Using the most recent returns and fund update reports from June 2022 Quarter, we will examine SuperLife’s recent KiwiSaver Performance.

SuperLife is managed by Smartshares Limited, a wholly owned subsidiary of NZX Limited. SuperLife has over 50,000 members and offers KiwiSaver, investment, superannuation, and insurance services. SuperLife is also one of six government-appointed default KiwiSaver providers in which their KiwiSaver funds are structured to follow a passive investment management approach aiming to provide more significant long-term outcomes.

In the June quarter, the cost of living in New Zealand significantly increased due to the negative impacts of Covid-19 and the Russian invasion of Ukraine. Furthermore, the Reserve Bank Of New Zealand (RBNZ) reports that inflation has reached a 32-year high of 7.3%. In response to this, the RBNZ has increased the official cash (OCR) to 3.0% percent taking it to a seven-year high to reduce inflation. Therefore, these societal and economic pressures have made it difficult for markets to perform, which can be seen in the returns for this quarter.

Table of Contents

Performance of SuperLife KiwiSaver Funds

SuperLife Income Fund

SuperLife Conservative Fund

SuperLife Balanced Fund

SuperLife Growth Fund

SuperLife High Growth Fund

Performance of SuperLife KiwiSaver Funds

|

1 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Income |

-1.33% |

-5.51% |

-1.03% |

0.94% |

0.46% |

|

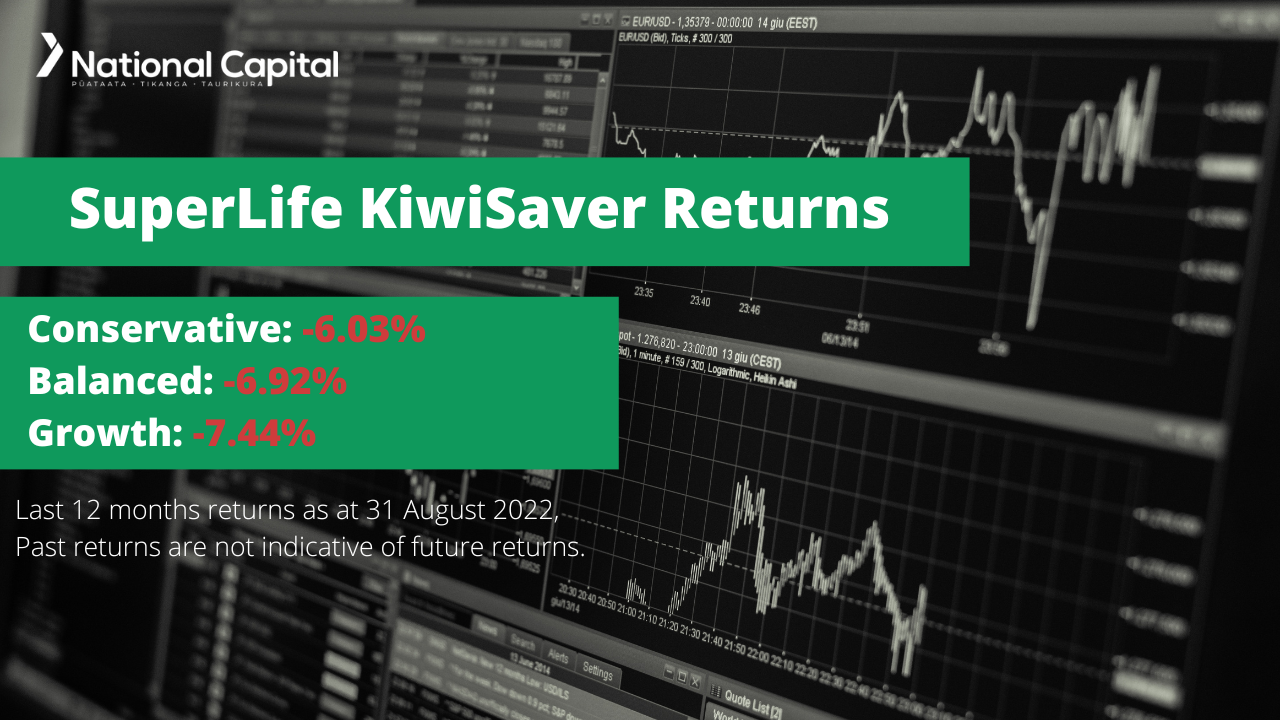

Conservative |

-1.14% |

-6.03% |

0.80% |

2.72% |

0.47% |

|

Balanced |

-0.83% |

-6.92% |

2.89% |

4.37% |

0.50% |

|

Growth |

-0.54% |

-7.44% |

3.87% |

5.23% |

0.51% |

|

High Growth |

-0.30% |

-7.93% |

4.88% |

6.04% |

0.53% |

Sourced from SuperLife fund performance report.

* These returns are to 31 August 2022and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from SuperLife Quarterly Fund updates published on 30 June 2022.

SuperLife Income Fund

The SuperLife Income Fund aims to provide exposure to a portfolio of income assets and is designed for investors that want investment in New Zealand and international fixed interest. The Income Fund has a 1-month return of -1.33% and a 1-year return of -5.51%, lower than the 5-year return of 0.94%.

*The following is Sourced from SuperLife Cash Fund Update.

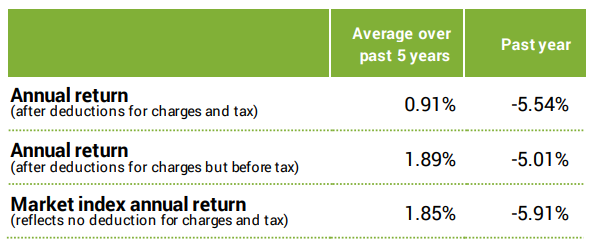

Returns

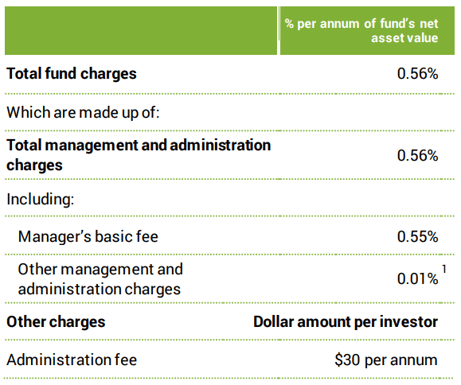

Fees

The total annual fees for investors in the SuperLife Cash Fund are 0.56% per year.

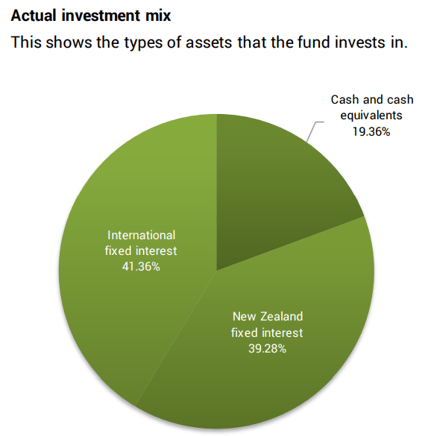

Investment mix

The investment mix shows the type of assets that the fund invests in.

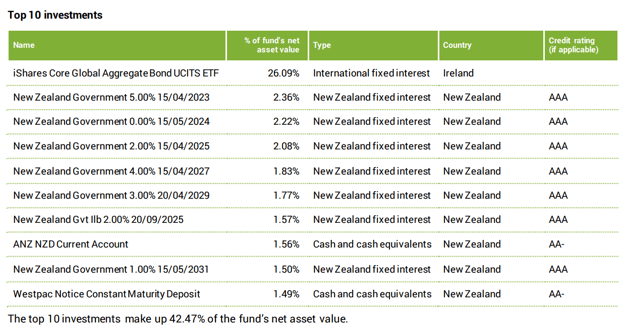

Top ten investments

This table shows SuperLife’s top 10 investments in the Cash KiwiSaver Fund, which comprise 42.47% of the fund.

SuperLife Conservative Fund

The SuperLife Conservative Fund aims to provide exposure to a portfolio of income assets and is designed for investors that want a conservative investment option. The Conservative Fund has a 1-month return of -1.14% and a 1-year return of -6.03%, lower than the 5-year return of 2.72%.

*The following is Sourced from SuperLife Conservative Fund Update.

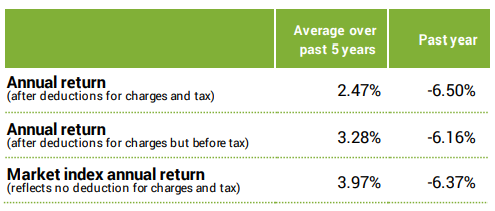

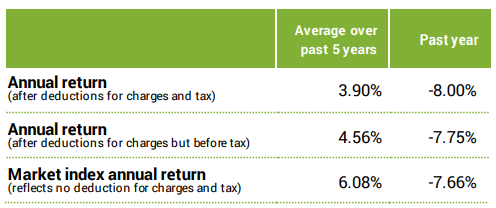

Returns

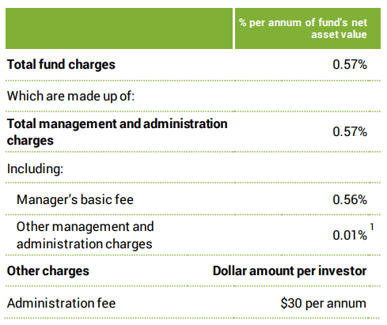

Fees

The total annual fees for investors in the SuperLife Conservative Fund are 0.57% per year.

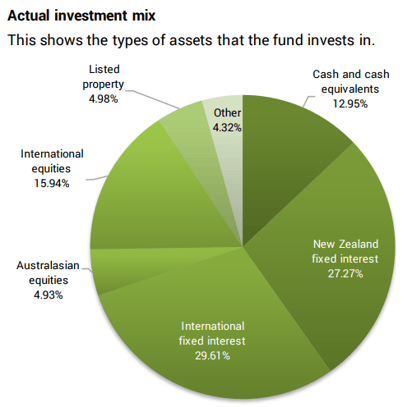

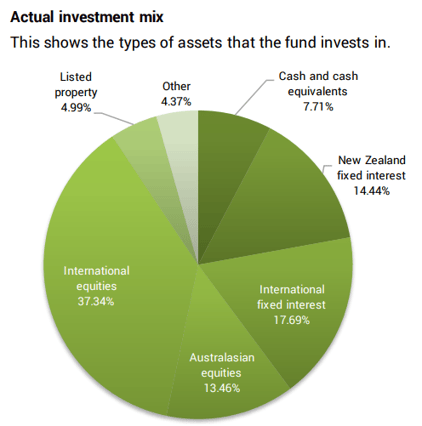

Investment mix

The investment mix shows the type of assets that the fund invests in.

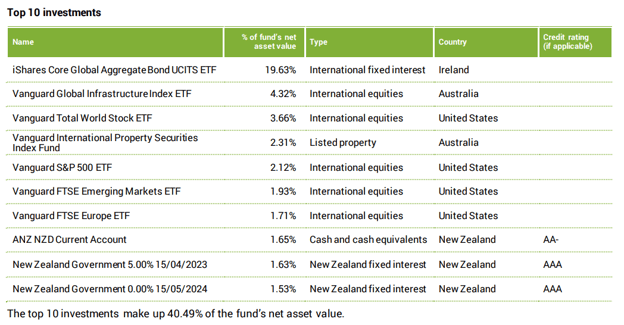

Top ten investments

This table shows SuperLife’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 40.49% of the fund.

SuperLife Balanced Fund

The SuperLife Balanced Fund aims to provide exposure to a portfolio of a mix of income and growth assets and is designed for investors that want a balanced investment option. The Balanced Fund has a 1-month return of -0.83% and a 1-year return of -6.92%, lower than the 5-year return of 4.37%.

*The following is Sourced from SuperLife Balanced Fund Update.

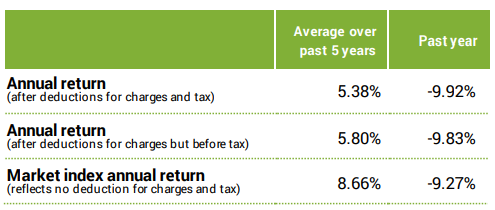

Returns

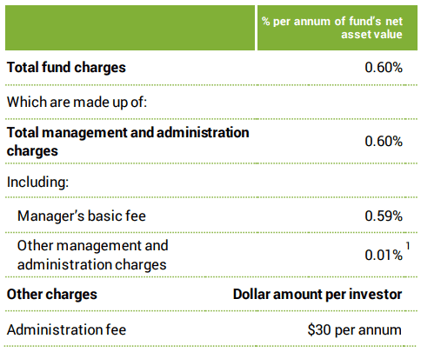

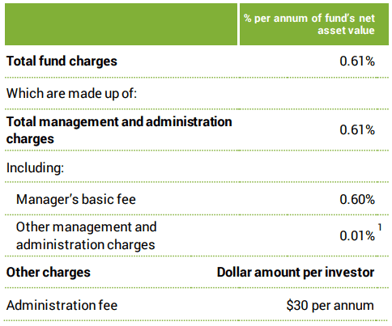

Fees

The total annual fees for investors in the SuperLife Balanced Fund are 0.60% per year.

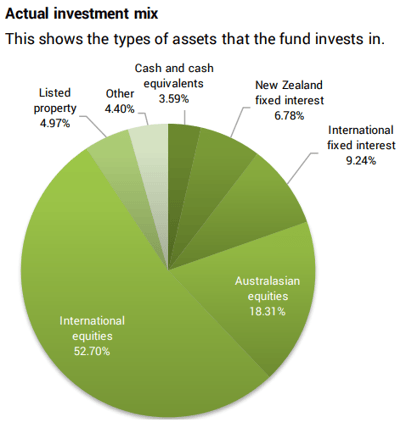

Investment mix

The investment mix shows the type of assets that the fund invests in.

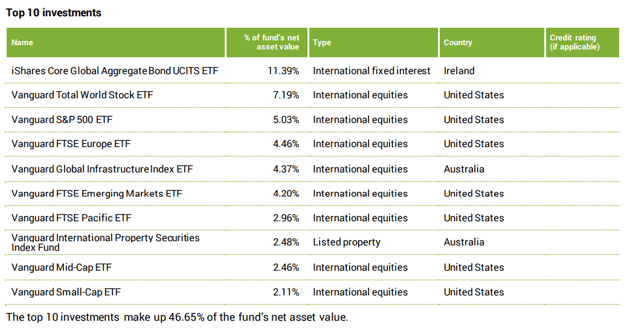

Top ten investments

This table shows SuperLife’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 46.65% of the fund.

SuperLife Growth Fund

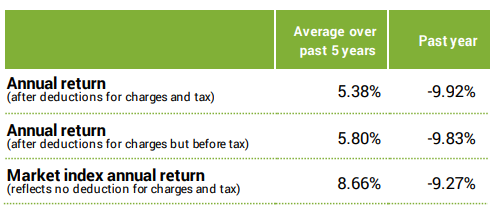

The SuperLife Growth Fund aims to provide exposure to a portfolio of growth assets and is designed for investors that want a growth investment option. The Growth Fund has a 1-month return of -0.54% and a 1-year return of -7.44%, lower than the 5-year return of 5.23%.

*The following is Sourced from SuperLife Growth Fund Update.

Returns

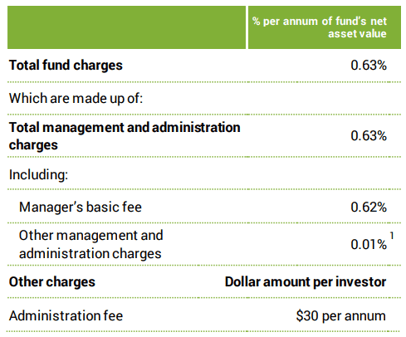

Fees

The total annual fees for investors in the SuperLife Growth Fund are 0.56% per year.

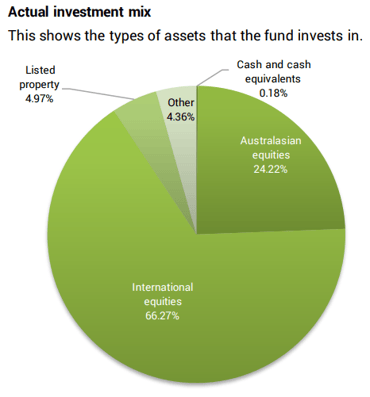

Investment mix

The investment mix shows the type of assets that the fund invests in.

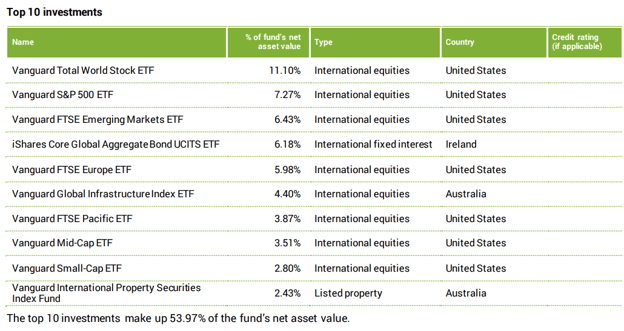

Top ten investments

This table shows SuperLife’s top 10 investments in the Growth KiwiSaver Fund, which comprise 53.97% of the fund.

SuperLife High Growth Fund

The SuperLife High Growth Fund aims to provide exposure to a portfolio of growth assets and is designed for investors that want an aggressive investment option that invests in shares and property. The High Growth Fund has a 1-month return of -0.30% and a 1-year return of -7.93%, lower than the 5-year return of 6.04%.

*The following is Sourced from SuperLife High Growth Fund Update.

Returns

Fees

The total annual fees for investors in the SuperLife High Growth Fund are 0.63% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

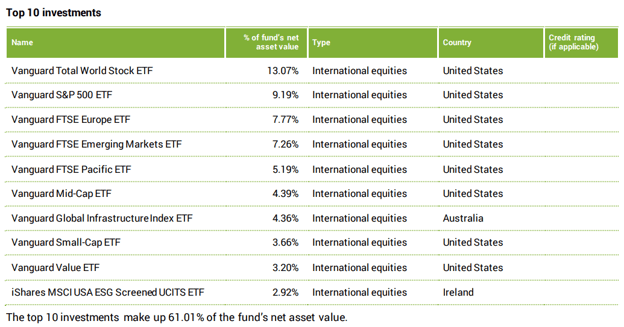

Top ten investments

This table shows SuperLife’s top 10 investments in the High Growth KiwiSaver Fund, which make up 61.01% of the fund.

Data for SuperLife KiwiSaver funds have been sourced from SuperLife KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if SuperLife has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.