Using the most recent returns and fund update reports from September 2021, we will examine ASB’s recent KiwiSaver Performance.

ASB is the Auckland Savings Bank, New Zealand’s first savings bank. ASB pledged to serve the community, grow, and help Kiwis grow. Since then, we have been committed to bringing New Zealanders the best banking products and services possible. The ASB Kiwisaver scheme has a total Assets Under Management of over $13.5 billion and over 530,000 KiwiSaver members.

There were negative returns on many funds in September and October. This could be attributed to the fact that Auckland is still in lockdown, the market settling down after last year’s significant returns or another external factor. There is a more positive outlook from November and December because of positive returns with the ending of lockdown and the markets readjusting after Covid.

Table of Contents

News about ASB

Performance of ASB KiwiSaver Funds

ASB Cash Fund

ASB Conservative Fund

ASB Moderate Fund

ASB Balanced Fund

ASB Growth Fund

ASB Positive Impact Fund

News about ASB

In July, ASB brought on board BlackRock as their new investment partner. They’re the world’s largest investment management firm with world-class expertise. BlackRock now manages our ASB KiwiSaver Scheme along with our other managed funds for asset allocation.

Also, from the 1st of October, ASB has removed their administration fee. It was an annual fee of $30, delivering even better value for customers and generally saving ASB members up to 24% in costs.

Performance of ASB KiwiSaver Funds

|

3 month |

6 months |

1 year |

5 years |

10 years |

Since Inception |

|

|

Cash |

0.09% |

0.14% |

0.21% |

1.28% |

1.53% |

1.97% |

|

Conservative |

0.27% |

0.22% |

0.53% |

3.84% |

4.19% |

3.75% |

|

Moderate |

1.20% |

1.21% |

2.86% |

5.24% |

5.86% |

4.33% |

|

Balanced |

2.33% |

2.47% |

6.87% |

7.29% |

8.01% |

5.12% |

|

Growth |

3.39% |

3.93% |

11.19% |

8.92% |

9.81% |

5.61% |

|

Positive Impact |

3.64% |

4.66% |

10.93% |

n/a |

n/a |

8.99% |

Sourced from ASB fund performance report

* These returns are to the 31st of December 2021, before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from ASB Quarterly Fund updates published on the 29th of October.

ASB Cash Fund

The Cash Fund aims to provide exposure to a portfolio of investment-grade short term deposits, and fixed interest investments with New Zealand registered banks by investing in a target investment mix of 100% income assets. The Cash Fund has a 3-month return of 0.09% and a 1-year return of 0.21% lower than the since inception return of 1.97%.

*The following is Sourced from ASB Cash Fund Update

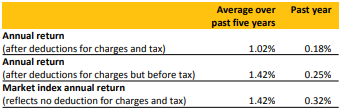

Returns

Fees

The total annual fees for investors in the ASB Cash fund are 0.35% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a cash fund.

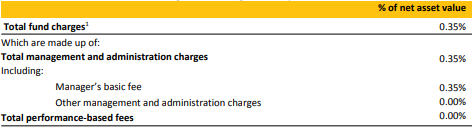

Top ten investments

This table shows ASB’s top 10 investments in the Cash KiwiSaver fund, which make up 99.99% of the fund.

ASB Conservative Fund

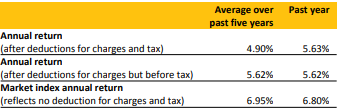

To provide modest total returns allowing for modest volatility by investing in income and growth assets with a target investment mix of 80% income assets and 20% growth assets. The Conservative Fund has a 3-month return of 0.27% and a 1-year return of 0.53% compared to the since inception return of 3.75%.

*The following is Sourced from ASB Conservative Fund Update

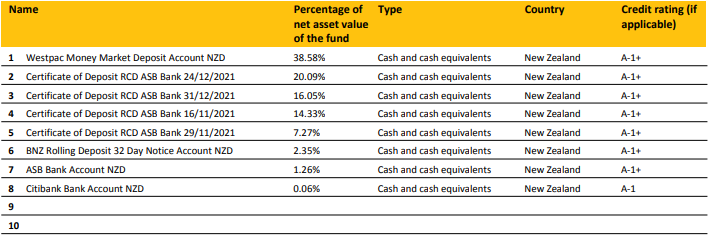

Returns

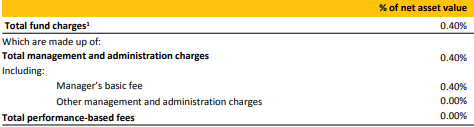

Fees

The total annual fees for investors in the ASB Conservative fund are 0.40% per year.

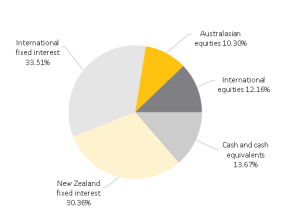

Investment mix

The investment mix shows the type of assets that the fund invests into.

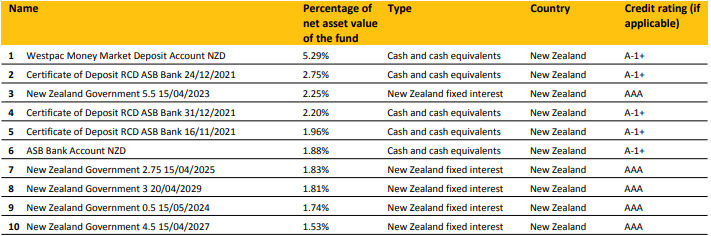

Top ten investments

This table shows ASB’s top 10 investments in the Conservative KiwiSaver Fund, which make up 23.24% of the fund.

ASB Moderate Fund

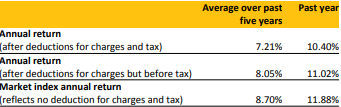

The fund aims to provide moderate total returns allowing for moderate volatility by investing in income and growth assets with a target investment mix of 60% income assets and 40% growth assets. The Moderate Fund has a 3-month return of 1.20% and a 1-year return of 2.86%, slightly lower than the since inception return of 4.33%.

*The following is Sourced from ASB Moderate Fund Update

Returns

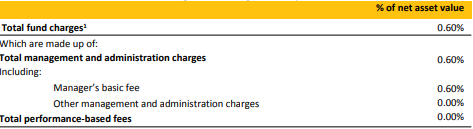

Fees

The total annual fees for investors in the ASB Moderate fund are 0.60% per year.

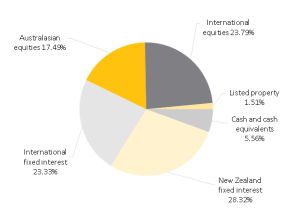

Investment mix

The investment mix shows the type of assets that the fund invests into.

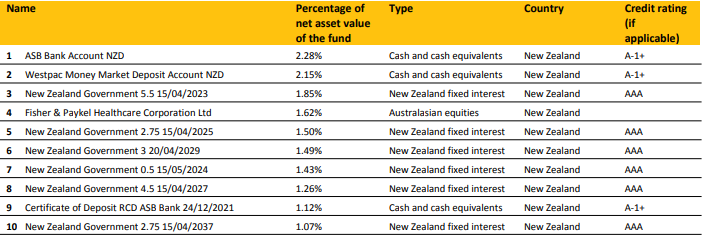

Top ten investments

This table shows ASB’s top 10 investments in the Moderate KiwiSaver fund, which make up 15.77% of the fund.

ASB Balanced Fund

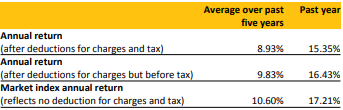

The Balanced Fund intends to provide moderate to high total returns allowing for moderate to high volatility movements by investing in income and growth assets with a target investment mix of 40% income assets and 60% growth assets. The Balanced Fund has a 3-month return of 2.33% and a 1-year return of 6.87%, slightly higher than the since inception return of 5.12%.

*The following is Sourced from ASB Balanced Fund Update

Returns

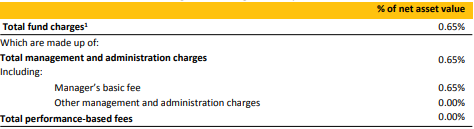

Fees

The total annual fees for investors in the ASB Balanced Fund are 0.65% per year.

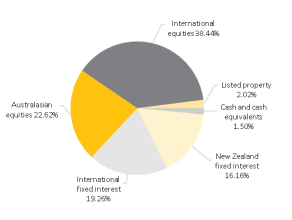

Investment mix

The investment mix shows the type of assets that the fund invests into.

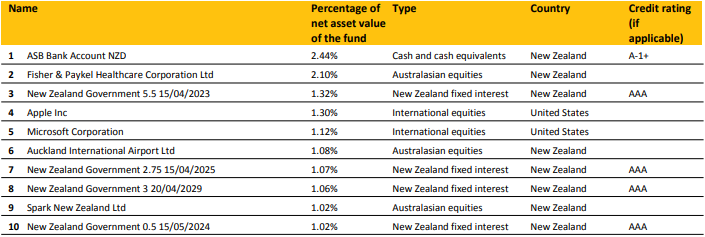

Top ten investments

This table shows ASB’s top 10 investments in the Balanced KiwiSaver Fund, which make up 13.53% of the fund.

ASB Growth Fund

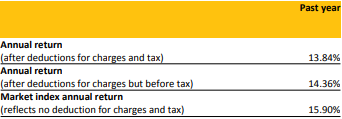

To provide high total returns allowing for large volatility movements by investing in income and growth assets with a target investment mix of 20% income assets and 80% growth assets. The fund has a 3-month return of 3.39% and a 1-year return of 11.19%, significantly higher than the since inception return of 5.61%.

*The following is Sourced from ASB Growth Fund Update

Returns

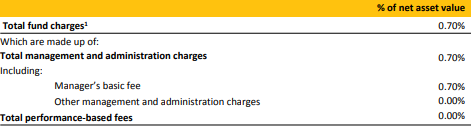

Fees

The total annual fees for investors in the ASB Growth Fund are 0.70% per year.

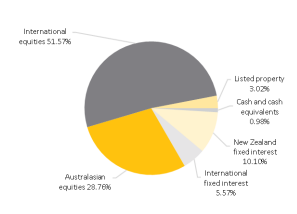

Investment mix

The investment mix shows the type of assets that the fund invests into.

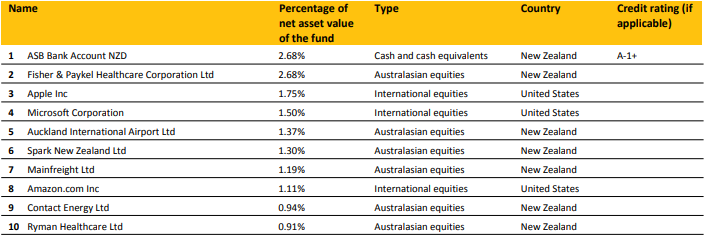

Top ten investments

This table shows ASB’s top 10 investments in the Growth KiwiSaver fund, which make up 15.43% of the fund.

ASB Positive Impact Fund

The Positive Impact Fund invests similarly to the Balanced Fund with a target investment mix of 40% income assets and 60% growth assets. The fund aims to invest in companies looking to positively impact society or the environment for a similar return to the average Balanced Fund. The fund has a 3-month return of 3.64% and a 1-year return of 10.93%, larger than the since inception return of 8.99%.

*The following is Sourced from ASB Positive Impact Fund Update

Returns

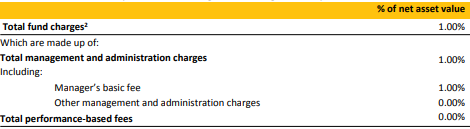

Fees

The total annual fees for investors in the ASB Positive Impact Fund are 1.00% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

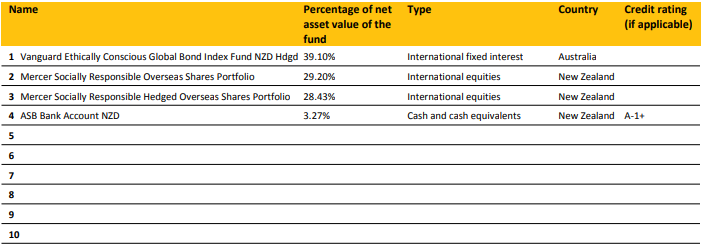

Top ten investments

This table shows ASB’s top 10 investments in the Positive Impact KiwiSaver Fund, which make up 100% of the fund.

Data for ASB KiwiSaver funds has been sourced from ASB KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if ASB has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.