Using the most recent returns and fund update reports from the Quarter Ended June 2022, we will examine ASB's recent KiwiSaver Performance.

Auckland Savings Bank (ASB) was established in 1847 and is owned by the Commonwealth Bank of Australia. ASB KiwiSaver scheme annual report shows that the scheme had 491,261 members on 31 March 2022. ASB entered into a strategic partnership with BlackRock on 19 July 2021, one of the world's largest investment management firms, enabling them to enhance investment offerings and manage NZD$13.56 billion in the ASB KiwiSaver Scheme (31 March 2022).

In the second quarter, the coronavirus pandemic has begun to decline in recent months, which has enabled the border between New Zealand and Australia to reopen entirely. However, the pandemic's negative effects have had a big impact on the economy of New Zealand. The Reserve Bank of New Zealand increased the official cash (OCR) in mid-August to 50 basis points, bringing the total OCR to 3.0 percent. This is because of inflationary pressures increasing the cost of living for New Zealanders. Therefore, the performance of ASB KiwiSaver has been significantly impacted by these societal contemporary concerns.

Table of Contents

News about ASB

Performance of ASB KiwiSaver Funds

ASB Cash Fund

ASB Conservative Fund

ASB Moderate Fund

ASB Balanced Fund

ASB Growth Fund

ASB Positive Impact Fund

News about ASB

In recent news, ASB, the fourth largest bank in New Zealand has reported a net profit for the year ended June 2022 of $1.47 billion, up 11 percent on the year before. Also, ASB has experienced home loan growth of 6%, despite falling property prices in 2022. This is said to be because investors are concerned about inflation increases, rising interest rates, ongoing challenges of COVID 19 and supply chain disruptions.

In the news regarding the ASB Kiwisaver Scheme, the annual report state that the number of members in the scheme has decreased from 534,262 on 1 April 2021 to 491,261 on 31 March 2022. Furthermore, in June 2022 there have been new investment strategies implemented for the Positive Impact Fund, aiming to achieve more measurable positive outcomes in accordance with United Nations Sustainable Development Goals.

Performance of ASB KiwiSaver Funds

|

1 Month |

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

0.58% |

0.88% |

1.15% |

0.78% |

1.27% |

2.74% |

|

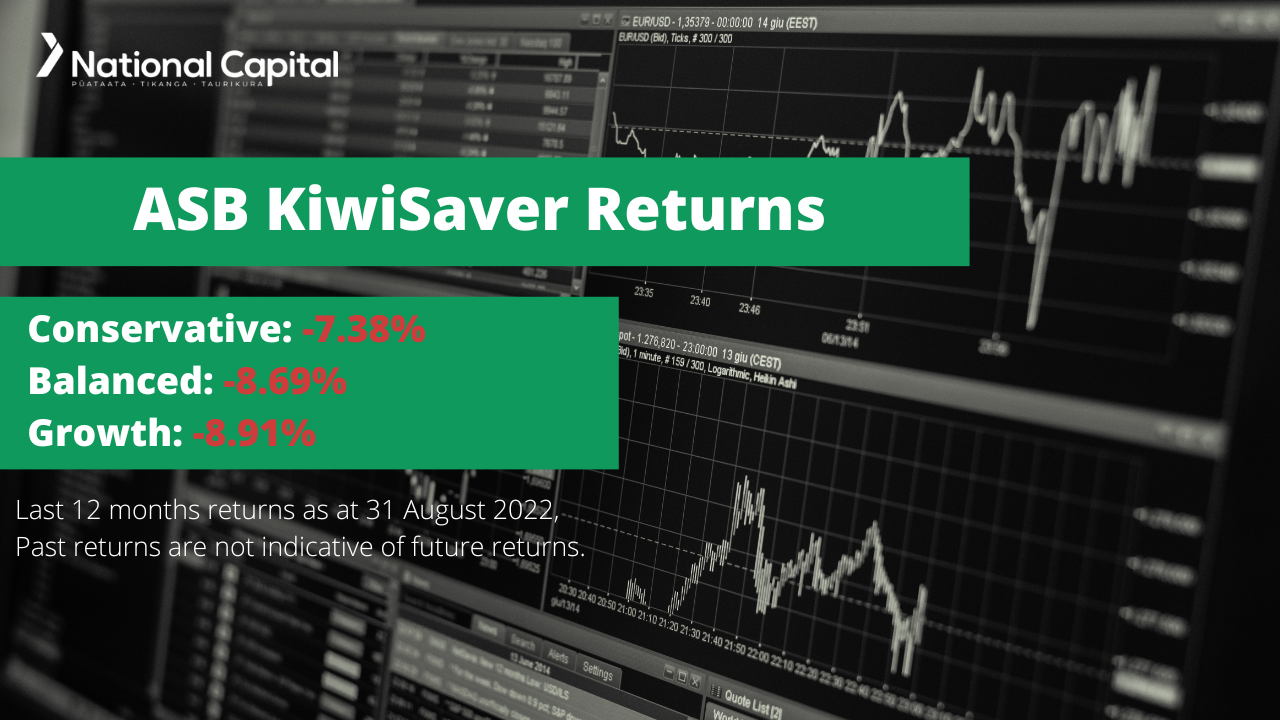

Conservative |

-0.86% |

-4.02% |

-7.38% |

-0.41% |

2.14% |

4.29% |

|

Moderate |

-0.95% |

-4.19% |

-8.18% |

0.41% |

3.03% |

4.77% |

|

Balanced |

-1.05% |

-4.40% |

-8.69% |

2.53% |

4.82% |

5.47% |

|

Growth |

-1.07% |

-4.47% |

-8.91% |

3.98% |

6.11% |

5.87% |

|

Positive Impact |

-2.53% |

-7.90% |

-13.97% |

2.84% |

N/A |

2.22% |

Sourced from ASB fund performance report

* These returns are to 31 August and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from ASB Quarterly Fund updates published on Date published 31 August 2022.

ASB Cash Fund

The Cash Fund aims to provide exposure to a portfolio of investment grade short-term deposits and fixed interest investments with New Zealand registered banks by investing in a target investment mix of 100% income assets. The Cash Fund has a 3-month return of 0.58% and a 1-year return of 1.15%, lower than the since inception return of 2.74%.

*The following is Sourced from ASB Cash Fund Update

Returns

Fees

The total annual fees for investors in the ASB Cash Fund are 0.35% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

Top ten investments

This table shows ASB’s top 10 investments in the Cash KiwiSaver Fund, which comprise 100% of the fund.

ASB Conservative Fund

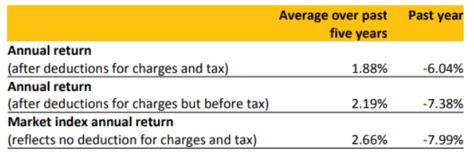

This fund aims to provide modest returns allowing for modest volatility by investing in income and growth assets with a target investment mix of 80% income assets and 20% growth assets. The Conservative Fund has a 3-month return of -0.86% and a 1-year return of -7.38% compared to the since inception return of 4.29%.

*The following is Sourced from the ASB Conservative Fund Update

Returns

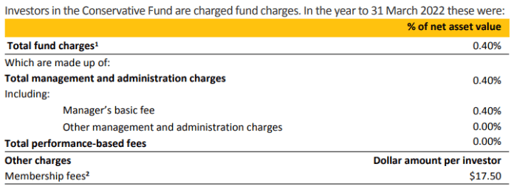

Fees

The total annual fees for investors in the ASB Conservative Fund are 0.40% per year.

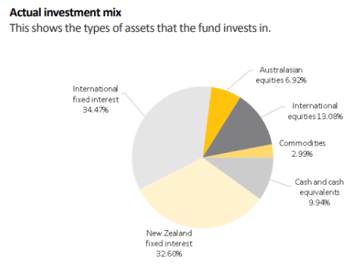

Investment mix

The investment mix shows the type of assets that the fund invests in.

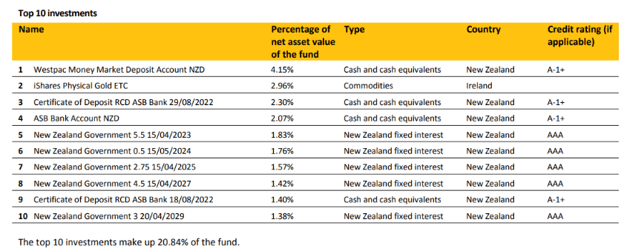

Top ten investments

This table shows ASB’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 20.84% of the fund.

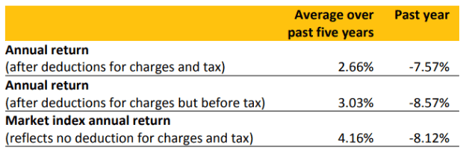

ASB Moderate Fund

The fund aims to provide moderate total returns allowing for moderate movements of volatility by investing in income and growth assets with a target investment mix of 60% income assets and 40% growth assets. The Moderate Fund has a 3-month return of -0.95% and a 1-year return of -8.18%, lower than the since inception return of 4.77%.

*The following is Sourced from ASB Moderate Fund Update

Returns

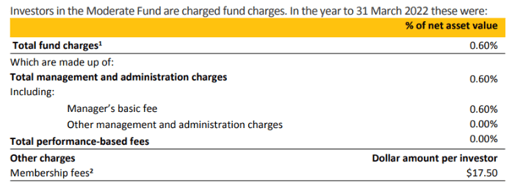

Fees

The total annual fees for investors in the ASB Moderate Fund are 0.60% per year.

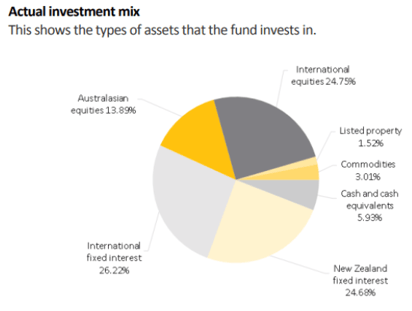

Investment mix

The investment mix shows the type of assets that the fund invests in.

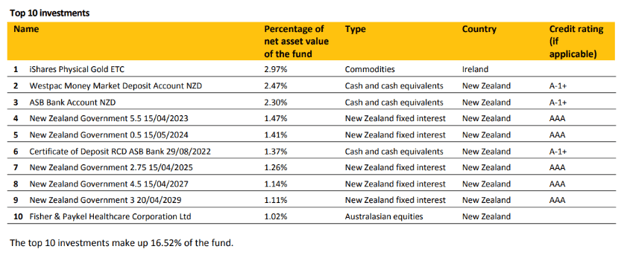

Top ten investments

This table shows ASB’s top 10 investments in the Moderate KiwiSaver Fund, which comprise 16.52% of the fund.

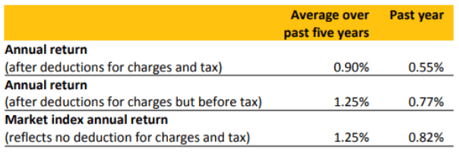

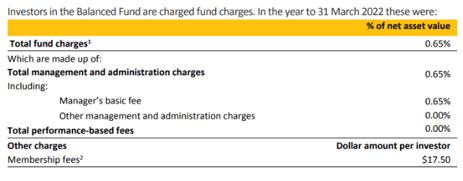

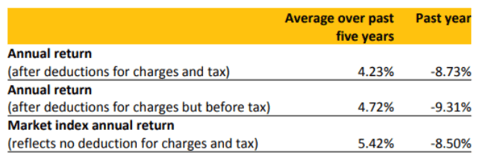

ASB Balanced Fund

The fund intends to provide moderate to high total returns allowing for moderate to high movements of volatility by investing in income and growth assets with a target investment mix of 40% income assets and 60% growth assets. The Balanced Fund has a 3-month return of -1.05% and a 1-year return of -8.69%, lower than the since inception return of 5.47%.

*The following is Sourced from the ASB Balanced Fund Update

Returns

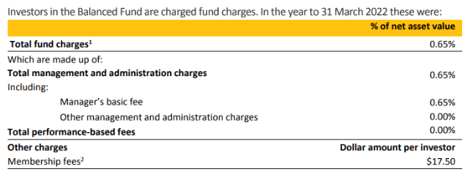

Fees

The total annual fees for investors in the ASB Balanced Fund are 0.65% per year.

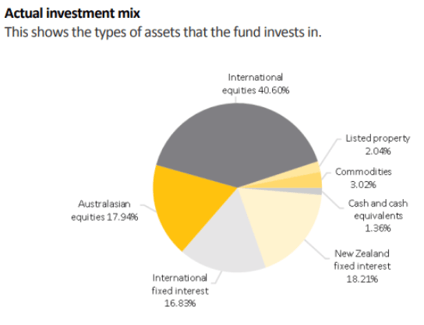

Investment mix

The investment mix shows the type of assets that the fund invests into.

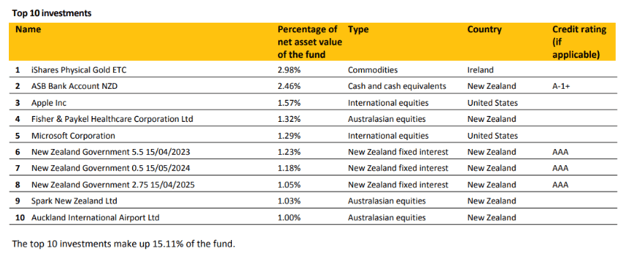

Top ten investments

This table shows ASB’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 15.11% of the fund.

ASB Growth Fund

The growth fund aims to provide high total returns allowing for large movements of volatility by investing in income and growth assets with a target investment mix of 20% income assets and 80% growth assets. The Fund has a 3-month return of -1.07% and a 1-year return of -8.91%, significantly lower than the since inception return of 5.87%.

*The following is Sourced from the ASB Growth Fund Update

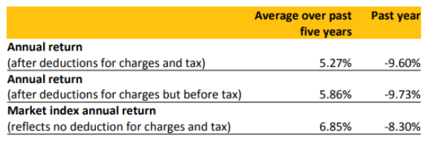

Returns

Fees

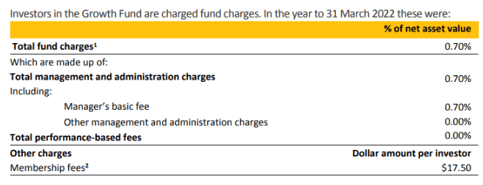

The total annual fees for investors in the ASB Growth Fund are 0.70% per year.

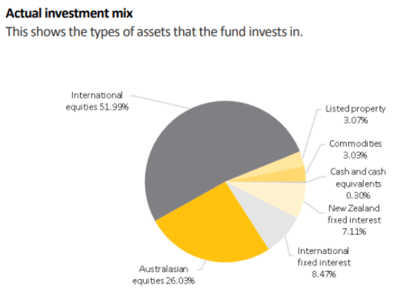

Investment mix

The investment mix shows the type of assets that the fund invests in.

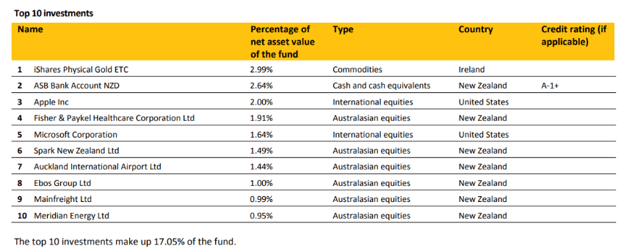

Top ten investments

This table shows ASB’s top 10 investments in the Growth KiwiSaver Fund, which comprise 17.05% of the fund.

ASB Positive Impact Fund

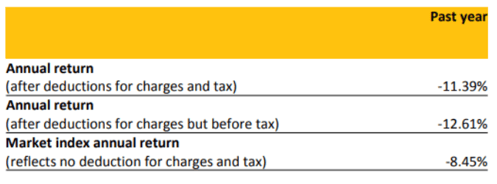

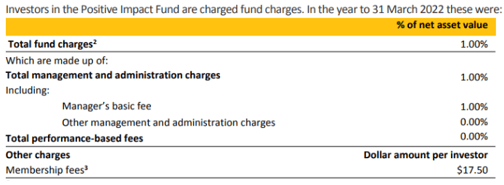

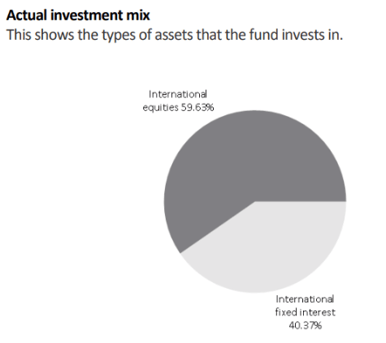

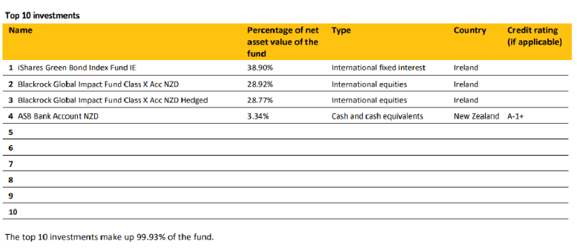

The Positive Impact Fund invests similarly to the Balanced Fund with a target investment mix of 40% income assets and 60% growth assets. The Fund aims to invest in companies looking to positively impact society or the environment, for a similar cost to the average balanced fund. The Fund has a 3-month return of -2.53% and a 1-year return of -13.97%, which is lower than the since inception return of 2.22%.

*The following is Sourced from ASB Aggressive Fund Update

Returns

Fees

The total annual fees for investors in the ASB Aggressive Fund are 1.00% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows ASB’s top 10 investments in the Aggressive KiwiSaver Fund, which make up 99.93% of the fund.

Data for ASB KiwiSaver funds have been sourced from ASB KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if ASB has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.