Using the most recent returns and fund update reports, we will examine Simplicity’s recent KiwiSaver performance.

Simplicity, a nonprofit fund management company, is dedicated to helping Kiwis achieve financial prosperity through low fees and an ethical investment approach. The annual fees on a $50,000 invested in a diversified fund.

Performance of Simplicity KiwiSaver Fund

News about Simplicity

In recent news (May, 2023), Simplicity strengthens its commitment to unlisted New Zealand assets through increased investment, including housing, in the form of affordable construction and mortgages. Also, Simplicity has announced that they have not only reduced its annual fund charges but also introduced new seven funds.

Performance of Simplicity KiwiSaver Funds

|

3 months |

1 year |

3 years |

5 years |

|

|

Conservative Fund |

1.58% |

0.18% |

-0.66% |

2.40% |

|

Default Fund |

2.40% |

1.42% |

N/A |

N/A |

|

Balanced Fund |

2.40% |

1.45% |

3.99% |

5.15% |

|

Growth Fund |

3.01% |

2.23% |

6.97% |

6.82% |

Sourced From Simplicity Fund Performance Report

These returns are to 30 April 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Simplicity Quarterly Fund ended on 31 March 2023

Simplicity Conservative Fund

Simplicity Conservative Fund aims to provide investors with limited exposure to growth assets. it invests mainly in income assets. Investors can anticipate lower returns over the long term of 10 years or more, but investors can expect less fluctuation in the value of the investment. Simplicity Conservative Fund has a 3-month return of 1.58%, a 1-year return of 0.18%, and a 5-year return of 2.40%.

The following is sourced from Simplicity Conservative Fund Update

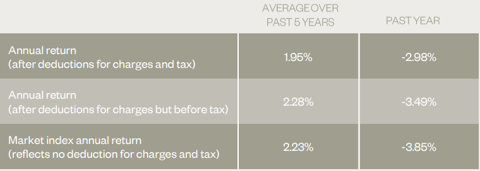

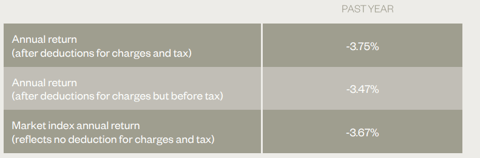

Returns

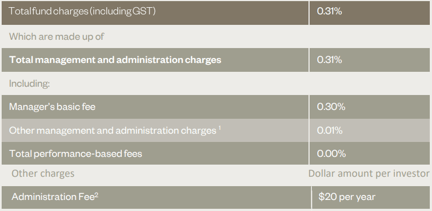

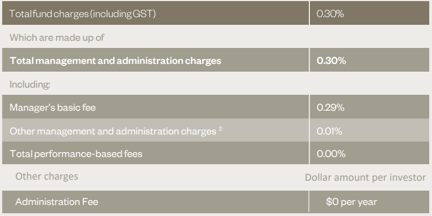

Fees

The total annual fees for investors in the Simplicity Conservative Fund are 0.31%.

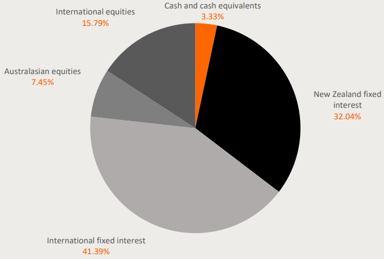

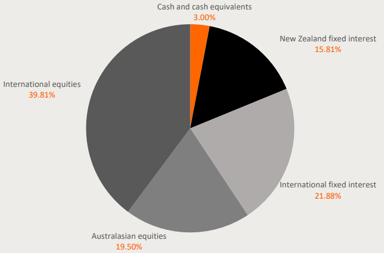

Investment mix

The investment mix shows the types of assets that the fund invests in.

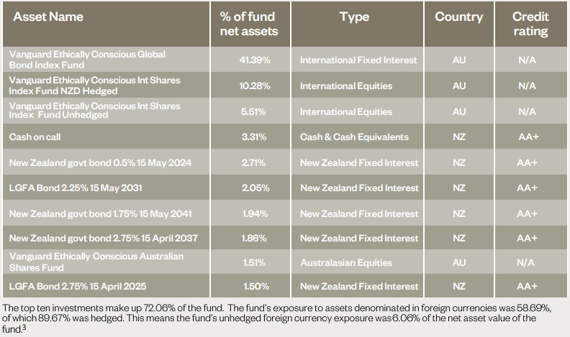

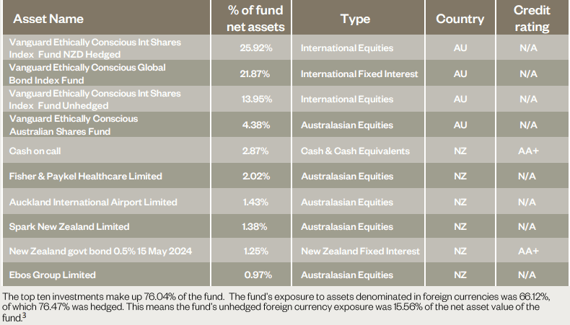

Top ten investments

This table shows Simplicity´s top 10 investments in the Conservative KiwiSaver Fund, which make up 72.06% of the fund.

Simplicity Default Fund

Simplicity Default Fund aims to provide investors with exposure to a mix of growth and income assets. The fund is likely to provide a lower return over the long term of 10 years or more. Investors can expect slight fluctuation in the value of the investment compared to the Conservative Fund. Simplicity Default Fund has a 3-month return of 2.40% and a 1-year return of 1.42%.

The following is sourced from Simplicity Default Fund Update

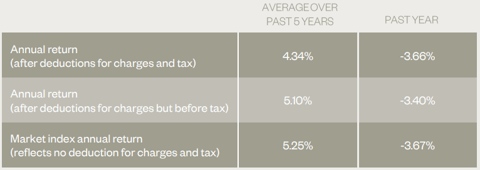

Returns

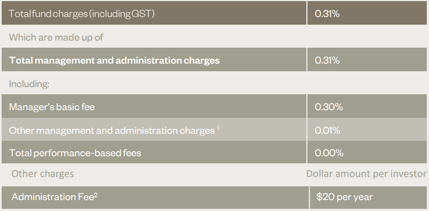

Fees

The total annual fees for investors in the Simplicity Default Fund are 0.30%.

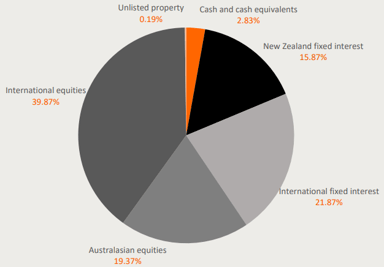

Investment mix

The investment mix shows the types of assets that the fund invests in.

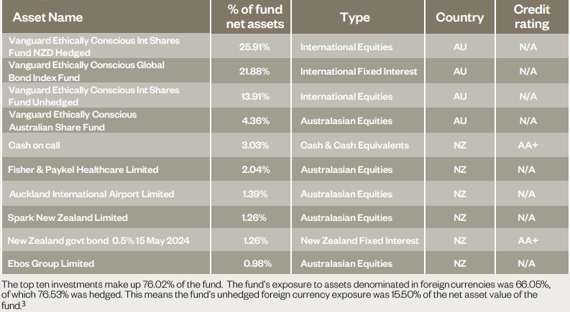

Top ten investments

This table shows Simplicity´s top 10 investments in the Default KiwiSaver Fund, which make up 76.02% of the fund.

Simplicity Balanced Fund

Simplicity Balanced Fund aims to provide investors with exposure to a mix of growth and income assets. The fund is likely to provide a lower return over the long term of 10 years or more. Investors can expect slight fluctuation in the value of the investment compared to the Conservative Fund. Simplicity Balanced Fund has a 3-month return of 2.40%, a 1-year return of 1.45%, and a 5-year return of 5.15%.

The following is sourced from Simplicity Balanced Fund Update

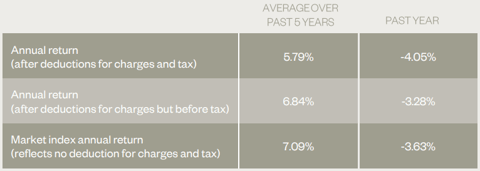

Returns

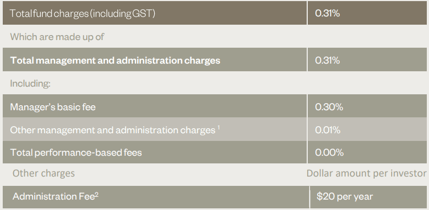

Fees

The total annual fees for investors in the Simplicity Balanced Fund are 0.31%.

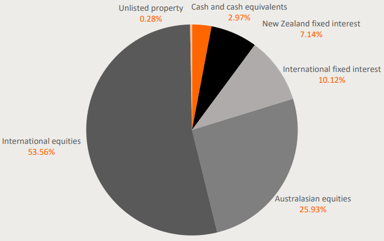

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Simplicity´s top 10 investments in the Balanced KiwiSaver Fund, which make up 76.04% of the fund.

Simplicity Growth Fund

Simplicity Growth Fund aims to provide investors with high long-term returns, with the majority of its investments in growth assets and limited exposure to income assets. Investors can expect to exhibit greater fluctuations compared to Balanced or Conservative Funds. Simplicity Growth Fund has a 3-month return of 3.01%, a 1-year return of 2.23%, and a 5-year return of 6.82%.

The following is sourced from Simplicity Growth Fund Update

Returns

Fees

The total annual fees for investors in the Simplicity Growth Fund are 0.31%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

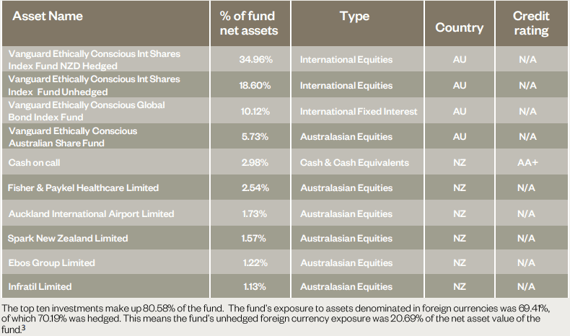

Top ten investments

This table shows Simplicity´s top 10 investments in the Growth KiwiSaver Fund, which make up 80.58% of the fund.

Data for Simplicity KiwiSaver funds have been sourced from Simplicity KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Simplicity has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.