With chatter about Cryptocurrency and Sharesies becoming a popular conversation during summer BBQs and potluck dinners, we are being exposed to some of the more daunting investing ideas. Words like risk, loss, and volatility are being thrown around, creating a worrying picture for someone who may not be super familiar with investing. For most New Zealanders, KiwiSaver will be their most common form of investment, so shouldn't we be talking about KiwiSaver investment at the next BBQ and the possibility of losing money?

To answer this, you must first ask: Can you lose money in KiwiSaver?

When people come to us and ask this question it often comes in the forms:

1. What happens if my KiwiSaver provider goes bankrupt?

2. My KiwiSaver account balance has dropped, have I lost that money?

This article will answer these questions in detail, which will shed light on whether you can lose money since joining KiwiSaver. However, in general, the good news is it's highly unlikely that you will lose money in Kiwisaver if you invest in a diversified fund.

In saying this, apprehension is still valid, and the risk of loss is often the hardest thing to come to terms with. It's important to note that the KiwiSaver scheme is highly regulated by the government, meaning it's a secure investment that can help relieve some of the worries around the risk of losing money. Hopefully, this article can help reassure you and put your mind at ease.

Let's Tackle Bankruptcy: What happens if my KiwiSaver provider goes bankrupt?

Your KiwiSaver provider has just declared itself bankrupt, will you lose all your money?

No! If your provider goes bankrupt, they cannot use your money to cover their debt. In other words, your money is safe. This is because your provider does not directly hold your KiwiSaver investment, instead is stored independently in a trust.

But what is a trust and why is my money safe in one?

To fully understand what a trust is, it's key to have some basic knowledge regarding these three legal roles: The Settlor, The Trustee, and The Beneficiary.

The Settlor (you): This person has original ownership over the asset. Which, in this case, is you as the money you have invested in KiwiSaver funds is your asset.

The Trustee: A trustee is an independent legal entity that holds ownership of another person's assets. In this case, the trustee is appointed by your KiwiSaver provider but is fully independent, and their role is to ensure your provider complies with their legal obligations. While also holding legal ownership of your invested assets.

The Beneficiary (you): This person has the right to receive the benefits from the trust through the form of capital or income. In the context of KiwiSaver, you are the beneficiary, you are entitled to withdraw this investment based on the rules set out by the government. There are three:

What is a KiwiSaver trust and why is your money safe in one?

Simply put, a trust is the legal relationship formed between a Settlor (you), a Trustee and a Beneficiary (you). During KiwiSaver sign up you transfer the legal ownership of your investment to a trustee who is independent of your provider. The trustee then has legal ownership of your asset and ensures that the asset is safe for the benefit of the beneficiary (you).

The key reason it's important for your money to be held in a trust is to create a layer of protection between your money and your KiwiSaver scheme. To put it another way, this protective layer is created so that your provider does not legally own your assets, an independent trustee does. This ensures your money is safe for when you need it in the future.

So in the rare circumstance that your provider goes bankrupt, your money will be protected, as it's with a trust, and trusts cannot go bankrupt. In this circumstance, what will happen is your trustee will change KiwiSaver to a new provider of your choice, and you will be back to working towards your investment goal.

So what role does your provider play?

Your provider simply has the role of managing where your money is invested. Accessing KiwiSaver money for any other reason is not possible for them.

This is why you have the choice of which provider you would like to manage your money. National Capital specialises in understanding your specific circumstances and considers your investment goals to give you personalised KiwiSaver advice on what provider is best for you. With the ultimate aim to help optimise your return on investment. To optimise your return, it's important you select the right Kiwisaver scheme as each offering is unique in the way they invest your money. Each provider has different funds which allocate your contributions across a range of assets and stocks, such as shares, property, cash and bonds, to name a few. How your money is invested alters how much risk is involved and influences the growth of your investment. Safe to say, there are plenty of KiwiSaver investment options for you to choose from.

Okay, let's move on to the second topic. Let's consider the risk of losing money due when your KiwiSaver login balance drops.

Can you lose money in KiwiSaver due to market volatility?

Like any investment, your KiwiSaver investment will experience both increases and decreases in its overall value—it's the market's nature to shift up and down. This movement is called market volatility.

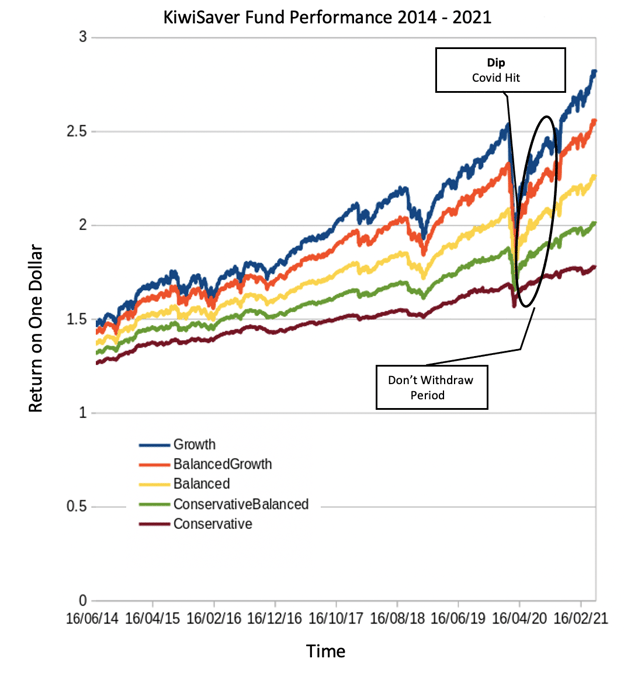

Events such as Covid-19 can increase market volatility because the global economy experiences a downturn. This has a large impact on the financial markets and, therefore, KiwiSaver. Since it started in 2007, two major events are remembered vividly for their large impact on the financial market, which sent waves of uncertainty and fear across the world. These events were the 2007 Global Financial Crisis and Covid-19. Although such events created a lot of financial pressure, we now have historical data that reflects how the market reacts when faced with extreme volatility. Below is a graph that is indicative of what happened across many KiwiSaver Funds when Covid hit.

As you can see, there was a significant dip when Covid-19 sprung onto the world. Although dips in the market can be an unnerving experience, data shows that they are usually accompanied by a recovery period, which in this graph has been labelled the 'Don't Withdraw Period'. During this time, if you were to withdraw your savings or are changing KiwiSaver to a more conservative fund, the dip would turn into an actual loss. This may sound scary, but it's essential to remain calm, hold tight and endure the short-term losses. With this strategy, you are less likely to miss out on thousands that could have gone towards your first home deposit or retirement. With time, you will experience that the market will recover and rise to new highs.

It is also important to recognise the constant minor fluctuations seen from this graph. This is the natural movement of the market and isn't significant for long-term investing. Not every day is a winning day, but when the long-term trend of the market is positive, these minor fluctuations are not something you need to worry about.

Overall, with the support from historical data and as clearly illustrated in the graph, it can be said that the market will recover and rise in the long run. The time frame in which they recover is hard to predict, but if you stay calm and handle it correctly, market volatility should not result in a loss.

How do I handle my investment correctly?

We have already touched on the short answer to this question: simply stay calm and hold tight until the market recovers. But I know this is easier said than done when you are faced with a KiwiSaver login balance that is $10,000 less than it was yesterday, but this truly is the key to making sure you don't lose any money.

Let's take 2020 as a real example and look at the consequences of what could happen if you responded emotionally to the fall in the market. Rewind a couple of years to when Covid-19 has just hit, and you, along with millions of other New Zealanders, are faced with feelings of fear and panic after looking at your balance. More than 200,000 New Zealanders let human instinct kick in, resulting in switching KiwiSaver to a lower-risk fund or withdrawing their investment. By failing to remain calm and holding on, these New Zealanders inadvertently turned the dip in their balance into a real loss. Alternatively, if they had waited for the market to recover, their balance would have fully recovered and be at an all-time high, and that loss they saw in their balance would have never been made into a real loss. Like many, I was also quick to find my KiwiSaver details to log in and check out my balance during that time. As bad as the dip is, remaining patient is key.

What if I need to withdraw my KiwiSaver during a time of financial downturn?

If you were in a situation where a significant dip in the market occurs when you were planning on withdrawing your money, and holding on is not an option, then strategies can be put in place to help minimise loss and manage risk.

What it all comes down to is selecting the right fund. Selecting the right fund is key to making sure you are optimising your returns and making sure you will still be on track to your investment goal even despite market volatility. To put it simply, the closer you are to needing to withdraw your KiwiSaver investment, the less risk you want to take to help minimise loss due to market volatility. Alternatively, if your investment goal is way in the future, you are in a better position to take on risk to make a greater return.

In saying this, more factors can influence what option is right for you, but knowing which fund is the best for you can be a time-consuming and complicated process as there are many to choose from and everyone's goals are specific to their situation.

The good news is that this is National Capital's expertise. Our team specialises in giving KiwiSaver advice and creating a personalised plan to ensure your investment is optimised to your goals and needs. Our team recognises the importance of selecting the right fund and how the impact of not being in the right one can result in missing out on thousands of dollars, so our service is completely free! It doesn't matter if you are in KiwiSaver self employed or through your employee, we can help. Before I get into our offering at National Capital, it's good for you to understand a bit about these funds in relation to market volatility.

To build a basic understanding of how KiwiSaver funds differ when faced with market volatility, let's refer back to the graph above. By looking at the graph, you can see these different coloured lines represent the different fund types available. I will compare the growth fund (blue line) and the conservative fund (brown line). Looking at these two funds during the dip from Covid-19, you can see a much greater decrease in the growth fund than the conservative fund.

Well, why is this? This is because of how the money is invested in each of these funds. A growth fund is largely made up of growth assets such as shares and property, which are more susceptible to the effects of market volatility. Comparatively, conservative funds are mostly made up of income assets such as cash and bonds, which are more secure when faced with market volatility. This explains why the dips seen on the graph are larger for the growth fund compared to the conservative fund. With this new knowledge, you may be beginning to understand why it's important to select the correct Kiwi Saver options. It would be a severe mistake for someone three years out from retirement to be in a growth fund where a market crash could significantly impact how much they are retiring with.

Key Takeaways

Can you lose money if your provider goes bankrupt?

No. The bottom line is that KiwiSaver providers do not have any legal ownership of your investment; their role is simply to manage it. This means in the unlikely event of bankruptcy, you will not lose your money. Phew!

Can you lose money due to market volatility?

Not if you manage your investment correctly (say calm and hold on) and make sure you are in the right fund. Our team at National Capital understands that events that cause the financial market to fall are anxiety-inducing, and it's a natural response to panic, but we want to reassure you that the best thing you can do is to stay calm. For example if you are with ANZ, do not compare your ANZ KiwiSaver login with the performance results that your friend is seeing through their Milford KiwiSaver login. The circumstances are most likely different and you are not comparing apples to apples.

If you remember that historical data shows that the market will bounce back and rise, then during dips, you don't need to stress or panic, in fact, you now have the knowledge to keep rational and calm. Rest assured by riding out the short-term loss means you will receive long-term gains.

Do differences between funds matter?

Ensuring you are in the right fund is also key in ensuring you don't lose money in KiwiSaver (or at least minimise the loss if you have to withdraw). You now know that growth funds are influenced more by market volatility than conservative funds because of how your money is invested. So the closer you get to making a first home deposit or retirement, the better it is for you to be in a more conservative fund. However, there is no one-size-fits-all rule, this is just some fund basics, and more research should be done to make sure you are selecting the best fund for you. This can be an overwhelming and time-consuming process for the everyday busy Kiwi, but National Capital offers a HealthCheck, which takes less than 15 minutes, and our team will do the hard work to find which fund is right for you. Our team from there will help create your personalised plan to optimise your returns, minimise the risk of loss and work towards your investment goals.

How it works in 3 steps:

So let's start talking about the importance of making the most out of KiwiSaver at the next BBQ and make sure your friends and family are optimising their savings.