Using the most recent returns from December 2021, we will take a look at KiwiWealth's recent KiwiSaver Performance.

KiwiWealth has been at the forefront of investment management in New Zealand since its founding in 2000. The KiwiWealth KiwiSaver Scheme administers six funds, each with a particular degree of potential return and tailored to the demands of a certain life stage. It presently handles NZ$6.1 billion in KiwiSaver assets under management of 260,083 KiwiSaver members.

In March 2022, investors weighed the implications of the invasion war and the accompanying sanctions on Russia on economic growth, energy prices, and global trade. Overall, this had a significant impact on financial markets throughout the globe.

Table Of Contents

Performance of KiwiWealth KiwiSaver Funds

KiwiWealth Cash Fund

KiwiWealth Conservative Fund

KiwiWealth Balanced Fund

KiwiWealth Growth Fund

Performance of KiwiWealth KiwiSaver Funds

|

1 month |

1-year |

3-years |

5-years |

Since Inception |

|

|

Cash |

0.06% | 0.53% | 1.27% | 1.84% | 2.59% |

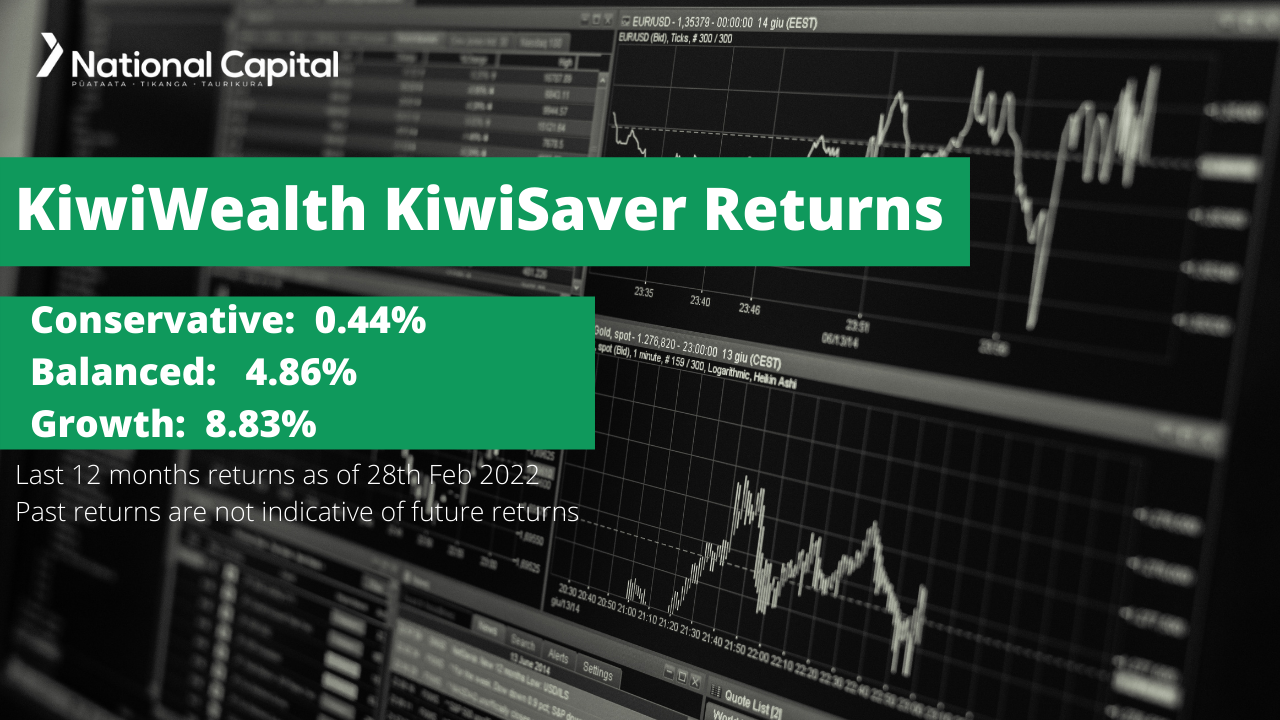

| Conservative | -1.68% | 0.44% | 4.31% | 4.59% | 5.15% |

|

Balanced |

-2.58% | 4.86% | 7.96% | 7.48% | 6.36% |

|

Growth |

-3.32% | 8.83% | 11.05% | 9.99% | 6.90% |

*Sourced from KiwiWealth fund performance report

* These returns are to 28 February 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from KiwiWealth Quarterly Fund updates published on 31 December 2021.

KiwiWealth Cash Fund

KiwiWealth Cash Fund invests only in cash assets. It is a low-volatility fund with the aim of outperforming the returns you would earn from investing 100% of your funds in New Zealand cash through the active selection of cash assets. The Cash Fund has had a 1-month and 1-year return of 0.06% and 0.53%, far below the 5-year return of 1.84%. This suggests that the fund is producing returns, but not at the projected level.

*The following is Sourced from KiwiWealth Cash Fund Update

Returns

Fees

The total annual fees for investors in the KiwiWealth Cash Fund are 0.52% per year. The manager's basic fee each member pays is subject to a minimum fee of $40 per year, although this minimum fee only affects balances under $8,000.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

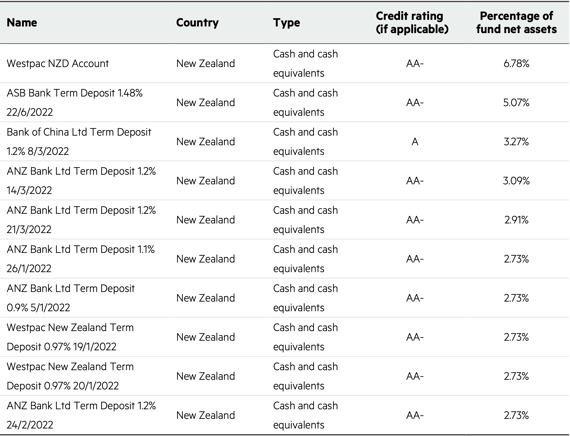

Top ten investments

This table shows KiwiWealth’s top 10 investments in the Cash KiwiSaver Fund, which make up 34.77% of the fund.

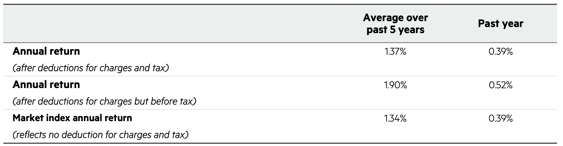

KiwiWealth Conservative Fund

KiwiWealth Conservative Fund invests up to 35% in shares and other growth assets, with the remaining invested in cash and fixed-interest assets. Through active asset allocation and active selection of shares, fixed interest, and cash assets, the goal is to outperform the returns you would obtain if you invested 70% of your money in New Zealand fixed interest assets and cash and 30% in shares. The Conservative Fund has had a 1-month and 1-year return of -1.68% and 0.44%, far below the 5-year return of 4.59%. This suggests that the fund is producing returns, but not at the projected level.

*The following is Sourced from KiwiWealth Conservative Fund Update

Returns

Fees

The total annual fees for investors in the KiwiWealth Conservative Fund are 0.90% per year. The manager's basic fee each member pays is subject to a minimum fee of $40 per year, although this minimum fee only affects balances under $4,819.

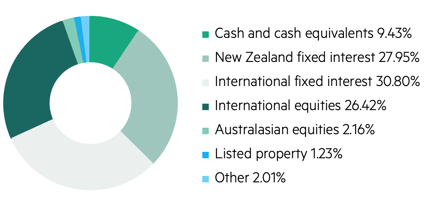

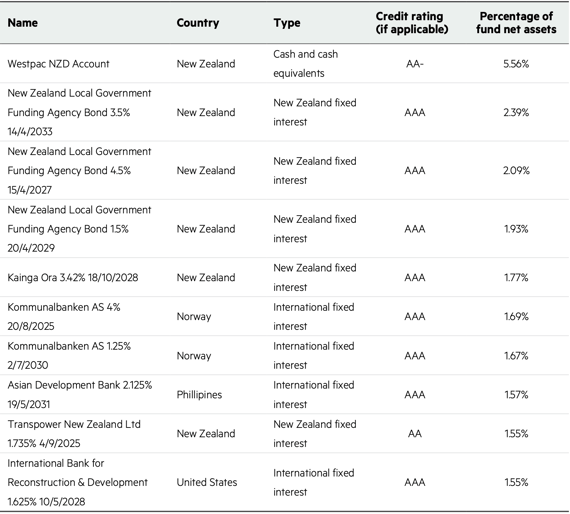

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows KiwiWealth’s top 10 investments in the Conservative KiwiSaver Fund, which make up 21.77% of the fund.

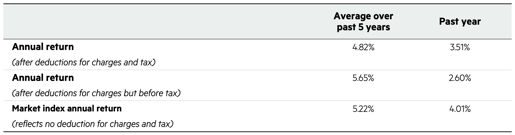

KiwiWealth Balanced Fund

KiwiWealth Balanced Fund invests up to 70% in shares and other growth assets, with the remainder in cash and fixed interest assets. It is the goal to outperform the returns you would receive from investing 45% of your funds in New Zealand fixed interest assets and cash and 55% in shares through active allocation and active selection of shares, fixed interest and cash assets. The Balanced Fund has had a 1-month and 1-year return of -2.58% and 4.86%, far below the 5-year return of 7.48%. This suggests that the fund is generating returns, but not at the rate at which investors had anticipated them to.

*The following is Sourced from KiwiWealth Balanced Fund Update

Returns

Fees

The total annual fees for investors in the KiwiWealth Balanced Fund are 1.03% per year. The manager's basic fee each member pays is subject to a minimum fee of $40 per year, although this minimum fee only affects balances under $4,210.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows KiwiWealth’s top 10 investments in the Balanced KiwiSaver Fund, which make up 16.50% of the fund.

KiwiWealth Growth Fund

The KiwiWealth Growth Fund invests up to 70% of its assets in shares and other growth assets, with the remaining in cash and fixed-income investments. The aim is to exceed the returns you would receive from investing 45% of your funds in New Zealand fixed interest assets and cash and 55% in shares through active allocation and active selection of shares, fixed interest and cash assets. The Growth Fund has had a 1-month and 1-year return of -3.32% and 8.83%, far below the 5-year return of 9.99%. This suggests that the fund is generating returns, but not at the projected level.

*The following is Sourced from KiwiWealth Growth Fund Update

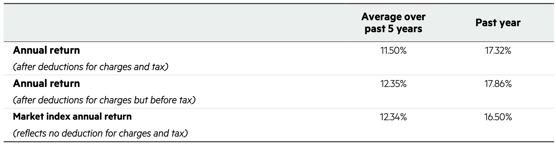

Returns

Fees

The total annual fees for investors in the KiwiWealth Growth Fund are 1.03% per year. The manager's basic fee each member pays is subject to a minimum fee of $40 per year, although this minimum fee only affects balances under $4,210.

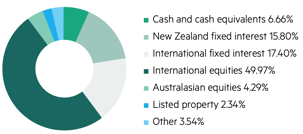

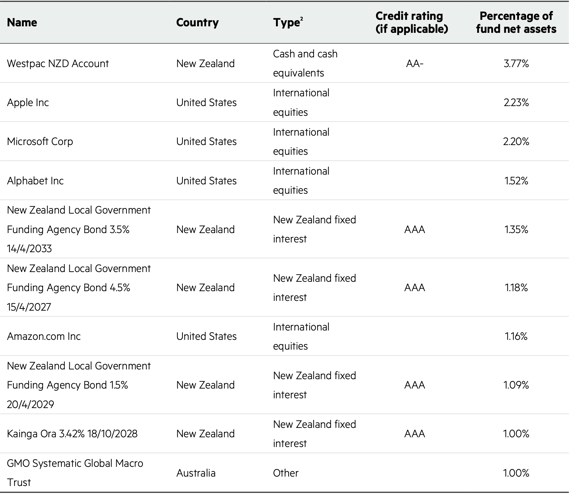

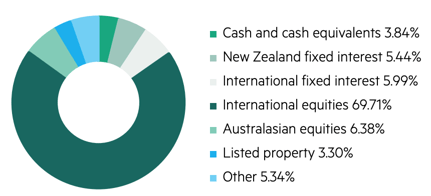

Investment mix

The investment mix shows the type of assets that the fund invests into.

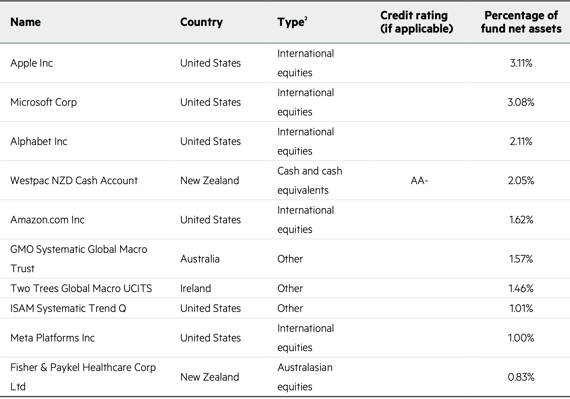

Top ten investments

This table shows KiwiWealth’s top 10 investments in the Growth KiwiSaver Fund, which make up 17.84% of the fund.

KiwiWealth KiwiSaver funds have been sourced from KiwiWealth KiwiSaver Fund Updates. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if KiwiWealth has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.