*Past performance is not necessarily indicative of future performance.

*All returns are per annum after fees and tax (28% PIR) as of the quarter ended 31st August 2025.

*Source: National Capital Research

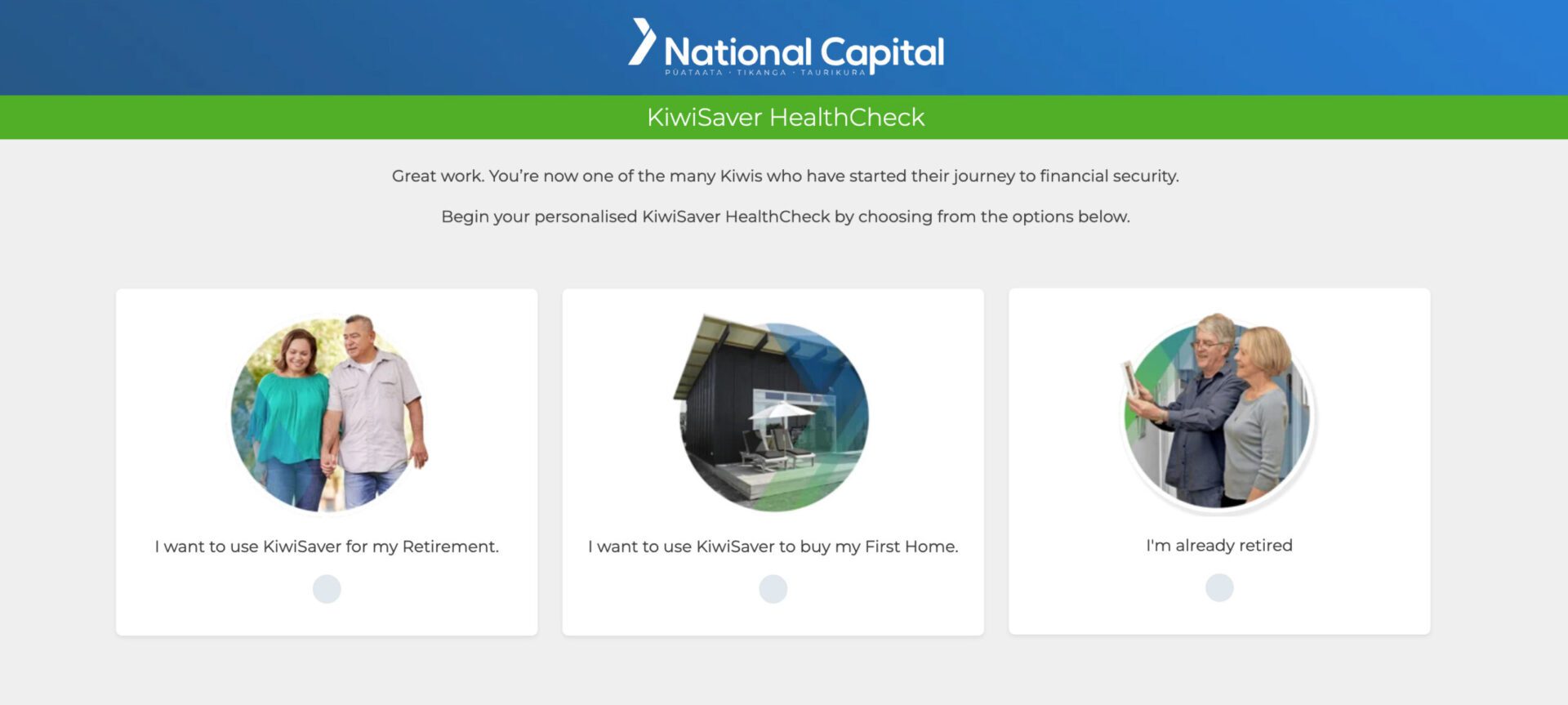

We’re here to help find the best KiwiSaver fund for you. Our team are financial advisers specialising in KiwiSaver & Investment research. We provide free KiwiSaver advice, with the goal of empowering Kiwis to become financially secure.

By taking a few minutes of your time to complete our KiwiSaver HealthCheck questionnaire, you will receive an instant recommendation tailored specifically to your goals and beliefs.

Our system combines the latest figures and technology to provide the most suited recommendations. Nonetheless, whether you take us up on the advice, is completely up to you.

A KiwiSaver scheme is an entity that offers a collection of investment funds for you to choose from. That choice varies depending on your risk tolerance and interests. Naturally, the life stage you’re in will also play an important role in your choice too. For example, if you’re just starting work as a teenager or nearing you’re retirement.

A KiwiSaver scheme will invest your savings on your behalf should you decide to opt in. The government initially set up the KiwiSaver scheme idea as a way to boost Kiwi retirement savings. Notably, the government continues to play a key role in regulation to ensure that KiwiSaver scheme companies meet certain criteria. That criteria can be found in detail as written under the KiwiSaver Act 2006 legislation.

The government also has the power to set a list of default KiwiSaver Scheme companies. Joining members get automatically enrolled in one of the following (current) default providers if they don’t make their own choice:

The default providers must meet the following criteria to ensure that members’ best interests are looked after:

Although the goal is to get Kiwis to save more for their retirement, the KiwiSaver scheme is not guaranteed. You can lose money just like with any other investment. However, historically, there has been a growth trend in funds managed by a KiwiSaver scheme.

The right KiwiSaver scheme will make a big difference to your payout.

Spending 10 minutes to complete our HealthCheck form may be the most important thing you can do for your KiwiSaver account right now.

Are you interested in joining a specific KiwiSaver scheme? Before you do, here’s a detailed breakdown of their offering and how the compare against other KiwiSaver schemes.

AMA

Formerly known as Amanah KiwiSaver Plan, the AE KiwiSaver Plan rebranded recently to Always-Ethical Limited. This rebranding aimed to make the Strict Ethical Mandate, developed over centuries by Islamic scholars, accessible to all New Zealanders seeking ethical investment options. Always-Ethical Limited remains the only KiwiSaver provider that does not invest in pork products and strictly enforces the prohibition of Riba (interest-based earnings).

AMP

AMP is a well-established financial services company in New Zealand, offering a variety of investment and insurance products. With a significant presence in the KiwiSaver market, AMP provides members with tools like the MyAMP app and online portal for easy account management. The company’s investment philosophy emphasises sustainable investing, aiming to deliver healthy fund performance while contributing positively to the environment and society.

ANZ

ANZ, or the Australia and New Zealand Banking Group, is a prominent banking institution in New Zealand, offering a comprehensive range of financial services, including the ANZ KiwiSaver Scheme. With a significant presence in the KiwiSaver market, ANZ provides various investment options to help New Zealanders achieve their retirement goals.

AON

Aon KiwiSaver was a scheme offered by Aon New Zealand, providing members with a range of investment options managed by external investment managers. Following its acquisition, Fisher Funds now oversees these KiwiSaver accounts, integrating them into their broader suite of retirement and investment solutions.

ASB

ASB Bank, established in 1847 as the Auckland Savings Bank, is one of New Zealand’s leading financial institutions. The ASB KiwiSaver Scheme offers a variety of funds designed to help New Zealanders achieve their retirement and savings goals.

BNZ

The BNZ KiwiSaver Scheme is managed by BNZ Investment Services Limited (BNZISL), a wholly-owned subsidiary of Harbour Asset Management Limited. BNZISL is responsible for the investment strategy and governance of the scheme’s funds. The scheme is part of the broader Bank of New Zealand (BNZ) group, which is ultimately owned by National Australia Bank (NAB).

BOO

Booster is a New Zealand-based financial services company committed to enhancing the financial resilience of New Zealanders. Beyond KiwiSaver, they offer a suite of services, including investment funds, superannuation products, and insurance solutions. Booster’s mission centers on providing accessible financial products and fostering financial literacy among Kiwis.

CHR

The Christian KiwiSaver Scheme is specifically designed for individuals within New Zealand’s Christian community, encompassing all denominations. It provides an opportunity for members to invest their KiwiSaver funds in a manner consistent with Christian ethics and values.

CRA

Craigs Investment Partners, a leading New Zealand investment advisory firm, manages the Craigs KiwiSaver Scheme. With a nationwide presence and a commitment to personalized wealth management, Craigs offers a range of investment services, including the KiwiSaver scheme, to help clients achieve their financial objectives.

FF

Established in 1998, Fisher Funds has grown to become one of New Zealand’s largest specialist investment managers. Their mission is to make investing understandable and accessible, helping Kiwis achieve their financial aspirations. With a team of over 20 investment professionals, Fisher Funds combines local expertise with global insights to manage their investment portfolios.

FFTWO

Fisher Funds TWO KiwiSaver Scheme was established to provide New Zealanders with a structured approach to retirement savings. Managed by Fisher Funds, one of New Zealand’s largest specialist investment managers, the scheme benefits from the firm’s extensive experience and expertise in fund management.

GEN

Generate is New Zealand-owned and operated KiwiSaver provider, passionate about helping members save for a comfortable retirement. They have attracted over 160,000 members, reflecting their commitment to delivering quality service and investment options tailored to individual retirement goals.

Kōura

Kōura Wealth is a New Zealand-based KiwiSaver provider committed to simplifying the investment process and empowering individuals to make informed decisions about their retirement savings. Utilizing innovative digital tools and offering a variety of investment options, Kōura focuses on delivering tailored KiwiSaver solutions that cater to the diverse needs of New Zealanders.

MAS

The MAS KiwiSaver Scheme is managed by Medical Funds Management Limited, a wholly-owned subsidiary of the Medical Assurance Society (MAS). MAS is a New Zealand-owned mutual organization that has been serving its members for over 100 years. As a mutual, MAS is owned by its members, meaning profits are reinvested to benefit members and support initiatives like the MAS Foundation, which focuses on health and wellbeing equity in Aotearoa.

MER

Mercer is a subsidiary of Marsh & McLennan Companies, a global professional services firm specializing in risk, strategy, and human capital. With a presence in over 40 countries, Mercer leverages its extensive expertise to offer retirement, superannuation, and KiwiSaver solutions to individuals and institutions in New Zealand.

MIL

Milford is a New Zealand-based investment firm known for its active management style and commitment to delivering strong investment returns. They offer a range of investment products, including the Milford KiwiSaver Plan, which is designed to help New Zealanders achieve their retirement goals.

PAT

Pathfinder Asset Management Limited is a New Zealand-based investment firm specializing in ethical investing. With a history dating back to 2010 in ethical fund management, Pathfinder launched its KiwiSaver Plan in 2019 to provide investors with a values-aligned retirement savings option. The firm is a Certified B Corporation, reflecting its commitment to high standards of social and environmental performance, accountability, and transparency.

JNO

The Pie KiwiSaver Scheme is managed by Pie Funds Management Limited, a boutique investment manager based in New Zealand. Established in 2007, Pie Funds launched the JUNO KiwiSaver Scheme in 2018, which was rebranded to Pie KiwiSaver Scheme on 5 December 2023. The firm is known for its active investment approach and has a global presence with teams in New Zealand, Australia, and the UK.

QS

QuayStreet Asset Management is a specialist funds management firm based in New Zealand. The QuayStreet KiwiSaver Scheme is managed and issued by Smartshares Limited, a subsidiary of NZX Limited. With a focus on active management and a commitment to delivering value to investors, QuayStreet combines local expertise with a global perspective to navigate the complexities of financial markets.

SBS

SBS Wealth Limited is a New Zealand-based financial services provider, operating under the umbrella of SBS Bank, which is owned by its members. This structure ensures that the organization remains focused on serving the local community. The SBS Wealth KiwiSaver Scheme is designed to help New Zealanders achieve their retirement goals by offering a variety of investment options and personalized financial advice. The scheme’s management emphasizes transparency, client-focused service, and a commitment to responsible investing.

SIM

Simplicity NZ Limited is the issuer of the Simplicity KiwiSaver Scheme and the Simplicity Investment Funds. Founded by former Tower Investments CEO Sam Stubbs, Simplicity operates as a nonprofit organization, reinvesting profits to benefit members. The organization is based in Auckland, New Zealand, and is committed to providing low-cost, ethical investment options to its members.

SUM

The Summer KiwiSaver Scheme is managed by Forsyth Barr Investment Management Limited, a licensed manager of registered schemes and part of the Forsyth Barr group of companies. Forsyth Barr is a New Zealand-owned investment firm with a history dating back to 1936. The scheme is structured as a trust, with Trustees Executors Limited acting as the Supervisor and custodian, ensuring that members’ investments are held separately from Forsyth Barr for their benefit.

SUP

SuperLife is managed by Smartshares Limited, a wholly-owned subsidiary of NZX Limited. They have been assisting New Zealanders with their investments for over 15 years and are one of six government-appointed default KiwiSaver providers. SuperLife’s offerings include KiwiSaver, superannuation, insurance, and investment products, catering to a wide range of financial needs.

WES

The Westpac KiwiSaver Scheme is managed by BT Funds Management (NZ) Limited, the investment arm of Westpac in New Zealand. Westpac New Zealand Limited acts as a distributor of the scheme. With a strong presence in the New Zealand financial sector, Westpac offers a comprehensive suite of banking and investment services, aiming to support Kiwis in achieving their financial goals.

We track all KiwiSaver scheme performances in order to come up with a subjective answer to this frequently asked question. To find the best option in terms of financial returns, you can click through to our dedicated page here.

However, as previously mentioned, you’re choice will depend on more than just performance. A highly volatile fund that is performing well may not be a wise choice for someone looking to withdraw in the short term. On the other hand, a low-return KiwiSaver scheme may not be the best option for a teenager just starting work. For a tailored answer that is suited specifically to you, you can complete our Free KiwiSaver Recommendations form.

To find out more about a KiwiSaver scheme before investing you can read their product disclosure statements. They are legally bound to have one and you can find them through each of their individual websites. Their product disclosure statements will include information about:

Speaking to an authorised financial adviser, someone like National Capital for example can help in your decision. Although we discuss general scenarios here, going through your unique circumstances will point to the right KiwiSaver scheme for you. Even if you have been enrolled automatically or you aren’t sure you’ve made the right choice, switching is simple.

Below is a list of KiwiSaver scheme providers that we have done detailed extensive research on. On each specific page, you can find a general overview of the KiwiSaver scheme, the latest news, and more.

The right KiwiSaver scheme will make a big difference to your payout.

Spending 10 minutes to complete our HealthCheck form may be the most important thing you can do for your savings right now.

The most common questions regarding the KiwiSaver scheme initiative.

There are many benefits to partaking in the KiwiSaver scheme. From getting into the habit of saving a percentage of your salary, to employer and government contributions.

Firstly, the reason why the government created the KiwiSaver scheme was due to statistics showing Kiwis didn’t save enough money. According to Stats NZ, that mentality has slightly shifted with household income savings changing from under 1% of net disposable income in 2017 to upwards of 3% in 2022. Regularly investing in a KiwiSaver scheme can certainly be attributed to a shift in the mentality to save more.

The other benefit you get is the employer and government contributions that come as an added incentive to participate. Your employer is obligated by law to contribute 3% of your salary to your KiwiSaver scheme at their cost. The government will contribute up to $521.43 to your account each year you contribute at least $1042.86. Therefore, if you haven’t already joined, you are missing out on a significant sum of added savings each year.

There is also the benefit of supporting your financial goals. The KiwiSaver scheme savings you collect can be used as a deposit to purchase your first home or for retirement. Think of how difficult it can be to save for your first home deposit at the present time. The KiwiSaver scheme is a well-structured savings and investment system to help you achieve that goal. Also, financially relying solely on Superannuation is extremely difficult once you stop working and this long-term investment is important.

The rigidity that the KiwiSaver scheme provides in terms of savings and investment is extremely helpful for everyday Kiwis. It is a way of making investing completely hassle-free but also government-regulated to ensure best practices.

There are plenty of KiwiSaver scheme options available for you to choose from. In fact, there are so many, that you may feel overwhelmed by the abundance of choices you have. The first step to choosing the right KiwiSaver scheme is identifying what your goals are. Free advice on which option is the right one for you is available via our HealthCheck analysis and report.

Each KiwiSaver scheme offers a range of options they call ‘funds’ that you can pick from. These options will have different risk ratings based on the type of investments they are made up of. Cash and bonds are typically lower risk, while stocks, especially international are higher risk. However, the higher-risk stocks have shown a rate of higher return as a long-term investment. In the short term, these high-risk stocks have a track record of being volatile and exposed to market shocks.

There are also faith-based schemes such as the Christian and Amanah KiwiSaver schemes. They specialise in providing ethical investment solutions according to the Christian and Islamic religious faiths, respectively.

As you can see, there are options out there to suit everyone. It has also become the norm of every KiwiSaver scheme to invest ethically and consider environmental, societal, and governance issues.

You must identify what your goals and investment boundaries are. National Capital can help filter through all the KiwiSaver scheme options to find the one that best aligns with you. If you don’t make a choice, you will be automatically enrolled into a default KiwiSaver scheme. Regardless, you are free to switch to another KiwiSaver scheme anytime and as many times as you desire.

It is reasonable to feel overwhelmed with the KiwiSaver scheme choices readily available. With over 20 KiwiSaver scheme options, how do you know you’ve picked the right one?! Well, you can rest assured that these options do indeed serve a purpose and are tightly regulated. The good news is that you have advisers like National Capital that can help you pick the right KiwiSaver scheme. The answer to the abundance of options is linked to what also sets them apart. With that in mind, let’s dive deeper and discuss the differences between KiwiSaver scheme selections.

Banking and insurance providers make up a significant number of the KiwiSaver scheme selection readily available. Providers such as ANZ, ASB, BNZ, Westpac, and Aon are all established brands in the banking and insurance industries. From their perspective, they are leveraging their reputations and brand recognition by offering KiwiSaver scheme solutions as an additional product. On the other hand, you’re getting the convenience of consolidating your KiwiSaver scheme and banking or insurance in one platform.

Specialised investment firms such as Booster, Generate, and Milford Asset Management often have their roots in investing. They typically have a more hands-on approach and have a history as top performers when tracking returns on investment. If you are solely interested in returns, you may consider one of these options as the right one for you.

There are also KiwiSaver scheme solutions tailored for people investing based on cultural and ethical beliefs. Amanah and Christian KiwiSaver scheme are two examples of investment firms based on religious beliefs. Pathfinder is an example of a KiwiSaver scheme that avoids investing in companies or industries deemed harmful to the planet. Meanwhile, the Medical Assurance Society is the preferred KiwiSaver scheme for medical professionals.

In New Zealand, not everyone is legally authorised to offer advice on a KiwiSaver Scheme. It’s crucial to get advice from qualified professionals to make sure you get accurate and reliable information.

Financial Advisors: The KiwiSaver scheme is an important part of planning for your future, but it can be complicated to navigate. These experts have a deep understanding of the financial world and can offer tailored advice based on your individual situation. They take into account factors like your income, spending habits, and future goals to recommend the best KiwiSaver scheme, contribution rate, and investment strategy for you.

KiwiSaver Scheme Providers: The KiwiSaver scheme itself may not give you personal advice but does provide helpful information about their plans. Information includes how well the plan has done in the past, and how much it costs. By learning about the different plans, you can make smart choices that fit with your financial goals.

Employers: Employers play a supportive role in the KiwiSaver scheme journey. While not financial advisors, employers can offer practical assistance in the enrollment process, contribution setup, and basic information. They may also provide educational materials to employees and create an environment where questions about the KiwiSaver scheme are welcomed.

Citizens Advice Bureau: The Citizens Advice Bureau (CAB) is a community-based resource offering free advice on various topics, including the KiwiSaver scheme. While CAB provides general information and advice, they are not a substitute for professional financial or legal advice.

Reputable Resources: If you want to learn more about a KiwiSaver scheme, there are some trustworthy resources you can check out. These include the Financial Markets Authority (FMA), Inland Revenue Department (IRD), and Sorted. These resources offer tools, calculators, and educational materials to help you better understand any KiwiSaver scheme questions you might have.

Did you know that by enrolling in the KiwiSaver scheme, you can get some extra money for free? That’s right! But there’s a catch – you will need to contribute your own money to get these benefits. The good news is that there are many ways to get free money through the KiwiSaver scheme. However, you need to actively participate in the program to take advantage of these benefits. Here’s a detailed breakdown:

Member Tax Credits: The New Zealand government provides an incentive for saving through a KiwiSaver scheme, known as Member Tax Credits (MTC). If you contribute at least $1,042.86 each year, the government will reward you with a maximum MTC of $521.43. In simple terms, the government matches 50 cents for every dollar you save up to the designated maximum amount.

Employer Contributions: Employers participate in the KiwiSaver scheme by matching their employees’ contributions, usually up to a specified percentage of their salary. The minimum employer contribution is 3%.

First Home Grant: For those planning to buy their first home, the Grant offers additional funds to assist in the home-buying process. The amount you can get depends on things like the location of the property and number of kids you have. If you’re buying a house that’s already been built, the maximum grant amount per eligible member is $5,000. But if you’re buying a brand new house, the maximum grant amount per eligible member is $10,000. KiwiSaver scheme members aiming to buy their first home may qualify for the First Home Grant.

First Home Withdrawal: The KiwiSaver scheme allows members to withdraw funds to facilitate their first home purchase. While it’s technically not “free money”, government contributions, employer contributions, and returns collectively serve as a valuable source of funds.

The right KiwiSaver scheme will make a big difference to your payout.

Spending 10 minutes to complete our HealthCheck form may be the most important thing you can do for your savings right now.