KiwiSaver Tax - Everything you need to know

Is KiwiSaver taxed? The answer is yes. Although tax is not the most riveting subject in the world, nor is it something we like paying, having the right details when it comes to your KiwiSaver tax rate could save you a lot of money. So let’s try to be a step ahead and understand how KiwiSaver funds get taxed.

Note: The following information is general information and is not personalised advice. If you want personalised advice on which fund is most appropriate for you, please submit the KiwiSaver HealthCheck.

Prescribed Investor Rate (PIR)

Firstly, the amount of KiwiSaver tax you pay is based on your Prescribed Investor Rate (PIR). Your KiwiSaver Provider will collect your share of tax payable (calculated using your PIR) and pay the IRD on your behalf.

During KiwiSaver sign up, you are required to select a PIR tax rate which is based on how much you earn from salary, wages and other income. If you do not provide your KiwiSaver Provider with your PIR, you’ll be taxed at the default (highest) rate of 28%. The IRD may check if you’ve used the correct PIR. If the IRD believes the tax rate you have selected is incorrect, they will contact your KiwiSaver provider directly and have them change it.

You only pay tax on your employer’s contributions to your KiwiSaver Scheme and on the taxable portion of your KiwiSaver investment, not on the entire balance. Meaning, only some of your KiwiSaver account balance is subject to tax. We get into the reason for that in more depth in the sections below.

Your PIR for the current tax year depends on how much you earned from salary, wages and other income in the previous two tax years. Upon joining KiwiSaver, it’s your responsibility to tell your KiwiSaver provider the correct rate, so if you are still unsure, below is a simple way to determine your PIR. For more information visit the IRD website.

The Scheme provider pays the tax on your behalf. To do so, they cancel a number of units you have invested in order to fund the amount payable to the IRD when it is due.

It is important to understand that your PIR may be a different rate from your income tax rate.

You pay income tax to the IRD based on your income from salary, wages and other income. Your PIR is based on your lowest income in the previous two income years. Additionally, the bands & minimum and maximum rates for your Income Tax and PIR are different.

Upon joining a KiwiSaver Scheme, if you do not provide your KiwiSaver Scheme provider with a PIR, you will be charged tax at a default rate of 28%.

The IRD has systems in place where they may calculate your PIR and ask you (via your KiwiSaver provider) to correct your PIR if you have registered with an incorrect rate.

The IRD may also request your KiwiSaver Provider to change your PIR if they believe the rate is no longer correct. This might happen if your lowest income from salary, wages and other income in the previous two income years puts you in a different PIR tax bracket. We recommend keeping your PIR information up to date with your KiwiSaver Provider.

Which Part of My KiwiSaver Money Is Taxed?

Your employee contributions to KiwiSaver are not taxed as they are paid from your after-tax income, but your employer’s contributions to KiwiSaver are subject to Employer Superannuation Contribution Tax (ESCT). The ESCT rate for your employer’s contributions will depend on how much you earn from salary or wages from your employer. The ESCT rate ranges from 10.5% to 39% and will be deducted by your employer from their contributions and paid by them directly to the IRD.

You will also pay tax on a portion of your KiwiSaver investment earnings based on your PIR. The tax on your investment earnings is calculated by your KiwiSaver Provider and paid by them directly to the IRD. Your KiwiSaver Provider pays the tax due by cancelling units in your KiwiSaver investments. If you are due a tax refund, your KiwiSaver Provider will credit you with additional units equal to the value of the refund.

Your KiwiSaver Provider will keep a running total of the tax on your investment earnings and deduct the tax from your investments following 31 March each year or earlier if you switch or withdraw funds during the income year. If you are due a tax refund, you will receive a tax credit instead.

The money you withdraw from your KiwiSaver investments is tax free.

Government's Contribution to KiwiSaver

If you are making contributions to your KiwiSaver Scheme, the Government will also make a contribution to your KiwiSaver Scheme.

How it works – The government contributes $0.50 for every $1 you contribute to your KiwiSaver Scheme up to a maximum of $521.43 each year. To get the full amount you need to contribute $1042.86 of your own money between the 1st of July to the 30th of June each year. Your employee and voluntary contributions count towards the $1042.86 but your employer contributions are excluded. If you are not working, you can still make voluntary contributions to your KiwiSaver scheme and receive the Government contribution. The Government’s contributions will cease when you reach age 65.

Taxable Returns In Different Types of Funds

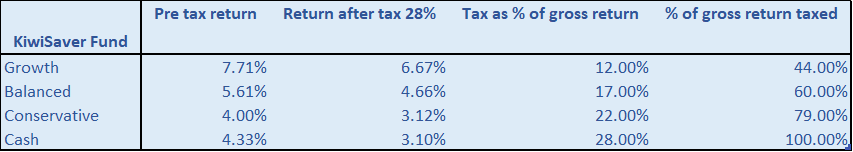

As we mentioned before, you only pay tax on the ‘taxable portion’ of your investment earnings. The makeup of your fund can play a part in how much KiwiSaver tax is paid. We did some research to find how much of a fund’s pre-tax investment returns are subject to tax. The findings were that generally, conservative funds pay a greater percentage of their investment returns in tax whereas growth funds tend to pay a lower percentage of investment returns in tax. This is due primarily to the different tax treatment of fixed interest and equity investments. Using a selection of funds from an unnamed KiwiSaver provider we can see how this works in practice.

As seen above, 100% of the cash fund returns were taxable – while only 44% of the growth fund returns were taxable for the period. Putting it another way, the cash fund paid tax at 28% whereas the effective tax rate on the growth fund was only 12%.

We explore why this is in the section below.

Fixed Interest vs Shares

As most KiwiSaver investment options are PIE schemes, we will discuss the tax treatment of KiwiSaver investments based on the rules applying to PIEs. To keep things simple, we will cover the tax treatment of fixed interest and share investments only which are typical investments in KiwiSaver funds.

Fixed interest investments are taxed on their total investment earnings which are made up of interest earned and any capital gains or losses. As can been seen from the table above, the Cash fund which is totally invested in short term fixed interest investments has been taxed on 100% of its investment earnings.

Most New Zealand and Australian listed shares managed through a PIE scheme only pay tax on dividends. Capital gains are not taxed. This is significant because over the long term, most of the investment returns from shares is likely to come from capital gains.

International shares are mostly taxed under the Foreign Investment Fund (FIF) tax rules. For PIE Schemes, the FIFs are not taxed on their actual investment earnings. Instead, tax is based on 5% of the average daily value of the fund. That means tax is paid regardless of how the investments perform. The good news is over the long term, investment returns are likely to exceed 5% per annum which means the total investment earnings is unlikely to be taxed.

As can be seen from the table above, the growth fund has effectively only been taxed on 44% of its gross earnings. This is because most of the fund is invested in shares.

One last comment on tax. While growth funds may pay a lower proportion of investment earnings in tax, the total amount of tax payable may be higher than for a more conservative fund. This is because the growth fund’s investment earnings are likely to be greater over time.

It's Not All About KiwiSaver Tax

Paying tax is a fact of life when it comes to investing, including KiwiSaver investments. But tax shouldn’t be the primary driver for making decisions when choosing a KiwiSaver fund.

We recommend you consult a professional in order to get the best KiwiSaver advice suited to your unique situation and circumstances.

National Capital provides personalised KiwiSaver advice at the touch of a button. Don’t hesitate and find out right away how you can optimise your KiwiSaver Scheme.

Spending 10 minutes to complete National Capital’s KiwiSaver HealthCheck may be the most important thing you can do right now. Sort out your future by taking action today.