Using the most recent returns and fund update reports from 31 March 2023, we will examine ANZ’s recent KiwiSaver Performance.

One of the top financial and banking services groups in New Zealand is ANZ. ANZ currently has over 8.5 million customers and is among the world's largest banks. Australia and New Zealand Bank (ANZ) were established in 1835, and the ANZ KiwiSaver funds have performed relatively well compared to the market average. As of 2023, the statistics show that ANZ manages more than $30 billion in investment for over 650,000 investors participating in the ANZ KiwiSaver scheme throughout New Zealand.

Table of Contents

Performance of ANZ KiwiSaver Funds

ANZ Conservative Balanced Fund

News about ANZ

In recent news (March 2023), ANZ has reported that several funds in ANZ have received certification from the Responsible Investment Association Australasia (RIAA). RIAA’s certification is the longest-running responsible investment program globally. By achieving this certification, ANZ responsibly invests its customers’ money and generates sustainable returns. ANZ takes a comprehensive approach to researching, selecting, and managing investment beyond excluding certain companies. In addition, ANZ would also point out that even if a fund has not been certified by RIAA, ANZ would still apply the same consistent, responsible investing process to all of our investment offerings.

Performance of ANZ KiwiSaver Funds

|

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

3.18% |

3.18% |

1.54% |

1.75% |

2.57% |

|

Conservative |

-3.06% |

-3.06% |

2.39% |

2.39% |

4.47% |

|

Conservative Balanced |

-3.58% |

-3.58% |

3.51% |

3.51% |

5.15% |

|

Balanced |

-3.99% |

-3.99% |

4.50% |

4.50% |

5.73% |

|

Balanced Growth |

-4.21% |

-4.21% |

5.56% |

5.56% |

6.26% |

|

Growth |

-4.44% |

-4.44% |

6.53% |

6.53% |

6.70% |

Sourced from ANZ fund performance report

*These returns are to 31 March 2023 (date of returns) before tax and after fund management fees. Past performance does not necessarily indicate future performance and return periods may differ.

Note: The following information is from ANZ Quarterly Fund updates on 31 March 2023.

ANZ Cash Fund

The Cash Fund's primary investments are cash and cash equivalents. New Zealand has issued these investments - registered banks, the New Zealand Government, Corporate or local authorities, and non-New Zealand government.

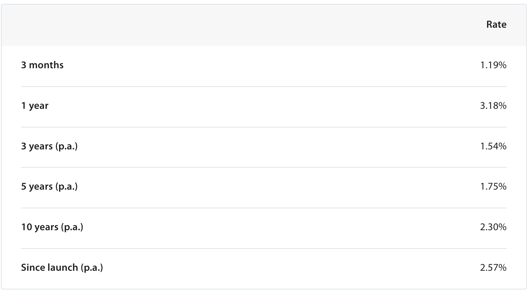

The Cash Fund’s long-term goal is to preserve capital for investors while offering low volatility in returns. As of 31 March 2023, the Cash Fund’s three months return is 1.19%, its one-year return is 3.18%, and its five - years return is 1.75%.

*The following is Sourced from ANZ Cash Fund Update.

Returns

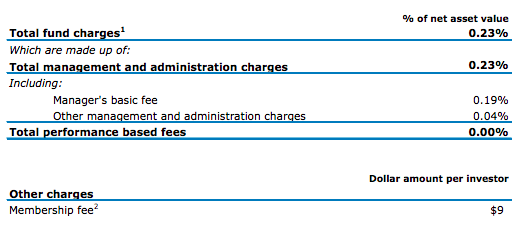

Fees

The total annual fees for investors in the ANZ Cash Fund are 0.23% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

Top ten investments

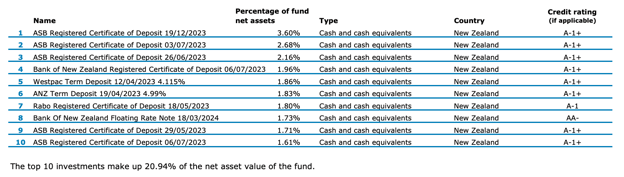

This table shows ANZ’s top 10 investments in the Cash KiwiSaver Fund, which comprise 20.94% of the fund.

ANZ Conservative Fund

The Conservative Fund mainly invests in income assets (cash and cash equivalents and fixed interest), with a smaller exposure to growth assets (equities, listed property, and listed infrastructure). The fund may also invest in alternative assets.

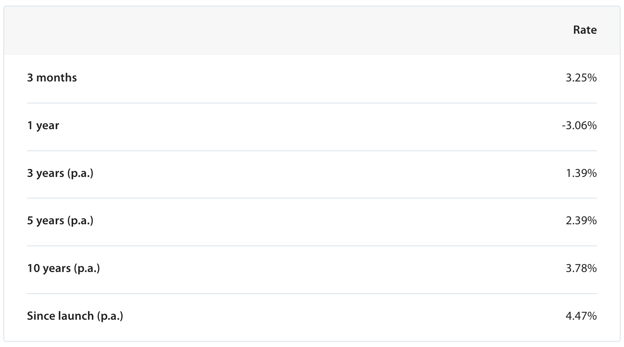

The Conservative Fund is designed for investors with low-risk tolerance. The Conservative Fund’s three months return is 3.25%, one-year return is -3.06% and five-year return is 2.39%.

*The following is Sourced from ANZ Conservative Fund Update.

Returns

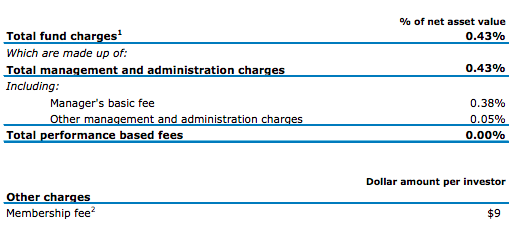

Fees

The total annual fees for investors in the ANZ Conservative Fund are 0.72% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 10% of the fund.

ANZ Conservative Balanced Fund

The Conservative Balanced Fund primarily invests in income assets (cash and cash equivalents and fixed interest), with some exposure to growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

The Conservative Balanced Fund aims to achieve (after the fund charge and before tax) a modest to moderate yearly return over the long term, allowing for modest to moderate movements of value up and down, including occasional negative yearly returns. The Conservative Balanced Fund’s three months return is 3.82%, one year is -3.58% and five years is 3.51%.

*The following is Sourced from ANZ Conservative Balanced Fund Update.

Returns

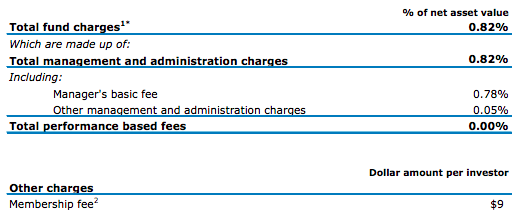

Fees

The total annual fees for ANZ Conservative Balanced Fund investors are 0.82% per year.

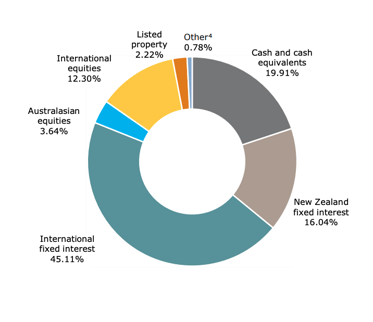

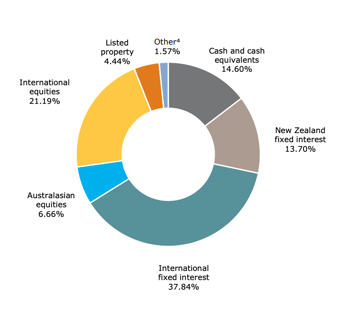

Investment mix

The investment mix shows the type of assets that the fund invests in.

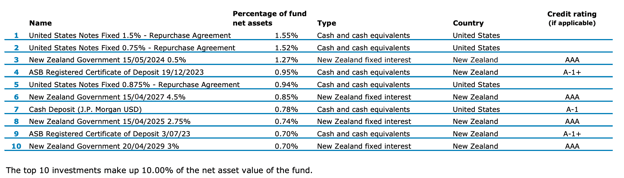

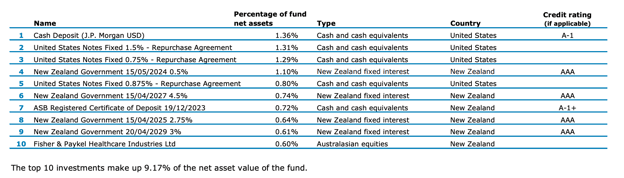

Top ten investments

This table shows ANZ’s top 10 investments in the Conservative Balanced KiwiSaver Fund, which comprise 9.17% of the fund.

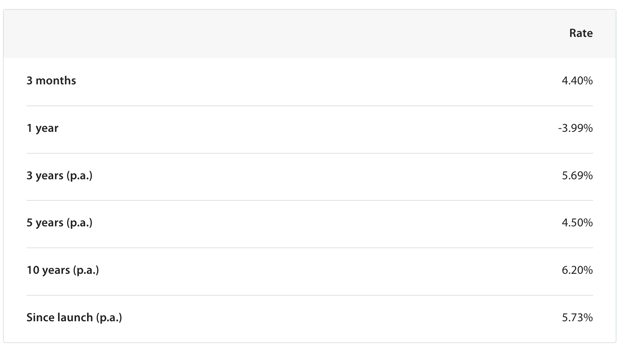

ANZ Balanced Fund

The Balanced fund invests in similar income assets (cash and cash equivalents and fixed interest) and growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets. This fund is intended for investors with balanced volatility tolerance. The Balanced Fund’s three months return is 4.40%, the one-year return is -3.99% and the five-year return is 4.50%.

*The following is Sourced from ANZ Balanced Fund Update.

Returns

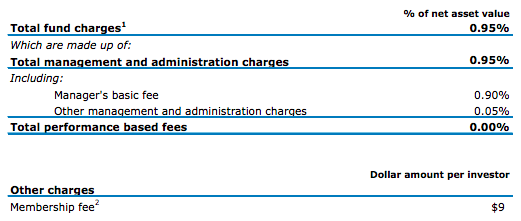

Fees

The total annual fees for investors in the ANZ Balanced Fund are 0.95% per year.

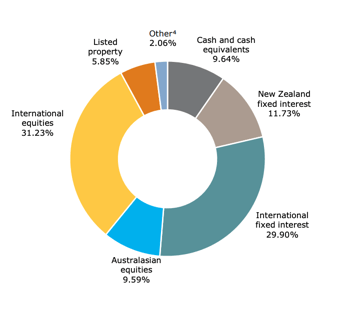

Investment mix

The investment mix shows the type of assets that the fund invests in.

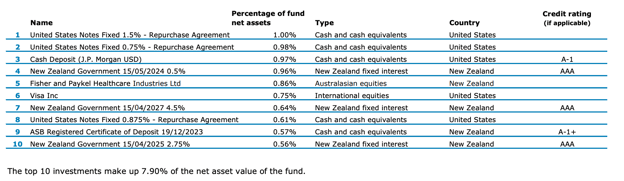

Top ten investments

This table shows ANZ’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 7.90% of the fund.

ANZ Balanced Growth Fund

The fund invests mainly in growth assets (equities, listed property and listed infrastructure), with some exposure to income assets (cash and cash equivalents and fixed interest). The fund may also invest in alternative assets. This fund is intended for investors.

The fund aims to achieve (after the fund charge and before tax) a moderate to higher yearly return over the long term, allowing for moderate to significant value swings up and down, including occasional negative yearly returns. The Balanced growth fund’s three months return is 5.03%, the one-year return is -4.21%, and five years return is 5.56%.

*The following is Sourced from ANZ Balanced Growth Fund Update.

Returns

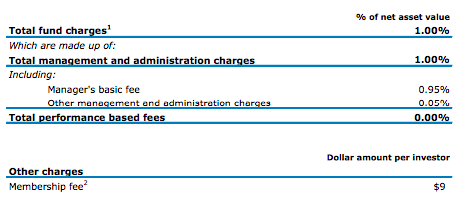

Fees

The total annual fees for ANZ Balanced Growth Fund investors are 1.00% per year.

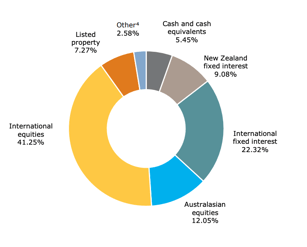

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

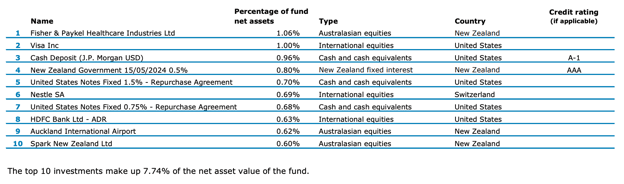

This table shows ANZ’s top 10 investments in the Balanced Growth KiwiSaver Fund, which comprise 7.74% of the fund.

ANZ Growth Fund

The fund invests mainly in growth assets (equities, listed property and listed infrastructure), with exposure to income assets (cash and cash equivalents and fixed interest). The fund may also invest in alternative assets.

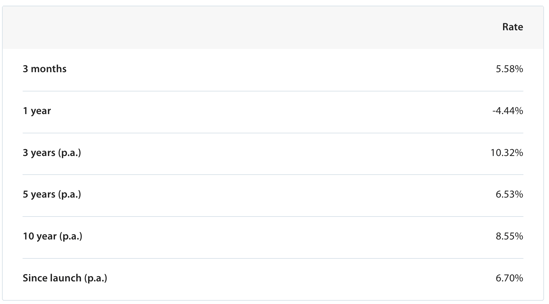

The fund aims to achieve (after the fund charge and before tax) a higher yearly return over the long term, allowing for significant increases in value, including occasional negative yearly returns. The Growth Fund’s three months return is 5.58%, the one-year return is -4.48% and the five-year return is 6.53%.

*The following is Sourced from ANZ Growth Fund Update.

Returns

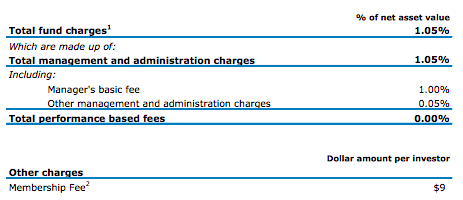

Fees

The total annual fees for investors in the ANZ Growth Fund are 1.05% per year.

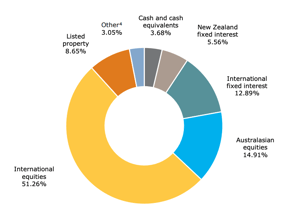

Investment mix

The investment mix shows the type of assets that the fund invests in.

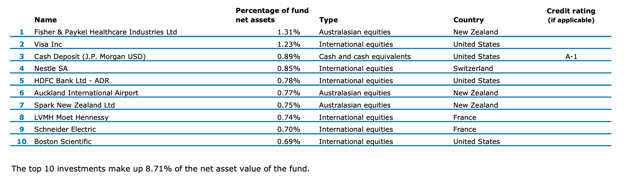

Top ten investments

This table shows ANZ’s top 10 investments in the Aggressive KiwiSaver Fund, which comprise 8.74% of the fund.

Data for ANZ KiwiSaver funds have been sourced from ANZ KiwiSaver Funds. Past performance does not necessarily indicate future performance and return periods may differ.

To see if ANZ has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.