Using the most recent returns and fund update reports from the June 2022 Quarter, we will examine QuayStreet’s recent KiwiSaver Performance.

QuayStreet utilises active investment management across its funds and believes that actively managing investments with a concentrated selection can provide investors with better returns than industry benchmarks. QuayStreet adopts a sustainable business model, investing long-term and focusing on its investments' underlying value and quality. The QuayStreet KiwiSaver Scheme currently has 6,229 members with NZ$258,134,457 million in assets under management, according to the latest annual report that ended 31 March 2022.

In the June quarter, the cost of living in New Zealand significantly increased due to the negative impacts of Covid-19 and the Russian invasion of Ukraine. Furthermore, the Reserve Bank Of New Zealand (RBNZ) reports that inflation has reached a 32-year high of 7.3%. In response to this, the RBNZ has increased the official cash (OCR) to 3.0% percent taking it to a seven-year high to reduce inflation. Therefore, these societal and economic pressures have made it difficult for markets to perform, which can be seen in the returns for this quarter.

Table of Contents

Performance of QuayStreet KiwiSaver Funds

QuayStreet Income Fund

QuayStreet Conservative Fund

QuayStreet Socially Responsible Investment Fund

QuayStreet Balanced Fund

QuayStreet Growth Fund

Performance of QuayStreet KiwiSaver Funds

|

1 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Income |

-0.13% |

-0.62% |

2.07% |

4.28% |

5.22% |

|

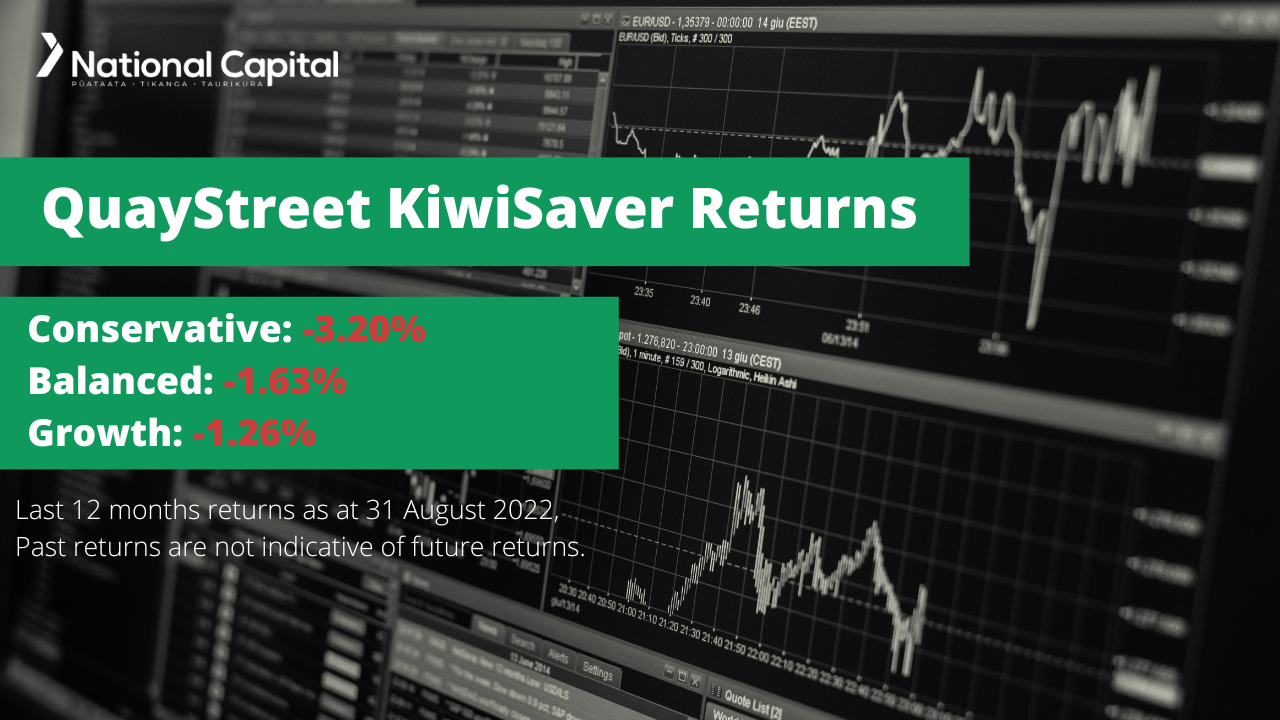

Conservative |

-0.96% |

-3.20% |

2.24% |

3.94% |

5.37% |

|

Balanced |

-0.89% |

-1.63% |

5.90% |

6.83% |

6.84% |

|

Socially Responsible Investment |

-1.34% |

-4.56% |

4.69% |

6.06% |

6.76% |

|

Growth |

-0.98% |

-1.26% |

7.45% |

8.24% |

7.67% |

Sourced from QuayStreet fund performance report.

* These returns are to 31 August 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from QuayStreet Quarterly Fund updates published on 30 June 2022.

QuayStreet Income Fund

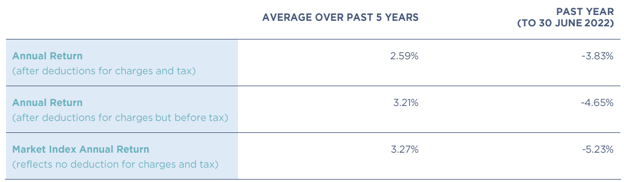

The QuayStreet Income Fund invests in a diversified portfolio with a strong focus on income-producing assets like New Zealand and International fixed interest investments and derivatives. This fund may also include an allocation to growth assets such as listed property and equity securities. The Income Fund has had a 1-year return of -0.62% and a 5-year return of 4.28%, which is lower than the return since its inception of 5.22%.

*The following is Sourced from QuayStreet Income Fund Update.

Returns

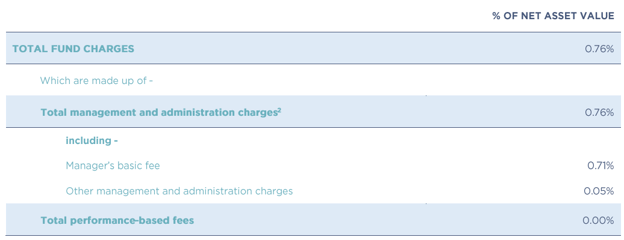

Fees

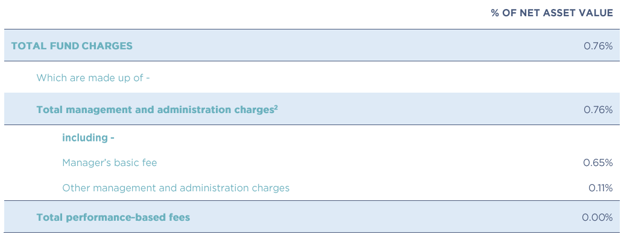

The total annual fees for investors in the QuayStreet Income Fund are 0.76% per year.

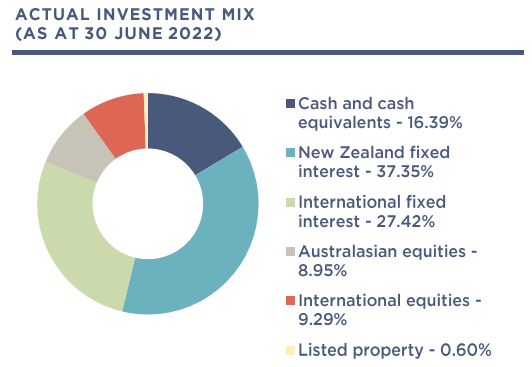

Investment mix

The investment mix shows the type of assets that the fund invests in.

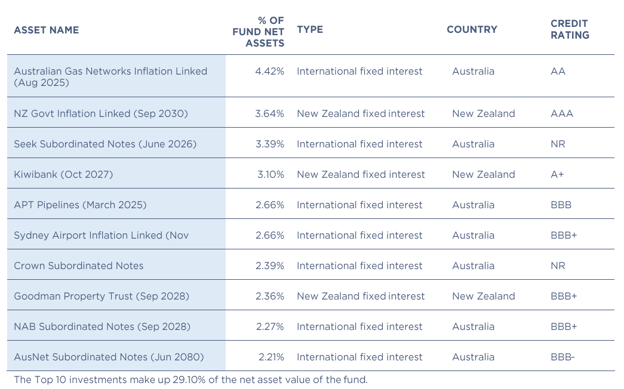

Top ten investments

This table shows QuayStreet’s top 10 investments in the Income KiwiSaver Fund, which comprise 29.10% of the fund.

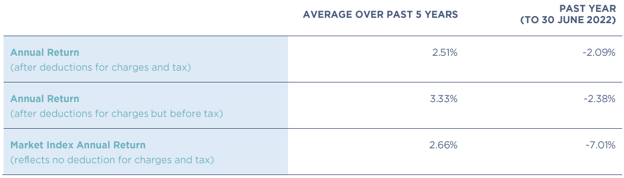

QuayStreet Conservative Fund

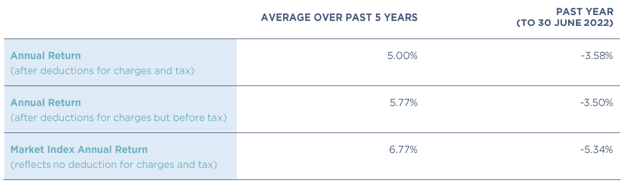

The QuayStreet Conservative Fund invests in a diversified portfolio emphasising conservative assets such as fixed interest investments. This fund is typically chosen by investors with a short investment horizon and low volatility tolerance, as it is not unlikely for the value to fluctuate as much as the Balanced Fund or Growth Fund. The Conservative Fund has had a 1 year return of -3.20% and 5 year return of 3.94%.

*The following is Sourced from QuayStreet Conservative Fund Update.

Returns

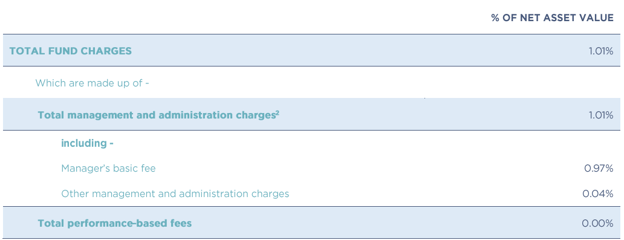

Fees

The total annual fees for investors in the QuayStreet Conservative Fund are 0.76% per year.

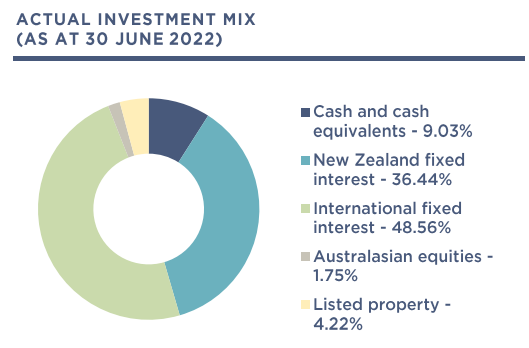

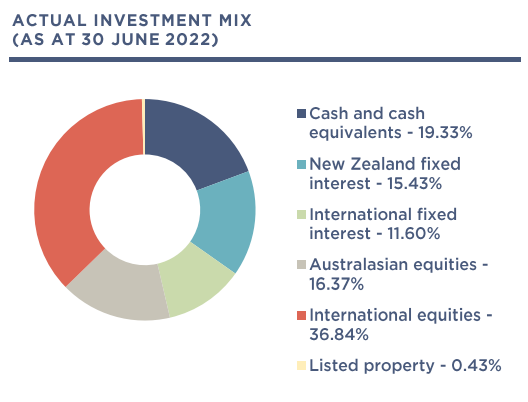

Investment mix

The investment mix shows the type of assets that the fund invests in.

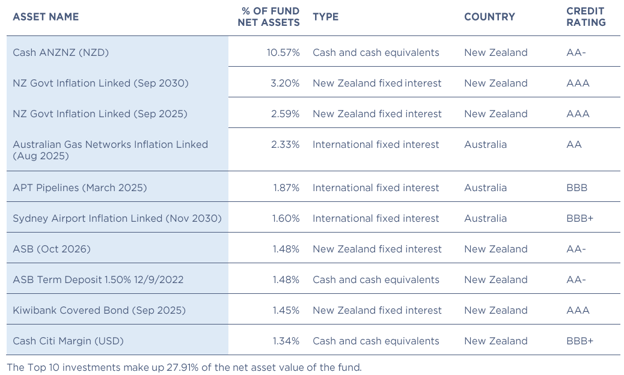

Top ten investments

This table shows QuayStreet’s top 10 investments in the Conservative KiwiSaver Fund, which make up 27.91% of the fund.

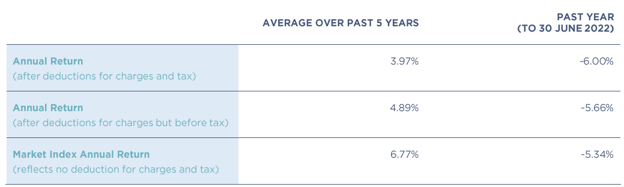

QuayStreet Balanced Fund

The QuayStreet Balanced Fund is a diversified portfolio with an equal mix of fixed interest and growth assets like shares. The Balanced Fund is likely to have higher volatility than Conservative Fund but not as volatile as Growth Fund. This fund might be suitable for investors with a long investment horizon but low volatility tolerance, or vice versa. The Balanced Fund has had 1 year return of -1.63% and 5 year return of 6.83%.

*The following is Sourced from QuayStreet Balanced Fund Update.

Returns

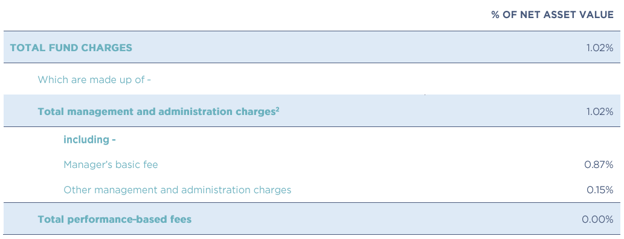

Fees

The total annual fees for investors in the QuayStreet Balanced Fund are 1.01% per year.

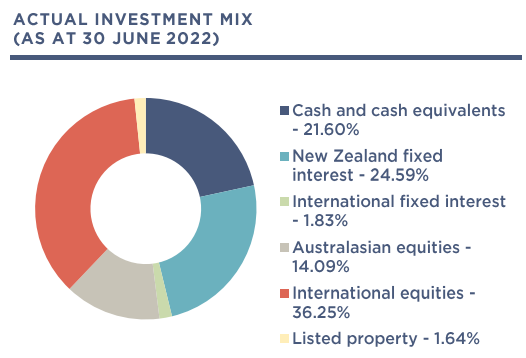

Investment mix

The investment mix shows the type of assets that the fund invests in.

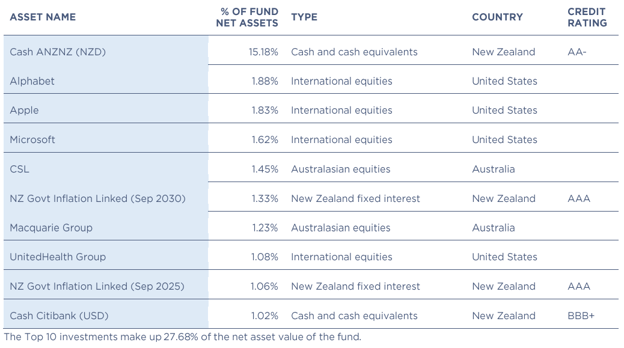

Top ten investments

This table shows QuayStreet’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 27.68% of the fund.

QuayStreet Socially Responsible Investment Fund

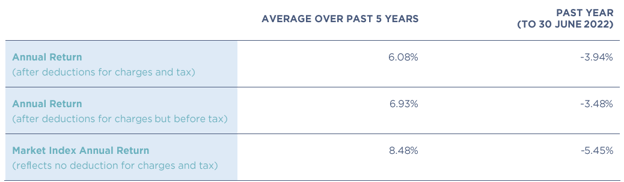

The QuayStreet Socially Responsible Investment (SRI) Fund aims to have a environmentally and socially responsible diversified investment portfolio. QuayStreet SRI Fund invests in both income and growth assets in accordance with their SRI Policy. This fund can also vary between a growth and a balanced investment strategy. The SRI Fund has had a 1 year return of -4.56% and 5 year return of 6.06%.

*The following is Sourced from QuayStreet Socially Responsible Investment Fund Update.

Returns

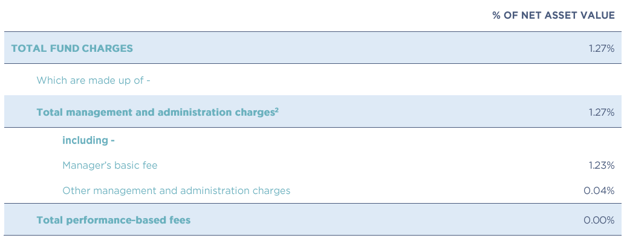

Fees

The total annual fees for investors in the QuayStreet Socially Responsible Investment Fund are 1.02% per year.

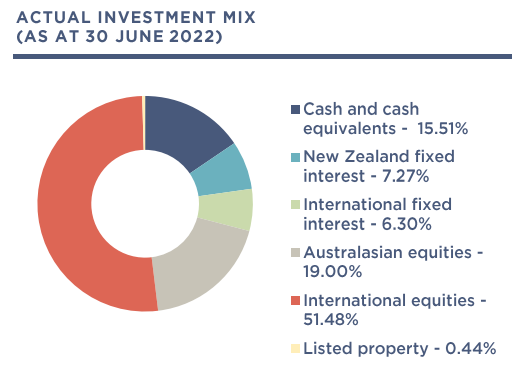

Investment mix

The investment mix shows the type of assets that the fund invests in.

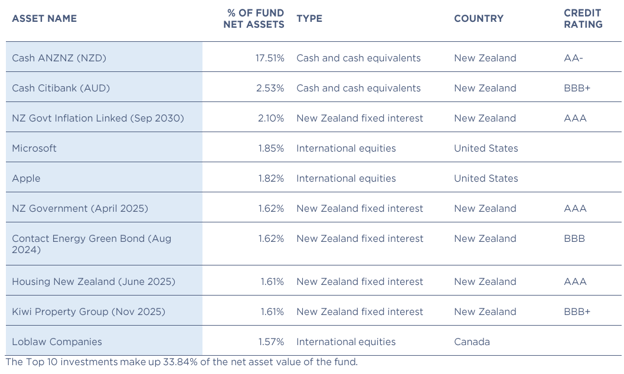

Top ten investments

This table shows QuayStreet’s top 10 investments in the QuayStreet Socially Responsible Investment KiwiSaver Fund, which make up 33.84% of the fund.

QuayStreet Growth Fund

The QuayStreet Growth Fund invests in a diversified portfolio emphasising growth assets like shares. This fund is likely to have high volatility, therefore it is typically chosen by investors with longer investment horizon or those with higher volatility tolerance. The Growth Fund has had a 1 year return of -1.26% and 5 year return of 8.24%.

*The following is Sourced from QuayStreet Growth Fund Update.

Returns

Fees

The total annual fees for investors in the QuayStreet Growth Fund are 1.27% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

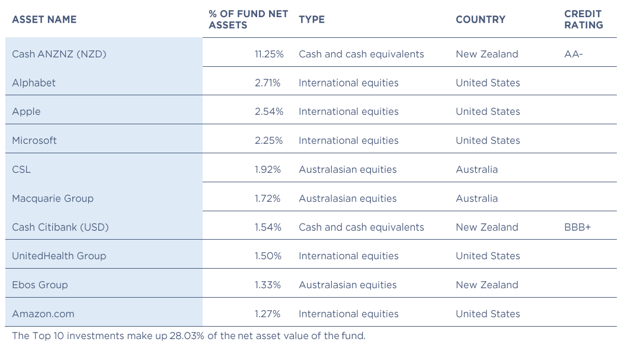

Top ten investments

This table shows QuayStreet’s top 10 investments in the Growth KiwiSaver Fund, which make up 28.03% of the fund.

Data for QuayStreet KiwiSaver funds have been sourced from QuayStreet KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if QuayStreet has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.