The current market volatility has many kiwis wondering if they should stay away from the markets and wait for the perfect time to invest, or whether they should withdraw their investments now and reinvest later to avoid further losses.

In theory this strategy has merit, but in reality there is a major flaw; timing the markets is pretty much impossible and the benefits associated with doing so successfully are insignificant in the long run.

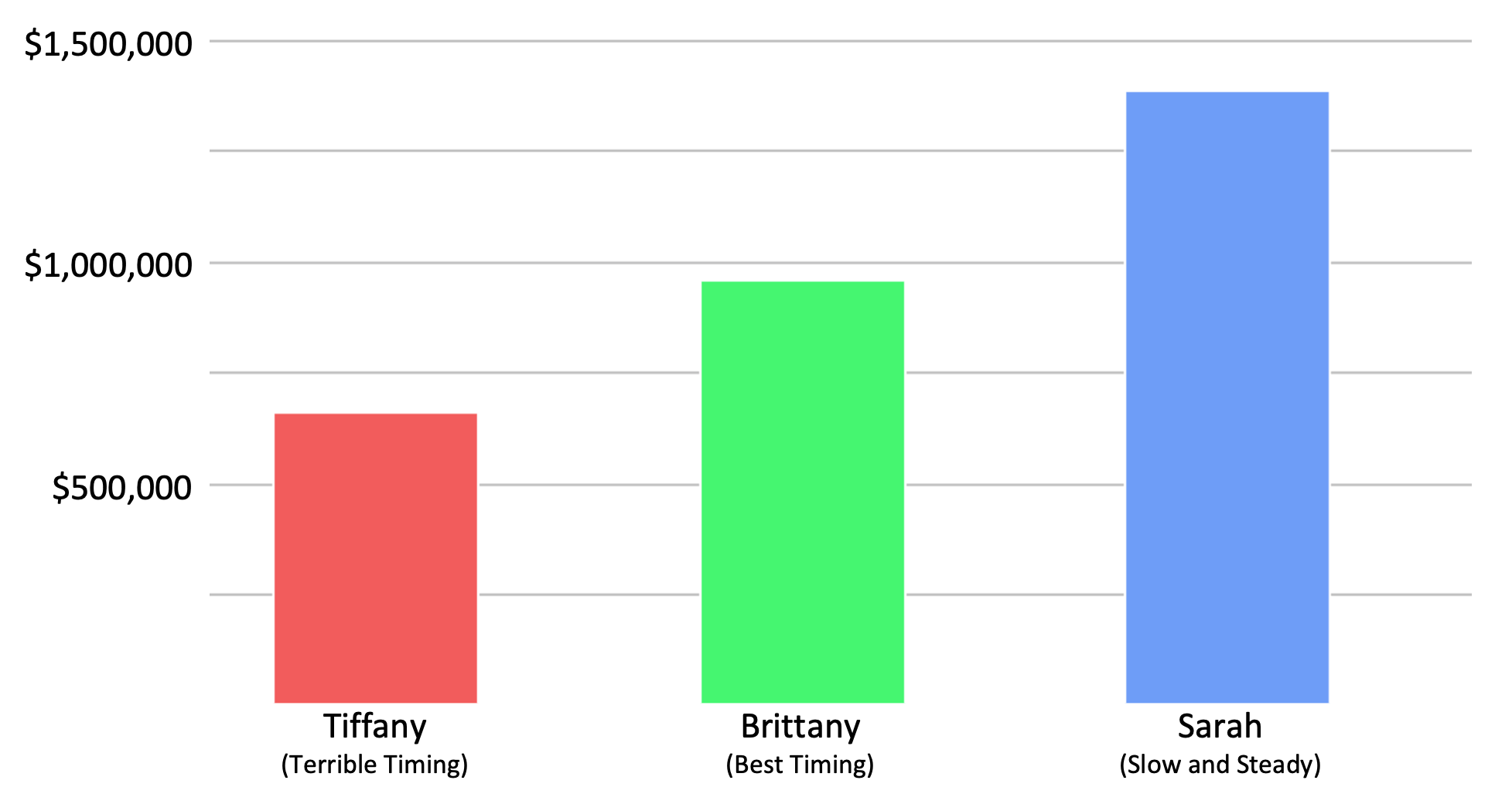

An article compared the difference between three theoretical investors in the S&P stock market over a 40 year period. The first investor, Tiffany, had terrible timing and incorrectly predicted the markets. She saved up, and invested when she thought the time was right, only to be followed by a market crash. Brittany, on the other hand, had much better luck and perfectly predicted the markets. She was able to buy at the very bottom of the market crashes. The last investor, Sarah, took a slow and steady approach. She did not attempt to time the markets and instead, invested an allocated amount each month into the S&P index.

The results of this theoretical analysis are compelling as Brittany, who had the best possible market timing, did not outcompete Sarah’s slow and steady approach.

While this case is oversimplified as the theoretical investors only invested in the S&P index and all took an invest and hold approach, it still illustrates the importance of investing regularly and often. This famous saying, well known in the investing world, sums it up perfectly;

“Time in the market is more important than timing the market.”

Waiting for the most opportune moment to invest means that you miss out on all of the smaller gains, which are going to add up over a long period of time. Even if you manage to perfectly predict the markets it makes little difference to your investment portfolio in the long run.

We all know the saying “slow and steady wins the race,” and this little and often approach is precisely what KiwiSaver aims to achieve.

How does this relate to the coronavirus crisis?

After the Global Financial Crisis in 2008, the financial markets experienced one of the longest bull markets in history. Investors observed steady positive returns for over a decade. COVID-19 has brought a rapid halt to this and investors are now watching their investments lose thousands of dollars over the space of a few weeks. KiwiSaver is no exception. Since it invests in the financial markets, it fluctuates just like the markets. This is unsettling, but now is not the time to withdraw and attempt to reinvest later when the market is less volatile. It makes no difference in the long term because as we have seen time and time again, the markets recover and come back stronger.

KiwiSaver is a long term investment so there is time to ride out the ups and downs of the financial markets. Sticking to your regular investment plan means that although you are in the market at the ‘worst times’, you are also still invested at the ‘best times’ too.

Your KiwiSaver will recover if you give it time.