Using the most recent returns and fund update reports from the June 2023 Quarter, we will examine QuayStreet’s recent KiwiSaver Performance.

QuayStreet utilises active investment management across its funds and believes that actively managing investments with a concentrated selection can provide investors with better returns than industry benchmarks. QuayStreet adopts a sustainable business model, investing long-term and focusing on its investments' underlying value and quality. The QuayStreet KiwiSaver Scheme currently has 6,050 members with NZ$270,932,864 in assets under management, according to the latest annual report that ended 31 March 2023.

Table of Contents

Performance of QuayStreet KiwiSaver Funds

QuayStreet Socially Responsible Investment Fund

News about QuayStreet

NZX, the stock exchange operator, is set to acquire management rights of QuayStreet Asset Management from Craigs Investment Partners in a deal valued at up to $50 million. NZX will make an initial payment of $31.25 million, consisting of $22.5 million in cash and $8.75 million in NZX shares. Additionally, there's a potential $18.75 million contingent payment based on the asset manager's future fund inflows over the next three years.

Performance of QuayStreet KiwiSaver Funds

|

1 Year |

5 Year |

Since Inception |

|

|

Income |

5.33% |

4.09% |

5.23% |

|

Conservative |

6.01% |

3.64% |

5.41% |

|

Balanced |

11.59% |

6.66% |

7.14% |

|

Socially Responsible Investment |

12.08% |

6.18% |

7.09% |

|

Growth |

14.48% |

7.99% |

8.09% |

Sourced from QuayStreet fund performance report.

* These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from QuayStreet Quarterly Fund updates published on 30 June 2023.

QuayStreet Income Fund

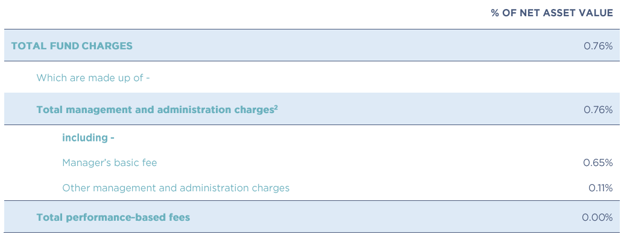

The QuayStreet Income Fund invests in a diversified portfolio with a strong focus on income-producing assets like New Zealand and International fixed-interest investments and derivatives. This fund may also include an allocation to growth assets such as listed property and equity securities.

*The following is Sourced from QuayStreet Income Fund Update.

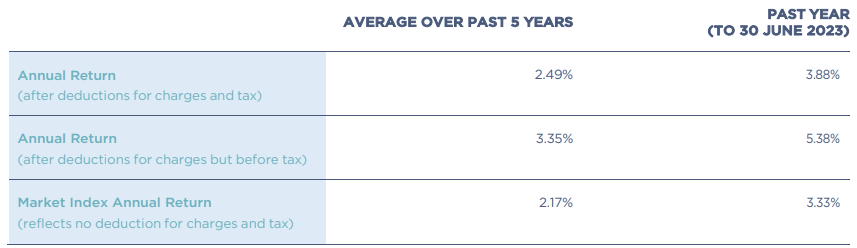

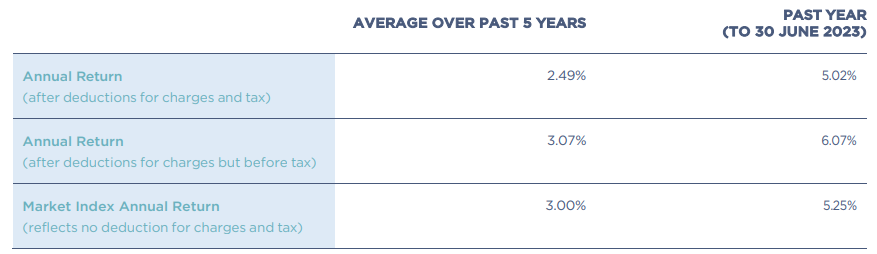

Returns

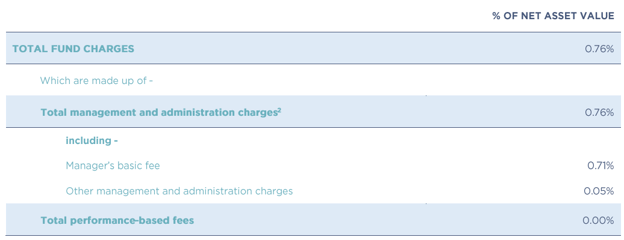

Fees

The total annual fees for investors in the QuayStreet Income Fund are 0.76% per year.

Investment mix

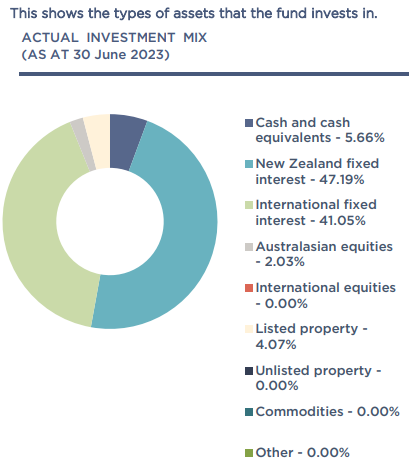

Top ten investments

This table shows QuayStreet’s top 10 investments in the Income KiwiSaver Fund, which comprise 32.21% of the fund.

QuayStreet Conservative Fund

The QuayStreet Conservative Fund invests in a diversified portfolio emphasising conservative assets such as fixed-interest investments. This fund is typically chosen by investors with a short investment horizon and low volatility tolerance, as it is not unlikely for the value to fluctuate as much as the Balanced Fund or Growth Fund.

*The following is Sourced from QuayStreet Conservative Fund Update.

Returns

Fees

The total annual fees for investors in the QuayStreet Conservative Fund are 0.76% per year.

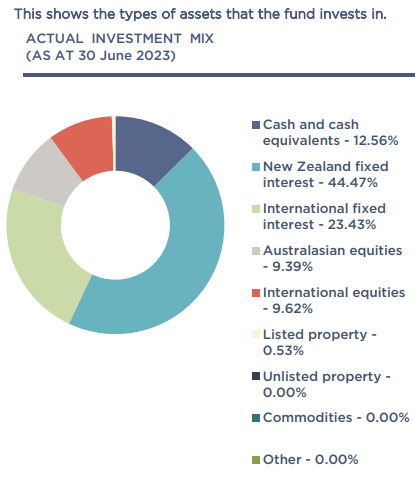

Investment mix

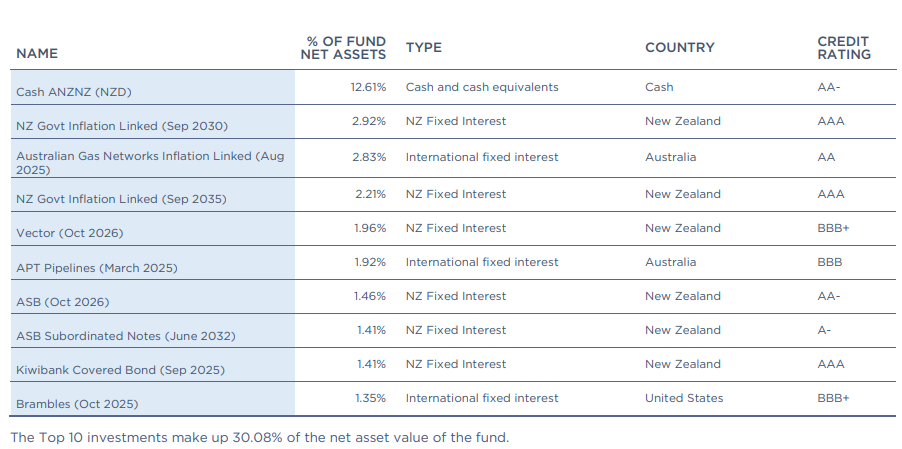

Top ten investments

This table shows QuayStreet’s top 10 investments in the Conservative KiwiSaver Fund, which make up 30.08% of the fund.

QuayStreet Balanced Fund

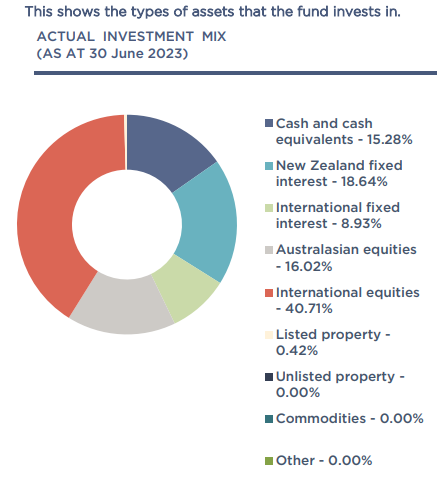

The QuayStreet Balanced Fund is a diversified portfolio with an equal mix of fixed interest and growth assets like shares. The Balanced Fund is likely to have higher volatility than a Conservative Fund but not as volatile as a Growth Fund. This fund might be suitable for investors with a long investment horizon but low volatility tolerance, or vice versa.

*The following is Sourced from QuayStreet Balanced Fund Update.

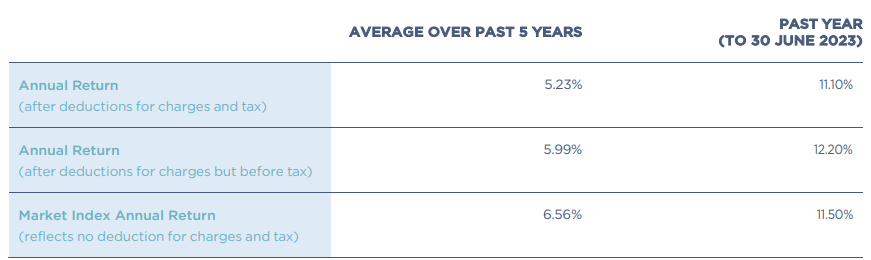

Returns

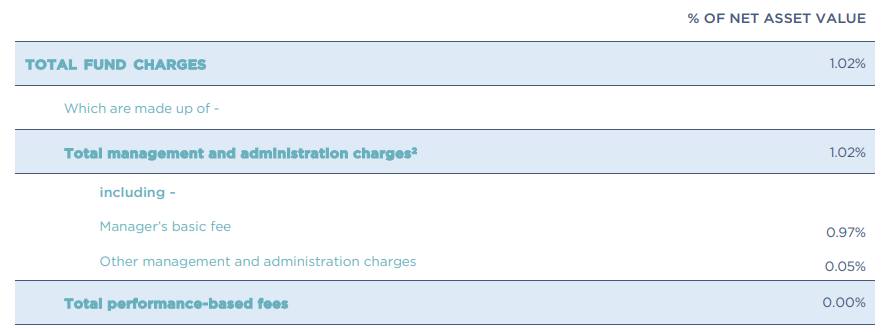

Fees

The total annual fees for investors in the QuayStreet Balanced Fund are 1.02% per year.

Investment mix

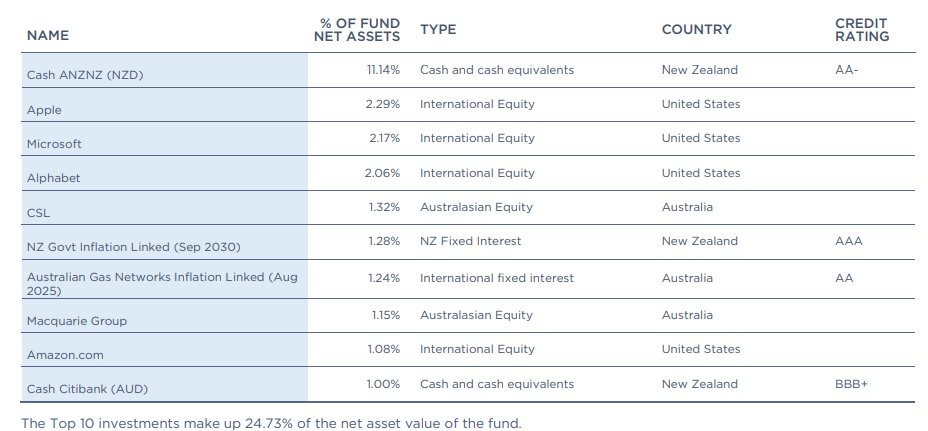

Top ten investments

This table shows QuayStreet’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 24.73% of the fund.

QuayStreet Socially Responsible Investment Fund

The QuayStreet Socially Responsible Investment (SRI) Fund aims to have an environmentally and socially responsible diversified investment portfolio. QuayStreet SRI Fund invests in both income and growth assets in accordance with their SRI Policy. This fund can also vary between a growth and a balanced investment strategy.

*The following is Sourced from QuayStreet Socially Responsible Investment Fund Update.

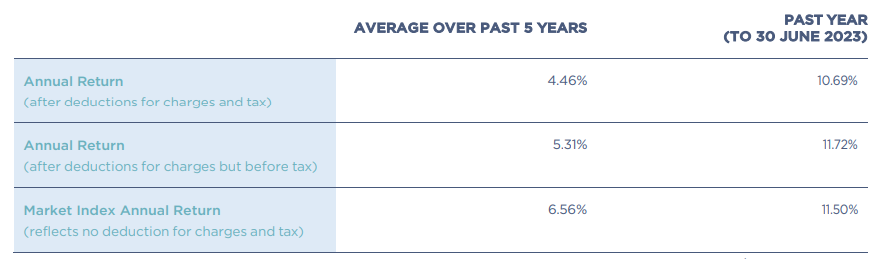

Returns

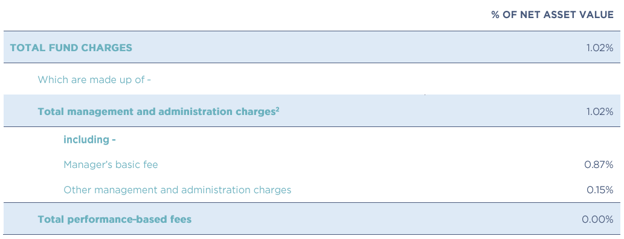

Fees

The total annual fees for investors in the QuayStreet Socially Responsible Investment Fund are 1.02% per year.

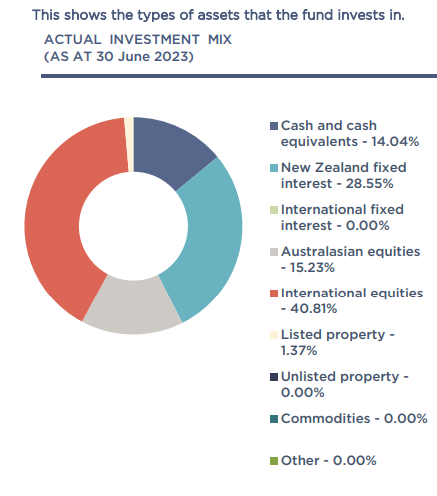

Investment mix

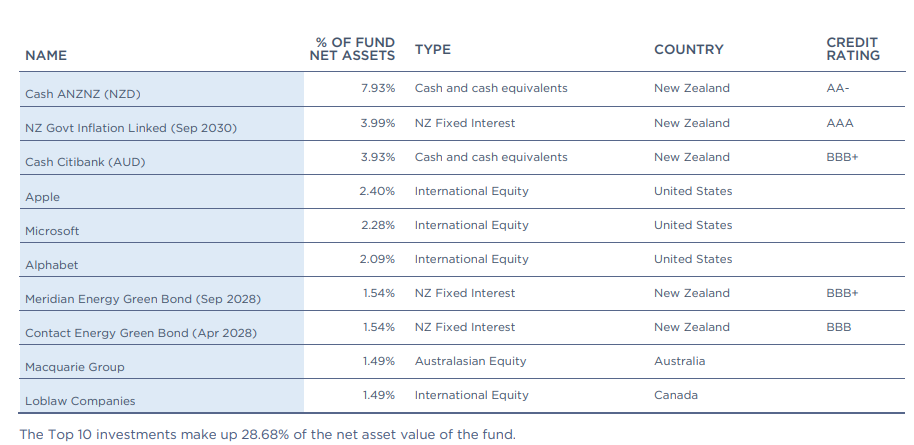

Top ten investments

This table shows QuayStreet’s top 10 investments in the QuayStreet Socially Responsible Investment KiwiSaver Fund, which make up 28.68% of the fund.

QuayStreet Growth Fund

The QuayStreet Growth Fund invests in a diversified portfolio emphasising growth assets like shares. This fund is likely to have high volatility, therefore it is typically chosen by investors with longer investment horizon or those with higher volatility tolerance.

*The following is Sourced from QuayStreet Growth Fund Update.

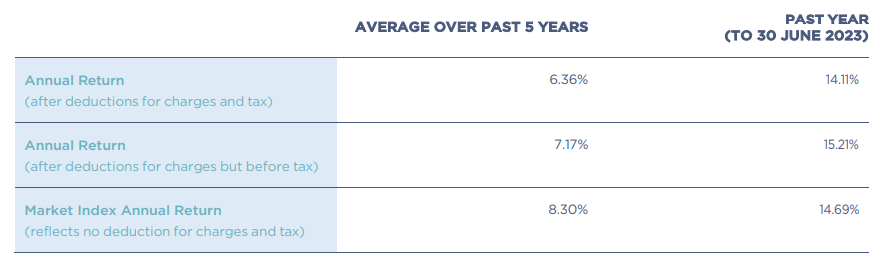

Returns

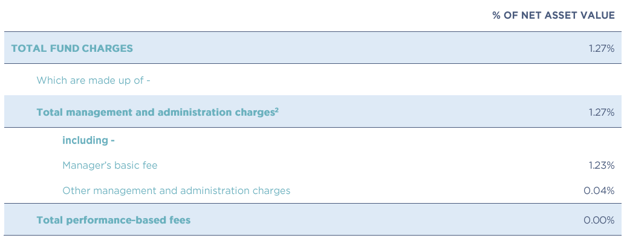

Fees

The total annual fees for investors in the QuayStreet Growth Fund are 1.27% per year.

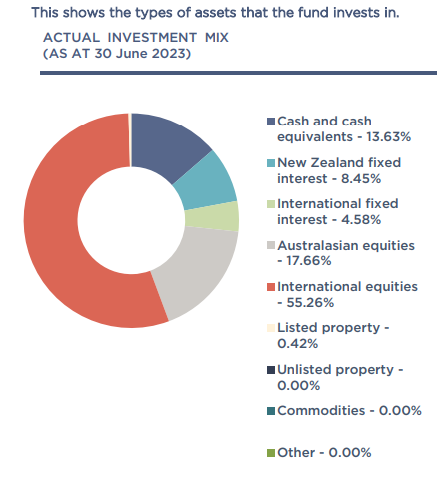

Investment mix

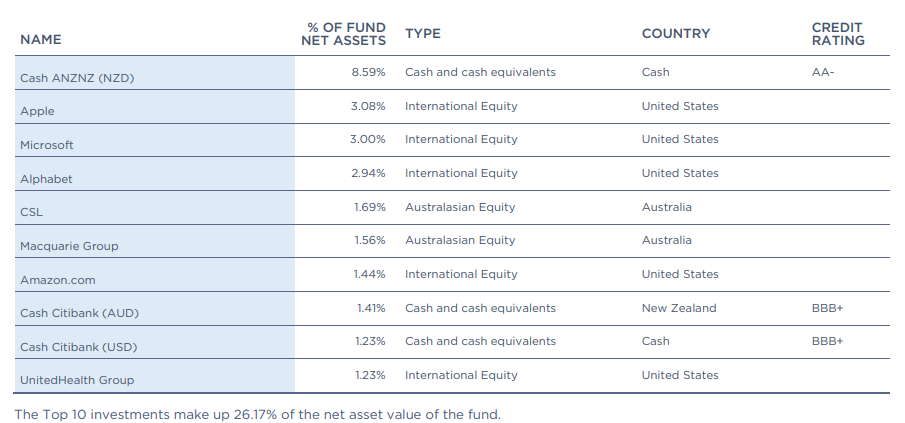

Top ten investments

This table shows QuayStreet’s top 10 investments in the Growth KiwiSaver Fund, which make up 26.17% of the fund.

Data for QuayStreet KiwiSaver funds have been sourced from QuayStreet KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if QuayStreet has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.