First Home Buyer Guide - Everything You Need to Know

Buying your first home can seem daunting, but here at National Capital we believe that everyone can reach this milestone if you set yourself up with the right foundations. We have listened to your questions, and compiled the A – Z of all things ‘First Home Buyer’. From using KiwiSaver first home withdrawal to plenty other related topics.

Note: While we have tried to be as comprehensive as possible, this is only a guide for information purposes – and we may not actually cover ‘everything’! If you want some personalised advice on using KiwiSaver first home withdrawal and more, please get in touch with us.

- What is the process to buying a First Home?

- How can I use money from my KiwiSaver account to buy a home?

- First Home Grant, First Home Loans & KiwiBuild.

- What do I need to be able to get a mortgage and how much will I be able to borrow?

- How can I maximise my potential of Buying my First Home?

- How can I maximise my mortgage application pre-approval?

What is the required deposit as a First Home Buyer?

As a first home buyer, one of, if not the biggest challenges is to save up for a large enough deposit. It is well known that the industry standard on a home loan deposit is 20%. However, as a first home buyer you may be eligible to get into your first home by lowering the required deposit to 5% (Kainga Ora).

Some banks also have a low-deposit lending option for a first home buyer with a 10% deposit. Although, they are restricted by the Reserve Bank of New Zealand to only a certain amount of approvals per year of these low-deposit loans as part of responsible lending practices.

As a first home buyer, you must keep in mind that you are likely eligible for the KiwiSaver first home withdrawal. This means that whatever you have saved in the scheme at the time of purchase (less $1000), you can use as part or all of your deposit. Below is an example of some actual house deposit figures based on 5%, 10% and 20% requirements. Remember, your deposit can be an accumulation of savings, the KiwiSaver first home withdrawal, or gifts (e.g. from parents).

| First Home Buyer – Purchase Price | 5% Deposit | 10% Deposit | 20% Deposit |

| $350,000 | $17,500 | $35,000 | $70,000 |

| $500,000 | $25,000 | $50,000 | $100,000 |

| $750,000 | $37,500 | $75,000 | $150,000 |

| $1,000,000 | $50,000 | $100,000 | $200,000 |

| $1,250,000 | $62,500 | $125,000 | $250,000 |

As a financial advisor, we welcome your questions and are happy to help with your specific circumstances as a first home buyer. From assessing eligibility criteria, to help with the KiwiSaver first home withdrawal and long-term financial planning, we’re here to make things stress-free.

Will you get a mortgage as a First Home Buyer?

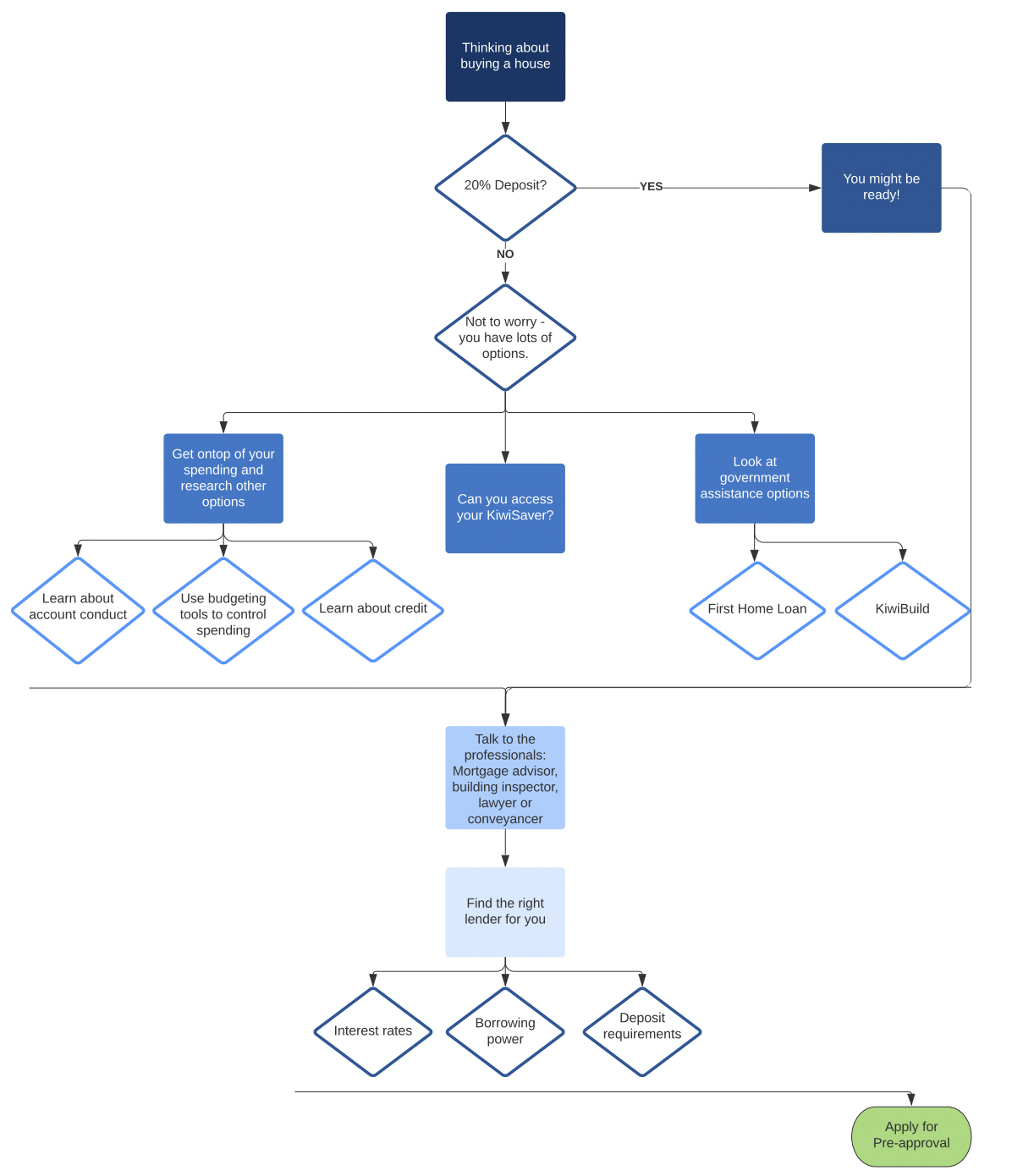

What is the process as a First Home Buyer?

Are you wanting to buy a home but don’t know where to start? Buying your First Home is a huge accomplishment, and we want to help you get there! Take a look at our flowchart of the house buying process to see what step of the process you are up to. Our First Home Buyers page is designed to answer all of your questions. From using KiwiSaver first home withdrawal to budgeting tools and interest rates. So keep scrolling to find out more.

How can I utilise the KiwiSaver First Home Withdrawal Scheme?

Many Kiwi’s rely on their KiwiSaver first home withdrawal as a deposit, but are there rules as to who can do this? Read on to find out more.

Everything you need to know about the KiwiSaver first home withdrawal solution.

- How does KiwiSavers First Home withdrawal work?

- Am I eligible for KiwiSavers First Home withdrawal?

- What can I withdraw?

- Which is the best KiwiSaver fund for a First Home withdrawal?

- I am getting close to my deposit goal. Do I have too much risk in my KiwiSaver account?

- How do I apply for a First Home withdrawal?

- When will my KiwiSaver be paid out for a First Home withdrawal?

- My partner has owned a home in the past, but I have not. Can we purchase a home together using KiwiSaver?

- Can I use KiwiSaver to buy land?

- Can I use KiwiSaver to build on land I inherited?

- Can I use KiwiSaver to buy a house to be put on land that my family owns?

- What happens if my circumstances change and I need to sell within 6 months of living in my first home in which I used KiwiSaver as a deposit?

- Can I use KiwiSaver to purchase a workspace that has a residential unit attached if the residential unit is my primary place of residence?

- I am looking to make an offer on a first home that is currently locked in a fixed term tenancy with 6 months left before it will be vacated. Is it classified as a first home if I intend to move in as soon as it is vacated?

- I’m in a superannuation scheme that is not KiwiSaver. Can I withdraw this money to buy my First Home?

- I am a beneficiary in my late parents Trust which has our family home in it. Can I still withdraw my KiwiSaver for a first home?

How does the KiwiSaver First Home withdrawal work?

The KiwiSaver First Home withdrawal allows first home buyers to withdraw part or all of their KiwiSaver to buy first home as a contribution to the deposit required. Eligible applicants are able to withdraw part or all of their scheme savings, but must keep a minimum of $1,000 in the account.

Am I eligible for a KiwiSaver First Home withdrawal?

You can use KiwiSaver to buy first home if:

- You are 18 years or over.

- You’ve been a member for at least three years.

- You have not made a withdrawal for the purchase of a home before (first home buyer).

- The property/land is in New Zealand.

- You intend to live in the property – it is not an investment property.

- This is your first home (If you have owned property or land before, you still might be eligible for the first home buyer withdrawal).

- You are a member of a complying fund (Check with National Capital if your fund is a complying fund).

You cannot use KiwiSaver First Home Withdrawal if:

- You already own a home.

- You already own land (there may be an exception if the land is Māori land).

- You own a house overseas.

What can I withdraw?

- Your contributions.

- Government contributions.

- Government member tax credits*.

- Investment returns.

You can withdraw as much as you like, but you will need to leave at least $1,000 in your account afterward. You cannot withdraw any Australian superannuation savings.

*Only member tax credits that have already been paid into your account can be withdrawn.

Which is the best fund for a KiwiSaver First Home withdrawal?

The “best KiwiSaver funds” for first-home buyers will depend on a few factors, such as your balance and the timeframe until you are wanting to withdraw. There is no one perfect solution for all. Complete our online KiwiSaver HealthCheck so we can analyse your situation and create a personalised recommendation.

I am getting close to my deposit goal. Do I have too much risk in my account?

The best type of fund varies depending on a variety of factors such as the time before you want to withdraw, your personal tolerance for volatility and your flexibility. If your current fund is too aggressive, your balance could drop just as you are wanting or needing to withdraw. For personalised advice as a first home buyer, National Capital has a HealthCheck to see if you’re where you need to be to achieve your goals.

How do I apply for the KiwiSaver first home withdrawal?

You apply directly through your provider. Are you with Milford? Sign in online through your Milford KiwiSaver login and apply in a few steps. The same process goes for most providers. If you are applying as a previous homeowner, you need to apply through Kāinga Ora before approaching your provider.

When will my savings be paid out for a KiwiSaver First Home withdrawal?

It can take more than 10 days to process a KiwiSaver first home withdrawal application, so check with your fund provider in advance. Funds are usually paid to your solicitor who will then forward it onto the vendor on the settlement date.

My partner has owned a home in the past, but I have not. Can we purchase a home together using KiwiSaver?

If your spouse/partner has previously or currently owns a home, only you can withdraw your funds – if it is your first home. The fact that your partner has previously owned a home does not affect your ability to withdraw your savings.

Can I use the KiwiSaver First Home Withdrawal to buy land?

Yes, you can use your savings to purchase a section/land without a house. There is no timeframe for when a house must be built. You can also use your savings for a house and land package.

Can I use it to build on land I inherited?

Assuming you already own the land (or have an “estate in land”), then you will not be able to withdraw money from your account to build on it under the KiwiSaver Act. There may be an exception if the land is Maori land, and if you have not owned any property previously.

Do I qualify as a First Home Buyer for a house to be put on land that my family owns?

No, unfortunately, you will not be eligible to use the First Home Buyer Grant to buy a house to place on land that you do not own. An alternative option could be to buy the family land (with some help from the grant) and then withdraw money from your account to buy the house to be put on your purchased land.

What happens if my circumstances change and I need to sell within 6 months of living in my first home in which I used the grant as a deposit?

Nothing. There is no minimum time you must live in a house before selling bought using KiwiSaver money as a first home withdrawal.

Can I use it to purchase a workspace that has a residential unit attached if the residential unit is my primary place of residence?

Yes, this should be ok if this is your first home. As long as the residential property appears on the title, and you are going to purchase the whole section (workspace and unit), and you intend to live on the property as your primary place of residence. You should be eligible for the KiwiSaver first home withdrawal in such a scenario.

I am looking to make an offer on a first home that is currently locked in a fixed-term tenancy with 6 months left before it will be vacated. Is it classified as a first home if I intend to move in as soon as it is vacated?

This situation would be decided case by case. It may be best to speak with a broker to put your best application forward. You could also check out this case study, where the buyer had to sign a more detailed statutory agreement before the funds from KiwiSaver to buy first home were released.

I'm in a superannuation scheme that is not KiwiSaver. Can I withdraw this money similar to a KiwiSaver first home withdrawal?

Possibly. There are some superannuation schemes that allow for first-home withdrawal similarly to using KiwiSaver to buy first home, but the requirements will not fall under the KiwiSaver Act. You will need to contact your fund provider directly to find out their specific requirements for withdrawal.

I am a beneficiary in my late parents Trust which has our family home in it. Do I still qualify for the KiwiSaver first home withdrawal?

Being a beneficiary of a trust does not make you part of the trust entity, therefore the assets in the trust are not owned by you. The trust is the owner of the home. As long as the house remains in the trust and is not moved to be directly in your name, you do not own the property. As a beneficiary of the trust, you may receive benefits from the trust, but this should not interfere with your financial situation in terms of home ownership if the trust is the main proprietor. Thus, it should not interfere with your decision to use KiwiSaver first home withdrawal.

Ensure that you are not a nominated trustee of the trust either, as that could mean you have control and vested interest in the property, in which case would complicate the process. Finally, there is also an assumption that your financial situation is equivalent to that of a first home buyer. If you meet all of these conditions, you should qualify for the KiwiSaver first home withdrawal.

First Home Grant, First Home Loans & KiwiBuild

Kāinga Ora offers a few schemes to help First Home Buyers get onto the property ladder. In addition to using the KiwiSaver first home withdrawal, these are the First Home Grant, First Home Loans, and KiwiBuild. There are strict criteria to be eligible for any of these, so read on to find out if they could help you.

Everything you need to know about Kāinga Ora schemes for First Home Buyers:

Is my property eligible for the First Home Grant?

Your property is eligible for the First Home Grant if:

- It will be your only home (you cannot own any other houses).

- The house is within the maximum house price caps based on the Territorial Local Authority boundaries:

How much money can I receive from the First Home Grant?

If you are purchasing an existing/older home, the First Home Grant is $1,000 for each year of contribution (with a maximum of $5,000).

If you are purchasing a new home, a property bought off the plans or land to build a new home on, the First Home Grant is $2,000 for each year of contribution to the scheme (with a maximum of $10,000).

How can I apply for the First Home Grant?

If you are eligible for the First Home Grant, submit your application to Kāinga Ora no later than 4 weeks (20 working days) before settlement/payment date. If you are wanting the First Home Grant to be part of your pre-approval application, along with using the KiwiSaver first home withdrawal, apply to receive the letter of approval before approaching a bank.

What is the First Home Loan, is it the same as the First Home Grant?

No. As well as offering the First Home Grant to eligible first home buyers, Kāinga Ora also offers First Home Loans (previously known as the Welcome Home Loan).

These loans are issued by specific banks and underwritten by Kāinga Ora. They are targeted to first home buyers with less than 20% deposit and follow similar criteria to the First Home Grant. You only need a 5% deposit and can help make getting your first home a lot more achievable.

You are eligible for the First Home Loan if:

- Maximum income of $95,000 for a single person, or combined annual income of $150,000 for two or more people.

- Minimum deposit of 5% of the purchase price of the house.

- House price must be within the regional house price cap, same as First Home Grant.

- First home buyer, or a previous home owner in a similar financial position to a typical first home buyer.

Other criteria:

- You must live in the home you are buying.

- You cannot own any other property, this does not include ownership of Maori land.

- You will need to pay a Lender’s Mortgage Insurance (LMI) premium of 1% of the loan account.

- You must be a New Zealand citizen or permanent resident.

- Most participating lenders will require applicants to be a minimum of 18 years of age.

What is KiwiBuild, can anyone purchase a KiwiBuild home?

The KiwiBuild programme was established to create affordable housing for eligible Kiwi’s. There are a number of criteria that you must meet to qualify to a KiwiBuild home and homes are often balloted to applicants as there can be high interest. KiwiBuild can be a great way to get onto the property ladder as these homes are within the regional house price caps for new builds, therefore applicants that are eligible for a KiwiBuild home are usually also eligible for the First Home Grant and possibly the First Home Loan if you have a low equity deposit. It is a great option in addition to using the KiwiSaver first home withdrawal.

You may be eligible for a KiwiBuild home if:

- You are over 18 years of age.

- You are a New Zealand citizen, permanent resident or resident visa holder.

- You must not currently own a home in New Zealand or overseas.

- If you are a single person, your income cannot be higher than $120,000 or a couple cannot be more than $180,000.

What do I need to be able to get a mortgage and how much will I be able to borrow?

As a first home buyer, it is important to know how much houses cost, how much deposit you will need to buy a house and how much the bank will let you borrow. Of course, it helps if you are eligible to use the KiwiSaver first home withdrawal too. This section will explain the fundamental money milestones that you need to achieve to help you get your First Home, so read on if this is for you.

What is KiwiBuild, can anyone purchase a KiwiBuild home?

- What is the Loan-to-Value (LVR) ratio? What does it have to do with buying a home?

- How much will my First Home cost?

- How much deposit do I need for my first home?

- I have been gifted money, can I use this as a deposit for my first home?

- How much can I borrow?

- I have past bad debt, can I still buy a house?

- What other costs do I need to consider? How much money do I need to put aside for these?

- Can I use a boarder or flatmate as a form of income? If I tell the bank that I will get a flatmate, do I actually have to follow through with it?

- What financial provider options do I have?

- How do I choose the best loan provider and get the best interest rate?

What is the Loan-to-Value (LVR) ratio? What does it have to do with buying a home?

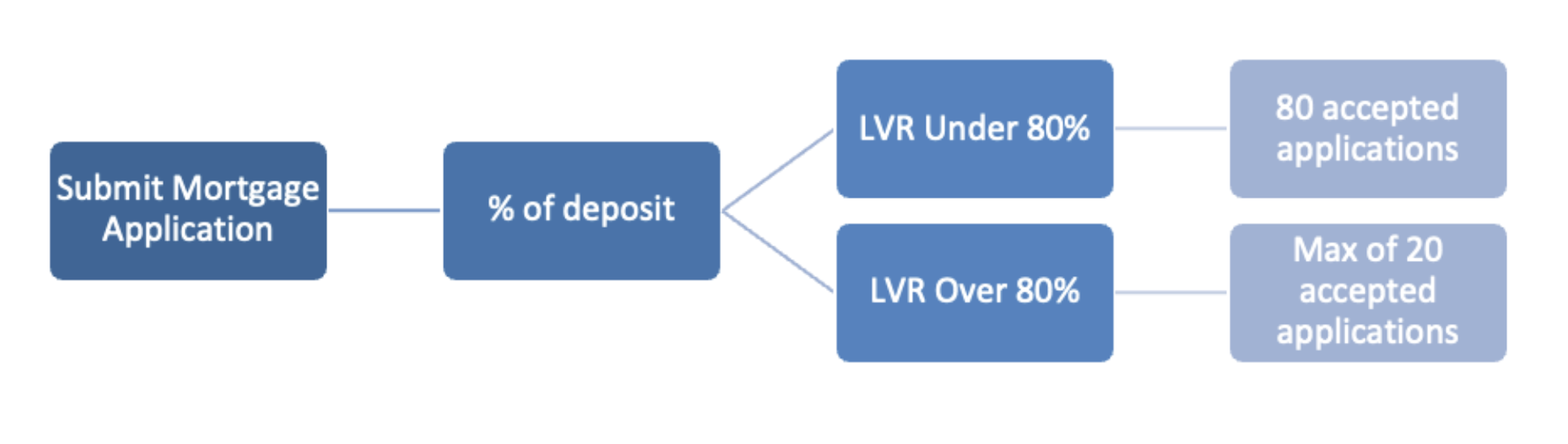

Understanding LVR can help you understand the borrowing requirements for banks. LVR stands for ‘Loan to Value Ratio’ and the Reserve Bank of New Zealand (RBNZ) has restrictions on how the bank can lend to customers through the LVR. The requirements as of 1st May, 2021 are that banks can only take on 20% of owner-occupied loans over 80% LVR. This means that banks can only accept 20% of home loan applications with customers who have less than 20% deposit. You can try to use your KiwiSaver first home withdrawal and get over this deposit threshold. The other requirement is that banks can only take on 5% investment loans over 60% LVR. This means that 95% of investors who wish to get a loan from a bank must have at least 40% deposit for the property value.

This is why understanding LVR is important for you. A majority of customers who apply for a home loan need to have a 20% deposit for their first home and banks will only accept the best applicants with less than 20% deposit because they are heavily restricted on how many they are allowed to accept. If you want to learn more, you can find information on the RBNZ website.

How much will my First Home cost?

It can be hard to know how much a home is worth when you first start looking. There is no denying that houses in New Zealand can be expensive. But in saying that, they have a strong history of positive returns and have historically been a good investment option for a lot of people. If you’re wanting to buy in a large city such as Auckland or Wellington, prepare to pay more than small towns in places like the central North Island and the West Coast. Some people have to compromise on location in order to buy their first home, but with continuous technological advancements, working remotely from home has become achievable for many. We recommend checking out the residential property data website to find out what houses cost in different areas of New Zealand. Your KiwiSaver first home withdrawal will also help contribute towards your deposit.

How much deposit do I need for my first home? Are there any benefits to having a 20% deposit?

The amount needed for a first home deposit stems from the LVR restrictions set by the RBNZ. To get the lowest interest rates, you need a 20% deposit of the value of your home. This not only entices customers to aim for the magical 20% deposit, but it also eases the pressure for banks who can only accept a limited number of LVR’s over 80%.

I have been gifted money, can I use this as a deposit for my first home?

Yes – however it is preferred that at least 5% of the total home value is saved by you. This 5% is called Genuine savings. Requiring genuine savings is a bank’s way of ensuring that you are capable of saving part of your income, and therefore capable of paying off a mortgage. Most banks will require you to show that you are capable of saving the equivalent to 5% of the house price you are wanting. They determine genuine savings as money saved in your bank account or KiwiSaver accounts, and this needs to be evidenced by providing 3 months of past statements. If there is a large lump sum payment during this time, it may be deemed as not genuine.

For example, if you sold a vehicle, this would not be classed as genuine savings – however if this lump sum appears in your bank account more than 3 months before applying for finance, you will not need to explain where that money came from. The best way to demonstrate genuine savings is to set up an automatic payment into a savings account to put money aside each time you get paid.

How much can I borrow?

- Deposit: Money you are putting towards the purchase of the home.

- Income: Critical factor in determining how much you can afford to borrow.

- Outgoings: How much you spend to live.

- Genuine Savings: How much you are able to save each week.

- Credit score: Tells the banks how well you have managed your money in the past.

If you are wanting to get a good idea of your borrowing ability, you could contact a mortgage advisor.

I have past bad debt, can I still buy a house?

Unfortunately, past bad debt can have serious impacts on your chances of bank approval. The Credit Reporting Privacy Code 2020 explains how long certain information can remain on your credit file:

Non-bank lenders will probably be your best bet if you have any of the above on your credit history, they have many options for people with past bad debt and individuals have a higher chance of application success through the non-bank lenders.

After the above dates surpass, banks and lenders will no longer be able to access the information and therefore will be more likely to accept an application. Many people with bad debt start their mortgage through a non-bank lender and transfer their mortgage to a bank once the bad credit is wiped from their history.

Something else to consider with bad debt is that if you have a good credit history, but your partner has bad debt and you are wanting to buy your first home together, you will most likely still be declined from a bank. Keep this in mind when thinking of applying for pre-approval as banks want to know the full picture and will always find ways to minimise the risk they take on.

What other costs do I need to consider? How much money do I need to put aside for these?

There are a few one-off costs when buying a home that can total to around $5,000. It is suggested that you have a separate savings account to cover these costs, separate to your deposit savings. These costs come from the following:

Lawyer or conveyancer fees: This varies dramatically between firms, so it is recommended to find a lawyer early and give yourself plenty of time to shop around to find the best person for your situation and at the best price.

Building inspection reports: Unless you’re a builder by trade, it is unlikely that you will know what to look out for in a home. Building reports can be extremely valuable as they can identify any issues within a home. We recommend that you only request building reports on a house that you are really serious about, as they can cost anywhere from $300.

LIM reports: It is useful to know all you can about a property that you’re really interested in. A Land Information Memorandum (LIM) is a report that collates all the information that the different departments within your local council hold. Costs vary depending on where you are located, so you will need to contact your local council to find out more information.

Valuation: If you have less than a 20% deposit, you may also be required to pay for a valuation of the property in order for your bank to approve you. Valuation costs can range from $400 to over $1,000 if there is time pressure.

On top of these one-off costs, there are also some ongoing costs of owning a home. These can vary depending on the condition and value of the home, but a rough estimate recommends about 10% on top of your mortgage repayments should cover you for the following:

Insurance: It is very common for bank loans to be approved only under the condition that you pay insurance for a range of possibilities including; house, contents, life, and income. This is due to the fact that if anything unexpected occurred in your life, whether to yourself or your new home, you would most likely not be in a position to cover your mortgage repayments, which is a liability for your bank. It is important not to under-insure yourself. Income insurance needs to cover your actual income, house insurance needs to cover the cost of rebuilding your entire house from scratch, and contents needs to be able to cover all of your contents if everything was lost, ie. in a fire or natural disaster.

Rates: Rates vary with local councils. You can find information on their websites which can usually provide past rates bills for any property you are looking at and also the percentage cost compared to the value of your home. For example, Auckland rates can be found here.

Body corp fees: If you’re thinking of purchasing an apartment or some townhouses, you will have to pay an annual body corp fee. This covers things such as general upkeep of the land and outside building, insurance, water etc. This will cost thousands of dollars each year, so keep this in mind when thinking about the affordability of these types of properties.

Maintenance: This is the biggest variation in buying a home. If you are buying an older home, there is more likely going to be maintenance that needs attending to. We recommend you consult a professional about likely repairs and maintenance that will be due soon. It is important to factor in a regular amount to put aside for anything unexpected that could need repairing, as not everything is covered under insurance.

Can I use a boarder or flatmate as a form of income? If I tell the bank that I will get a flatmate, do I actually have to follow through with it?

Some banks accept boarder’s as income if there is a clear regular payment into your account. When COVID-19 hit our shores, banks stopped accepting boarder’s as a form of income, however most have started allowing up to $150 – $200 per week as income from a boarder, some banks are even accepting two boarder’s for a maximum additional income of $150 – $400 per week depending on which bank you go to.

You may have been able to get away with not following through with a flatmate in the past, but with the new Responsible Lending Code, banks are starting to check and if you cannot prove boarder income, you may receive a ‘please explain’ letter from the bank. There are some legitimate reasons to have not found a boarder yet – such as you have not found the right person, or waiting for a better time of year to be looking (such as January, when there are a higher number of people looking for flats).

What financial provider options do I have?

There are two main options when wanting to borrow for a mortgage; banks and non-bank lenders. Each option will have its benefits for individual applicants, so make sure you look into each option to check you are going with the best provider for your individual needs.

Banks: This is the best option for most people as banks usually provide the lowest interest rates. They are however, most likely to decline an application and don’t take on unneeded risk. If you are accepted through a bank, a lot of applicants can receive a ‘cash-back’ of around 0.6% of the mortgage value. This helps cover some fee’s of purchasing a home, or to cover any urgent repairs when you move in.

Non-bank lenders: These lenders will typically charge higher interest rates than banks because they are prepared to take on more risk from applicants. This makes non-bank lenders a good option for people who have complicated financial situations, history of bad debt or need a non-bank lender until they reach 20% equity.

Mix of the two: An additional option for some applicants may be using both a bank and a non-bank lender. In some cases, the applicant can apply for the 80% loan from a bank, but they still need to borrow an extra amount to create their 20% deposit. If so, they might be able to approach a non-bank lender who would lend the remaining deposit. This smaller loan would be at a much higher interest rate and the aim would be to pay this off as fast as possible. The advantage of doing this is that your 80% loan is at the lowest possible interest rate through the bank and once you have paid off the smaller loan through the non-bank lender, you will have 20% equity in your home.

How do I go about choosing the best provider?

The best provider will depend on your circumstances. A mortgage advisor could be of great help in choosing the best option for you. Mortgage advisors work for the clients (you!) and create the best applications on your behalf to present to various banks. Some Mortgage advisors work with selected banks, so check who they can work with if you’re thinking about a particular bank. Most mortgage advisors are free of charge as they take commission from the bank that accepts your mortgage, but make sure you read any terms and conditions before working with a mortgage advisor just in case there are any fees that you are unaware of. Mortgage People is a company that offers mortgage advisory services for all situations. Check them out if you are interested in working with a mortgage advisor.

How can I maximise my potential of Buying my First Home?

Not quite ready to buy a house? Now is the perfect time to learn about maximising your potential. We know how hard it is to save enough for a decent deposit, so we have collated some helpful tools for budgeting, and information about interest rates, property prices, and mortgage calculators.

How do I go about choosing the best provider?

Budgeting Tools

Budgeting is a great habit to get into leading up to applying for pre approval, as well as helping with money management once you are paying a mortgage. Your account conduct will be rigorously checked and a solid, regular budget demonstrates to your bank that you have a handle on your finances. A couple of tools that we have used and found great are as follows:

Pocketsmith: Pocketsmith is an in-depth budgeting system that tracks your spending long term and can provide extensive pattern identification of your spending habits. They provide three types of subscriptions, ranging from free for a basic package, to $19.95 per month for a comprehensive package.

Max and Millie Store: Budgeting Template and Meal Plan template. If you’re into excel but get confused when trying to design your own templates, then these free templates are perfect for you! Both of these templates are very user friendly, adaptable to your personal needs, and are extremely relevant. Even using the meal planning template alone can cut the cost of your food shop by hundreds of dollars, and combining it with a full budget can help you save even more.

PAYE.net.nz: PAYE.net is a more simple budgeting tool, less adaptable but very user friendly and can provide a basic understanding of the proportion of your wages you are spending versus saving. If you are wanting a quick way to find out your spending and how much you could be saving, this will be a good website for you.

Interest Rates

Your interest rate can make a huge difference in the amount of principal you pay on your mortgage repayments. It is important to shop around to find the best rate for you. *hint* it may not be your current banking provider! Interest.co.nz has a helpful tool that compares all of the loan providers in New Zealand. It is also handy to note that providers can sometimes offer a better rate than what is currently advertised, so it may pay off to approach a few banks to see if you can get a better deal.

Mortgage Calculators

A mortgage calculator can be a great place to start to give you a rough idea of what you can afford. Calculate.co.nz has a range of handy calculators that we recommend you check out.

Residential Property Data

Another great place to start your home buying journey is making sure you know what to expect when the time is right to make an offer. The Residential Property Data website updates quarterly poverty prices by region to give you a solid idea as to the value of a property.

How can I maximise my mortgage application pre-approval?

You’ll most likely need to provide three months of bank statements in your mortgage pre-approval application. How you have used your accounts during that time can have a huge impact on your borrowing ability. The savings from your KiwiSaver first home withdrawal will also make a huge difference. This section is designed to prepare you to put your best foot forward to maximise your mortgage pre-approval.

Everything you need to know about your accounts and what it can mean for a mortgage pre-approval application:

Account Conduct

Account conduct is how you use money to and from your bank accounts. It is extremely important in the bank’s eyes and can have a huge impact on how much they are prepared to lend you. They will usually require copies of the last 3 months of your bank statements for all accounts, and 6 months of statements for any loan, credit or store cards.

Key things they will be looking for:

Account balances: To ensure that you are living comfortably within your income limits.

Automatic Payments/Direct Debits/Regular Payments: To ensure that they understand what these are for, then compare this with your application to certify that you have disclosed everything. For example, if you have said you pay $200 in rent on your application and your rent payment comes out as $230, they will need to query why this is different. Automatic payments into KiwiSaver to buy first home are another example.

Donations: Regular donations are considered an expense. If you regularly donate, you can adjust this to a bulk payment every now and again and this will prevent the donation from being counted as an expense. Alternatively, stop the payment for the three months leading up to your approval application and donate the equivalent bulk payment once you’re approved.

Credit Card Limits: Banks calculate 3% of your card limit as the monthly commitment on your card, regardless if the card is used. This may seem small, but it all makes a difference to your affordability. A $10K credit card, regardless if it is used, will reduce your affordability by $300 per month. Although good account conduct on credit cards can be a good tool in demonstrating to your bank that you are a responsible borrower, it is very common for approval to be on the condition to either lower your credit card limit, or cancel the credit cards. Keep this in mind when thinking about approaching a bank.

Key things they will be looking for:

Understanding a credit score is becoming a crucial part of many banks’ processes. A credit score ranges from 0 to 1000. The higher your score, the lower risk you are as a borrower. Centrix and Credit simple are two companies who offer free credit checks. You can view a sample credit check here.

The score is distributed across five bands as follows:

I'm ready to approach the bank for pre-approval. Do I need to take anything with me?

When approaching a bank, there are a few things they require, including:

Bank Statements: You will need to provide three months of statements showing the transactions on all of your bank accounts.

Credit Check: If you have sourced your own.

First Home Grant: If you are eligible and wanting to use this, complete the application and get the pre approval letter prior to wanting to apply for bank pre-approval.

Identification: A copy of your passport and/or driver’s license.

KiwiSaver: Confirmation from your provider that you qualify for the KiwiSaver first home withdrawal.

Loan Statements: You will need to provide 6 months of loan statements on any loans, hire purchase accounts and store cards or credit cards.

Proof of income: You will need to provide three most recent pay slips (at least one within the past four weeks and your IRD summary of earnings.

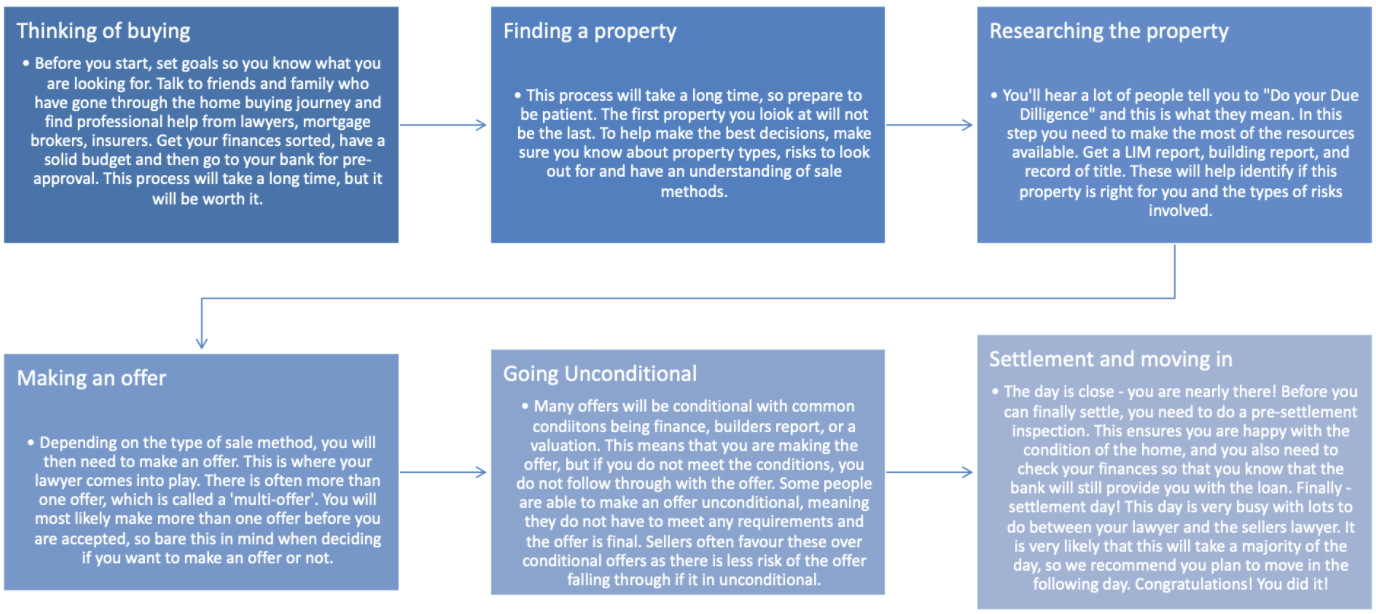

I’ve worked through these steps and am now ready to buy. What do I need to do?

We hope you have found our First Home Buyers Page educational and useful! Congratulations on being ready to buy your first home. Below are the main steps you will encounter on your home buying journey.

How much can you afford?

Submit the form below and one of our advisers will get in touch with tailored first home buyer advice.