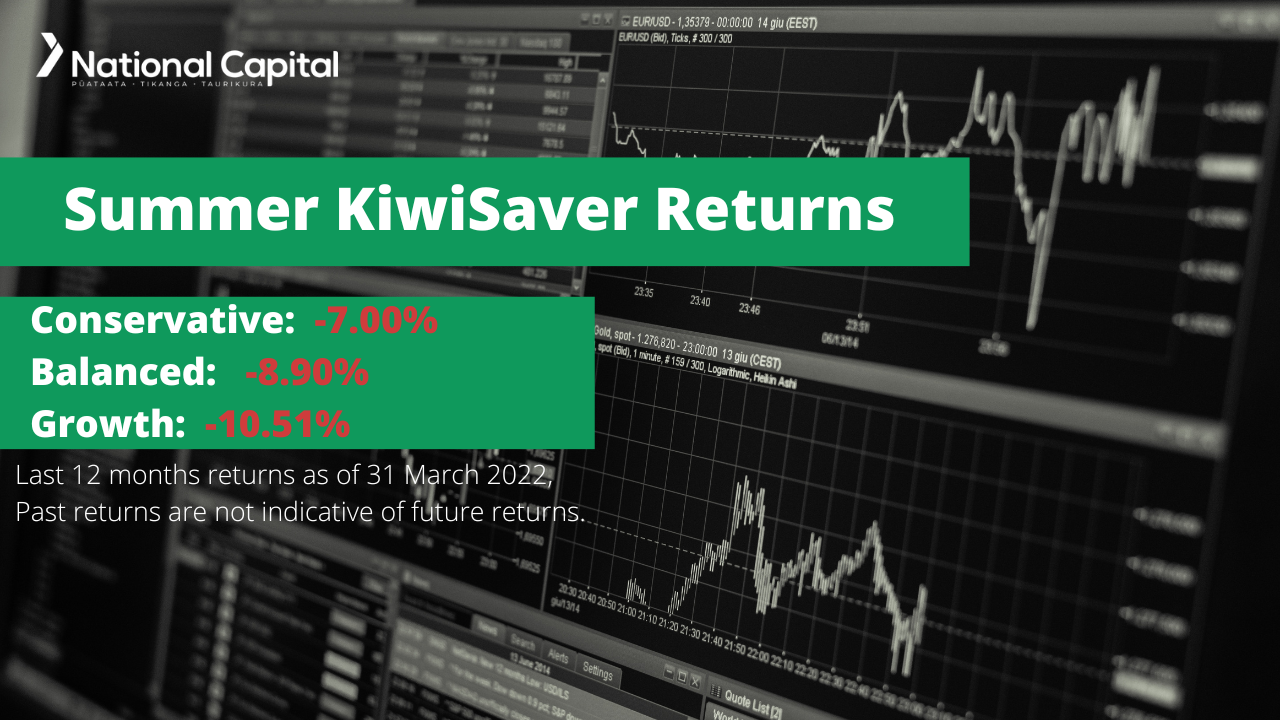

Summer KiwiSaver Performance - March 2022

Using the most recent returns and fund update reports from March 2022, we will examine Summer’s recent KiwiSaver Performance.

Summer KiwiSaver provider is a New Zealand-owned fund by Forsyth Bar, which has a reputable history of over 80 years of helping New Zealanders achieve their investment objectives. Research is the foundation of Forsyth Barr's investment advice. They have one of New Zealand's leading teams of analysts. Their global affiliations ensure comprehensive research coverage of all major investment markets. The name ‘Summer’ originates from the season, which evokes an enjoyable time of the year. A time in which people relax, spend precious time with family and appreciate the rewards of hard work throughout the year.

In the recent quarter, inflation has risen to 6.9%, the highest annual increase in the year to the June 1990 quarter. This has significantly impacted New Zealanders' cost of living because of the nation's rising consumer price index. Global markets have also been heavily affected by the Russian invasion of Ukraine. This is because of the imposed severe sanctions western societies, including New Zealand, have enforced in response to the unprovoked invasion.

Table of Contents

News about Summer

Performance of Summer KiwiSaver Funds

Summer Conservative Fund

Summer Balanced Fund

Summer Growth Fund

News about Summer

In December 2021, Forsyth Barr launched a specialist funds management business called Octagon Asset Management. Creating this independent asset management business enables Forsyth Barr to deliver new funds, access new markets, and provide new investment opportunities for investors.

An article published by Good returns also wrote a column discussing how Octagon Asset Management started off the funds under management with $650 million, including Forsyth Barr's KiwiSaver scheme, Summer.

Performance of Summer KiwiSaver Funds

|

1-Month |

3-Month |

1-Year |

3-Year |

Since Inception |

|

|

Conservative |

-2.09% |

-4.16% |

-7.00% |

0.44% |

0.99% |

|

Balanced |

-3.22% |

-6.36% |

-8.90% |

1.59% |

4.39% |

|

Growth |

-4.30 |

-8.35% |

-10.51% |

2.48% |

3.11% |

Sourced from Summer fund performance report

* These returns are to 31 March 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Fund returns and unit price as of 31 March 2022 at a 28% Prescribed Investor Rate. Note: The following information is sourced from Summer Quarterly Fund updates published on the Date published publicly, 2 May 2022.

Summer Conservative Fund

The Conservative Fund aims to provide long-term returns by choosing a greater exposure to cash and fixed interest investments and less exposure to equity and property investments. Investors can expect low to moderate levels of movement up and down in value and to receive longer-term returns that are lower than those of Summer Balanced Selection.

The Conservative Fund 3-month return has provided negative returns of -4.16%. However, over the 3-year period, the Conservative Fund has generated an average positive return of 0.44%.

*The following is Sourced from Summer Conservative Fund Update

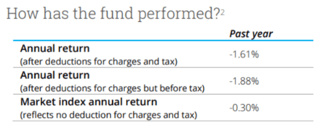

Returns

Fees

The total annual fees for investors in the Summer Conservative Fund are 0.75% per year.

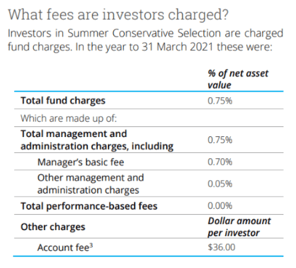

Investment mix

The investment mix shows the type of assets that the fund invests into.

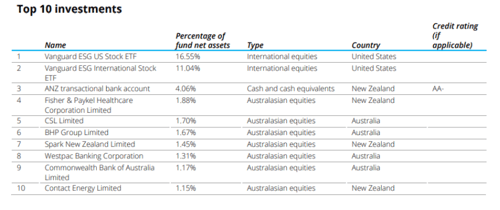

Top ten investments

This table shows Summer’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 34.17% of the fund.

Summer Balanced Fund

The Balanced Fund aims to achieve positive long-term returns by choosing a mix of cash, fixed interest, equity and property investments. Investors can expect moderate to high levels of movement up and down in value and to receive longer-term returns that are higher than those of the Summer Conservative Selection but lower than those of the Summer Growth Selection.

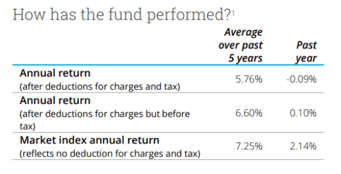

The Balanced Fund's 3-month return has provided negative returns of -6.36%. However, over the 3-year period, the Balanced Fund has generated an average positive return of 1.59%.

*The following is Sourced from Summer Balanced Fund Update

Returns

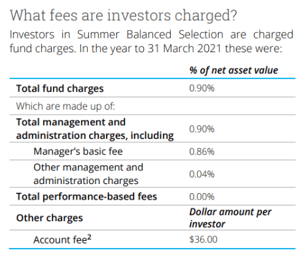

Fees

The total annual fees for investors in the Summer Balanced Fund are 0.90% per year.

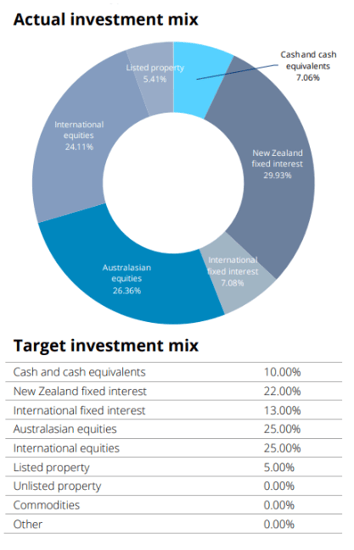

Investment mix

The investment mix shows the type of assets that the fund invests into.

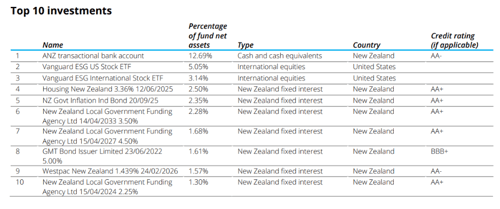

Top ten investments

This table shows Summer’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 31.48% of the fund.

Summer Growth Fund

The Growth Fund aims to achieve positive long-term returns by choosing a lesser exposure to cash and fixed interest investments and greater exposure to equity and property investments. Investors can expect moderate to high levels of movement up and down in value and receive longer-term returns that are higher than those of Summer Balanced Selection.

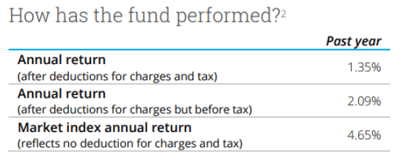

The Growth Fund 3-month return has provided negative returns of -8.35%. However, over the 3-year period, the Growth Fund has generated an average positive return of 2.48%.

*The following is Sourced from Summer Growth Fund Update

Returns

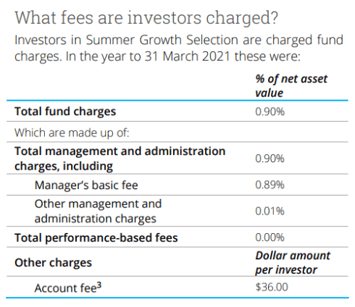

Fees

The total annual fees for investors in the Summer Growth Fund are 0.90% per year.

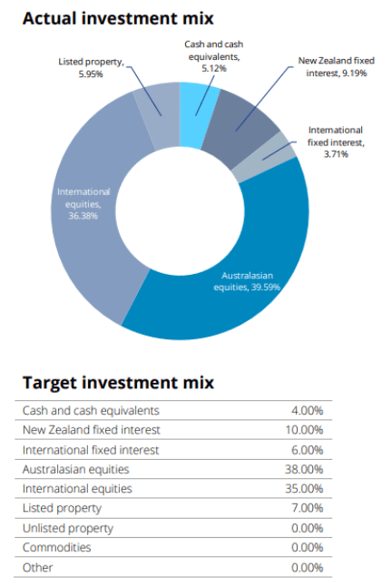

Investment mix

The investment mix shows the type of assets that the fund invests into.

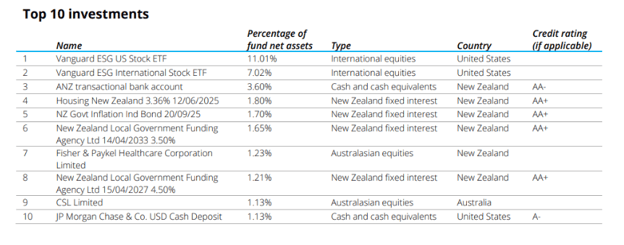

Top ten investments

This table shows Summer’s top 10 investments in the Growth KiwiSaver Fund, which comprise 41.98% of the fund.

Data for Summer KiwiSaver funds have been sourced from Summer KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Summer has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.