Using the most recent returns from 31st December 2021, we will examine JUNO’s recent KiwiSaver Performance.

JUNO is a fairly new KiwiSaver Scheme managed by Pie Funds Management Limited. In this quarter, JUNO KiwiSaver Growth Fund ranked first for 3-year returns in the Morningstar KiwiSaver multi-sector growth.

The global markets have lately been reactive to high inflation rates, rising interest rates, the COVID-19 pandemic, and now the devastating situation between Russia and Ukraine. Historically speaking, wars would typically affect the markets. However, KiwiSaver investors shouldn’t be worried as this wouldn’t be the indication of how the markets will perform in the long term.

Table of Contents

Performance of JUNO KiwiSaver Funds

News about JUNO

JUNO Growth Fund was the top-performing growth fund with a return of 30.3% in the 2020 financial year. Despite the 1-year period negative returns of this quarter that might be caused by rising COVID-19 cases, this fund still seems to consistently outperform its peers.

Performance of JUNO KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years (p.a.) |

Since Inception |

|

|

JUNO Conservative Fund |

-1.40% |

-3.52% |

-3.16% |

3.25% |

2.80% |

|

JUNO Balanced Fund |

-3.20% |

-8.83% |

-7.29% |

6.84% |

5.51% |

|

JUNO Growth Fund |

-4.75% |

-13.68% |

-10.37% |

11.71% |

9.66% |

*Sourced from JUNO Fund Performance Report

*These returns are to 28th February 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ. Note: The following information is sourced from JUNO Quarterly Fund updates published on 11th February 2022.

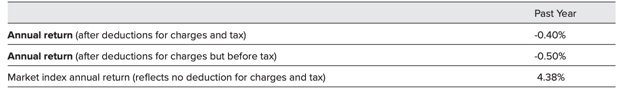

JUNO Conservative Fund

JUNO Conservative Fund invests mainly in cash or term deposits with New Zealand registered banks as well as in JUNO Balanced Fund. Members who choose to be in the Conservative fund would be those with low volatility tolerance or a short investment horizon. This fund has a 3 years return of 3.25%, which is higher than the returns of the fund since it was started (2.80%).

*The following is sourced from JUNO Conservative Fund Update

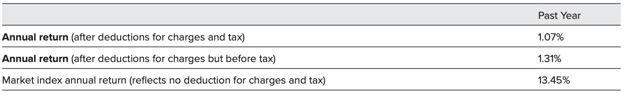

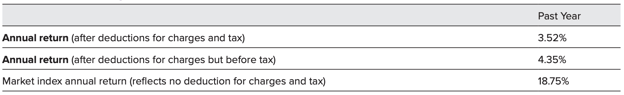

Returns

*Source JUNO Fund Update

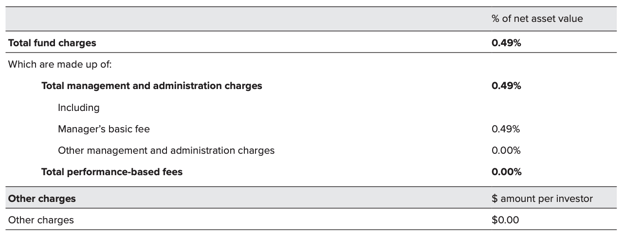

Fees

The total annual fees for investors in the JUNO Conservative Fund are 0.49% per year excluding monthly membership fees.

*Fees are GST exclusive if any

*Source JUNO Fund Update

Investment mix

The investment mix shows the type of assets that the fund invests into.

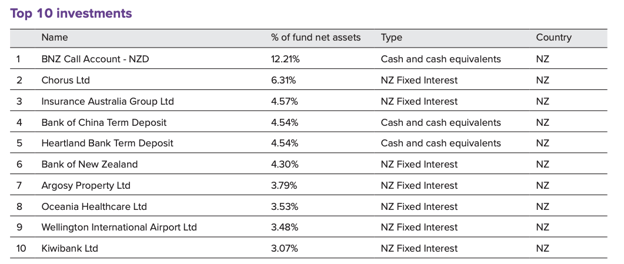

Top ten investments

This table shows JUNO’s top 10 investments in the Conservative Fund, which make up 50.34% of the fund.

*Source JUNO Fund Update

JUNO Balanced Fund

JUNO Balanced Fund invests in equities, cash, international fixed interest, and the JUNO Growth Fund. Members who have a medium-term investment horizon or a long horizon but low comfort in investing would typically invest in this fund. The 3 years return of this fund is significantly higher than that of when the fund was first started (6.84% and 5.51% respectively).

*The following is sourced from JUNO Balanced Fund Update

Returns

*Source JUNO Fund Update

Fees

The total annual fees for investors in the JUNO Balanced Fund are 0.43% per year excluding monthly membership fees.

*Fees are GST exclusive if any

*Source JUNO Fund Update

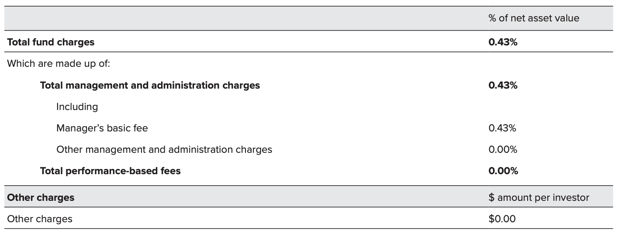

Investment mix

The investment mix shows the type of assets that the fund invests into.

*Source JUNO Fund Update

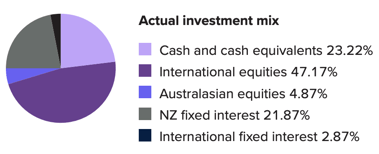

Top ten investments

This table shows JUNO’s top 10 investments in the Balanced KiwiSaver Fund, which make up 27.06% of the fund.

*Source JUNO Fund Update

JUNO Growth Fund

JUNO Growth Fund invests primarily in international equities focusing on global brands and a cash exposure. Members who have a longer-term investment horizon and a high volatility tolerance would typically choose to invest in this fund. The 3 years return of this fund is 11.71%, making the return higher than the 9.66% return since the fund was started.

*The following is sourced from JUNO Growth Fund Update

Returns

*Source JUNO Fund Update

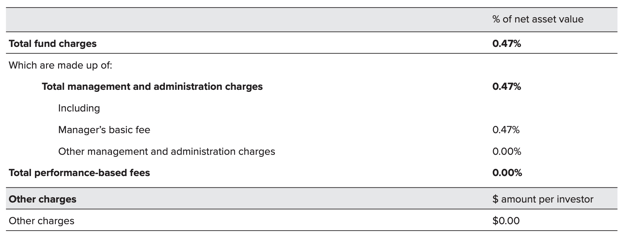

Fees

The total annual fees for investors in the JUNO Growth Fund are 0.47% per year excluding monthly membership fees.

*Fees are GST exclusive if any

*Source JUNO Fund Update

Investment mix

The investment mix shows the type of assets that the fund invests into.

*Source JUNO Fund Update

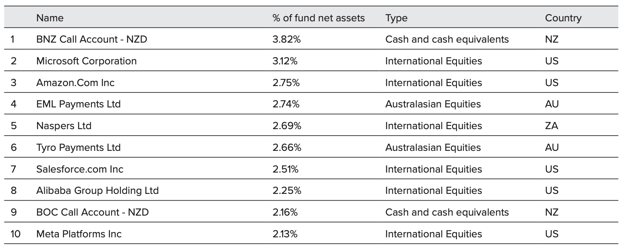

Top ten investments

This table shows JUNO’s top 10 investments in the Growth KiwiSaver Fund, which make up 26.83% of the fund.

*Source JUNO Fund Update

Data for JUNO KiwiSaver funds has been sourced from JUNO KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if JUNO has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.