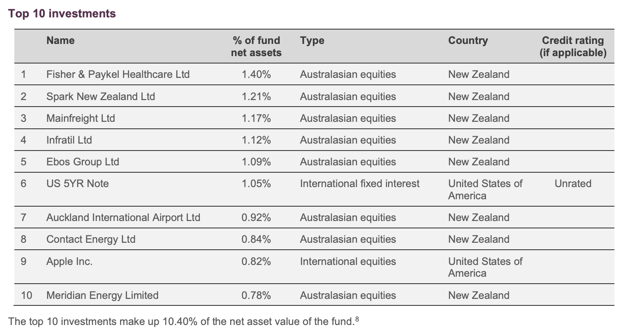

Top ten investments

This table shows Westpac’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 10.40% of the fund.

Westpac Growth Fund

Long-term increased returns are the goal of the Growth Fund. Although the fund has a portion allocated to income assets, it mostly invests in growth assets. Volatility is anticipated to be the highest of the funds in the Westpac KiwiSaver Scheme. Growth Fund’s three-month return is -4.05, and the one-year return is -13.22%, being lower than the return since inception of 5.59%.

*The following is Sourced from Westpac Growth Fund Update

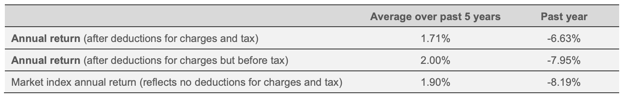

Returns

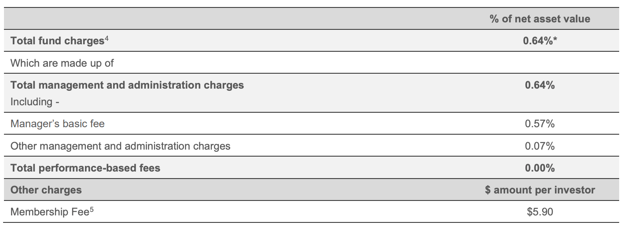

Fees

The total annual fees for investors in the Westpac Growth Fund are 0.64% per year.

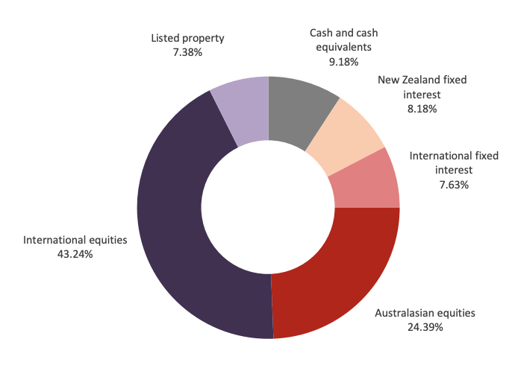

Investment mix

The investment mix shows the type of assets that the fund invests in.

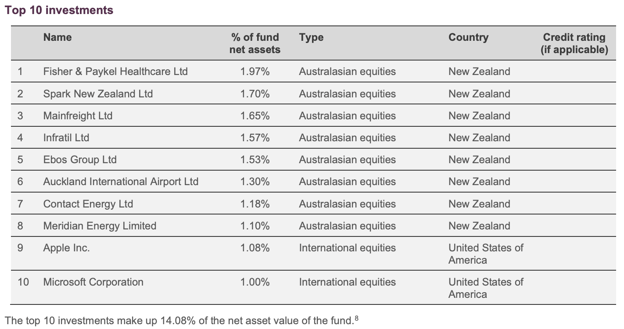

Top ten investments

This table shows Westpac’s top 10 investments in the Growth KiwiSaver Fund, which comprise 14.08% of the fund.

Data for Westpac KiwiSaver funds have been sourced from Westpac KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Westpac has the appropriate fund that aligns with your values, retirement goals, and situation, complete National Capital’s KiwiSaver Healthcheck.