Using the most recent returns and fund update reports from 30 June 2023, we will examine BNZ’s recent KiwiSaver performance.

Bank of New Zealand (BNZ) was founded in 1861, it is one of the major banks in New Zealand. They offer a range of financial products and services to its customers. These include personal banking, business banking, personal loans, home loans, insurance, investments, KiwiSaver Scheme, and wealth management. According to BNZ, they offer low fees without monthly member fees and low management fees. It means clients can keep more of their money.

Table of Contents

News about BNZ

Performance of BNZ KiwiSaver Funds

BNZ First Home Buyer Fund

BNZ Conservative Fund

BNZ Balanced Fund

BNZ Growth Fund

BNZ Default Fund

News about BNZ

In recent news, Bank of New Zealand has published its financial results for the first half of 2023. BNZ is stable, boasting strong capitalisation, and strong liquidity. BNZ revealed that statutory net profit increased by $96 million, equivalent to 13.5%, to $805 million. This growth is attributed to higher revenue. In addition, KiwiSaver funds under management experienced a notable increase of $351 million, up to 8%.

Performance of BNZ KiwiSaver Funds

| Funds |

1 Year |

5 Years |

Since Inception |

|

First Home Buyer |

4.44% | 1.99% | 2.90% |

|

Conservative |

3.34% |

1.39% |

3.78% |

|

Balanced |

6.65% | 4.02% | 6.65% |

|

Growth |

8.39% | 5.40% | 8.18% |

|

Default |

6.57% | 4.02% | 6.27% |

Sourced From BNZ Fund Performance Report

These returns are to 30 June 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from BNZ Quarterly Fund published on 30 June 2023.

BNZ First Home Buyer Fund

BNZ´s First Home Buyer Fund aims to provide relatively steady returns over the short to medium term. It invests mainly in income assets, which typically have lower levels of risk and the possibility for lower returns. It also has a small allocation to growth assets, which typically have elevated levels of risk and the possibility of potential return.

The following is sourced from BNZ First Home Buyer Fund Update

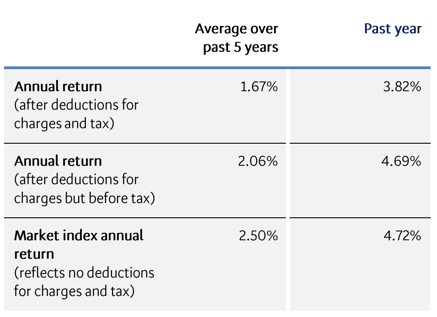

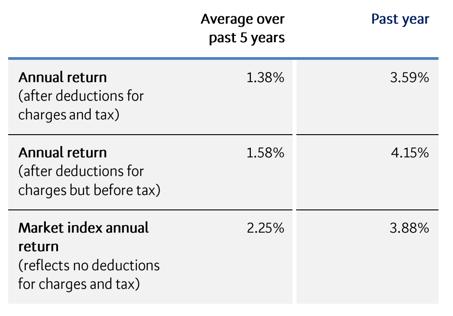

Returns

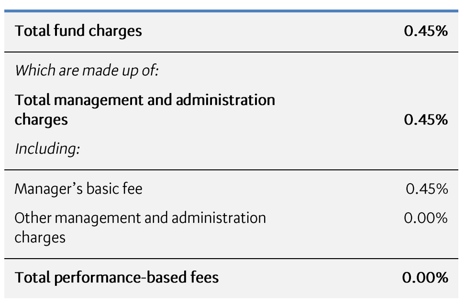

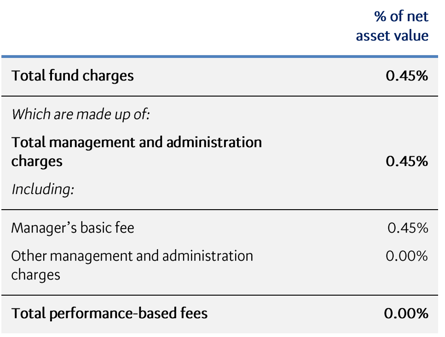

Fees

The total annual fees for investors in the BNZ First Home Buyer Fund are 0.45%.

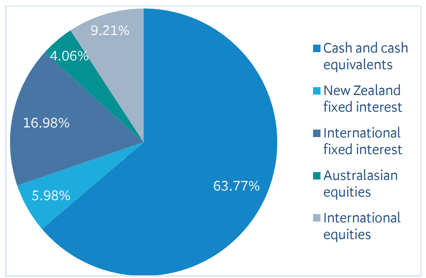

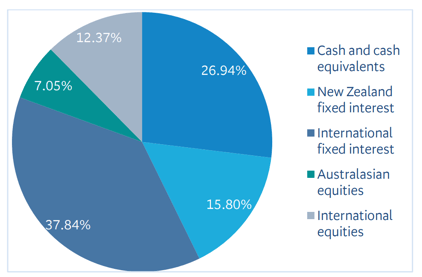

Investment mix

The investment mix shows the types of assets that the fund invests in.

*

*

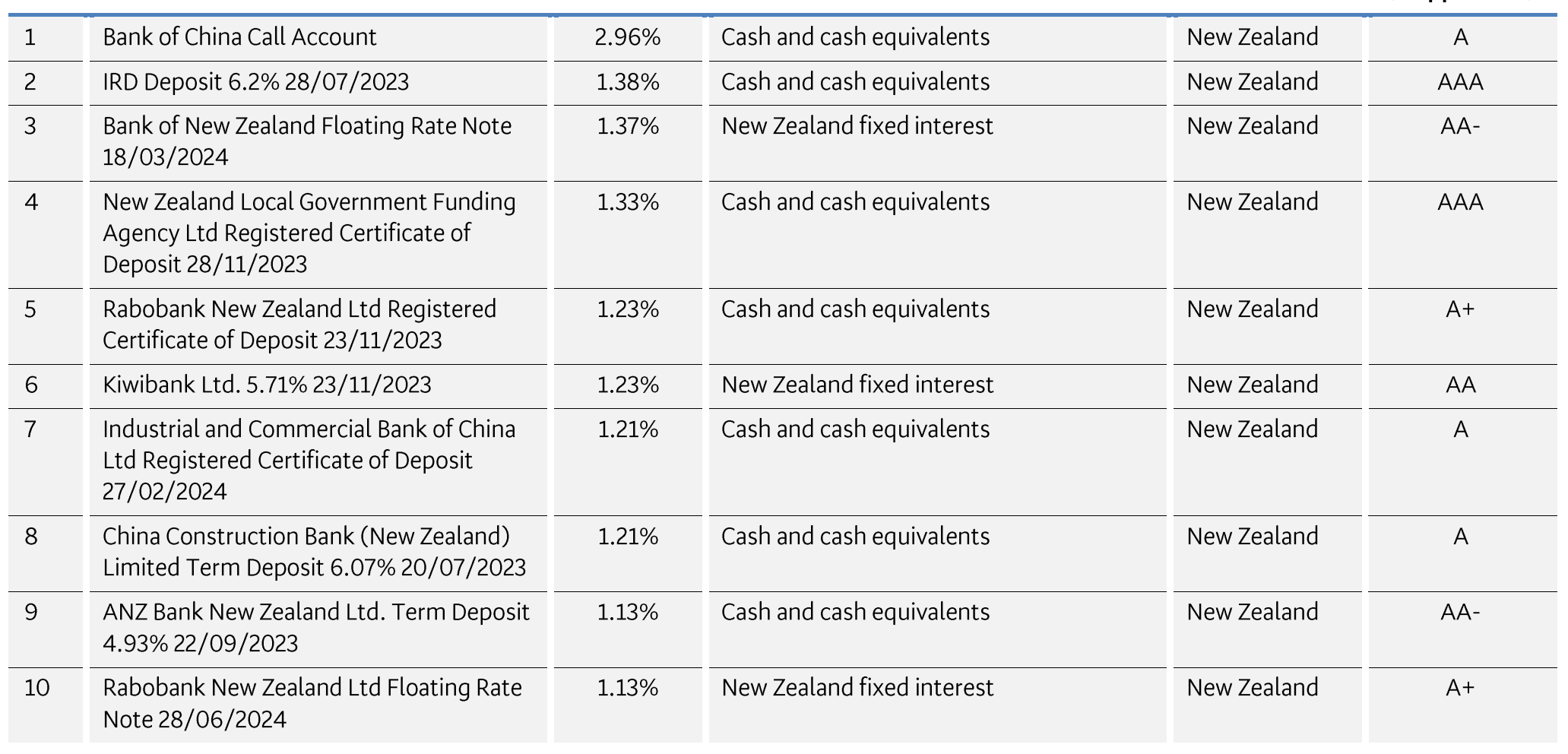

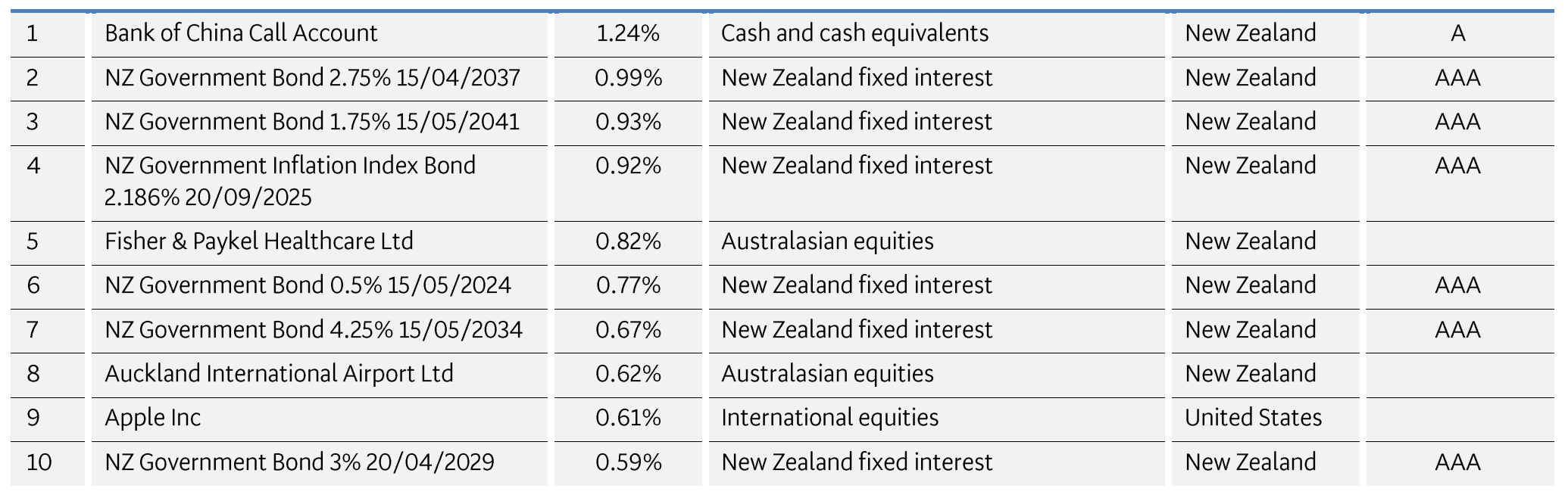

Top ten investments

This table shows BNZ´s top 10 investments in the First Home Buyer KiwiSaver Fund, which make up 14.18% of the fund.

BNZ Conservative Fund

BNZ´s Conservative Fund aims to provide relatively steady returns over the short to medium term. It invests mainly in income assets, which typically have lower levels of risk and the possibility for lower returns. It also has a modest allocation to growth assets, which typically have elevated levels of risk and the possibility of potential return.

The following is sourced from BNZ Conservative Fund Update

Returns

Fees

The total annual fees for investors in the Conservative Fund are 0.45%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows BNZ´s top 10 investments in the Conservative KiwiSaver Fund, which make up 8.16% of the fund.

BNZ Balanced Fund

BNZ´s Balanced Fund aims to provide a medium level of returns over the medium to long term. It invests largely in growth assets, which typically have higher levels of risk and the possibility for high returns. It also has a considerable allocation to income assets, which typically have lower levels of risk and potential return.

The following is sourced from BNZ Balanced Fund Update

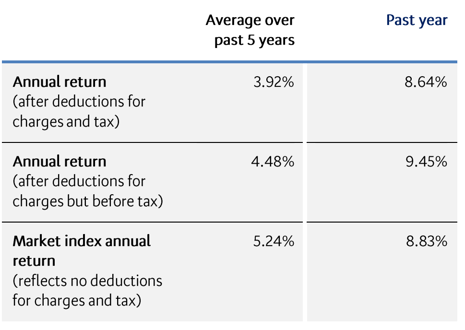

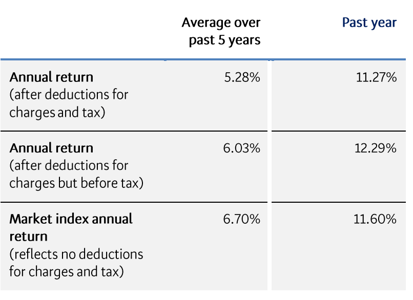

Returns

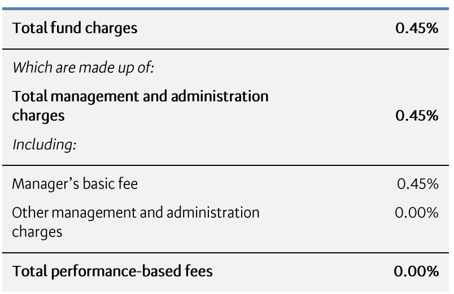

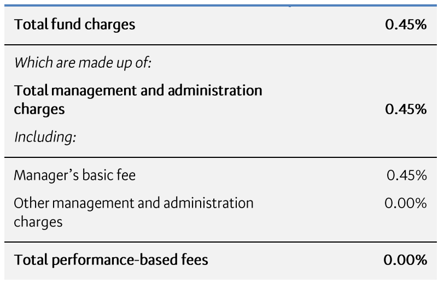

Fees

The total annual fees for investors in the BNZ Balanced Fund are 0.45%.

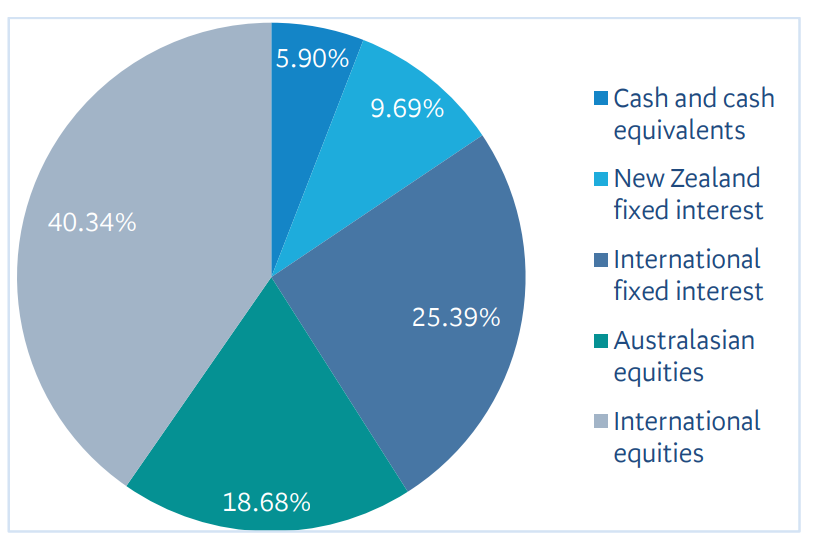

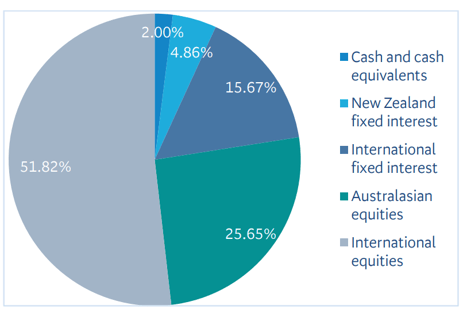

Investment mix

The investment mix shows the types of assets that the fund invests in.

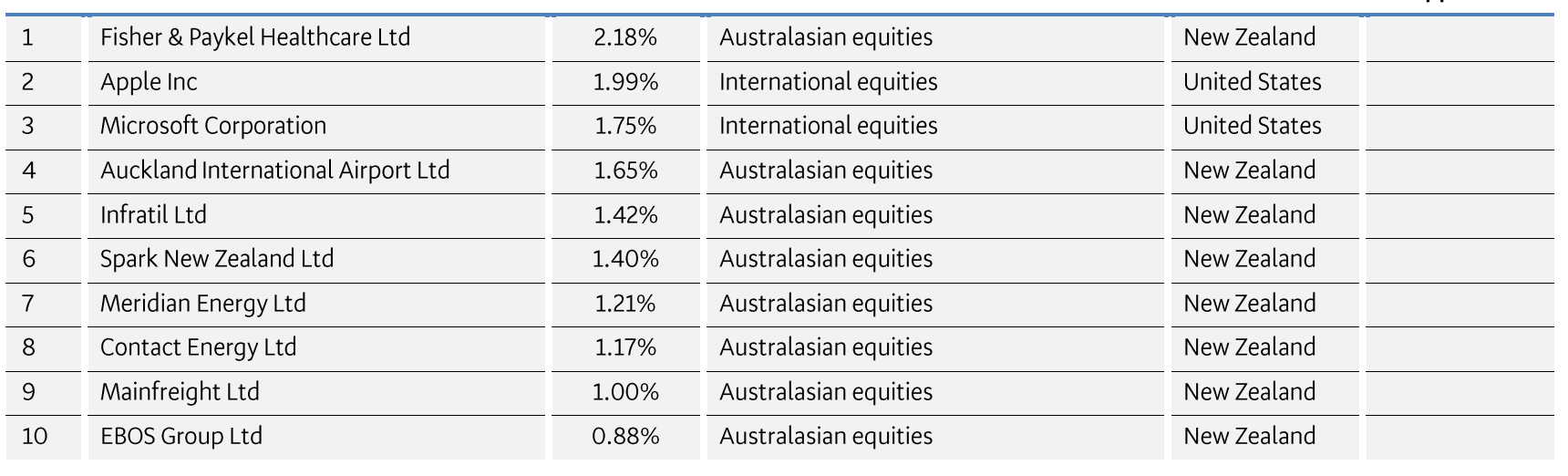

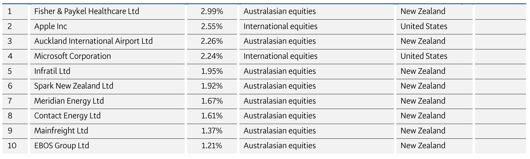

Top ten investments

This table shows BNZ´s top 10 investments in the Balanced KiwiSaver Fund, which make up 14.65% of the fund.

BNZ Growth Fund

BNZ´s Growth Fund aims to provide high returns over the long term. It invests mainly in growth assets, which typically have higher levels of risk and the possibility for high returns. It also has a modest allocation to income assets, which typically have lower levels of risk and potential return.

The following is sourced from BNZ Growth Fund Update

Returns

Fees

The total annual fees for investors in the BNZ Growth Fund are 0.45%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows BNZ´s top 10 investments in the Growth KiwiSaver Fund, which make up 19.77% of the fund.

BNZ Default Fund

BNZ´s Default Fund aims to provide a medium level of return high over the medium to long term. It invests mainly in growth assets, which typically have higher levels of risk and the possibility for high returns. It also has a significant allocation to income assets, which typically have lower levels of risk and potential return.

The following is sourced from BNZ Default Fund Update

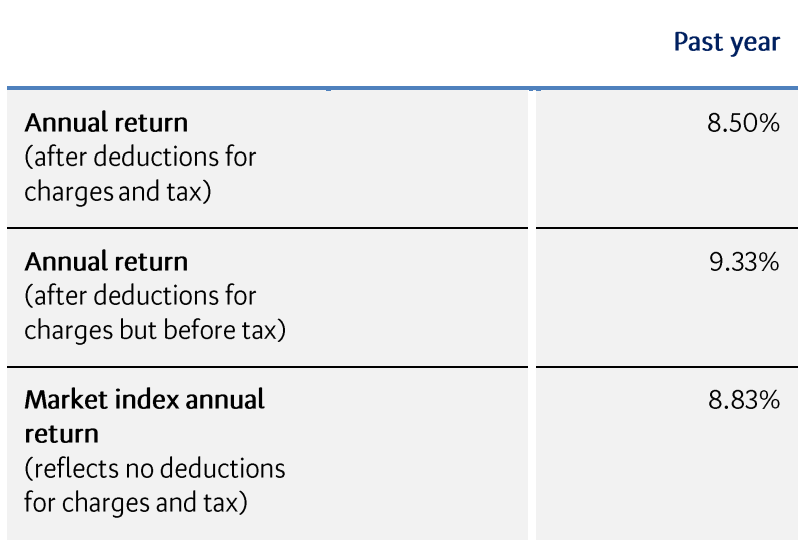

Returns

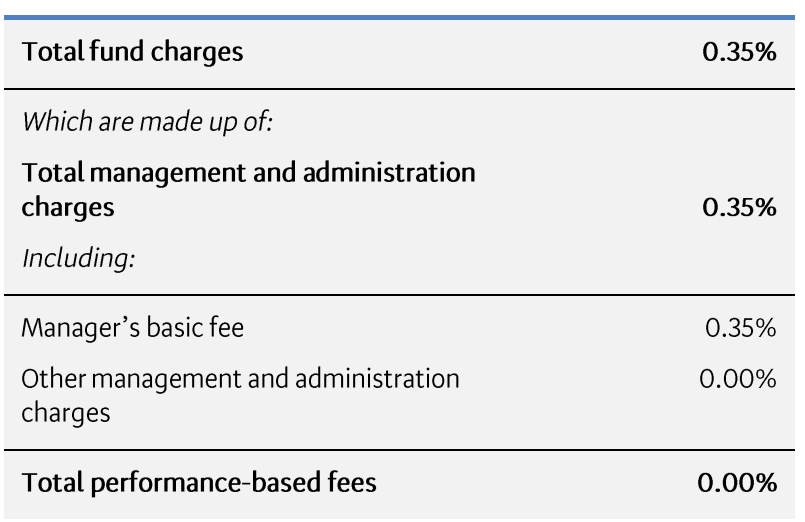

Fees

The total annual fees for investors in the BNZ Default Fund are 0.35%.

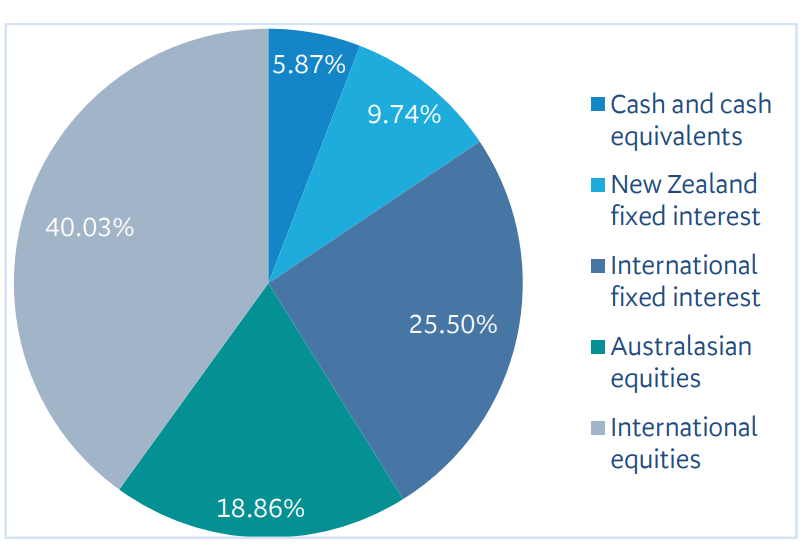

Investment mix

The investment mix shows the types of assets that the fund invests in.

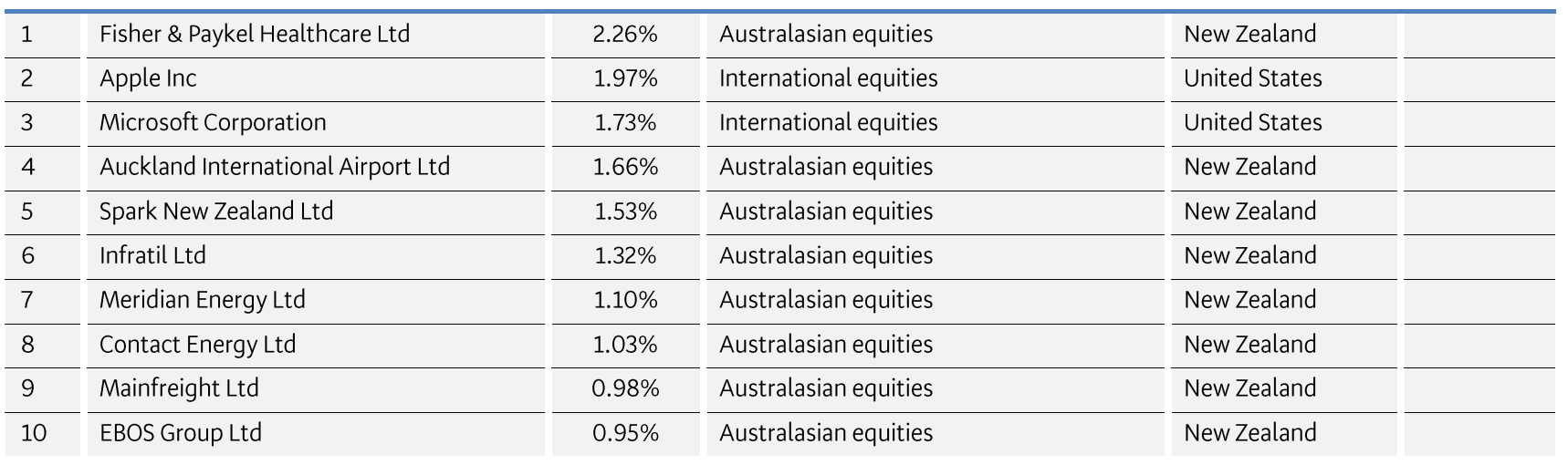

Top ten investments

This table shows BNZ´s top 10 investments in the Default KiwiSaver Fund, which make up 14.53% of the fund.

Data for BNZ KiwiSaver funds have been sourced from BNZ KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if BNZ has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.