Using the most recent returns and fund update reports from June 2022, we will examine BNZ's recent KiwiSaver Performance.

The Bank of New Zealand (BNZ), established in 1861, is one of the fourth largest banks in New Zealand and offers various services. The BNZ KiwiSaver Scheme currently has 231,380 members with NZ$4,473,763,000 funds under management in the scheme, according to the latest annual report ending on 31 March 2022.

In the June quarter, the cost of living in New Zealand significantly increased due to the negative impacts of Covid-19 and the Russian invasion of Ukraine. Reserve Bank Of New Zealand (RBNZ) reports that inflation has reached a 32-year high of 7.3%. In response, the RBNZ has increased the official cash (OCR) to 3.0% percent, taking it to a seven-year high to reduce inflation.

Table of Contents

News about BNZ

Performance of BNZ KiwiSaver Funds

BNZ Cash Fund

BNZ First Home Buyer Fund

BNZ Conservative Fund

BNZ Moderate Fund

BNZ Balanced Fund

BNZ Growth Fund

News about BNZ

In recent news, BNZ has announced a partnership with Waddle from Xero, the innovative invoice finance platform, to launch a new digital invoice financing product for businesses called CashFlow Plus. This will enable businesses to access up to 80% of the value of their unpaid invoices more effectively and efficiently.

Also, BNZ has recently launched a carbon emissions calculator as part of the climate action toolbox and was designed for SMEs to help them identify ways to reduce their emissions. This aligns with the BNZ Responsible Investment Policy, which was updated on 29 October 2021 to expand the exclusion of investment in fossil fuels.

Performance of BNZ KiwiSaver Funds

|

1 Month |

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

0.24% |

0.60% |

1.17% |

0.91% |

1.48% |

2.13% |

|

First Home Buyer |

-0.79% |

-0.20% |

-3.72% |

0.55% |

1.93% |

2.68% |

|

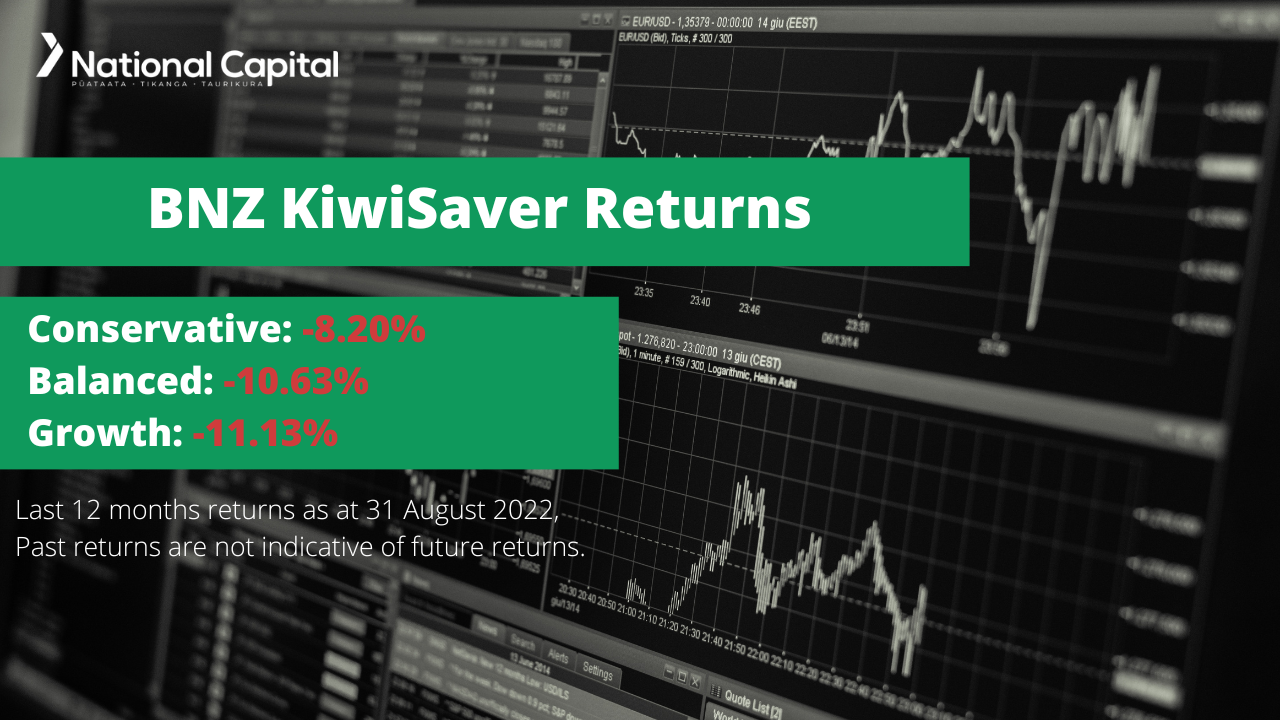

Conservative |

-1.84% |

-0.95% |

-8.20% |

-0.58% |

1.66% |

3.46% |

|

Moderate |

-1.95% |

-1.12% |

-9.48% |

0.93% |

3.23% |

4.97% |

|

Balanced |

-2.00% |

-1.16% |

-10.63% |

2.30% |

4.46% |

6.23% |

|

Growth |

-1.84% |

-1.07% |

-11.13% |

4.15% |

6.06% |

7.76% |

Sourced from BNZ fund performance report.

* These returns are to 31 August 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from BNZ Quarterly Fund updates published on 31 August 2022.

BNZ Cash Fund

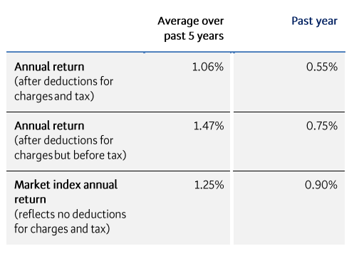

The Cash Fund primarily invests in cash and cash equivalents. The Cash Fund seeks to achieve consistent returns over the short term. The Cash Fund has had a 1-month return of 0.24%, and a 1-year return of 1.17%, which are both lower than the inception return of 2.13%.

*The following is Sourced from BNZ Cash Fund Update.

Returns

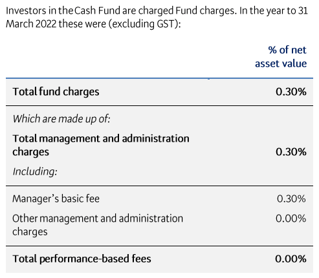

Fees

The total annual fees for investors in the BNZ Cash Fund are 0.30% yearly.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

Top ten investments

This table shows BNZ’s top 10 investments in the Cash KiwiSaver Fund, which comprise 27.62% of the fund.

BNZ First Home Buyer Fund

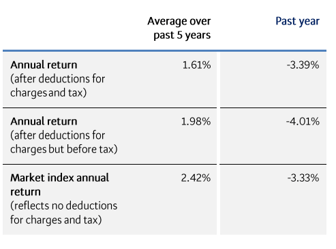

The First Home Buyer Fund seeks to offer steady returns over the short to medium term by primarily investing in income assets, which generally have lower levels of risk. The BNZ First Home Buyer fund saw a 1-month return of -0.79% and a 1-year return of -3.72%, both lower than the expected return of 2.68% since inception.

*The following is Sourced from BNZ First Home Buyer Fund Update.

Returns

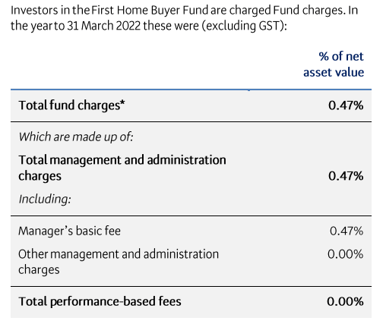

Fees

The total annual fees for investors in the BNZ First Home Buyer Fund are 0.47% per year.

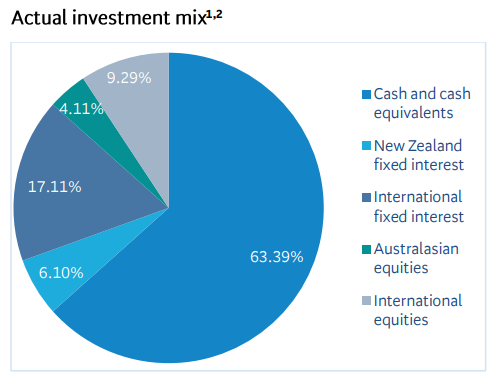

Investment mix

The investment mix shows the type of assets that the fund invests in.

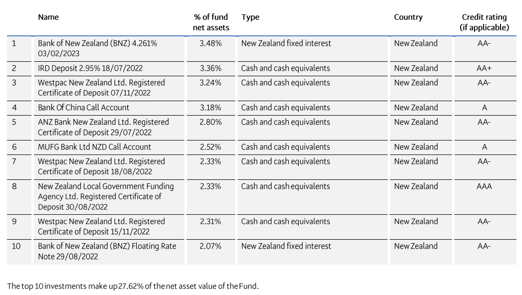

Top ten investments

This table shows BNZ’s top 10 investments in the First Home Buyer Fund, which comprise 17.51% of the fund.

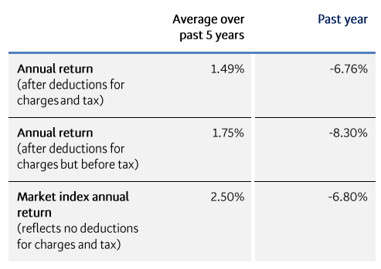

BNZ Conservative Fund

BNZ’s Conservative Fund seeks to provide investors with a consistent return over the long term. Therefore it invests mostly in income assets, which generally have lower risk associated. The BNZ Conservative Fund saw a 1-month return of -1.84%. The 1-year return of BNZ’s Conservative Fund is -8.20%, which is lower than the fund's return since its inception of 3.46%.

*The following is Sourced from BNZ Conservative Fund Update.

Returns

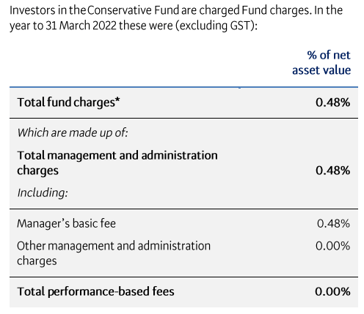

Fees

The total annual fees for investors in the BNZ Conservative Fund are 0.48% per year.

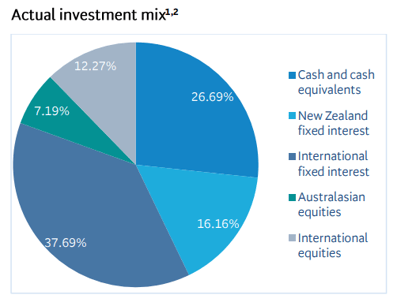

Investment mix

The investment mix shows the type of assets that the fund invests in.

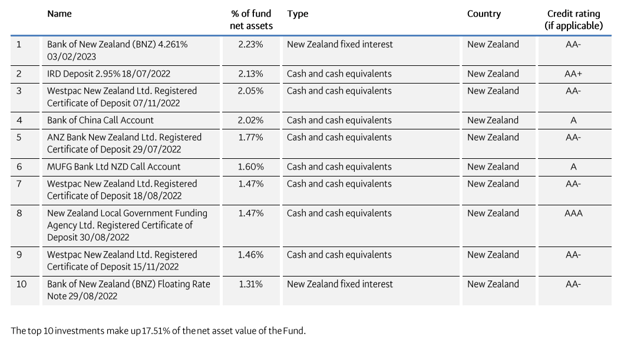

Top ten investments

This table shows BNZ’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 8.71% of the fund.

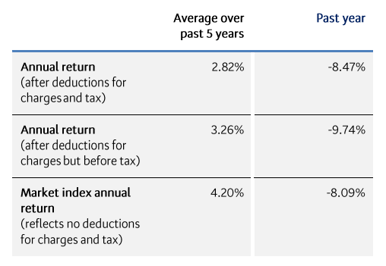

BNZ Moderate Fund

The BNZ Moderate Fund seeks to create moderate returns over the medium term by investing largely in income assets and a small proportion of its assets in growth. The Moderate Fund saw a 1-month return of -1.95%. The fund has a 1-year return of -8.20%, which is lower than the inception return of 3.46%.

*The following is Sourced from BNZ Moderate Fund Update.

Returns

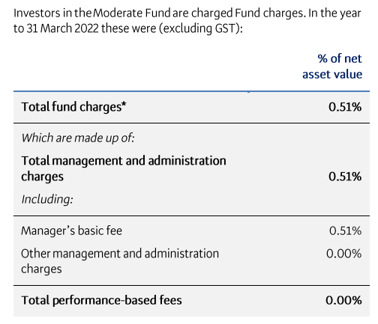

Fees

The total annual fees for investors in the BNZ Moderate Fund are 0.51% per year.

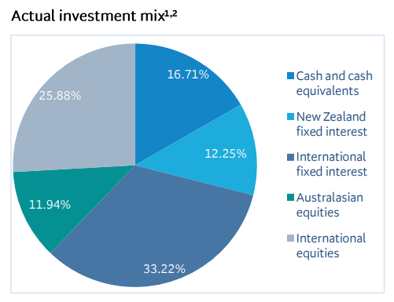

Investment mix

The investment mix shows the type of assets that the fund invests in.

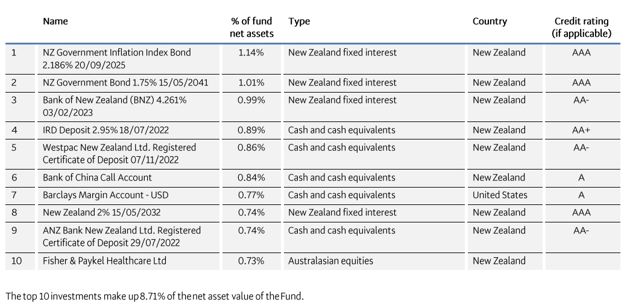

Top ten investments

This table shows BNZ’s top 10 investments in the Moderate KiwiSaver Fund, which comprise 8.87% of the fund.

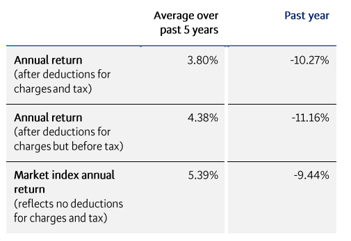

BNZ Balanced Fund

The BNZ Balanced Fund seeks a medium level of return over the medium to long term by investing primarily in growth assets and a substantial proportion of income assets, which generally have a lower level of risk associated. The Balanced fund has had a 1-month return of -2.00% and a 1-year return of -10.63%, which is lower than the 6.23% return since the fund's inception.

*The following is Sourced from BNZ Balanced Fund Update.

Returns

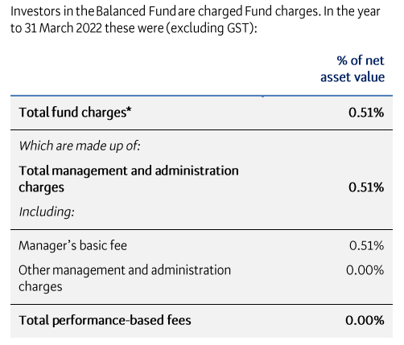

Fees

The total annual fees for investors in the BNZ Balanced Fund are 0.51% per year.

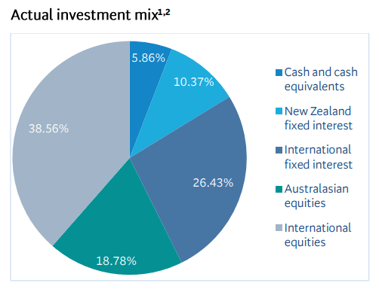

Investment mix

The investment mix shows the type of assets that the fund invests in.

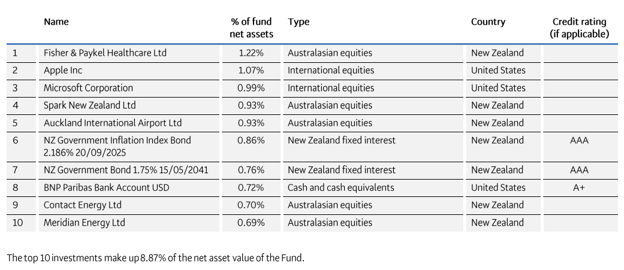

Top ten investments

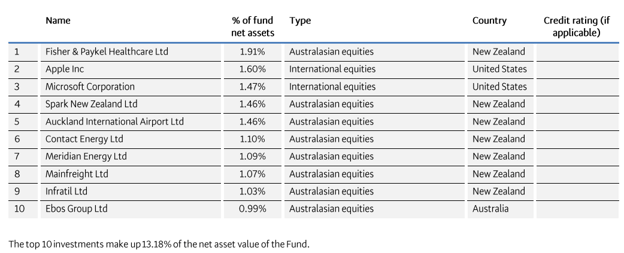

This table shows BNZ’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 13.18% of the fund.

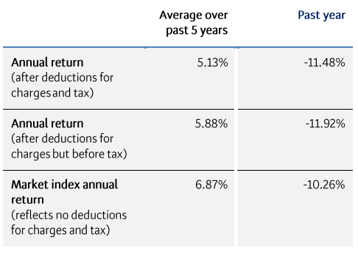

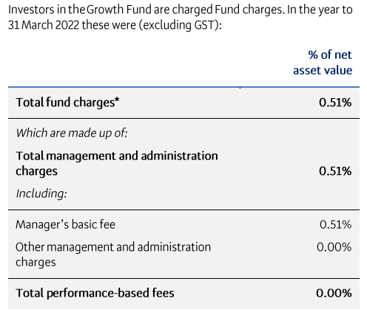

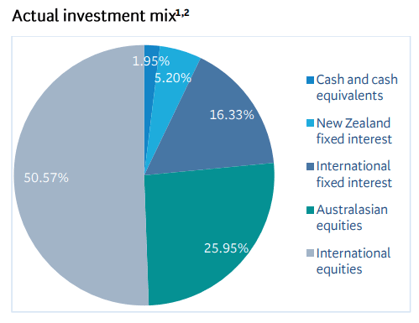

BNZ Growth Fund

The BNZ Growth Fund seeks to produce greater returns over the long term by investing primarily in growth assets, with moderate exposure to income assets. The fund saw a 1-month return of -1.84%. However, the 1-year return is -11.13%, which is significantly lower than the inception return of 7.76%.

*The following is Sourced from BNZ Growth Fund Update.

Returns

Fees

The total annual fees for investors in the BNZ Growth Fund are 0.51% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

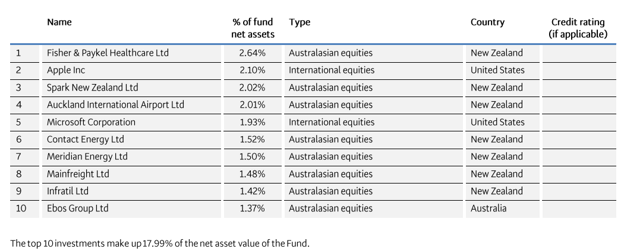

Top ten investments

This table shows BNZ’s top 10 investments in the Growth KiwiSaver Fund, which comprise 17.99% of the fund.

Data for BNZ KiwiSaver funds have been sourced from BNZ KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if BNZ has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.