Using the most recent returns and fund update reports from 30 September 2022, we will examine ANZ’s recent KiwiSaver Performance.

One of the top financial and banking services groups in New Zealand is ANZ. They have more than 5 million clients and are among the biggest banks in the world. More than 650,000 people participate in ANZ's KiwiSaver programme, making it the largest supplier of the savings programme in New Zealand.

The markets continue to be encircled by inflation and COVID-19's long-lasting economic impacts. The fact that several KiwiSaver providers have had negative returns on funds this quarter is evidence of this. These elements bring on market turbulence. Increasing the official cash rate is still being implemented as part of the Reserve Bank of New Zealand's effort to reduce this volatility and inflation. When these factors are minimised, favourable market trends may develop.

Table of Contents

News about ANZ

Performance of ANZ KiwiSaver Funds

ANZ Cash Fund

ANZ Conservative Balanced Fund

ANZ Balanced Fund

ANZ Growth Fund

News about ANZ

In recent news, ANZ has reached out to their customers to justify its portfolio returns and provide consumers with optimism. Justification entails comparing the performance of their funds to that of others and the market. ANZ reinforces the market's cyclical behaviour and is confident that conditions will improve soon. Encouragement to invest in these volatile times is present; as ANZ mentioned, a significant opportunity to generate returns is present.

Performance of ANZ KiwiSaver Funds

|

1 Month |

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

0.71% |

1.65% |

1.12% |

1.56% |

2.23% |

2.52% |

|

Conservative |

-4.46% |

-9.55% |

-0.33% |

1.72% |

3.80% |

4.34% |

|

Conservative Balanced |

-4.67% |

-10.37% |

0.74% |

2.73% |

5.20% |

5.01% |

|

Balanced |

-4.80% |

-11.18% |

1.64% |

3.62% |

6.52% |

5.57% |

|

Balanced Growth |

-4.83% |

-11.76% |

2.68% |

4.57% |

7.89% |

6.10% |

|

Growth |

-4.80% |

-12.35% |

3.66% |

5.43% |

9.16% |

6.51% |

Sourced from ANZ fund performance report

* These returns are to 30 September and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is from ANZ Quarterly Fund updates on 30 September 2022.

ANZ Cash Fund

The Cash Fund's primary investment types are cash and cash equivalents. These could be securities issued by banks with New Zealand registrations, the New Zealand Government, businesses, municipal governments, or governments from other countries.

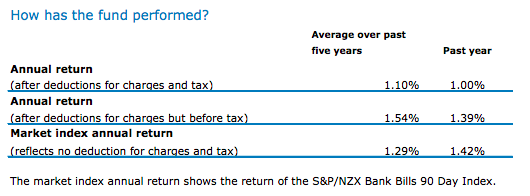

The long-term goal of the Cash Fund is to produce an annual return roughly in line with the appropriate market index (after the fund charge and before tax). The Cash Fund’s three-month return is 1.65%, and its one-year return is 1.12%, below the inception rate of 2.52%.

*The following is Sourced from ANZ Cash Fund Update.

Returns

Fees

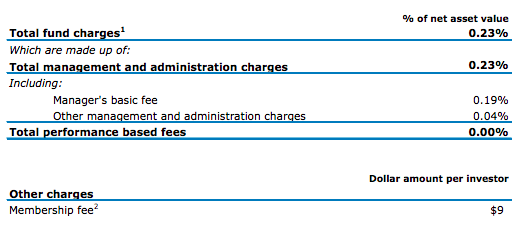

The total annual fees for investors in the ANZ Cash Fund are 0.23% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

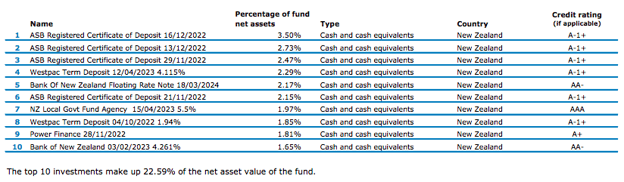

Top ten investments

This table shows ANZ’s top 10 investments in the Cash KiwiSaver Fund, which comprise 22.59% of the fund.

ANZ Conservative Fund

The Conservative Fund has a minor exposure to growth assets and invests primarily in income assets (cash, cash equivalents, and fixed interest) (equities, listed property and listed infrastructure). The fund may also purchase alternative assets.

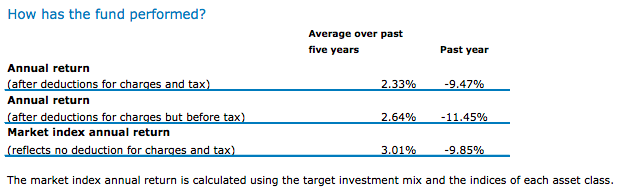

The Conservative Fund intends to generate a small annual return over the long term (after the fund charge and before tax) while permitting modest volatility, including infrequent negative annual returns. The Conservative Fund’s three-month return is -9.55%, and its one-year return is -0.33%, below the inception rate of 4.34%.

*The following is Sourced from ANZ Conservative Fund Update.

Returns

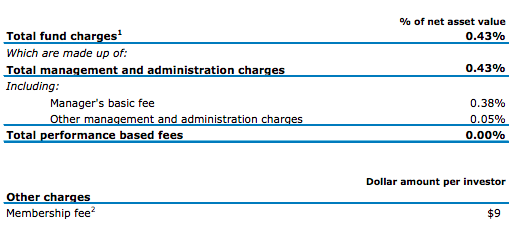

Fees

The total annual fees for investors in the ANZ Conservative Fund are 0.43% per year.

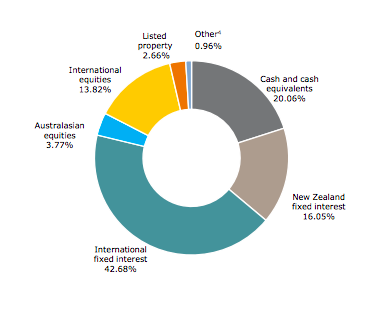

Investment mix

The investment mix shows the type of assets that the fund invests in.

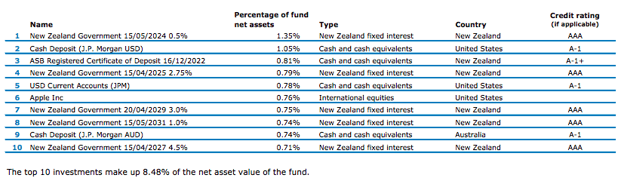

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 8.48% of the fund.

ANZ Conservative Balanced Fund

With modest exposure to growth assets, the Conservative Balanced Fund primarily invests in income assets (cash, cash equivalents, and fixed interest) (equities, listed property and listed infrastructure). The fund may also purchase alternative assets.

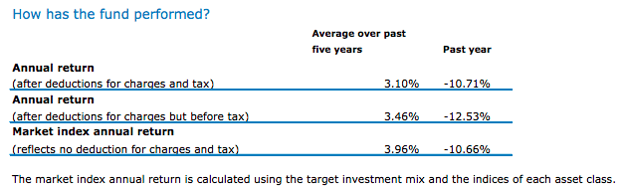

The Conservative Balanced Fund seeks to generate a modest to moderate yearly return over the long term (after the fund charge and before tax) while permitting modest to moderate value upheaval and occasional negative annual returns. The Conservative Balance Fund’s three-month return is -10.37%, and its one-year return is 0.74%, below the inception rate of 5.01%.

*The following is Sourced from ANZ Conservative Balanced Fund Update.

Returns

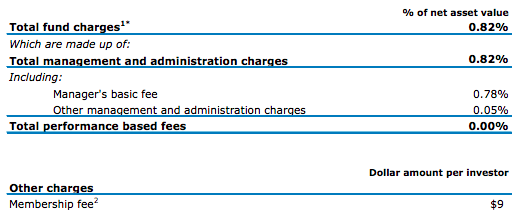

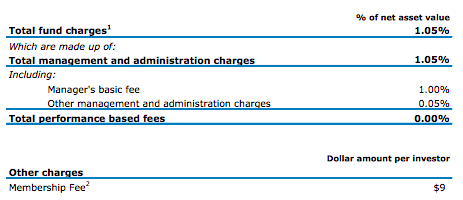

Fees

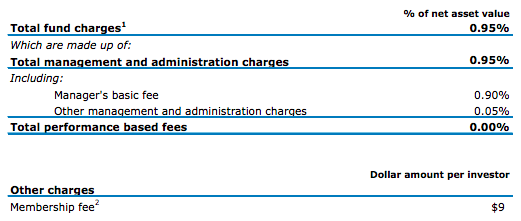

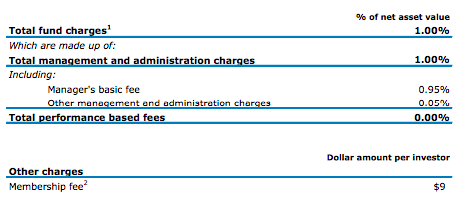

The total annual fees for investors in the ANZ Conservative Balanced Fund are 0.82% per year.

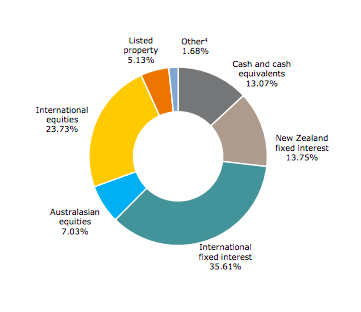

Investment mix

The investment mix shows the type of assets that the fund invests in.

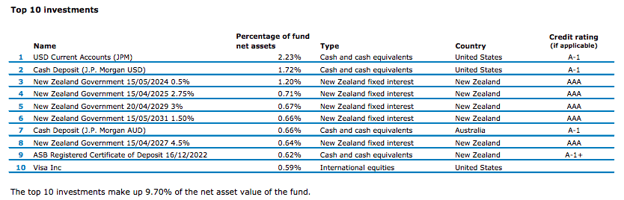

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative Balanced KiwiSaver Fund, which comprise 9.70% of the fund.

ANZ Balanced Fund

Equities, listed real estate, and listed infrastructure make up a similar portion of the Balanced Fund's investments in income assets (cash and cash equivalents, fixed interest). The fund may also purchase alternative assets.

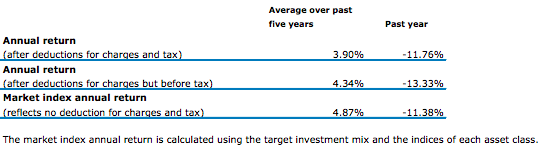

The Balanced Fund seeks to produce over the long term a moderate annual return (after the fund charge and before tax) while permitting modest value ups and downs, including sporadic negative annual returns. The Balance Fund’s three-month return is -11.18%, and its one-year return is 1.64%, below the inception rate of 5.57%.

*The following is Sourced from ANZ Balanced Fund Update.

Returns

Fees

The total annual fees for investors in the ANZ Balanced Fund are 0.95% per year.

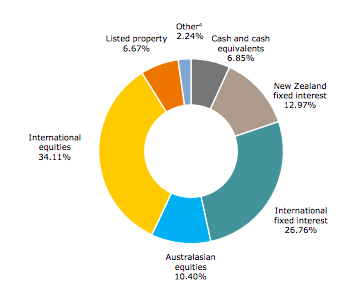

Investment mix

The investment mix shows the type of assets that the fund invests in.

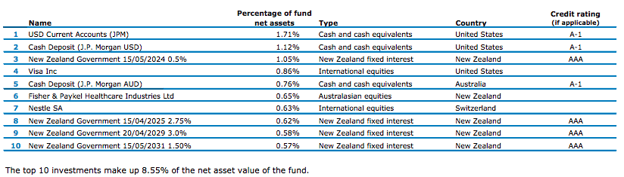

Top ten investments

This table shows ANZ’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 8.55% of the fund.

ANZ Balanced Growth Fund

With some exposure to income assets, the Balanced Growth Fund primarily invests in growth assets (equities, listed real estate, and listed infrastructure) (cash and cash equivalents and fixed interest). The fund may also purchase alternative assets.

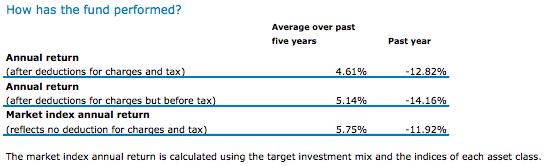

The Balanced Growth Fund seeks to produce a moderate to greater yearly return (after the fund charge and before tax) over the long term while permitting moderate to significant value swings up and down, including infrequent negative annual returns. The Balanced Growth Fund’s three-month return is -11.76%, and its one-year return is 2.68%, below the inception rate of 6.10%.

*The following is Sourced from ANZ Balanced Growth Fund Update.

Returns

Fees

The total annual fees for investors in the ANZ Balanced Growth Fund are 1.00% per year.

Investment mix

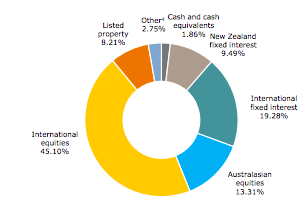

The investment mix shows the type of assets that the fund invests in.

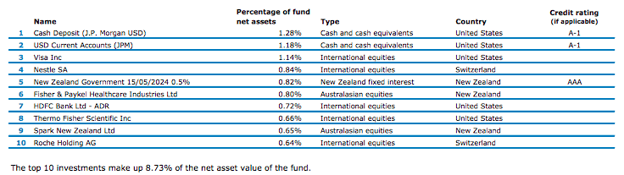

Top ten investments

This table shows ANZ’s top 10 investments in the Balanced Growth KiwiSaver Fund, which comprise 8.73% of the fund.

ANZ Growth Fund

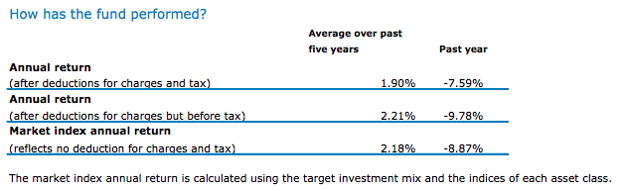

With less exposure to income assets (cash and cash equivalents and fixed interest), the Growth Fund primarily invests in growth assets (equities, listed property, and listed infrastructure). The fund may also purchase alternative assets. The Growth Fund seeks to generate a more significant yearly return over the long term (after the fund charge and before tax) while permitting significant value swings, including occasionally negative yearly returns. The Balanced Growth Fund’s three-month return is -12.35%, and its one-year return is 3.66%, below the inception rate of 6.51%.

*The following is Sourced from ANZ Growth Fund Update.

Returns

Fees

The total annual fees for investors in the ANZ Growth Fund are 1.05% per year.

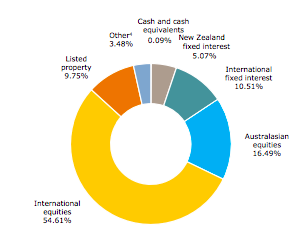

Investment mix

The investment mix shows the type of assets that the fund invests in.

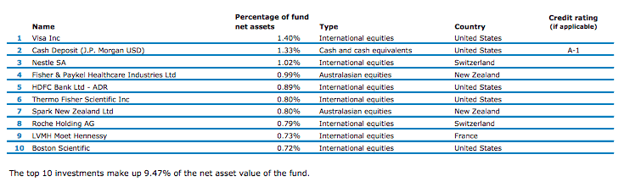

Top ten investments

This table shows ANZ’s top 10 investments in the Aggressive KiwiSaver Fund, which comprise 9.47% of the fund.

Data for ANZ KiwiSaver funds have been sourced from ANZ KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if ANZ has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.