To help our readers, National Capital has researched the KiwiSaver market and have come up with top-performing KiwiSaver Funds based on their 5-year returns in each category below.

This page has detailed information on each of those funds which have had the best 5 year performance as of March 2020.

Looking for an updated list? - Click the link or image below

Best Performing KiwiSaver Funds

Jump to

- Conservative fund

- Moderate fund

- Balanced fund

- Growth fund

- Aggressive fund

- How to choose?

This data is derived from the quarterly Morningstar Survey of March 2020.

Conservative Fund Category: Milford Conservative Fund (Five Year Returns: 5%).

Milford Conservative Fund Objective

Milford KiwiSaver Conservative Fund’s objective is to provide moderate returns and protect capital after the base fund fee* but before tax over the minimum recommended investment timeframe which is 3 years. It is a diversified fund that primarily invests in fixed interest securities, with a moderate allocation to equities.

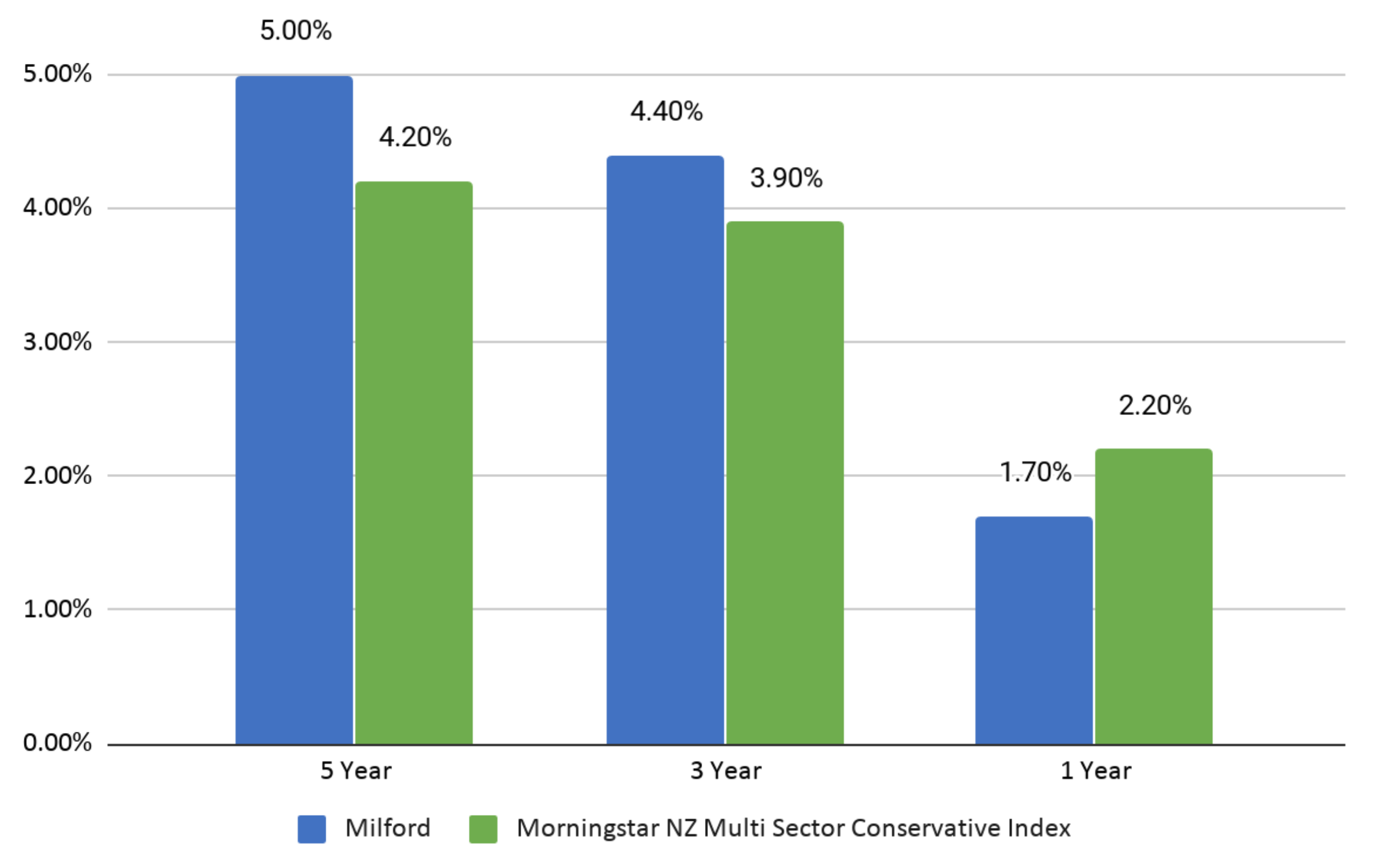

Fund's Net Returns vs Morningstar Conservative Index

The chart below compares the after fees and before-tax returns of the Fund to Morningstar’s New Zealand Multi-Sector Conservative Index. Over the past 5 years, the net return for the Fund is 5%, compared to the Morningstar index 5-year return of 4.20%. The Morningstar data calculates returns post fees but before tax. (Link: How is KiwiSaver tax calculated?)

Milford vs Morningstar NZ Multi-Sector Conservative Index

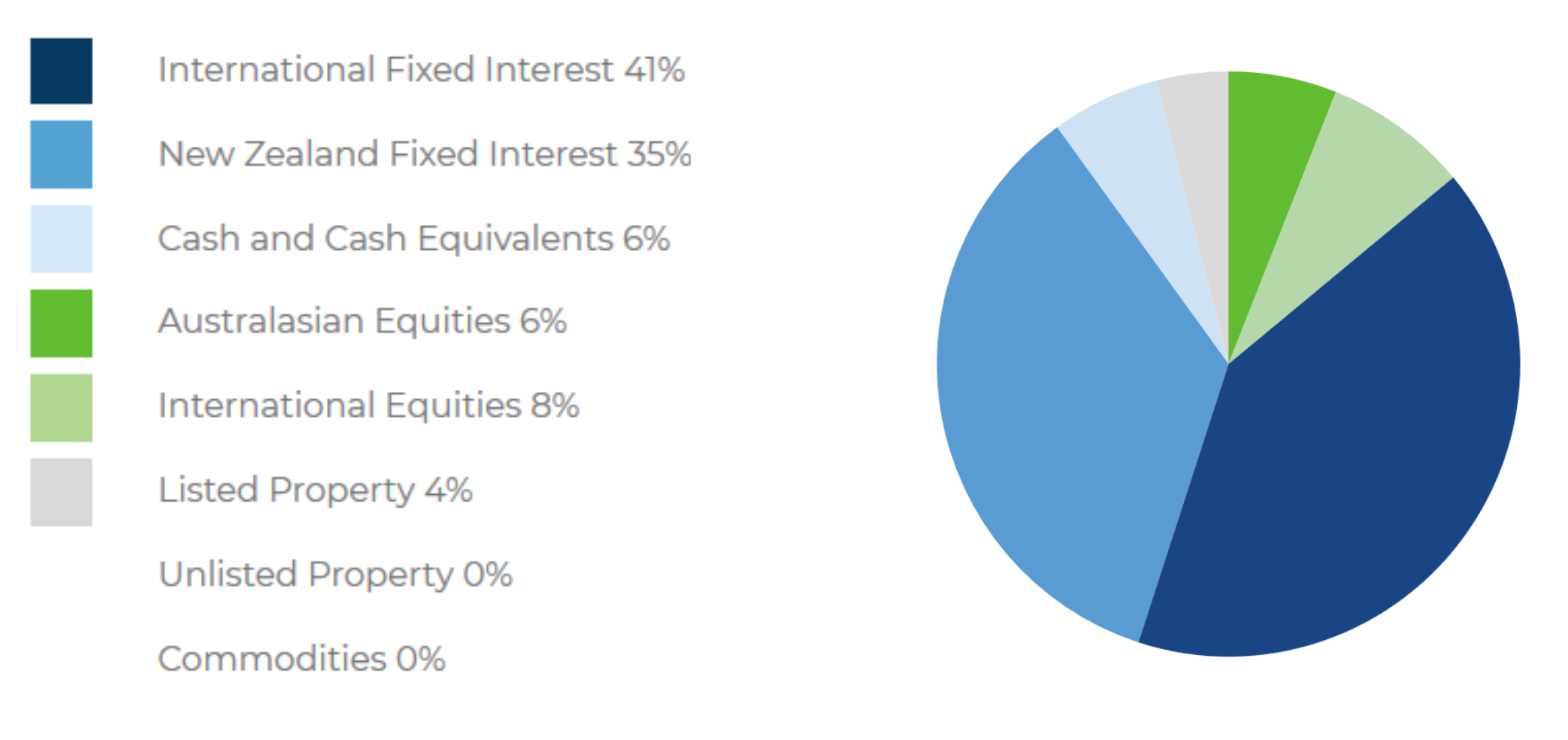

Furthermore, let us take a look at the asset allocation data that shows you where Milfords Fund Manager has invested their investor’s money. This allocation can make a big difference to the volatility, risk and returns generated which becomes even more important to know during the current volatile times. Thus, it is important for investors to know what the asset allocation of their fund is.

Asset Allocation Detailed Breakdown

As of March 2020, the Fund’s target asset allocation was as follows:

Fees Compared to Industry

|

FEES |

MILFORD CONSERVATIVE FUND |

PEER GROUP - CONSERVATIVE FUND |

|

Total Annual Fund Fees |

0.95% |

0.72% |

|

+ Membership Fee (annual) |

$36.00 |

$27.00 |

Is the Milford Conservative fund right for you?

Returns are not the primary concern for someone in a conservative fund. You need to ensure that the assets in the fund give you the stability that you are looking for in a conservative fund. You also need to ensure that a conservative fund is the appropriate fund for you in the first place.

You do not have to DIY your KiwiSaver. Please submit our KiwiSaver HealthCheck and one of our professional financial advisers will be able to give you a personalised KiwiSaver Recommendation and tell you which fund is best suited for you.

Moderate Fund Category: Generate Conservative Fund (Five Year Returns: 5.4%).

Generate Conservative Fund Objective

The objective of the Generate Conservative Fund is to provide a conservative investment return through investment in a portfolio of actively managed cash, fixed interest, property and infrastructure* assets, Australasian equities and international equities. Volatility is likely to be the lowest of between the Generate KiwiSaver Scheme funds. Long-term returns are likely to be the lowest of these Funds as well due to the lowest weighting of growth assets.

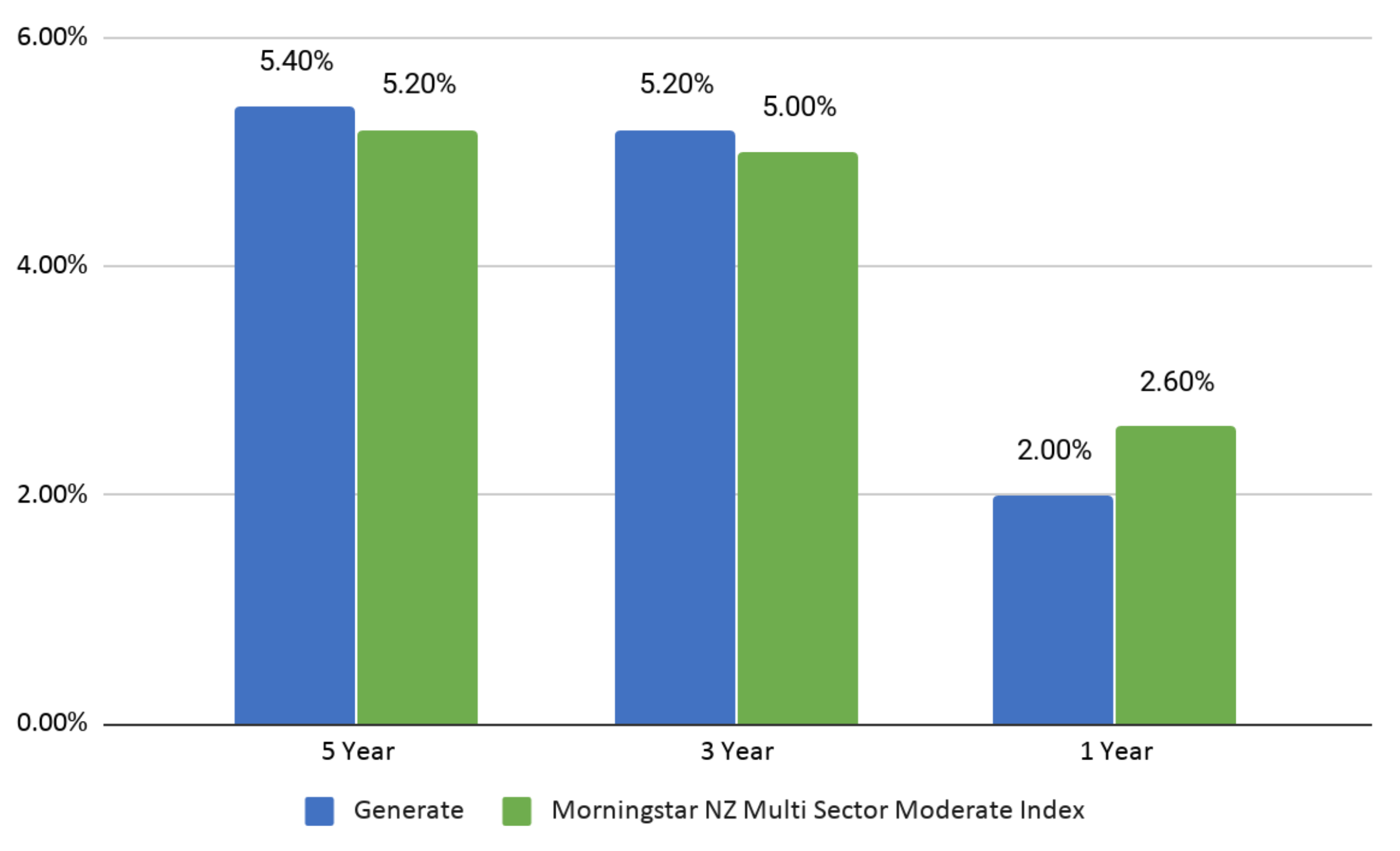

Fund's Net Returns vs Morningstar Moderate Index

The chart below compares the after fees and before-tax returns of the Fund to Morningstar’s New Zealand Multi-Sector Moderate Index. Over the past 5 years, the net return for the Fund is 5.40%, compared to the Morningstar index 5-year return of 5.20%. The Morningstar data calculates returns post fees but before tax.

Generate vs Morningstar NZ Multi-Sector Moderate Index

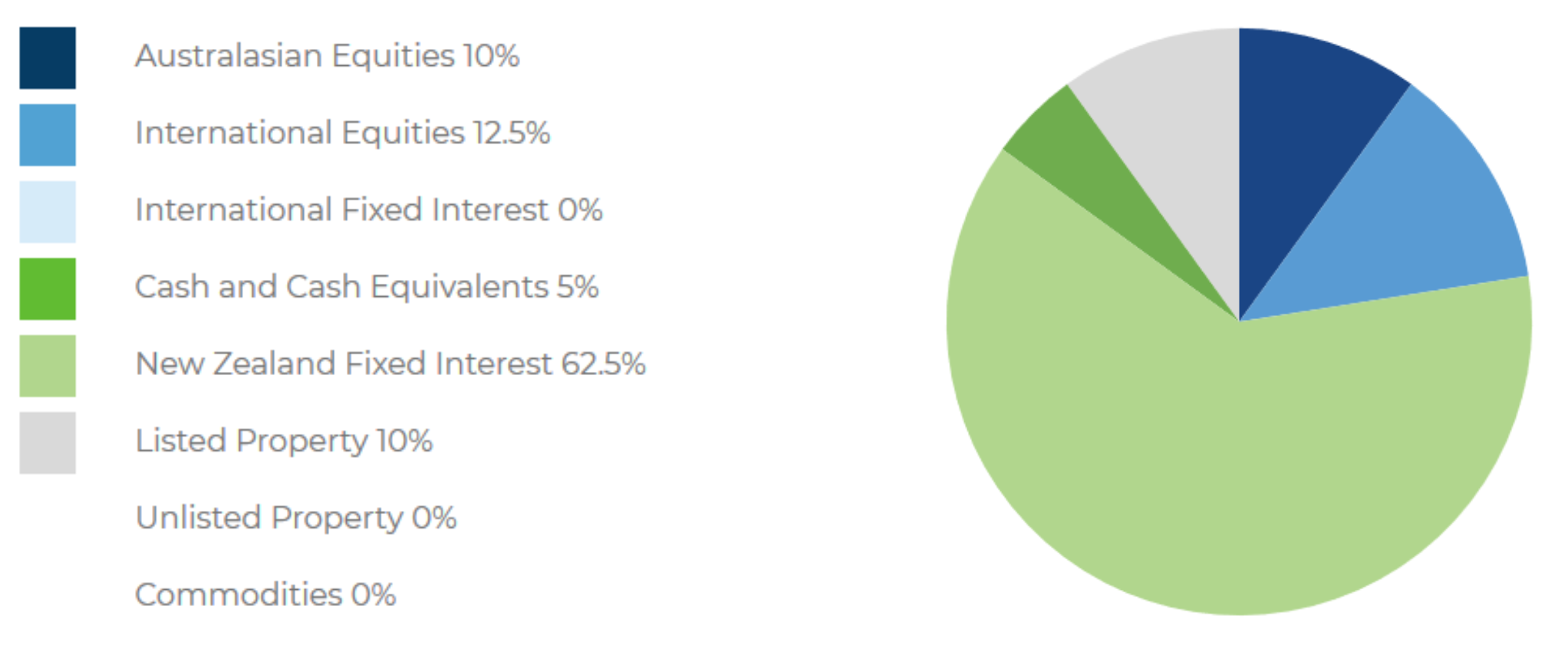

Asset Allocation Detailed Breakdown

As of March 2020, the Fund’s target asset allocation was as follows:

Fees Compared to Industry

|

FEES |

GENERATE CONSERVATIVE FUND |

PEER GROUP - MODERATE FUND |

|

Total Annual Fund Fees |

1.25% |

0.92% |

|

+ Membership Fee (annual) |

$36.00 |

$27.72 |

Is the Generate Conservative (Moderate type) fund right for you?

For someone in a moderate type fund, their primary concern is stability of their balance rather than returns. You need to ensure that the assets in the fund give you the stability that you are looking for in a moderate fund. You also need to ensure that a moderate fund is the appropriate fund for you in the first place.

You do not have to DIY your KiwiSaver. Please submit our KiwiSaver HealthCheck and one of our professional financial advisers will be able to give you a personalised KiwiSaver Recommendation and tell you which fund is best suited for you.

Balanced Fund Category: Milford Balanced Fund (Five Year Returns: 6.2%).

Milford Balanced Fund Objective

Milford KiwiSaver Balanced Fund’s objective is to provide capital growth after the base fund fee but before tax and before the performance fee over the minimum recommended

investment timeframe which is 5 years. It is a diversified fund that primarily invests in equities, with a significant allocation to fixed interest securities.

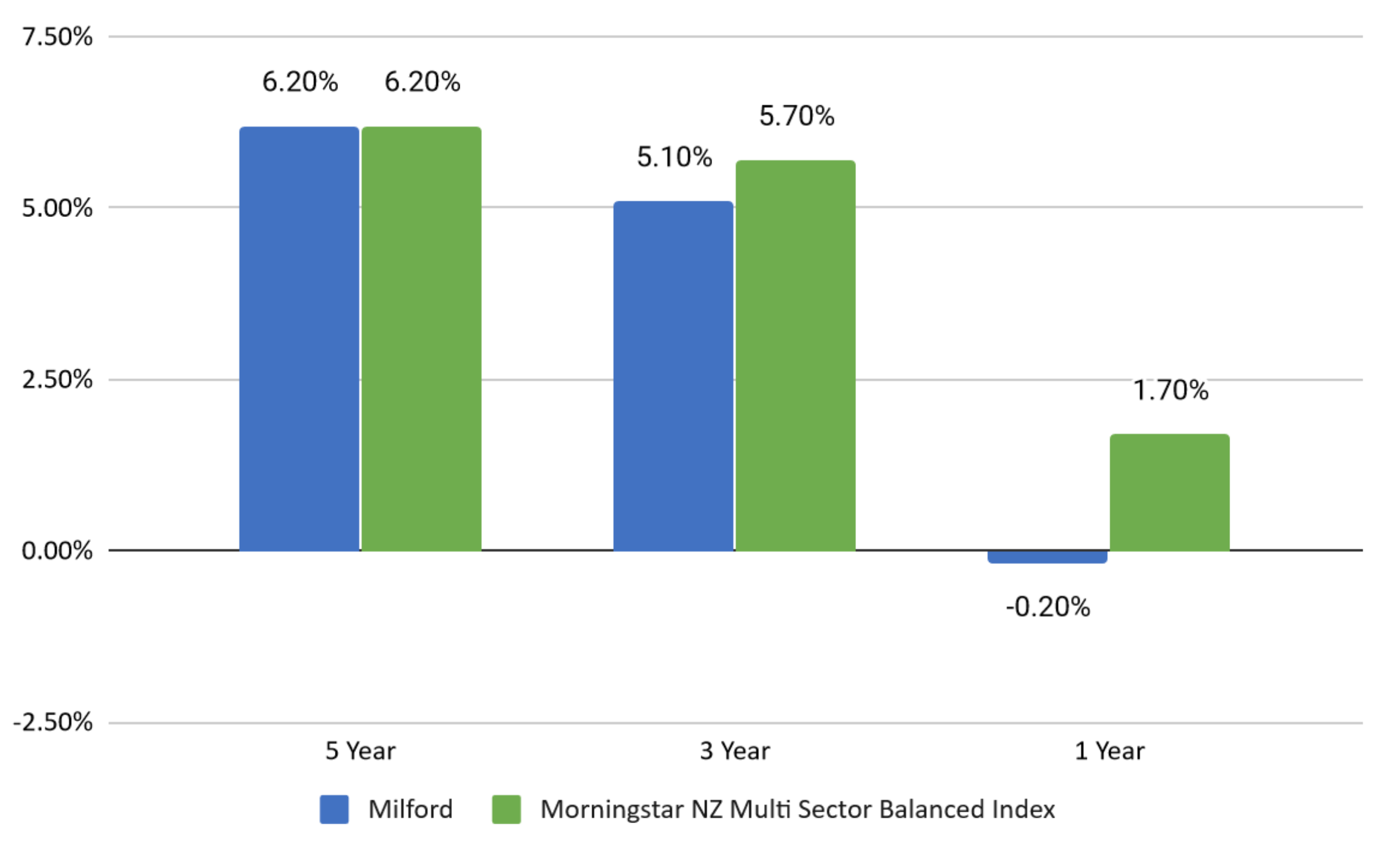

Fund's Net Returns vs Morningstar Balanced Index

The chart below compares the after fees and before-tax returns of the Fund to Morningstar’s New Zealand Multi-Sector Balanced Index. Over the past 5 years, the net return for the Fund is 6.20%, compared to the Morningstar index 5-year return of 6.20%. The Morningstar data calculates returns post fees but before tax.

Milford vs Morningstar NZ Multi-Sector Balanced Index

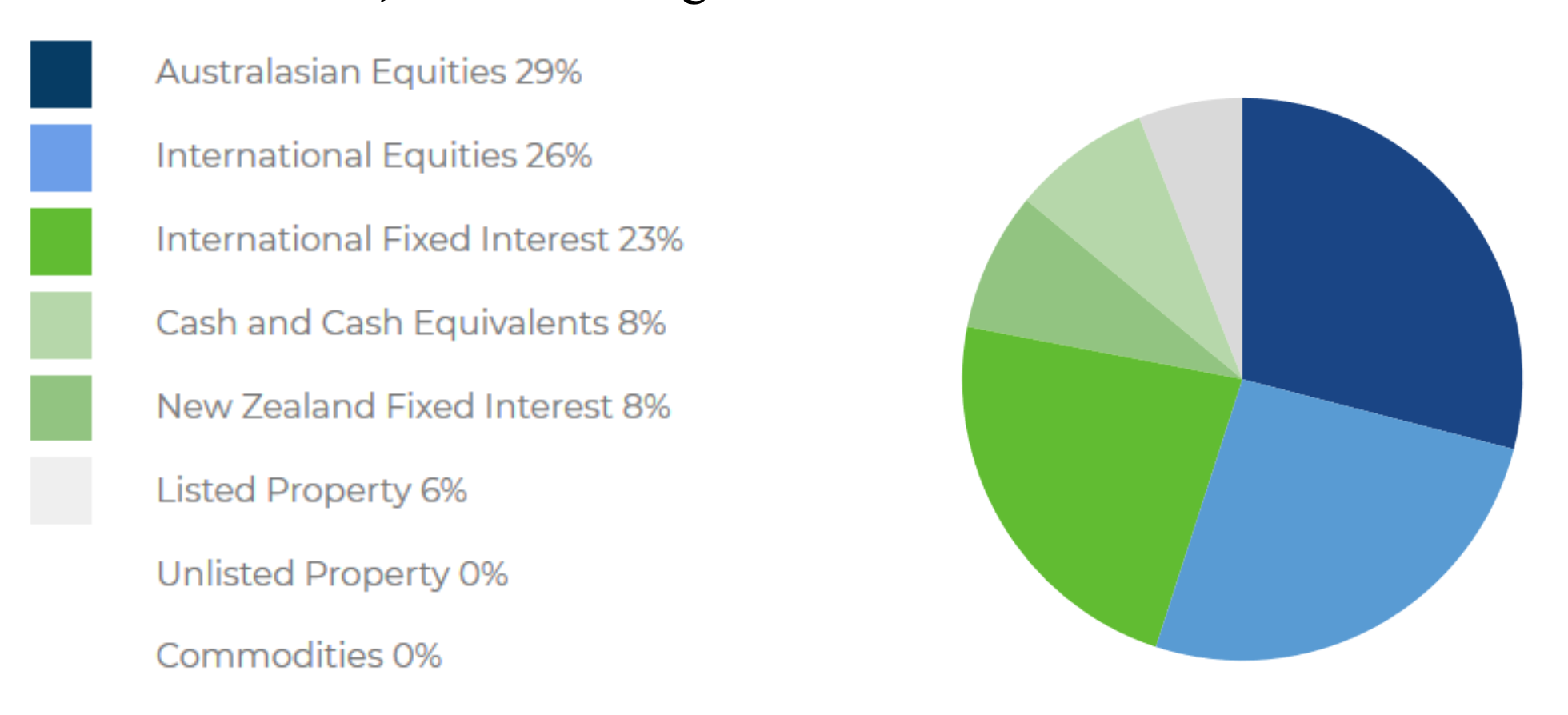

Asset Allocation Detailed Breakdown

As of March 2020, the Fund’s target asset allocation was as follows:

Fees Compared to Industry

|

FEES |

MILFORD BALANCED FUND |

PEER GROUP - BALANCED FUND |

|

Total Annual Fund Fees |

1.29% |

1.10% |

|

+ Membership Fee (annual) |

$36.00 |

$28.44 |

Is the Milford Balanced fund right for you?

When considering the right Balanced fund, you need to ensure that the assets in the fund give you both the stability and the returns that you are looking for. You also need to ensure that a balanced fund is the appropriate fund for you in the first place.

You do not have to DIY your KiwiSaver. Please submit our KiwiSaver HealthCheck and one of our professional financial advisers will be able to give you a personalised KiwiSaver Recommendation and tell you which fund is best suited for you.

Growth Fund Category: Milford Active Growth Fund (Five Year Returns: 7.3%).

Milford Active Growth Fund Objective

The Milford Active Growth Fund’s objective is to provide annual returns of 10% after the base fund fee but before tax and before the performance fee, over the minimum

recommended investment timeframe which is five years. It is a diversified fund that primarily invests in equities, with a moderate allocation to fixed interest securities.

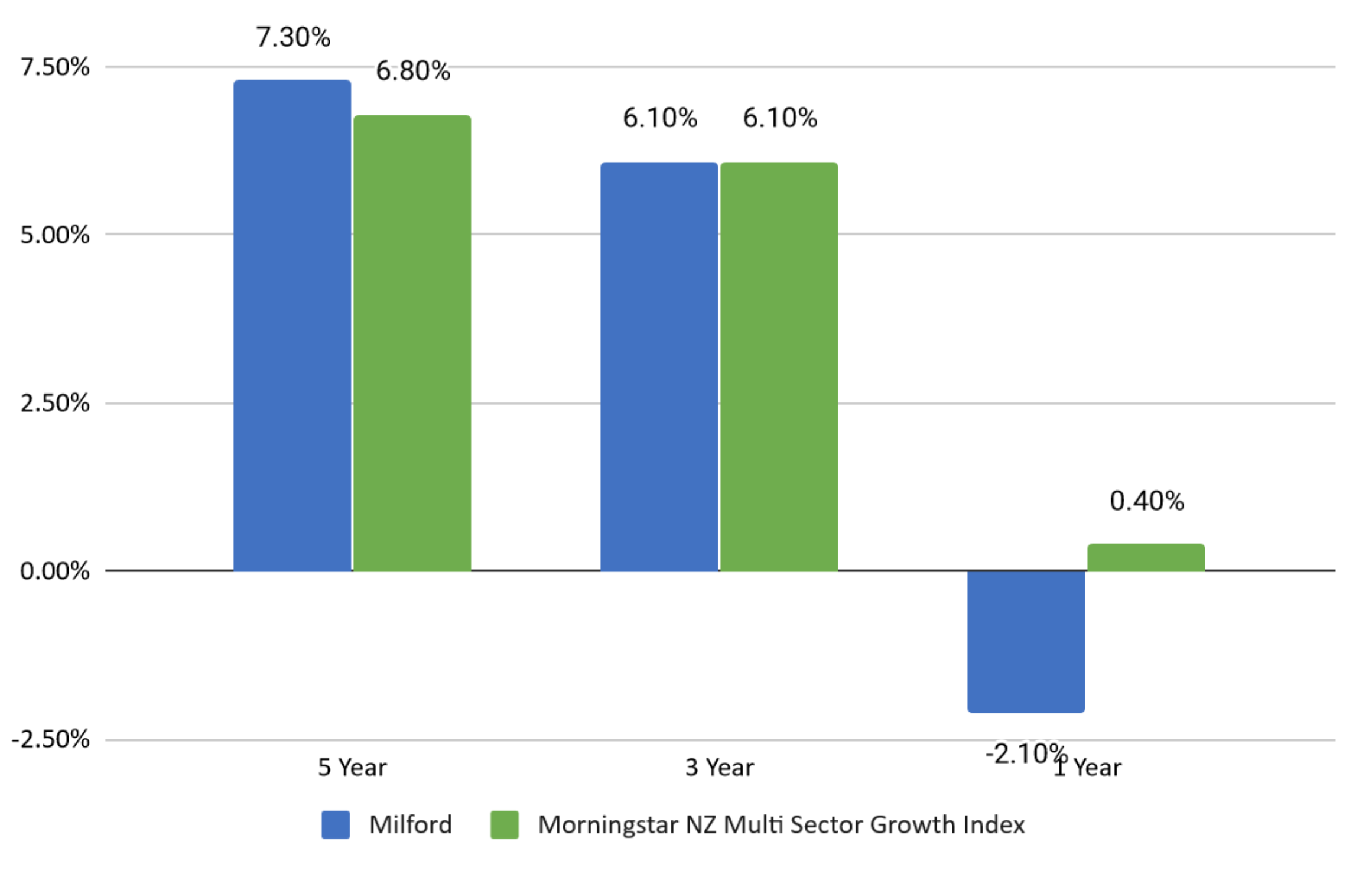

Fund's Net Returns vs Morningstar Growth Index

The chart below compares the after fees and before-tax returns of the Fund to Morningstar’s New Zealand Multi-Sector Growth Index. Over the past 5 years, the net return for the Fund is 7.30%, compared to the Morningstar index 5-year return of 6.80%. The Morningstar data calculates returns post fees but before tax.

Milford vs Morningstar NZ Multi-Sector Growth Index

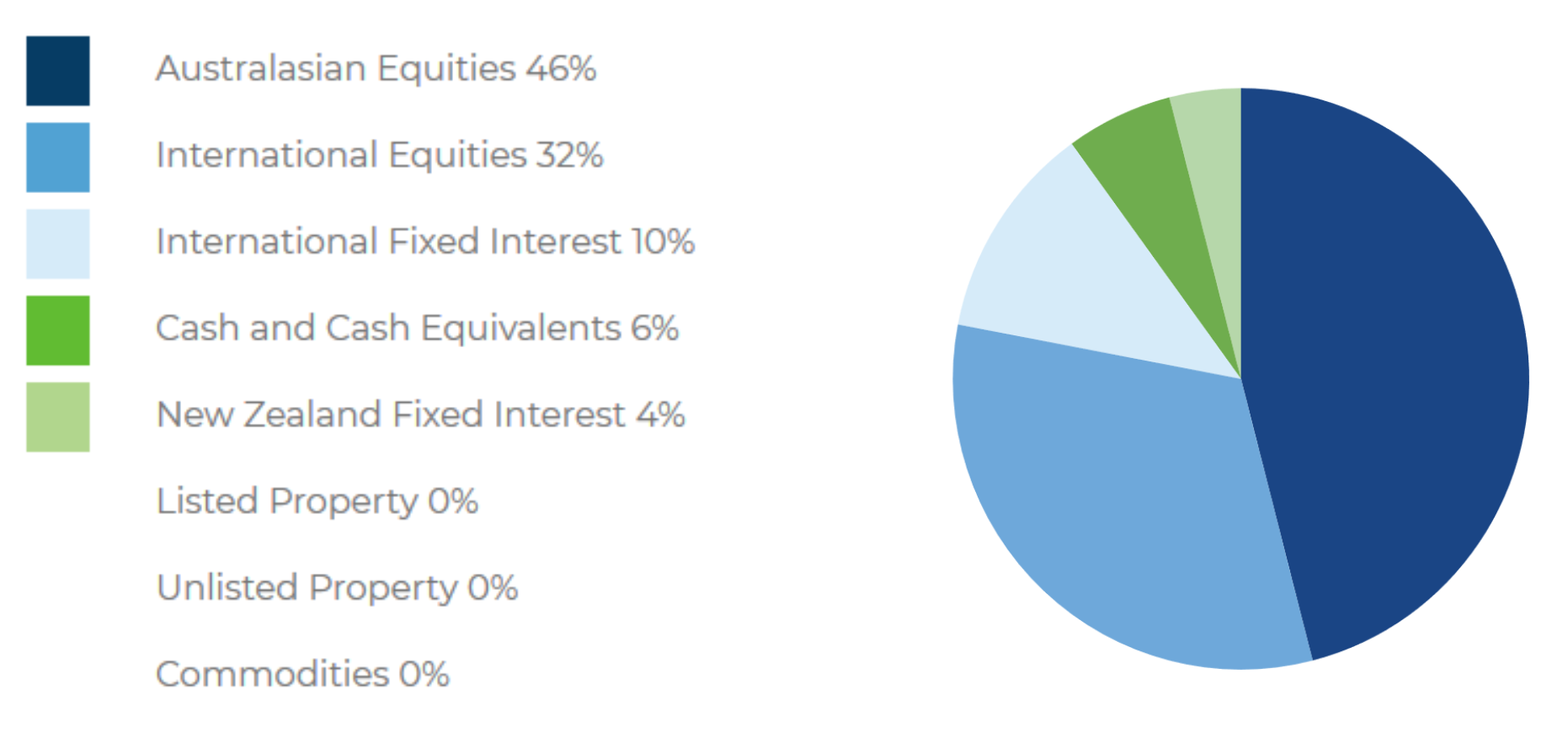

Asset Allocation Detailed Breakdown

As of March 2020, the Fund’s target asset allocation was as follows:

Fees Compared to Industry

|

FEES |

MILFORD ACTIVE GROWTH FUND |

PEER GROUP - GROWTH FUND |

|

Total Annual Fund Fees |

1.06% |

1.19% |

|

+ Membership Fee (annual) |

$36.00 |

$25.50 |

Is the Milford Active Growth fund right for you?

Firstly, you need to ensure that a growth fund is the appropriate fund for you. Then, don't just look at headline return figures, but dig deeper. Past performance is not necessarily an indication of the future. You need to see what kind of assets the fund holds, and what the investment processes are.

You do not have to DIY your KiwiSaver. Please submit our KiwiSaver HealthCheck and one of our professional financial advisers will be able to give you a personalised KiwiSaver Recommendation and tell you which fund is best suited for you.

Aggressive Fund Category: Booster SRI Growth Fund (Five Year Returns: 7.5%).

Booster SRI Growth Fund Objective

The fund’s objective is to maximise the potential for capital gains over the long term. It aims to achieve returns (after fees but before tax) of at least 4.5% per year above inflation over any ten year period. There will be significant movements up and down in the value of the fund. The fund invests predominantly in growth assets, with little or no income assets. It currently excludes investments in directly held companies and managed fund investments where the underlying activities are principally involved in the tobacco, alcohol, gambling, armaments, nuclear power, adult entertainment, GMO and fossil fuel industries. The criteria for screening out these investments may be modified over time to reflect developments in the socially responsible investment arena.

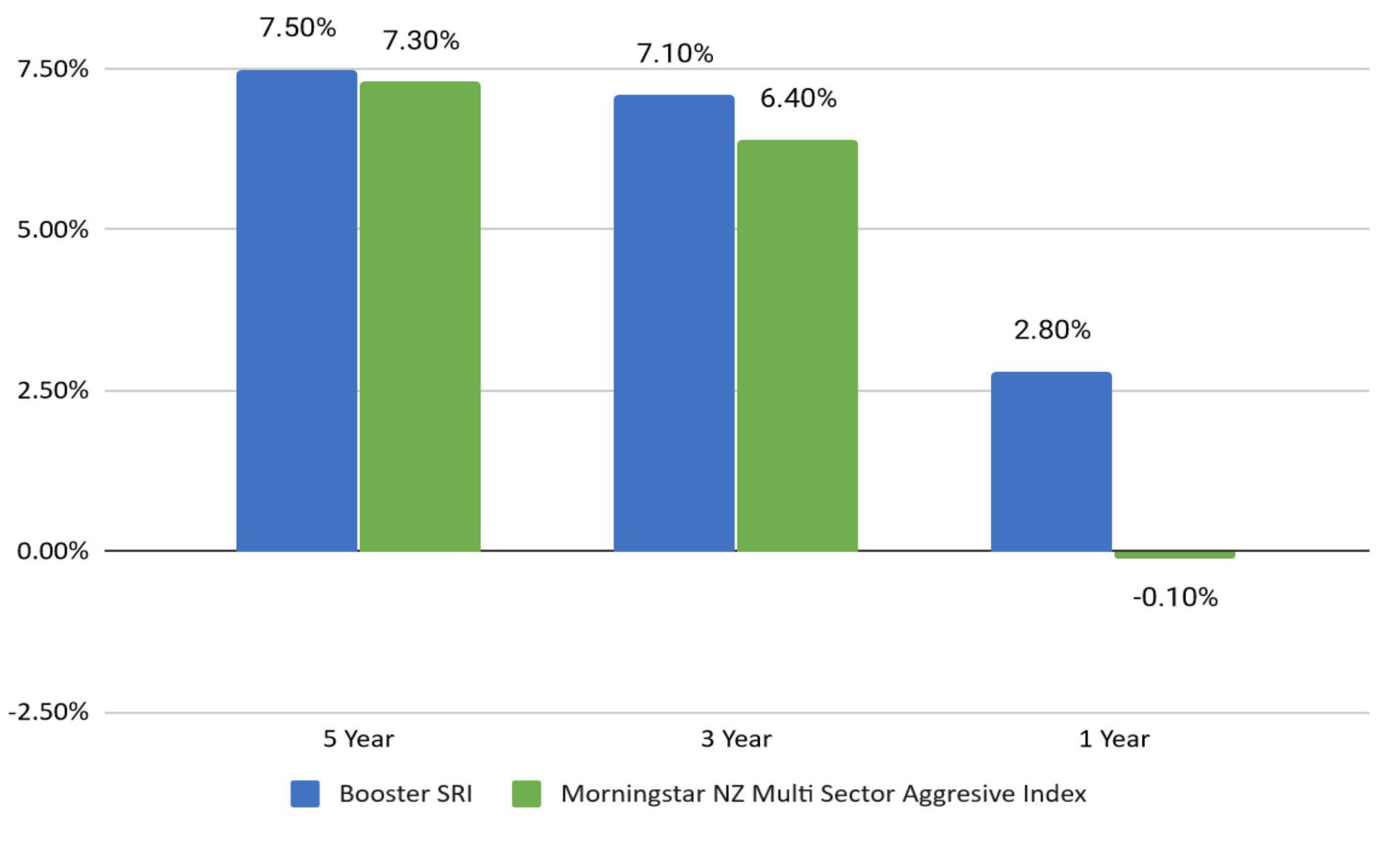

Fund's Net Returns vs Morningstar Aggressive Index

The chart below compares the after fees and before-tax returns of the Fund to Morningstar’s New Zealand Multi-Sector Aggressive Index. Over the past 5 years, the net return for the Fund is 7.50%, compared to the Morningstar index 5-year return of 7.30%. The Morningstar data calculates returns post fees but before tax.

Booster SRI vs Morningstar NZ Multi-Sector Aggressive Index

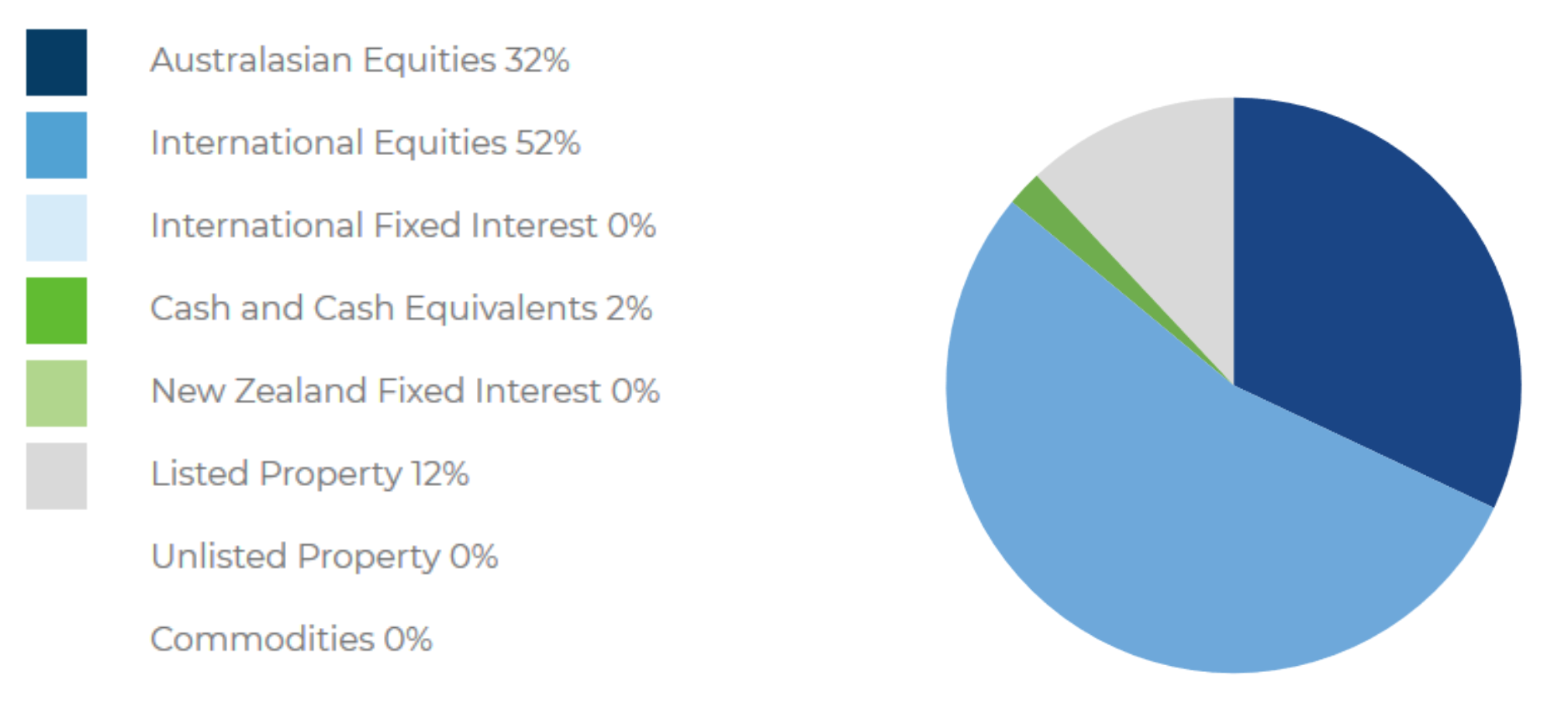

Asset Allocation Detailed Breakdown

As of March 2020, the Fund’s target asset allocation was as follows:

Fees Compared to Industry

|

FEES |

BOOSTER SRI GROWTH FUND |

PEER GROUP - AGGRESSIVE FUND |

|

Total Annual Fund Fees |

1.33% |

1.54% |

|

+ Membership Fee (annual) |

$36.00 |

$36.00 |

Is the Booster SRI Growth fund right for you?

Firstly, you need to ensure that an aggressive fund is the appropriate fund for you. Then, don't just look at headline return figures, but dig deeper. Past performance is not necessarily an indication of the future. You need to see what kind of assets the fund holds, and what the investment processes are.

You do not have to DIY your KiwiSaver. Please submit our KiwiSaver HealthCheck and one of our professional financial advisers will be able to give you a personalised KiwiSaver Recommendation and tell you which fund is best suited for you.

How to choose?

Past performance of a KiwiSaver fund is only one of the many factors that need to be considered when choosing a KiwiSaver fund. While analysing past performance is a helpful metric to evaluate investment options, you need to ask other questions, such as

- How is my money invested (asset allocation)?

- What is the Risk the fund is taking to achieve those returns?

- How are the Fees in relation to other similar funds?

- How much of the money is invested in NZ or overseas?

- How easy is it to make changes if I need to?

- etc...

Our research team at National Capital looks at over 100+ funds and can help you choose the right KiwiSaver investment for you. Our clients use us for KiwiSaver Advice because of the following reasons

- Detailed Research: Just checking the past performance and fees is NOT enough.

- Answers: How do I know my money is safe? What risks are being taken?

- Monitoring: We’re constantly monitoring the KiwiSaver landscape.

- Expertise: Our team specialise in Investment and KiwiSaver research.

- No cost to you: We get paid by the KiwiSaver providers

- Gift of Time: We do the hard work, so you can focus on life.

We provide a KiwiSaver HealthCheck which takes into consideration the big picture and not just the scorecard!

Best Performing KiwiSaver Funds - June 2020

Best Performing KiwiSaver Funds -Latest Update