There are a range of KiwiSaver providers out there, from big banks and insurance companies, to specialist and boutique investment managers. With more than 20 KiwiSaver providers and more than 200 different KiwiSaver funds, how do you choose?

Fees, returns, the way the funds are invested, and your final KiwiSaver balance at retirement can vary greatly depending on which fund you are in. For example, the highest 12-month return on a KiwiSaver fund in the June 2020 quarter was 30.6% (SuperLife US Large Growth) and the lowest was -33.1% (Nikko AM KS Scheme Option). That’s a huge difference!

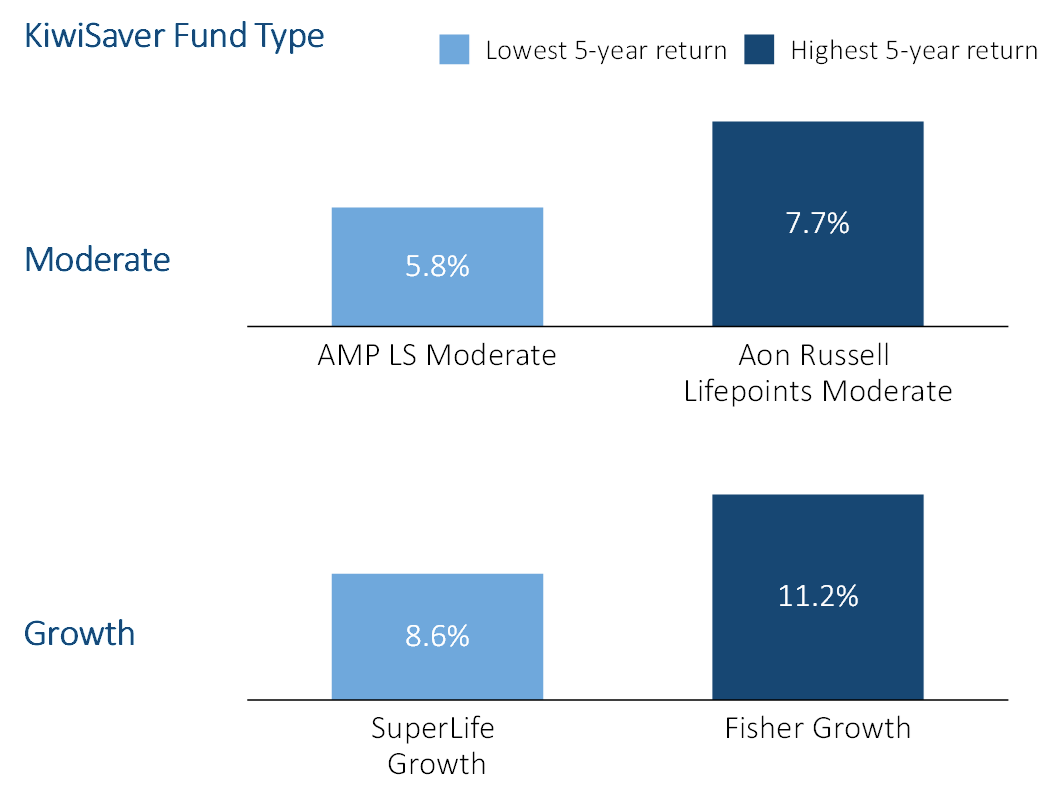

Even within the same fund category, there are large differences in fees, past returns, and asset allocation. The 5-year annual returns from a KiwiSaver Growth fund can range from 5.6% to 9.8% and fees can range from 0.31% to 1.37%. The wide scope of outcomes proves just how important it is for you to research deeply into KiwiSaver funds or get advice from experts.

Let’s take a look at the variance of returns, fees, and asset allocation among different KiwiSaver providers in the June Quarter 2020 (Source: MorningStar).

Ranging returns

There’s a range of possible returns from different providers. As seen below, depending on which fund you choose, the returns could vary widely. It’s also important to remember that returns are constantly changing. A fund that performs well this year, may not do as well in the next.

(Source: MorningStar)

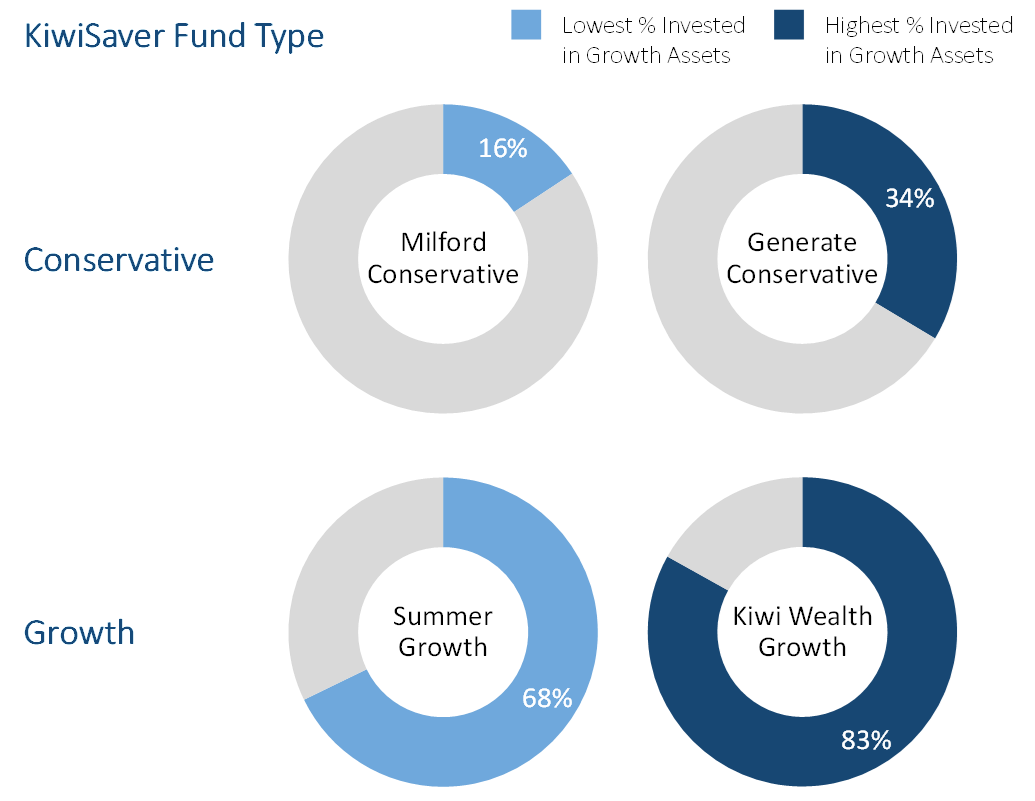

How are the funds investing your money?

Just because the funds are in the same KiwiSaver category (or called by a certain name such as Growth Fund) doesn’t mean they are the same. Names can be deceptive.

If you don’t look into the asset allocation of your KiwiSaver fund, you could be unknowingly taking on more volatility than what you can tolerate. Taking in excess risk to your volatility capacity can have dire consequences – like having your KiwiSaver balance drop when you need to use it. As shown below, different funds could have completely different asset allocations, so just comparing one ‘growth’ fund to another on sorted.co.nz might not be enough!

(Source: MorningStar)

Besides asset allocation, you should also be looking at who’s managing your fund, and what exactly your fund is invested in. If you don’t want to, or don’t have the time to research everything about each KiwiSaver fund, that’s what National Capital is here for!

What Fees are you being charged?

Fees across KiwiSaver funds of the same type also vary a lot as shown below. So it’s important to see where you are getting the best value for your money in fees. Of course, when choosing a KiwiSaver fund, it is important to look beyond fees. If you are simply looking for the lowest fees, you could be missing out on higher net returns.

|

KiwiSaver Fund Type |

Lowest percentage fee |

Highest percentage fee |

|

Conservative |

0.27% |

1.06% |

|

Moderate |

0.57% |

1.23% |

|

Balanced |

0.29% |

1.70% |

|

Growth |

0.29% |

1.36% |

|

Aggressive |

0.63% |

1.68% |

| (Source: MorningStar) | ||

Some providers may also have different fee structures. For example, Juno KiwiSaver scheme charges fixed fees ranging from $5 to $50 per month depending on how large your KiwiSaver balance is.

What can I do about it?

It seems like there’s a lot to look into when choosing a suitable KiwiSaver fund, but it doesn’t need to be difficult. National Capital researches more than 100 funds from 12 different KiwiSaver schemes and can recommend a fund to suit your circumstances. We operate online and give you free KiwiSaver recommendations with the goal of helping 1 million Kiwis become financially secure.

Want help in finding a suitable KiwiSaver fund for you? Take National Capital’s KiwiSaver HealthCheck now.