Bringing your Australian Superannuation (AU Super) home may be a smart financial choice if you have decided to stay in New Zealand permanently. You can consolidate your retirement savings and benefit from the KiwiSaver scheme’s advantages. This article will provide you with all the information to check your eligibility for transfer and guide you through the application process. Let’s get started!

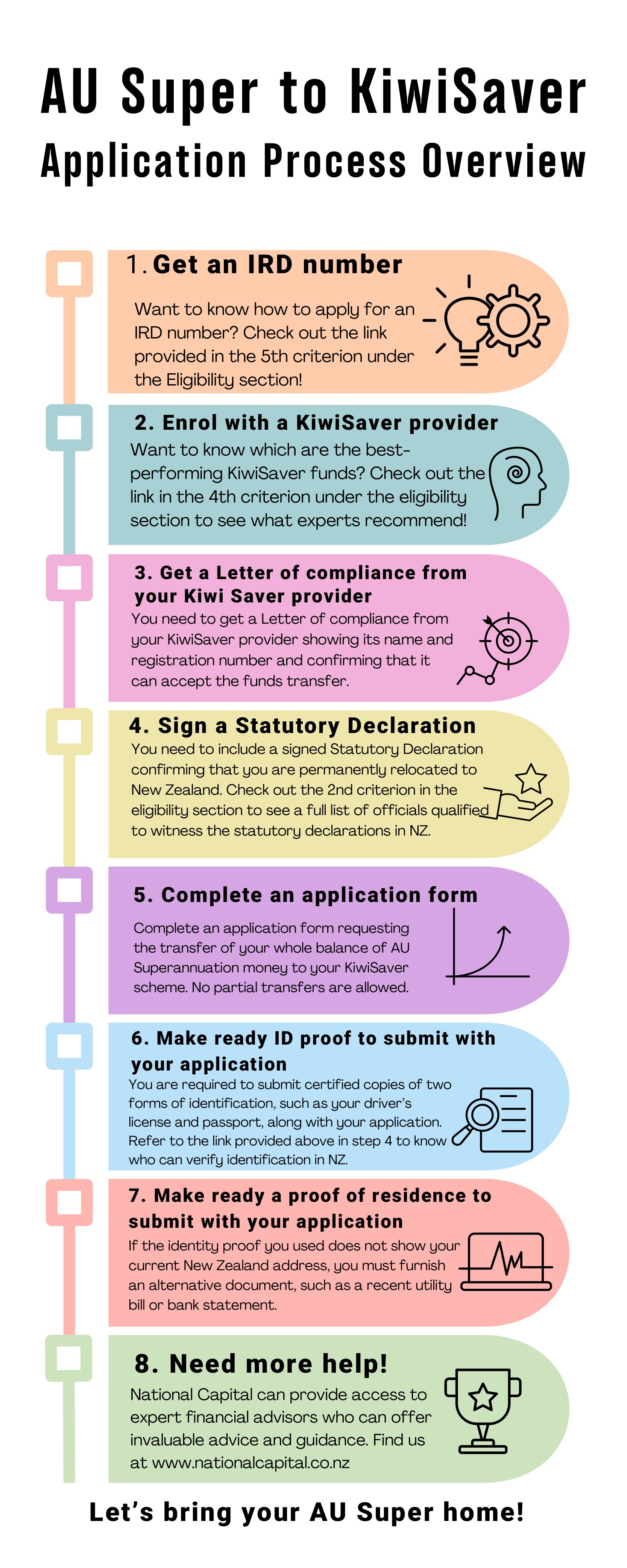

Let's dive into the step-by-step process of transferring your AU Super to KiwiSaver, making it a seamless and straightforward experience for you.

Interested in discovering if you are eligible for this transfer? Take a glance at the eligibility section provided below and determine if you meet the criteria!

Eligibility

The Trans-Tasman Retirement Savings Portability scheme enables individuals to move their retirement savings from Australia to New Zealand or vice versa when relocating between the two countries. However, to be eligible for the transfer, you must:

- Have your AU Super money invested with an Australian Prudential Regulation Authority (APRA) certified provider. Click here to check if your fund is APRA-certified.

- Have officially made New Zealand your new home. This requires signing a statutory declaration in the presence of an authorized official, affirming your relocation, and providing proof of your residence at a New Zealand address. Explore this link for a comprehensive list of officials qualified to witness statutory declarations in NZ.

- Transfer the entire balance of your AU super savings to a KiwiSaver scheme; partial transfers are not allowed.

- Have a KiwiSaver scheme that is ready to accept and receive your Australian transfer. (Want to know which are the best-performing KiwiSaver funds? Click here to see the recommendations from expert financial advisors)

- Finally, you will need to have a New Zealand Inland Revenue (IRD) number to make the application. To apply for an IRD number, please click here.

If you fulfill the criteria mentioned above, you are on the right track to transferring your AU Super to NZ KiwiSaver. So, let's kickstart the application process and ensure a seamless transition.

Beginning the process

To initiate the transfer of your AU Super balance to a KiwiSaver Scheme, you'll need to submit an application form along with the necessary supporting documents.

We’ve included links to the transfer application forms for a few AU Super providers. But don’t stress if you can’t find your specific provider among the links listed below. Simply go over to your superannuation provider’s website, and you’ll be able to access the form there. It’s that easy!

- Australian Super

- Australian Retirement Trust

- UniSuper

- Colonial First State

- HOSTPLUS

- MLC

- Cbus Super

- HESTA

Required Supporting Documents

These are the required supporting documents to include with your application.

- Proof of identity: You need to include certified copies of two forms of identification (Justice of Peace, Registered Medical Doctors, Registered Teachers, Lawyers, or Chartered Accountants can verify identification in New Zealand).

- Proof of residence in New Zealand: If the identity proof you used does not show your current New Zealand address, you must furnish an alternative document, such as a recent utility bill or bank statement.

- Statutory declaration: You must include a signed statutory declaration confirming that you are permanently relocated to New Zealand (An Australian Consular officer, a Justice of Peace, or a notary public can witness a statutory declaration in New Zealand).

- Letter of compliance: Ensure that you enclose a letter of compliance from your KiwiSaver scheme, displaying its name and registration number, while confirming its ability to accept the fund transfer.

If you require further assistance, don't hesitate to request one of our experienced financial advisors to reach out to you! Discover more about our services and how we can assist you by visiting our website at www.nationalcapital.co.nz.