Using the most recent returns and fund update reports from June 2022, we will examine Mercer's recent KiwiSaver Performance.

Mercer is a New Zealand-based KiwiSaver and Superannuation advisory specialist, who has advised Kiwis for over 60 years. Mercer has been a provider for the KiwiSaver Scheme for 15 years as of 2022 and has received the Platinum rating for seven years consecutively from the company SuperRatings. As of 31 March 2022, Mercer has a KiwiSaver Scheme membership count of 51,571 members, equating to 2.09 billion as a dollar value invested within the Scheme.

The quarter ended June 2022 has been another rocky period, with negative returns being very common across KiwiSaver funds and providers. Markets have still been struggling to recover from the impact of Covid-19, which has caused large volatility across markets, and negative returns have been realised due to this. The increase in inflation and the rise in the OCR to 3% have also contributed to the volatility seen in this quarter. Markets have also been impacted by the Ukraine crisis, with uncertainty at the forefront of international and domestic markets. These societal and economic pressures have made it difficult for markets to perform, which can be seen in the returns for this quarter.

Table of Contents

Performance of Mercer KiwiSaver Funds

Mercer Cash Fund

Mercer Conservative Fund

Mercer Moderate Fund

Mercer Balanced Fund

Mercer Growth Fund

Mercer High Growth Fund

Mercer Shares/Equity Fund

Performance of Mercer KiwiSaver Funds

|

1 Month |

3 Month |

1 Year |

5 Year |

|

|

Cash |

0.17% |

0.44% |

0.81% |

0.89% |

|

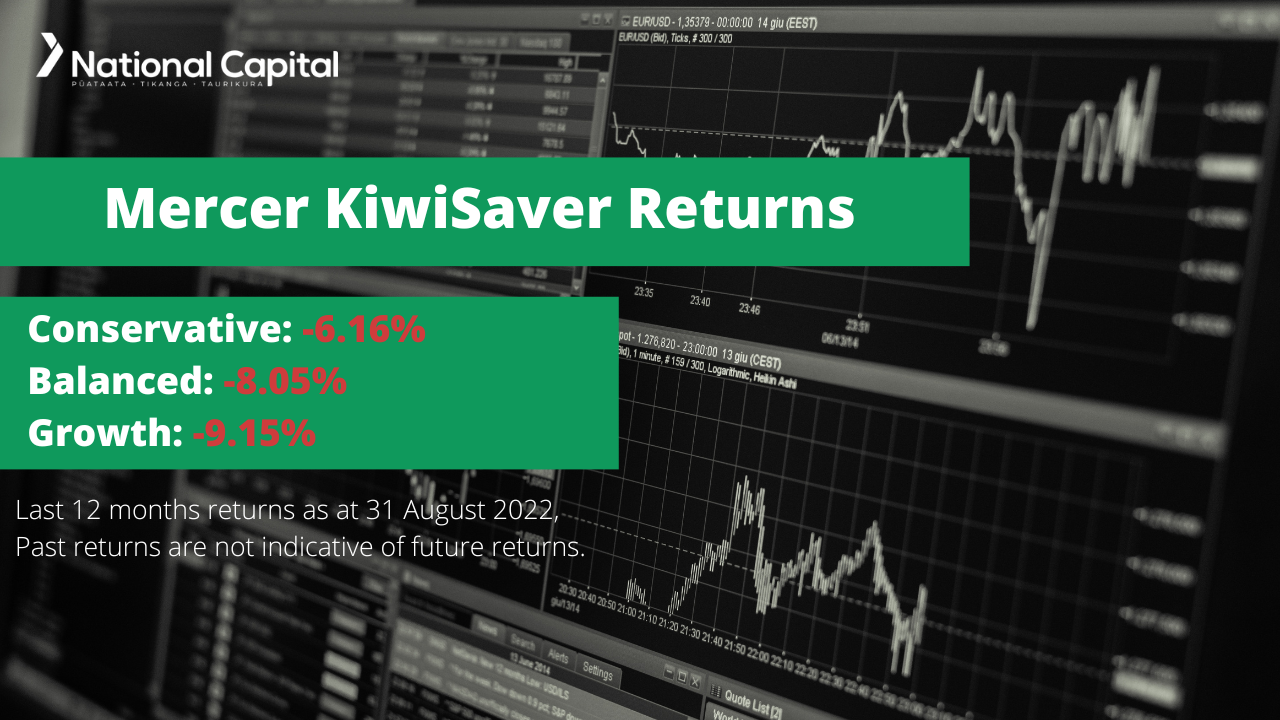

Conservative |

-1.41% |

-0.76% |

-6.16% |

1.94% |

|

Moderate |

-1.35% |

-0.79% |

-6.36% |

2.88% |

|

Balanced |

-1.71% |

-1.04% |

-8.05% |

4.05% |

|

Growth |

-1.96% |

-1.14% |

-9.15% |

5.16% |

|

High Growth |

-2.07% |

-1.18% |

-10.21% |

6.13% |

|

Shares/Equity |

-2.49% |

-1.16% |

-12.77% |

6.38% |

Sourced from Mercer fund performance report

* These returns are to 31 August 2022 and are after tax (PIR 28%) and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Mercer Quarterly Fund updates published on 31 August 2022.

Mercer Cash Fund

Invests mainly in cash and short-term interest-bearing investments. Designed for investors who want no exposure to growth assets or where the funds may be required in the shorter term. Mercer Cash Fund has a 3-month return of 0.44%, and a 1-year return of 0.81%, compared to a 5-year return of 0.89%.

*The following is Sourced from Mercer Cash Fund Update

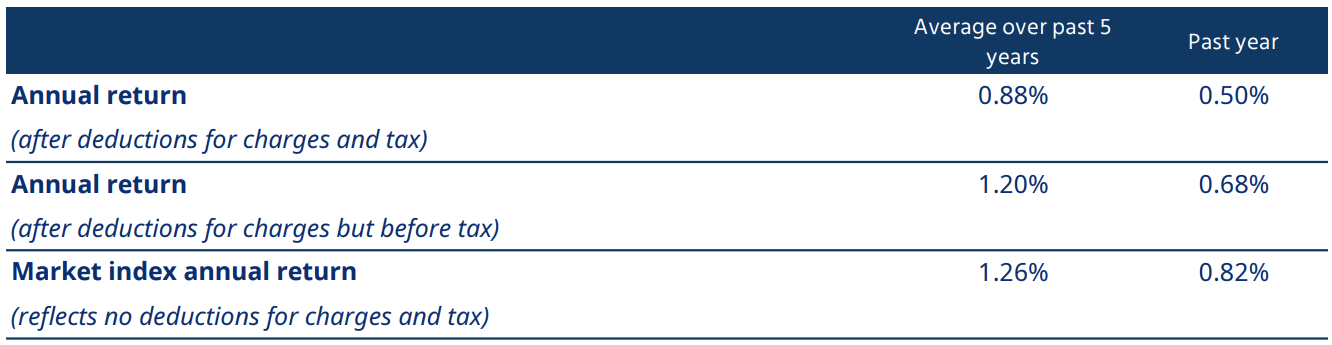

Returns

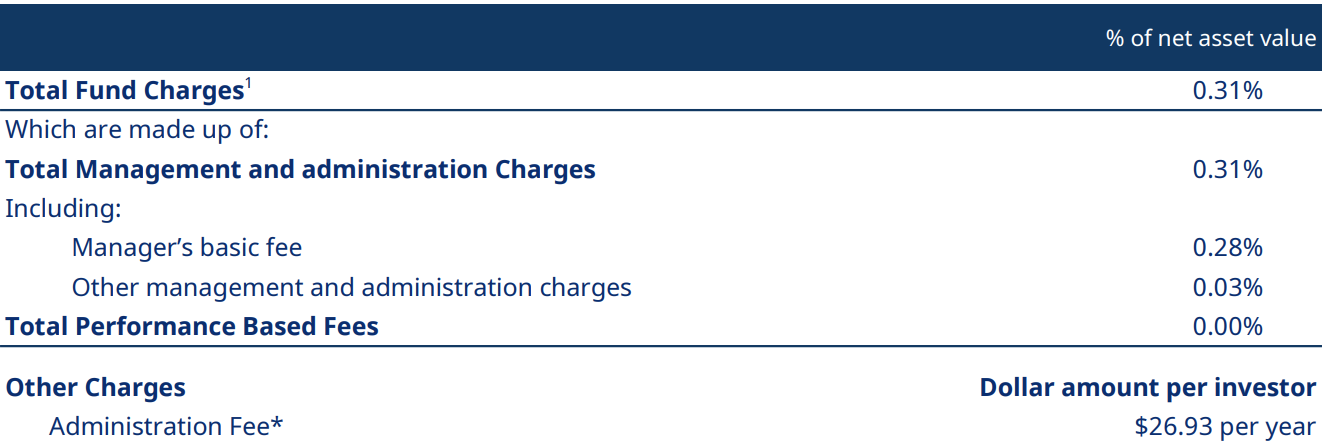

Fees

The total annual fees for investors in the Mercer Cash Fund are 0.31% per year.

Investment Mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

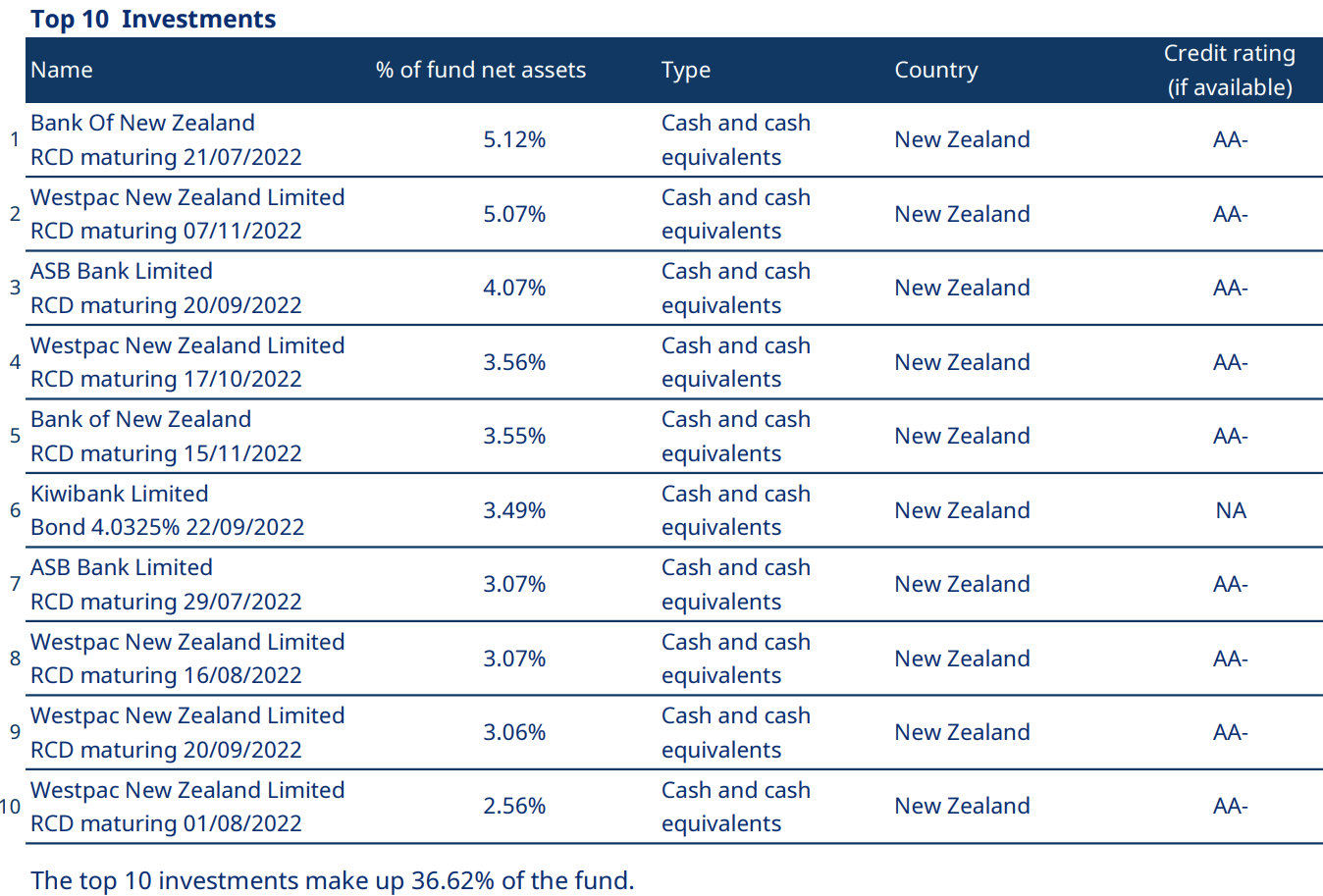

Top Ten Investments

This table shows Mercer’s top 10 investments in the Cash KiwiSaver Fund, which comprise 36.62% of the fund.

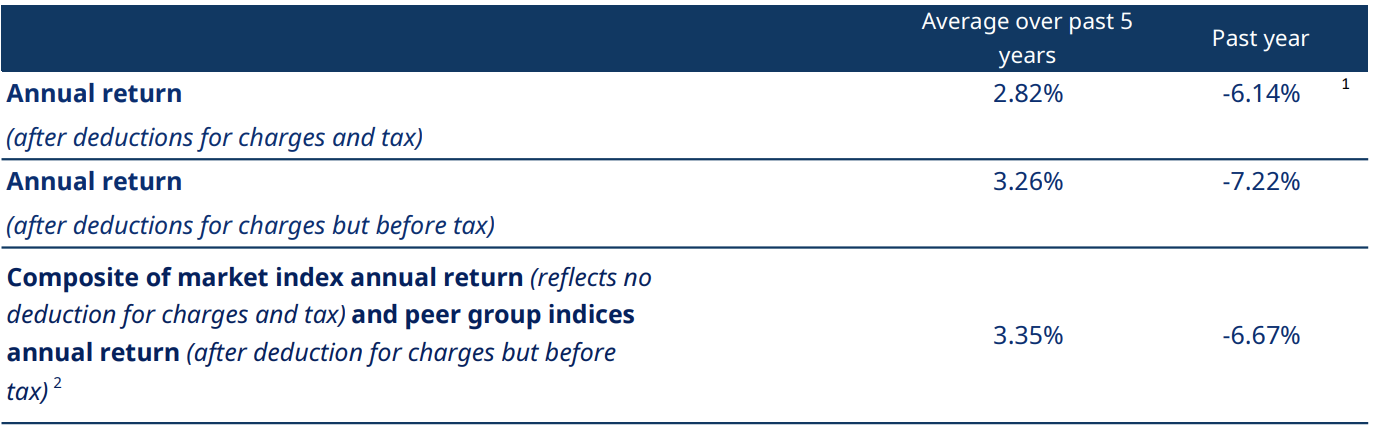

Mercer Conservative Fund

Invests primarily in cash and fixed interest, with only limited investment in growth assets such as shares. The Fund may be suitable for investors who want to achieve slightly higher returns than those expected from investing solely in cash. Investors need to be comfortable with the possibility of some fluctuations in returns. Mercer Conservative Fund has a 3-month return of -0.76%, and a 1-year return of -6.16% compared to the 5-year return of 1.94%.

*The following is Sourced from Mercer Conservative Fund Update

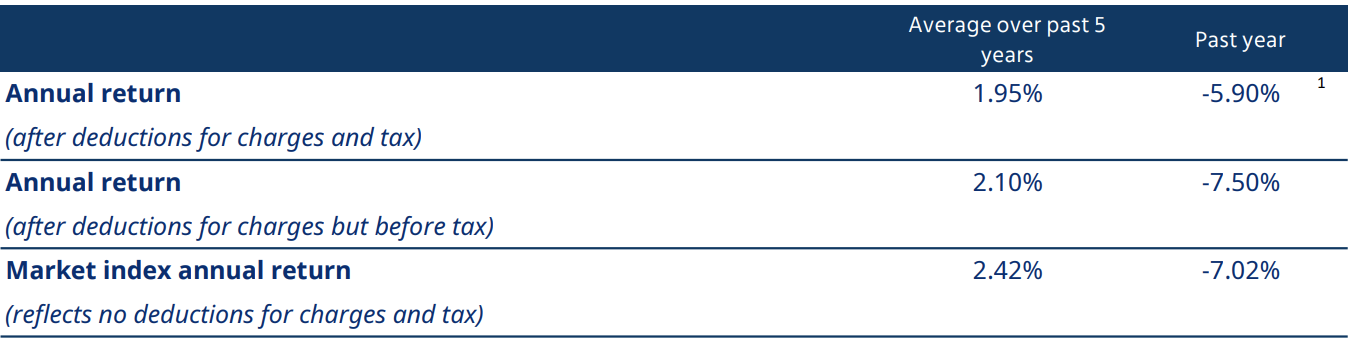

Returns

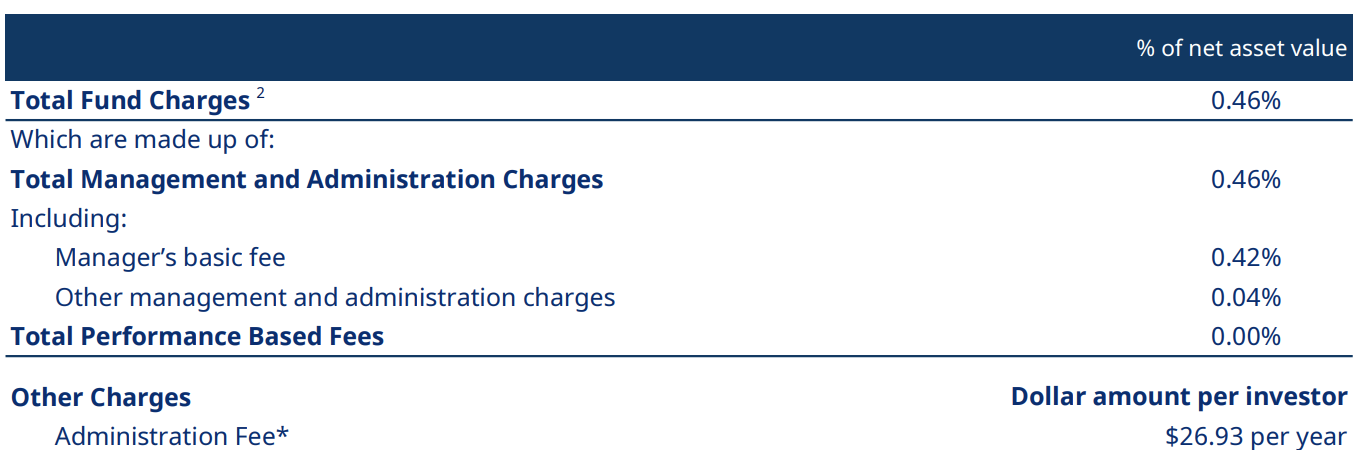

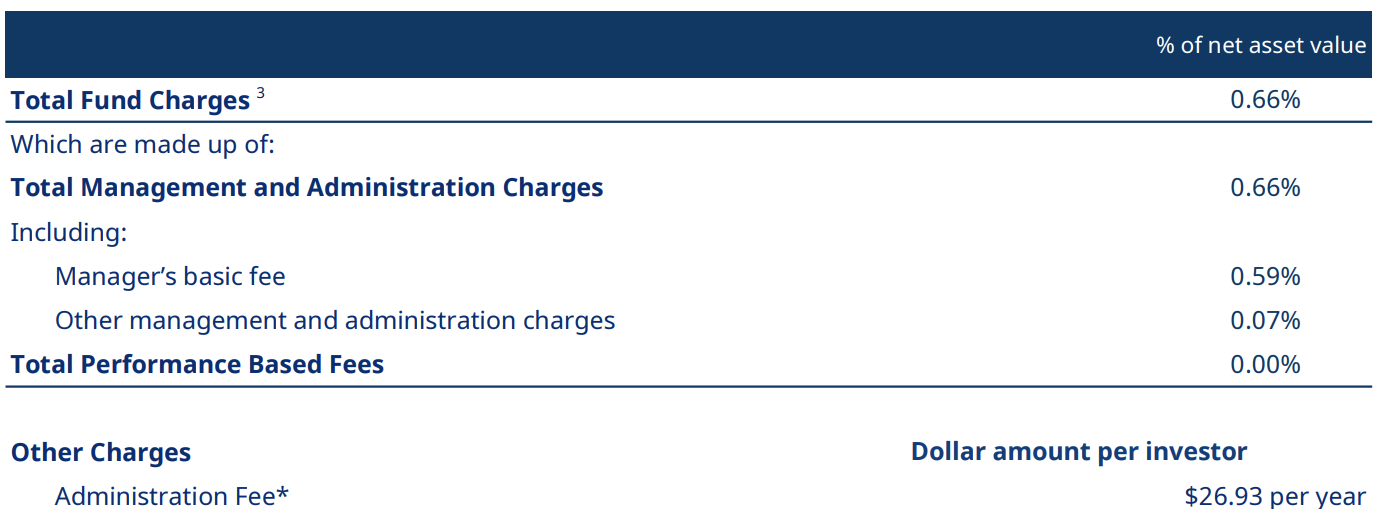

Fees

The total annual fees for investors in the Mercer Conservative Fund are 0.46% per year.

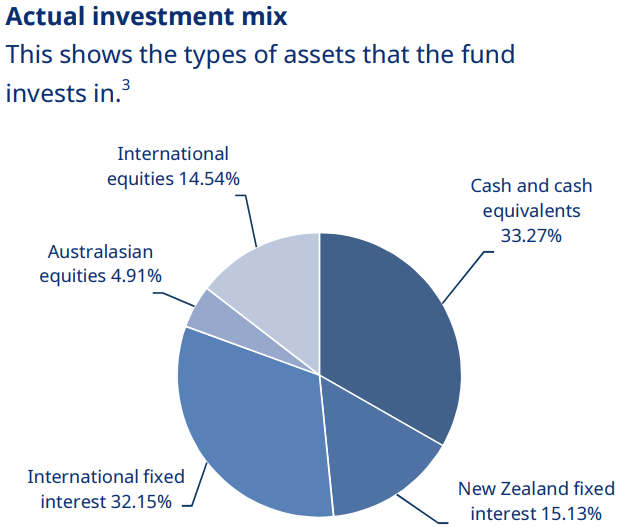

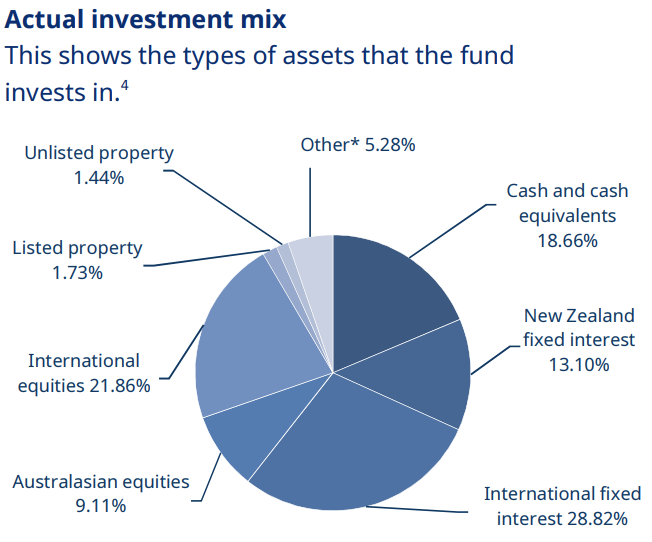

Investment Mix

The investment mix shows the type of assets that the fund invests in.

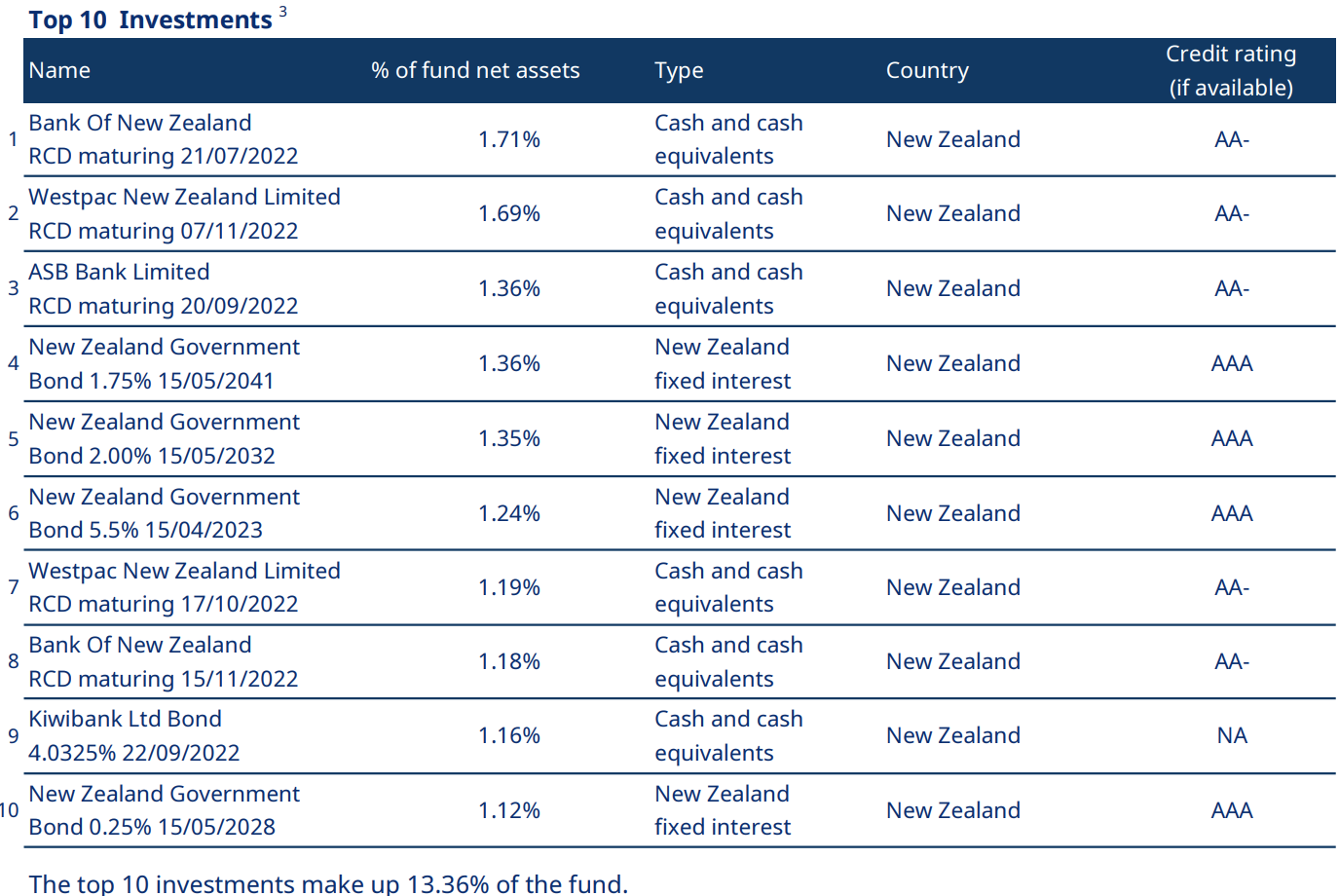

Top Ten Investments

This table shows Mercer’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 13.36% of the fund.

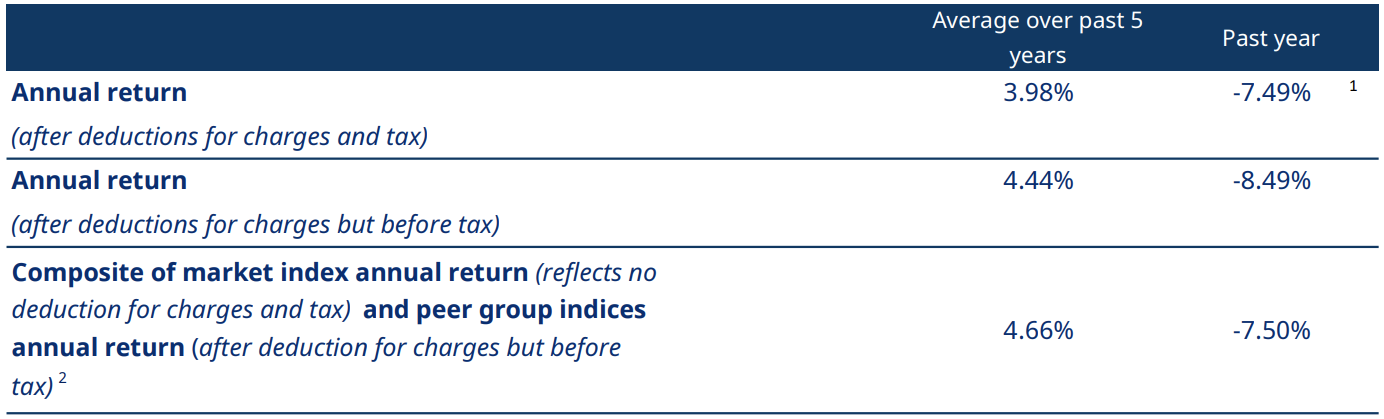

Mercer Moderate Fund

Invests in cash and fixed interest, with about a third of investments being in growth assets such as shares and real assets. This fund may be suitable for investors who want to invest in a fund with a broad mix of assets and who are comfortable with a higher degree of volatility in returns than can be expected from the Sustainable Conservative fund. Mercer Moderate Fund has a 3-month return of -0.79%, and a 1-year return of -6.36% compared to the 5-year return of 2.88%.

*The following is Sourced from Mercer Moderate Fund Update

Returns

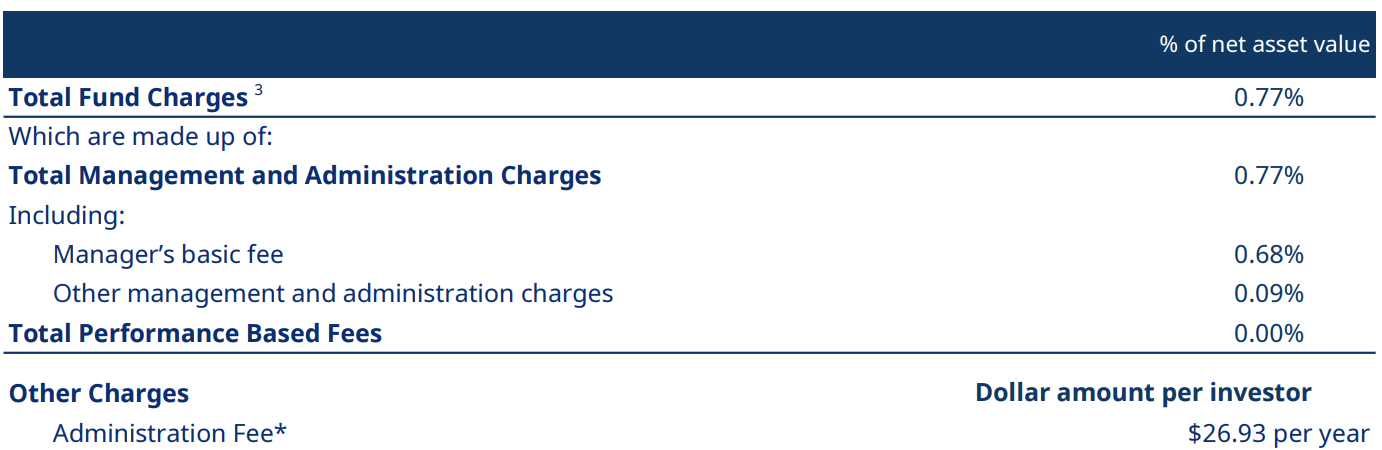

Fees

The total annual fees for investors in the Mercer Moderate Fund are 0.66% per year.

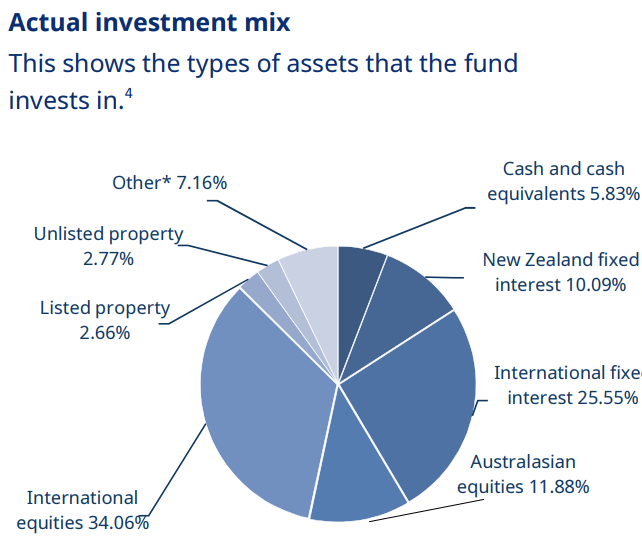

Investment Mix

The investment mix shows the type of assets that the fund invests in.

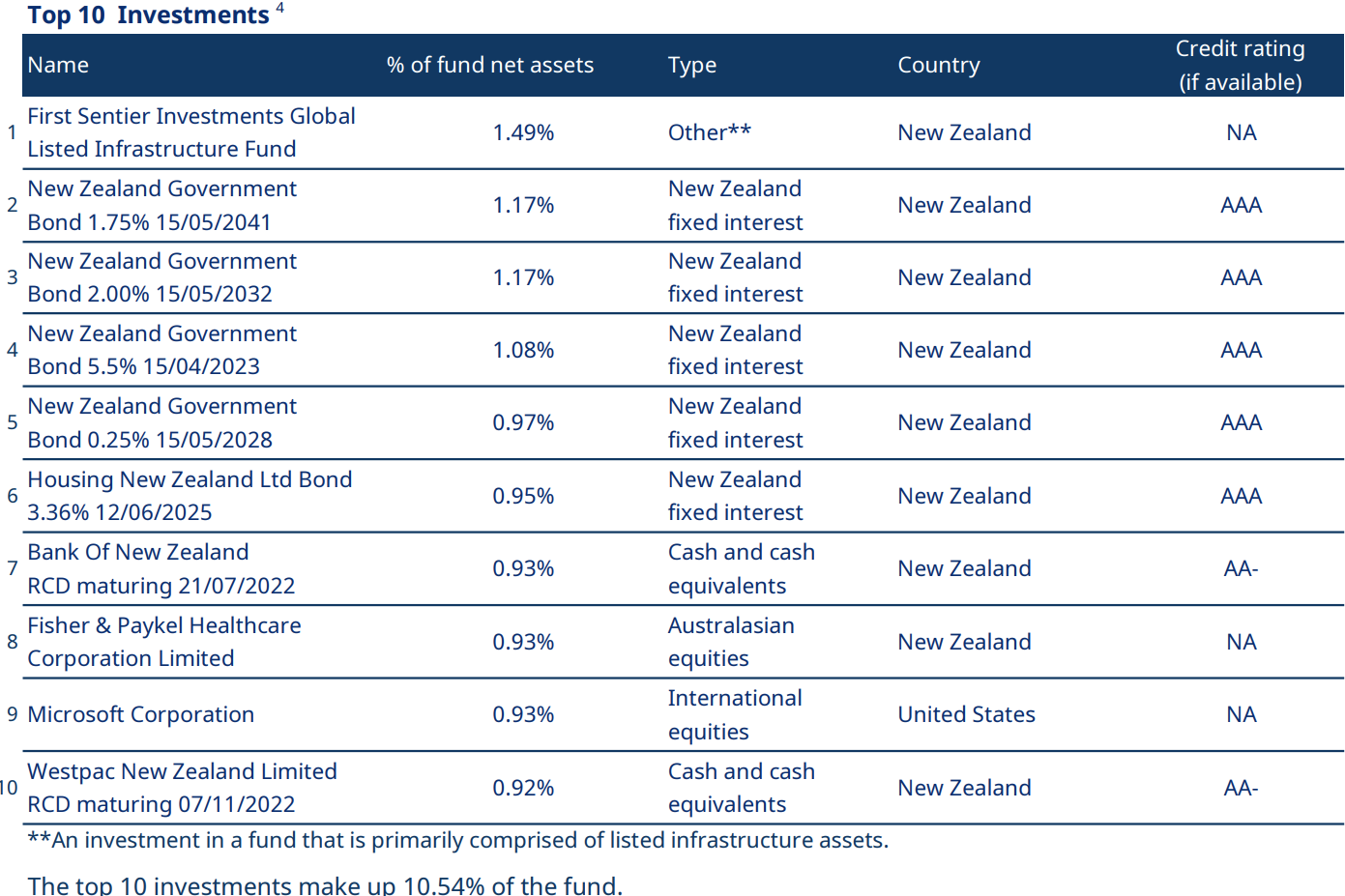

Top Ten Investments

This table shows Mercer’s top 10 investments in the Moderate KiwiSaver Fund, which comprise 10.54% of the fund.

Mercer Balanced Fund

Invests in a wide range of assets and may be suitable for investors who want a diversified investment with exposure to shares, real assets, fixed interest and cash. This fund can be expected to have a higher degree of volatility in returns than expected from the Sustainable Plus Moderate fund and is more suited to investors who can invest for the long term. Mercer Balanced Fund has a 3-month return of -1.04%, and a 1-year return of -8.05% compared to the 5-year return of 4.05%.

*The following is Sourced from Mercer Balanced Fund Update

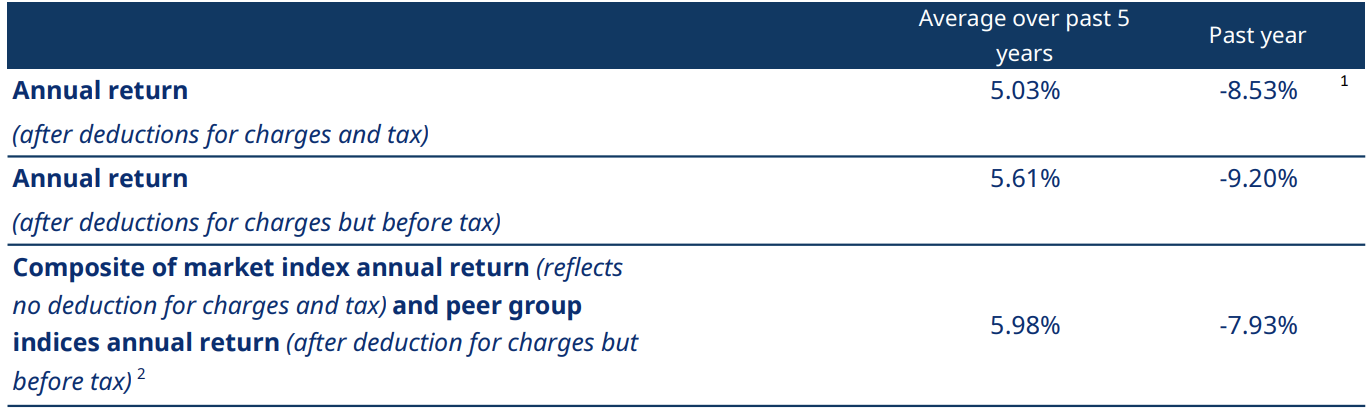

Returns

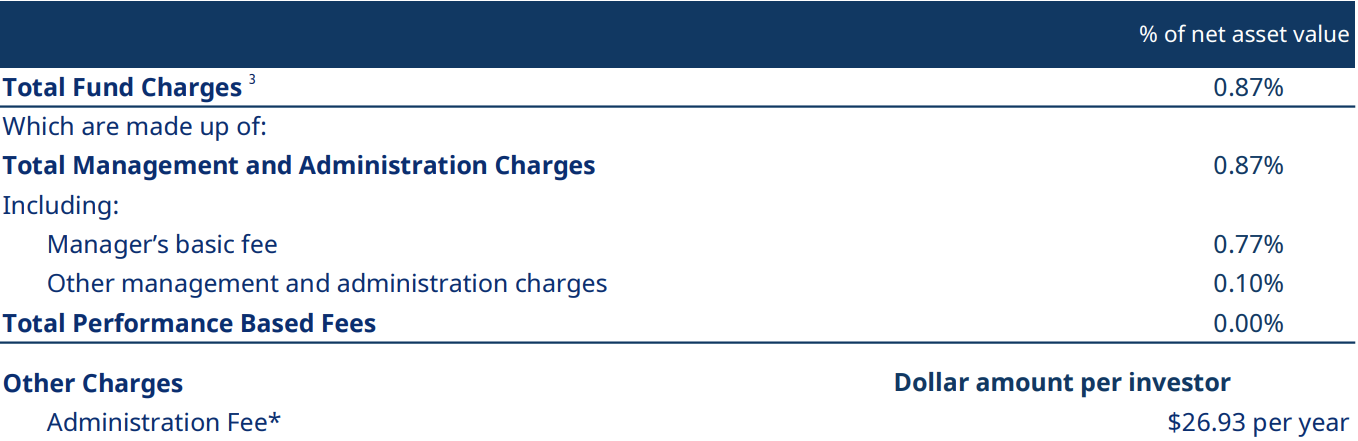

Fees

The total annual fees for investors in the Mercer Balanced Fund are 0.77% per year.

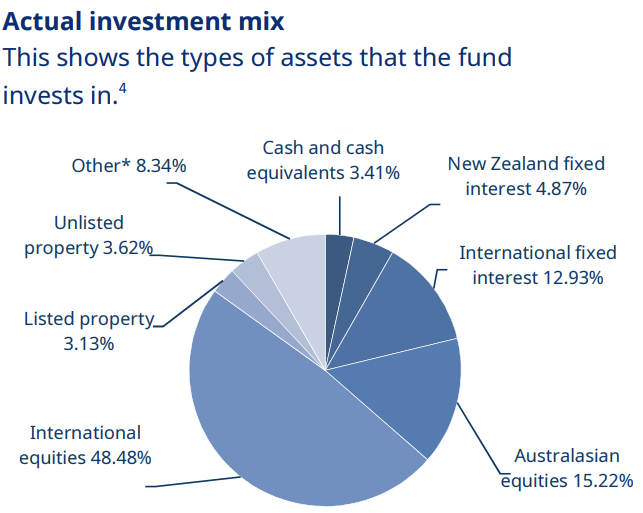

Investment Mix

The investment mix shows the type of assets that the fund invests in.

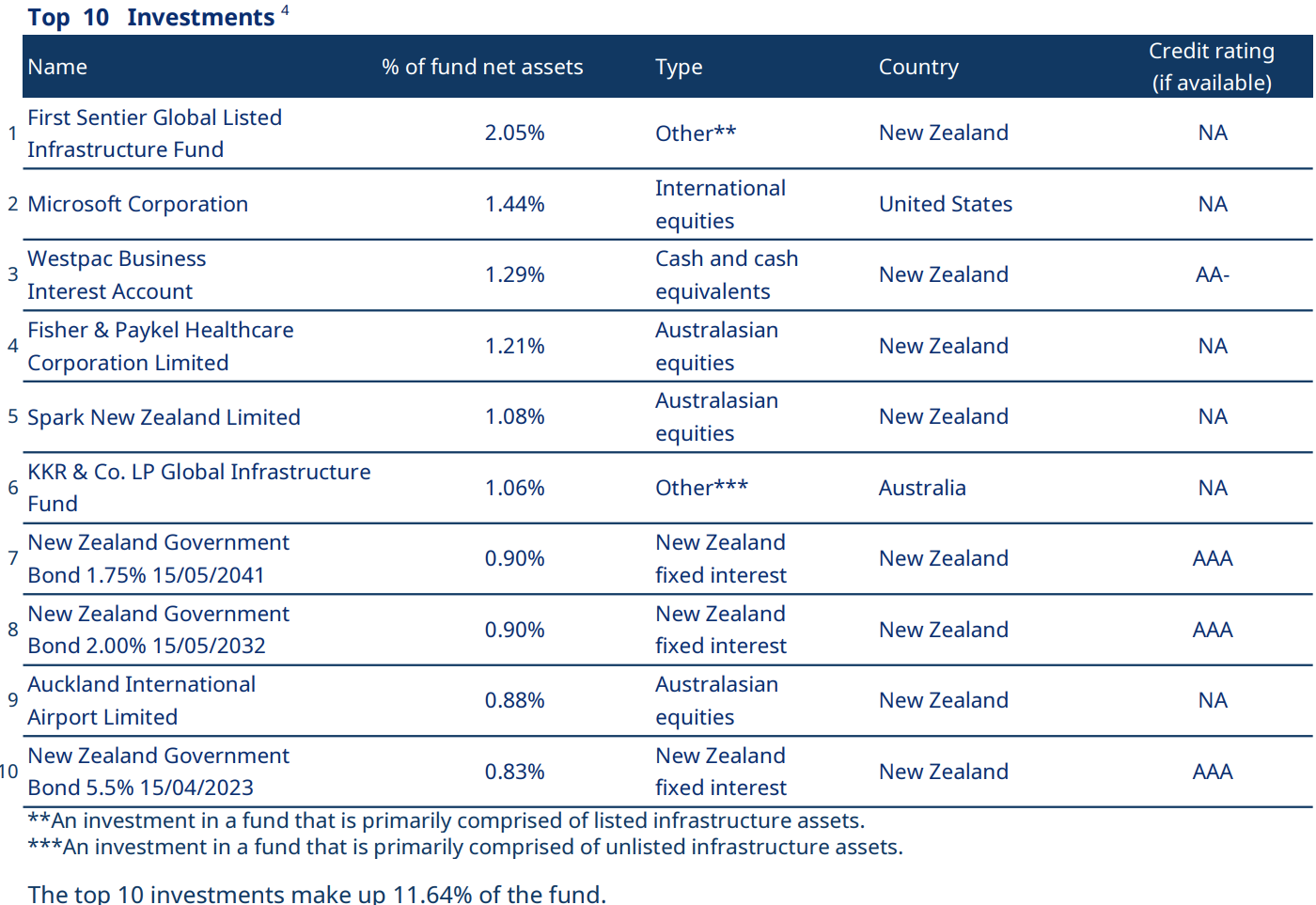

Top Ten Investments

This table shows Mercer’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 11.64% of the fund.

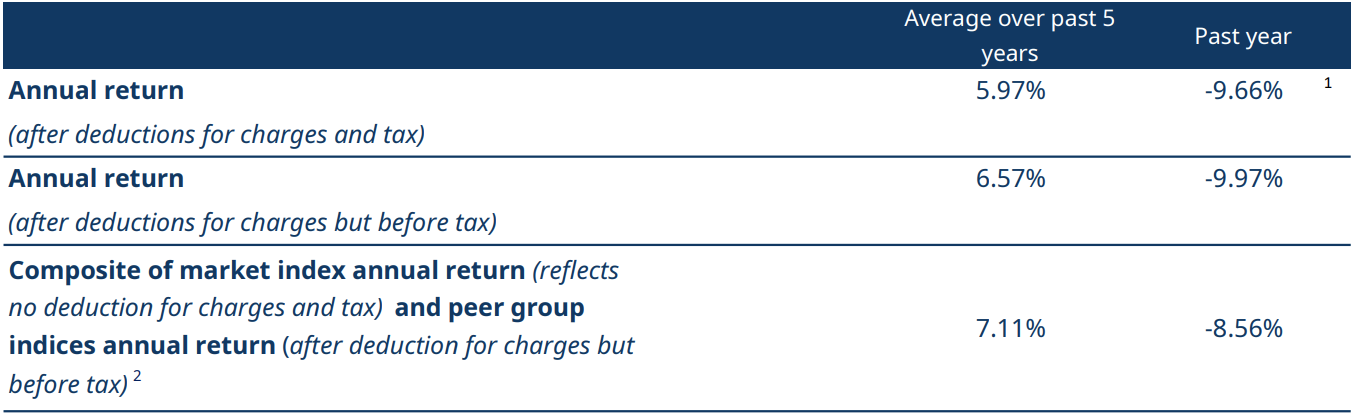

Mercer Growth Fund

Invests mainly in growth assets such as shares and real assets, with only a limited amount in cash and fixed interest. This fund may be suited to investors wanting to invest primarily in growth assets who are comfortable accepting more volatile returns than those expected from the Sustainable Plus Balanced fund to achieve higher longer-term returns. Mercer Growth Fund has a 3-month return of -1.14%, and a 1-year return of -9.15% compared to the 5-year return of 5.16%.

*The following is Sourced from Mercer Growth Fund Update

Returns

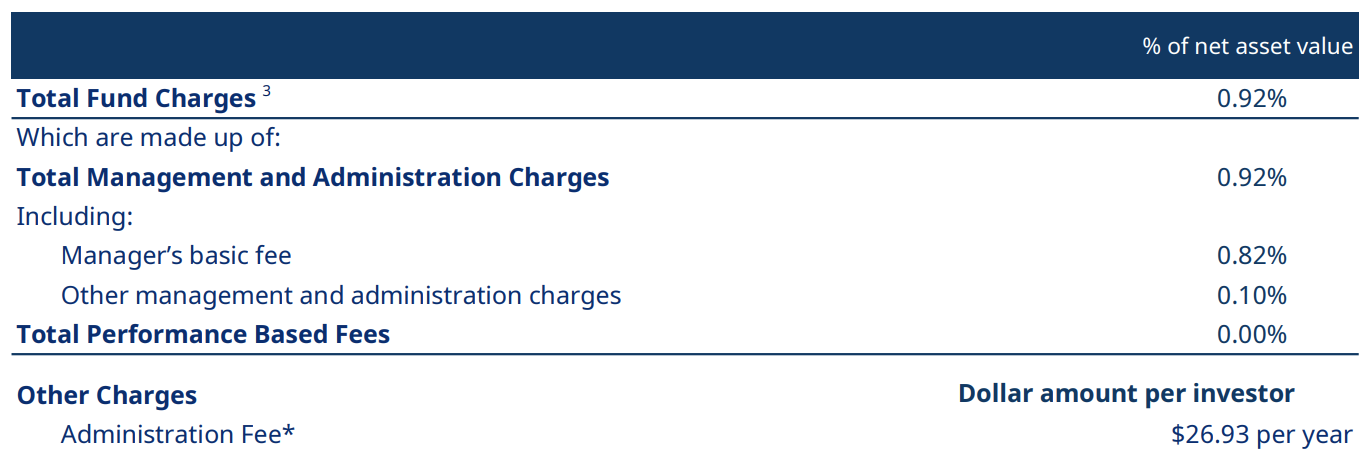

Fees

The total annual fees for investors in the Mercer Growth Fund are 0.87% per year.

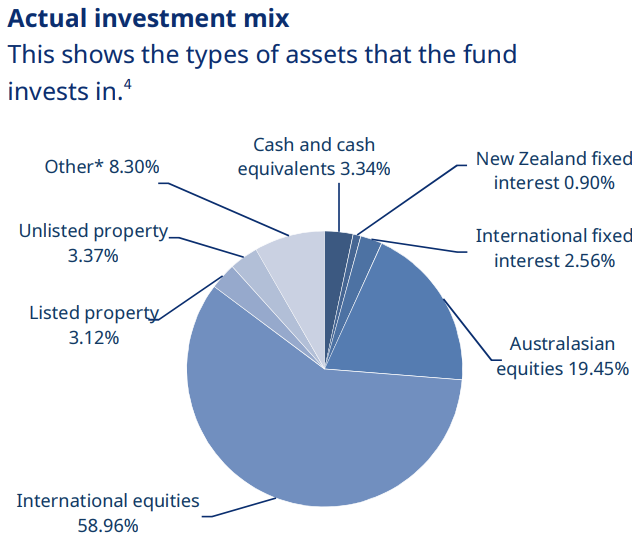

Investment Mix

The investment mix shows the type of assets that the fund invests in.

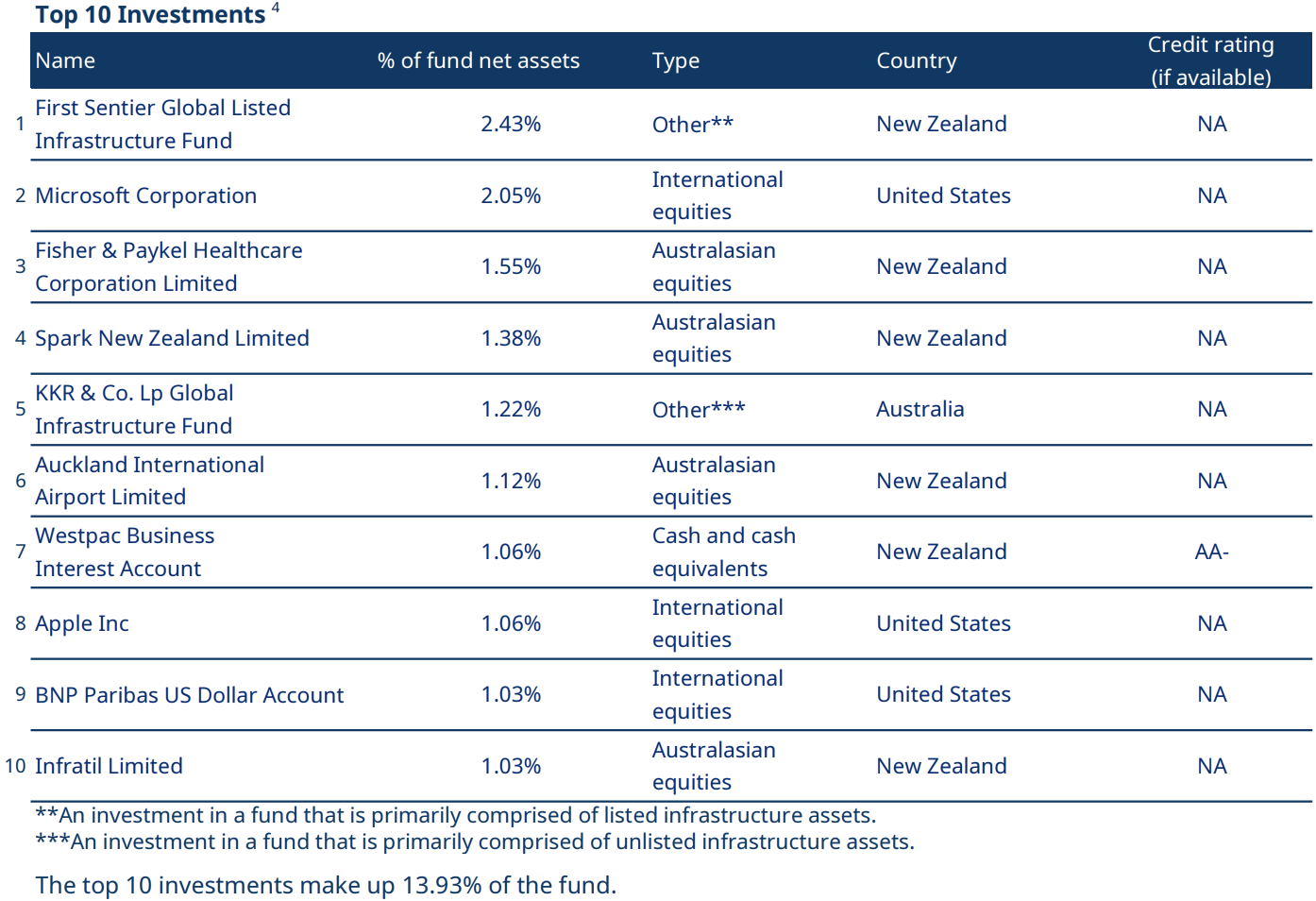

Top Ten Investments

This table shows Mercer’s top 10 investments in the Growth KiwiSaver Fund, which comprise 13.93% of the fund.

Mercer High Growth Fund

Invests almost entirely in growth assets such as shares, real assets, with only a small amount invested in cash and fixed interest. It may be suitable for investors wanting to invest predominantly in growth assets who want higher long-term returns and are comfortable with high volatility in returns. Mercer High Growth Fund has a 3-month return of -1.18%, and a 1-year return of -10.21% compared to the 5-year return of 6.13%.

*The following is Sourced from Mercer High Growth Fund Update

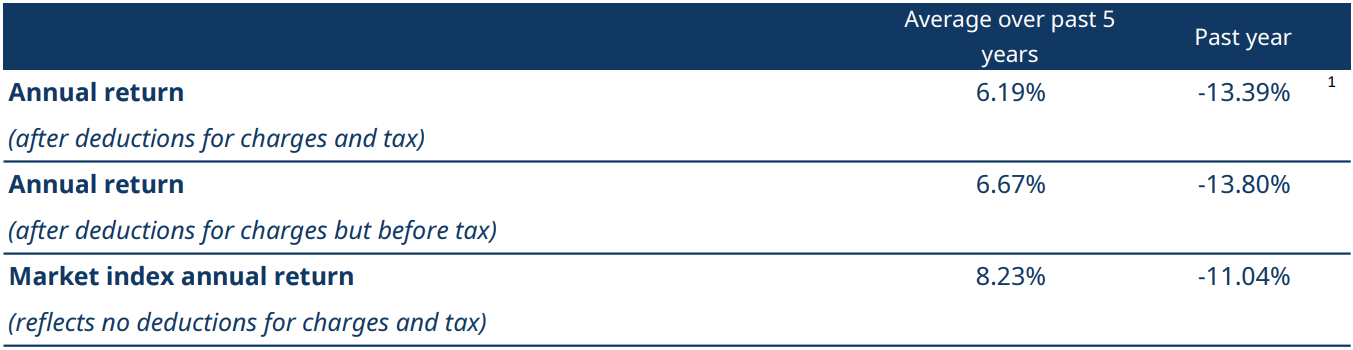

Returns

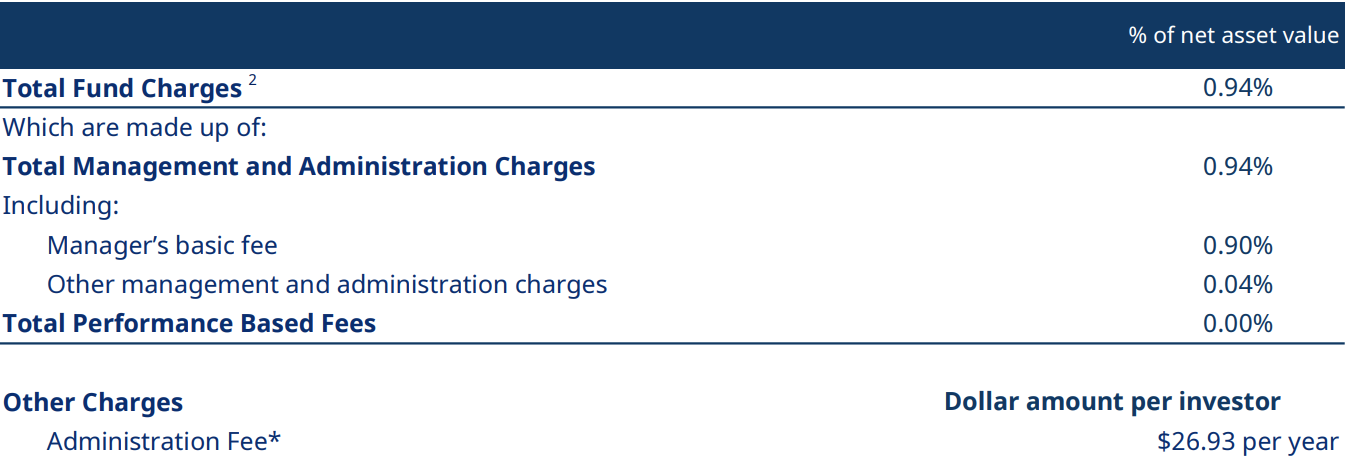

Fees

The total annual fees for investors in the Mercer High Growth Fund are 0.92% per year.

Investment Mix

The investment mix shows the type of assets that the fund invests in.

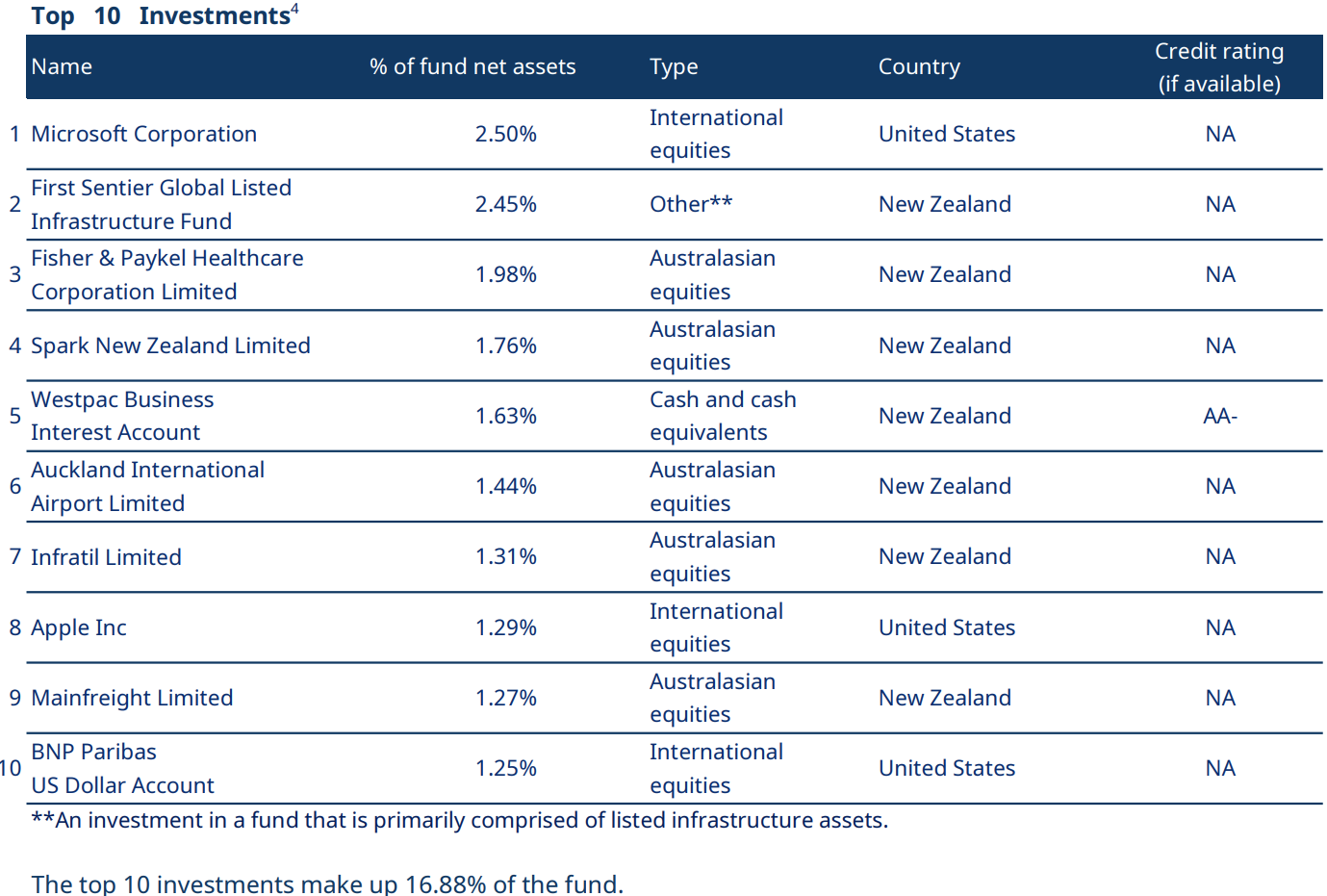

Top Ten Investments

This table shows Mercer’s top 10 investments in the Aggressive KiwiSaver Fund, which comprise 16.88% of the fund.

Mercer Shares Fund

Invests almost entirely in the share market. It may be suitable for investors seeking exposure primarily to shares and who are comfortable with a high level of volatility in returns. Mercer Shares Fund has a 3-month return of -1.16%, and a 1-year return of -12.77% compared to the 5-year return of 6.38%.

*The following is Sourced from Mercer Shares/Equity Fund Update

Returns

Fees

The total annual fees for investors in the Mercer Shares/Equity Fund are 0.94% per year.

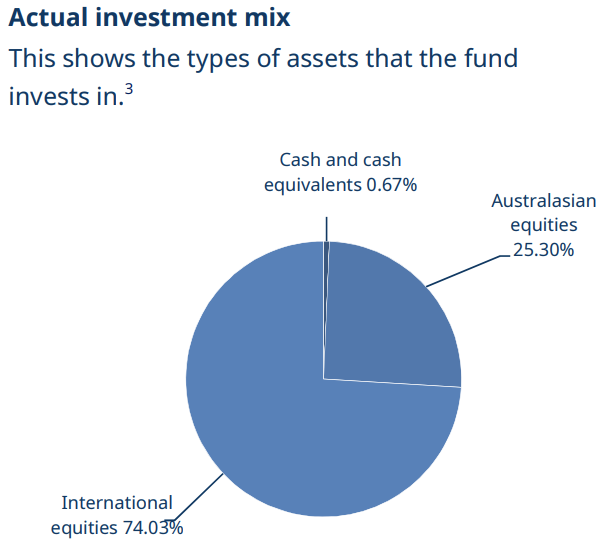

Investment Mix

The investment mix shows the type of assets that the fund invests in.

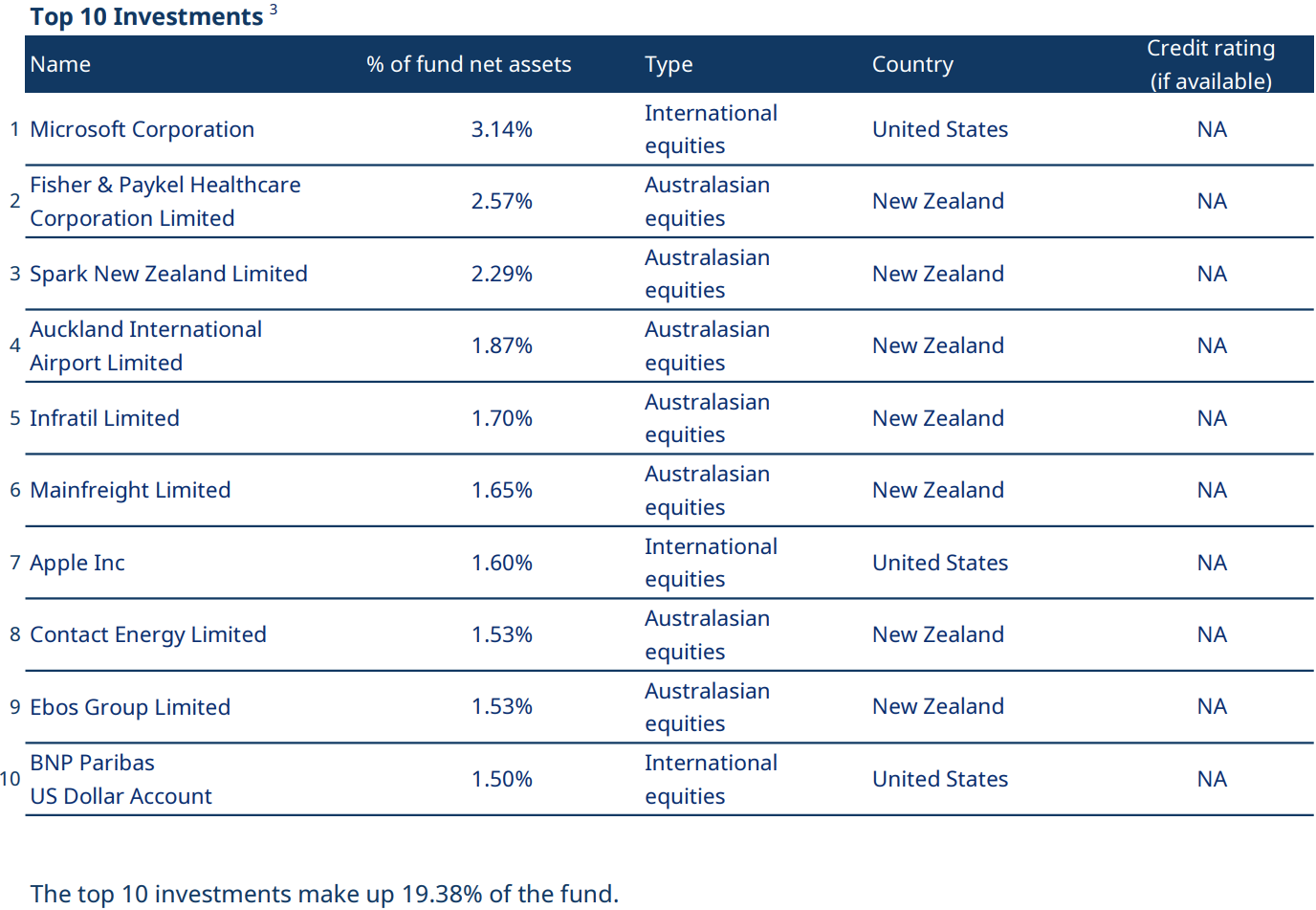

Top Ten Investments

This table shows Mercer’s top 10 investments in the Shares/Equity KiwiSaver Fund, which comprise 19.38% of the fund.

Data for Mercer KiwiSaver funds has been sourced from Mercer KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Mercer has the appropriate fund that aligns with your values, retirement goals and personal situation, complete National Capital’s KiwiSaver Healthcheck.