KiwiSaver NZ - KiwiSaver Benefits, Joining, & More!

Find out about how does KiwiSaver work, how to join, and much more about the KiwiSaver Scheme.

| KiwiSaver NZ Objective: | KiwiSaver is a savings and investment initiative designed to help create a sustainable retirement plan. |

| Who Can Join KiwiSaver: | All New Zealand citizens and residents of any age are eligible to join KiwiSaver, regardless if they work or not. |

| KiwiSaver Benefits & Contributions: |

|

Joining KiwiSaver may feel a bit confusing, and you may not know what questions to ask. But here at National Capital we believe in giving more power to the client. We will go over the most important information you need to know before you join KiwiSaver or an existing investor that wants to know more. Every one from a young age to someone nearing retirement can reap the KiwiSaver benefits.

Best Performing KiwiSaver Funds

*Past performance is not necessarily indicative of future performance.

*List is of the highest 5-year returns A-rated funds as per our Investment Selection Process.

*All returns are after fees and tax (28% PIR) as of the quarter ended 31st December 2023.

*Source: National Capital Research February 2024

Is your KiwiSaver fund missing from the list?

We’re here to help find the best KiwiSaver fund for you. Let’s start by providing you with a comparison report of your existing fund.

It’s important to check the health of your KiwiSaver fund and understand its position within the market. Submit the form below to view a simple graphic report of your fund.

Best Performing KiwiSaver Funds

*Past performance is not necessarily indicative of future performance.

*All returns are per annum after fees and tax (28% PIR) as of the quarter ended 31st August 2025.

*Source: National Capital Research

What is the best KiwiSaver fund for you?

We’re here to help find the best KiwiSaver fund for you. Our team are financial advisers specialising in KiwiSaver & Investment research. We provide free KiwiSaver advice, with the goal of empowering Kiwis to become financially secure.

By taking a few minutes of your time to complete our KiwiSaver HealthCheck questionnaire, you will receive an instant recommendation tailored specifically to your goals and beliefs.

Our system combines the latest figures and technology to provide the most suited recommendations. Nonetheless, whether you take us up on the advice, is completely up to you.

Performance and Fees comparison for all KiwiSaver NZ Schemes

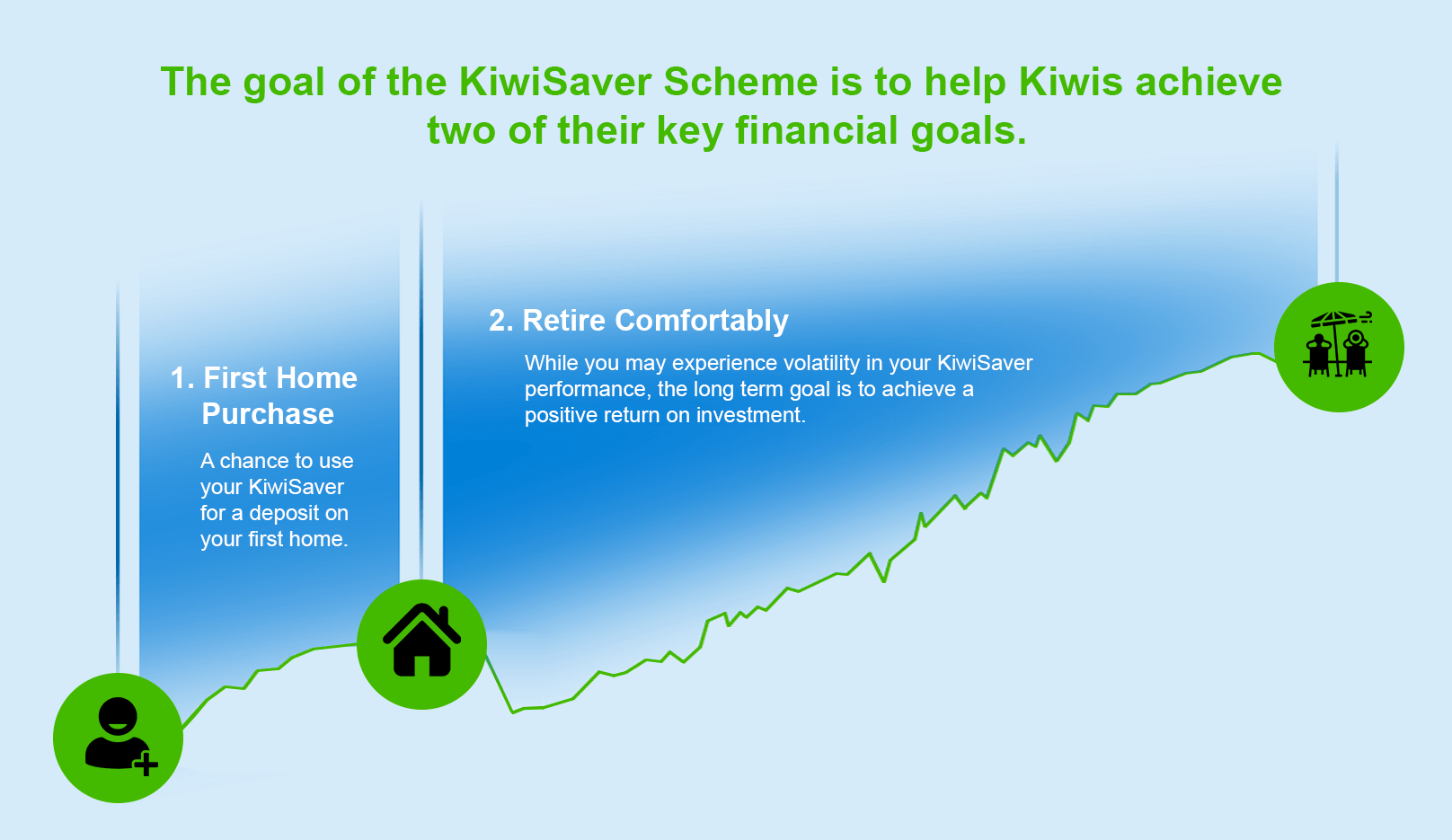

National Capital is specialised in KiwiSaver benefits and research. There are different considerations for someone planning to use their KiwiSaver for retirement as compared to someone who is looking to use it for a First Home purchase. If you are planning to use it for retirement, you need to take into consideration your retirement income goals, the lump sum you need at retirement, and your current balance and rate of savings. You will also need to take into consideration your capacity and tolerance for volatility.

Which is the right fund selection after you join KiwiSaver?

Please note that the information on this page is not personalised financial advice for KiwiSaver NZ. If you want advice based on your own circumstances and goals, follow the HealthCheck application on our website. National Capital was founded in 2018 and now advises Kiwis on over $170 million of their KiwiSaver NZ savings. We are based in Auckland, but serve clients all over New Zealand. We provide free advice, firstly answering how does KiwiSaver work, with the goal of empowering all kiwis to become financially secure.

KiwiSaver NZ Quicklinks - How Does KiwiSaver Work?

Whether you want to join KiwiSaver for the first time, wondering how does KiwiSaver work, or other circumstances, here are some quick links to the most common queries:

The latest analysis on the top-performing KiwiSaver funds.

Find out how to log in and check your balance online. Accessing KiwiSaver account in a few clicks.

A complete breakdown of of all things ‘First Home Buyer’.

Calculate how much tax you’ll pay on your investment.

A list of KiwiSaver Providers and how to find out if you are in a default scheme.

You’ll be surprised how easy the process is.

KiwiSaver NZ - Who Is National Capital?

And why should I listen to their KiwiSaver scheme advice?

Our core function is KiwiSaver research and advice. Therefore, whether you’re a long-time investor or just thinking of joining KiwiSaver, you can benefit from our specialised insight. It only takes a few minutes to enter your details and get your KiwiSaver recommendations. We’ve helped Kiwis from all walks of life make decisions tailored to their goals and circumstances. From those registered in KiwiSaver self-employed to people looking to switch from a default KiwiSaver Scheme.

National Capital is here to help you take the first step toward financial security through our KiwiSaver NZ Healthcheck.

KiwiSaver Benefits In 3 Simple Steps

1. HealthCheck / 2. Personalised Recommendations / 3. KiwiSaver Sign Up Decision

A combination of registered financial advisers and the latest technology deliver tailored recommendations, at no cost to you! Follow our 3 simple steps to maximise your KiwiSaver benefits.

HealthCheck

It should take you only 10 to 15 minutes to complete the Healthcheck. This gives us what we need to compare your current situation with opportunities to maximise your investment.

Recommendations

Our thorough analysis delivers tailored recommendations suited for you. Based on your goals, you will get recommendations on the most appropriate fund and KiwiSaver scheme.

Informed Decision

Our services allow you to make an informed decision amongst all the options available. You can ask questions, decide to proceed with our recommendations, or stick to your current KiwiSaver scheme.

Should you wish to apply our KiwiSaver scheme recommendations, National Capital makes the switch a completely hassle-free experience.

Joining KiwiSaver - Firstly, What Is It & How Does KiwiSaver Work?

How does KiwiSaver work? Simply put, KiwiSaver NZ is a voluntary investment and savings scheme. It was set up by the New Zealand government to help Kiwis save for buying their first home or retirement. Its features include a nationwide auto-enrolment through KiwiSaver sign up when getting a first job. Employees are automatically enlisted into a KiwiSaver scheme but have the choice to opt out if they don’t want to participate. A percentage of your salary is deposited, as well as a contribution from your employer. Joining KiwiSaver self employed means this process is a manual one. By choosing to stay in a KiwiSaver plan, your employers are obligated to contribute a minimum of 3% of your salary too. The contributions you make range from 3, 4, 6, 8, or 10% and it is 100% your choice. The government also offers capped annual contributions. Joining KiwiSaver prior to 2015 meant that the government deposited a $1000 lump sum. Although they no longer offer this, the government will contribute 25 cents to every dollar you deposit. This government contribution is capped at a maximum of $260.72 per year. Nonetheless, it is a significant component amongst KiwiSaver benefits.

When you join KiwiSaver, you’re able to choose your preferred KiwiSaver scheme and fund type. If you’re not sure, you’ll automatically be enlisted in a default KiwiSaver scheme but you can always change later. Many people come to National Capital long after joining to check if they’re in the right scheme.

Your KiwiSaver can be accessed for retirement, your first home deposit, or other uncommon circumstances. It is predominantly seen as a long-term investment to ensure a comfortable lifestyle beyond retirement. In the event that you are emigrating out of New Zealand, you may be eligible to withdraw your savings. However, strict guidelines and criteria are in place to minimise cases of early withdrawals.

Why KiwiSaver NZ Was Introduced - KiwiSaver Benefits.

KiwiSaver was introduced in 2007, as a way for Kiwis to save enough money towards either their first home or retirement. Before KiwiSaver, Kiwis needed to rely on a weekly $437 NZ superannuation payment once they reached the retirement age of 65, as well as whatever retirement savings they had set aside. Kiwis tend to spend more than what is provided by NZ superannuation as living expenses continue to increase. Thus, investing through the KiwiSaver scheme eases financial stresses that may occur in retirement. This has always been the core of what KiwiSaver benefits represent.

More specifically, a trend had come to the government’s attention, duly pointed out by Sir Michael Cullen. New Zealand had some of the lowest savings per household compared to other developed nations. Cullen also pointed out that an estimate was done on the savings rates per household and it was a negative 17.5%. In March 2007, four months before it became active, the NZ Treasury revealed the results of a study. It showed that around 20% of New Zealanders (between 45-64 years old) did not have enough for retirement. During that time, the study revealed that current retirees had their private savings and mortgage-free homes to sustain their retirement. The worry was around those who were younger that had large debt, a mortgage, student loans, and young children. KiwiSaver was a tool introduced to get more low and middle-income households investing for retirement.

Before it was introduced, there were retirement plans available but only around 600,000 people from the workforce were enrolled. In a survey done in 2001, less than 20% of people earning between $15k to $50K were enrolled in a retirement plan. This served as a big concern on which Sir Michael Cullen based his target audience when setting up KiwiSaver NZ.

Who pioneered KiwiSaver?

In August 2006, the law passed, giving it the go-ahead and the driving force behind this was Sir Michael Cullen. He was the Minister of Finance and was the great architect of not only KiwiSaver but of Working for Families. Sir Michael Cullen was born February 5th, 1945 in the town of Whakatane and led a three-decade political career. He served as the deputy prime minister to Helen Clark between 2002-2008 as well as the deputy leader of Labour. He retired in 2009 from Parliament but then went on to be involved in Treaty of Waitangi settlement negotiations. Moreover, chairing New Zealand Post, and the Earthquake Commission.

July 1st, 2007 marked the beginning of KiwiSaver officially. Two years in, just under 100,000 New Zealanders had enrolled by joining KiwiSaver. Major progress has been made since then and most if not all working Kiwis are aware of the scheme. Features like online applications have made the process easy to apply and join.

Unfortunately, in March 2020, Sir Michael announced that he had lung cancer and died in August 2021 at the age of 76. Prime Minister Jacinda Ardern gave a speech in his honour to which she said, “Sir Michael was one of the most influential figures in New Zealand politics over the last 40 years. Intelligent, funny, and kind, he left a significant legacy for the country.”

Most certainly, he is remembered for leading the way forward to the establishment of KiwiSaver NZ among many achievements. Whether joining KiwiSaver self employed or through a company, Sir Michael Cullen wanted all Kiwis to be more financially secure. As of June 2021, more than 3 million people are active members. An important milestone to be proud of.

Why should I join KiwiSaver and who can participate?

KiwiSaver NZ is intended to help you save for your future. When thinking about how does KiwiSaver work, it is for those looking for a simple way of investing their money that is actively managed by the KiwiSaver NZ managers. Ultimately, setting New Zealanders up with enough savings to live comfortably once retired. It was created to fix the issue of many pensioners living in poverty. You may know that joining KiwiSaver can help you save for either your first home or for retirement. The best way to find out which KiwiSaver scheme is best for you is by talking with your financial advisor or contacting us at National Capital here.

As per IRD, KiwiSaver is available to anyone who lives in NZ if they are an NZ or Australian citizen or resident. On the other hand, you cannot participate if you hold a temporary, student, or visitor visa. Furthermore, if you’re a citizen but just visiting NZ or are on holiday, joining KiwiSaver isn’t available.

For those under the age of 18, there are some rules around your ability to join KiwiSaver. Firstly, you can only join through a KiwiSaver Scheme provider and not through your employer. There are over 20 different KiwiSaver providers. For those who are 16 or 17 years old, they must have at least one legal guardian to sign their KiwiSaver NZ application. If not, they can contact the scheme provider about joining KiwiSaver. Anyone under the age of 16 must have all legal guardians sign the application as they cannot self-enroll without it. To find out if you are eligible for joining Kiwisaver, visit IRD’s website and take the eligibility quiz.

After meeting the set criteria, you can join KiwiSaver.

Can I join KiwiSaver when I'm young/before I start working?

KiwiSaver NZ is a long-term investment and savings plan. Therefore, to join KiwiSaver young is a great idea. You do not need to be working in order to register. However, there are certain pathways you must follow to join a KiwiSaver scheme.

If you are under 18 or joining KiwiSaver before starting work, you’ll need to join directly through a scheme provider. You cannot opt-in through your employer. Those under the age of 16 must have the consent of all their legal guardians to apply. You cannot enroll yourself. It is also worth noting that government and employer KiwiSaver contributions are only eligible to those 18 and over.

Those between the ages of 16 and 17 need at least one guardian to co-sign their KiwiSaver NZ application. If you don’t have a legal guardian, contact your chosen KiwiSaver firm for help.

Joining KiwiSaver is a financial decision after all, and these rules are in place to protect young Kiwis. Nonetheless, it is never too early to start thinking about long-term savings. The earlier you start, the more likely you are to reap the benefits of KiwiSaver post-retirement. While that may seem like a lifetime away, joining KiwiSaver is also a great way to build a saving habit. Most certainly, a financial tool you will need throughout your life.

Is it ever too late to think about joining KiwiSaver NZ?

KiwiSaver is a smart financial choice that’s available to anyone, regardless of their age or stage in life. It doesn’t matter if you’re joining KiwiSaver self employed with little starting income or in a salary role. It’s never too late, which is one of the great things about this program. KiwiSaver NZ is designed to be inclusive and flexible so everyone can benefit from it. Whether you’re young or nearing retirement, KiwiSaver benefits are worth considering.

Some KiwiSaver benefits include employer contributions, government incentives, and different options available. You can customise your approach to achieve your goals and secure your financial well-being. It’s important to understand that KiwiSaver benefits are great for anyone looking to take control of their financial future.

Of course, the earlier you join, the more time your savings have to grow. That is why it is important to understand how does KiwiSaver work as early as possible. Nonetheless, KiwiSaver benefits are significant even when nearing retirement age. It offers a well-regulated and robust system to get you in the habit of saving for the future. Although nothing is guaranteed, investing through KiwiSaver comes with a track record of growth in the medium to long term. There are also options that offer stability for short-term investors.

If you’re uncertain about how does KiwiSaver work and whether it’s right for you, speak to an advisor. Any specific questions about eligibility, contributions, or fund choices, you can also contact a provider directly. They can provide personalised guidance based on your unique circumstances.

How difficult is the process to join KiwiSaver?

Joining KiwiSaver is relatively simple. When you start a job, you are typically instructed to fill out a KiwiSaver sign up form. According to IRD, your employer may present you with one of two forms, the IR346K form or a KS2 form.

The IR346K form is for a new employee who is eligible but has not enrolled yet. This form is typically completed during the onboarding process and is a way of automatically enrolling into KiwiSaver. The information required of the employee includes:

- Name

- IRD Number and tax code

- Contact details

- Date of birth

For new employees that are already enrolled, you must fill out the KS2 form. It’s intended to determine the percentage deduction rate that the employee prefers and check whether they have a savings suspension.

Alternatively, you can get these forms online through the IRD website or your myIR login.

You can also join KiwiSaver directly from your preferred provider’s website. The process of joining KiwiSaver this way has been made hassle free in recent years. You simply need your IRD number and tax code on hand in addition to some contact information and you’re set. Making the hassle-free sign up process another to add to the list of KiwiSaver benefits.

Regardless of whether you’re joining KiwiSaver through an employer or have signed up for KiwiSaver self employed, one thing remains. You must choose between funds that best align with your short, medium, and long-term goals. While the process has become simple to do online, making the right decision should be thought out. If you need some free professional KiwiSaver advice, National Capital is here to help you make the right choice.

KiwiSaver NZ - Talking Numbers (Returns, Risks of Joining, & More)

How does KiwiSaver work regarding taxes? Am I taxed on my KiwiSaver?

Before you join KiwiSaver, this is a valid question to ask. The only money which is taxed is the earnings gained from your KiwiSaver returns each year. This means that you aren’t paying out of pocket for the returns, and is taken off the amount made within the year from the account. Any money that is withdrawn from your KiwiSaver scheme is tax-free.

KiwiSaver is taxed like any other investment fund type here in NZ. When you join KiwiSaver, you will determine your Prescribed Investor Rate (PIR) to determine your tax rate. As a New Zealand resident, you will typically fall into one of the following:

- If yearly income is $14,000 or less and total including PIE is below $48,000 = 10.5%

- If yearly income is $48,000 or less and total including PIE is below $70,000 = 17.5%

- If yearly income is above $48,000 = 28%

The good thing is that once you set your PIR, you don’t need to manually do your taxes on it. Any payable tax is automatically taken from your KiwiSaver NZ balance depending on your investment returns.

Do I have to pay to join KiwiSaver?

Depending on your provider, your KiwiSaver fees may vary. This includes annual management fees and fixed quarterly payments. Fees are based on your savings amount, and the services your KiwiSaver scheme provides. It is in your best interest to compare the fees with the returns when comparing schemes. Although you may receive higher returns, they may be outweighed by the fees charged. Check with your provider to see what you’re paying if you aren’t sure. You can also contact National Capital to help track down these figures for you. This is all part of understanding how does KiwiSaver work.

Over the past few years, fees have decreased with a push from various government actions. However, it is understandable for a KiwiSaver scheme to charge a management fee in order to provide the service. After all, it is a business with expenses and profit expectations. In order to hire the best financial analysts and investors to manage our funds, they need to pay good salaries. That is also at the core of how does KiwSaver work in a sustainable way where all parties are able to reap the KiwiSaver benefits.

Importantly, when you join KiwiSaver, you should not mistake higher fees for better performance and vice versa. There isn’t a clear correlation between KiwiSaver fees and performance, thus you need to look at other factors when selecting.

Are returns in KiwiSaver guaranteed?

No, KiwiSaver, much like other investments is not guaranteed to give specific returns. However, we can look at long-term averages to get an indication of KiwiSaver benefits and the range of expected returns. Of course, performance data will fluctuate over time.

These are the average KiwiSaver returns per annum for the last decade for the major funds:

- Average Default Fund – 5.4%

- Average Balanced Fund – 5.9%

- Average Growth Fund – 6.7%

Importantly, when figuring out how does KiwiSaver work, you shouldn’t neglect the fact that investments can go negative. However, history will tell us that long-term investment has an upward trend.

You may ask if that’s the case then when should I worry? You can start taking action if you see your KiwiSaver NZ scheme underperforming competitors on a consistent basis. That may be confusing to keep track of and that’s where National Capital comes in. If you’re struggling to find the right KiwiSaver scheme for you, we can help.

Can you lose money investing in KiwiSaver?

The KiwiSaver scheme, like any other investment, is not insulated from market volatility. This means that your money can go up or down in value. Therefore, the short answer is yes. You can lose money on KiwiSaver. When joining KiwiSaver, this is important to know so that you can make the right decisions when your balance is in the red.

However, it is not as doom and gloom as it sounds. Companies in the main global markets, in general, go up and down in value all the time. Reasons can vary from news articles to bad ad campaigns, and global pandemics like Covid-19. No matter how tech-savvy the financial industry gets, it is impossible to predict and guarantee investments as totally risk-free. KiwiSaver NZ firms work full time in researching market trends and analyse companies to ensure they have a sustainable business model.

Additionally, professionals working in a KiwiSaver scheme invest your money in a way designed to spread the risk. Whether this is across different companies, industries, or markets. For example, looking closely at the breakdown of your fund, you will see many companies across multiple industries. KiwiSaver firms structure your investment this way particularly to spread risk and minimise the impact of unforeseen downwards trends.

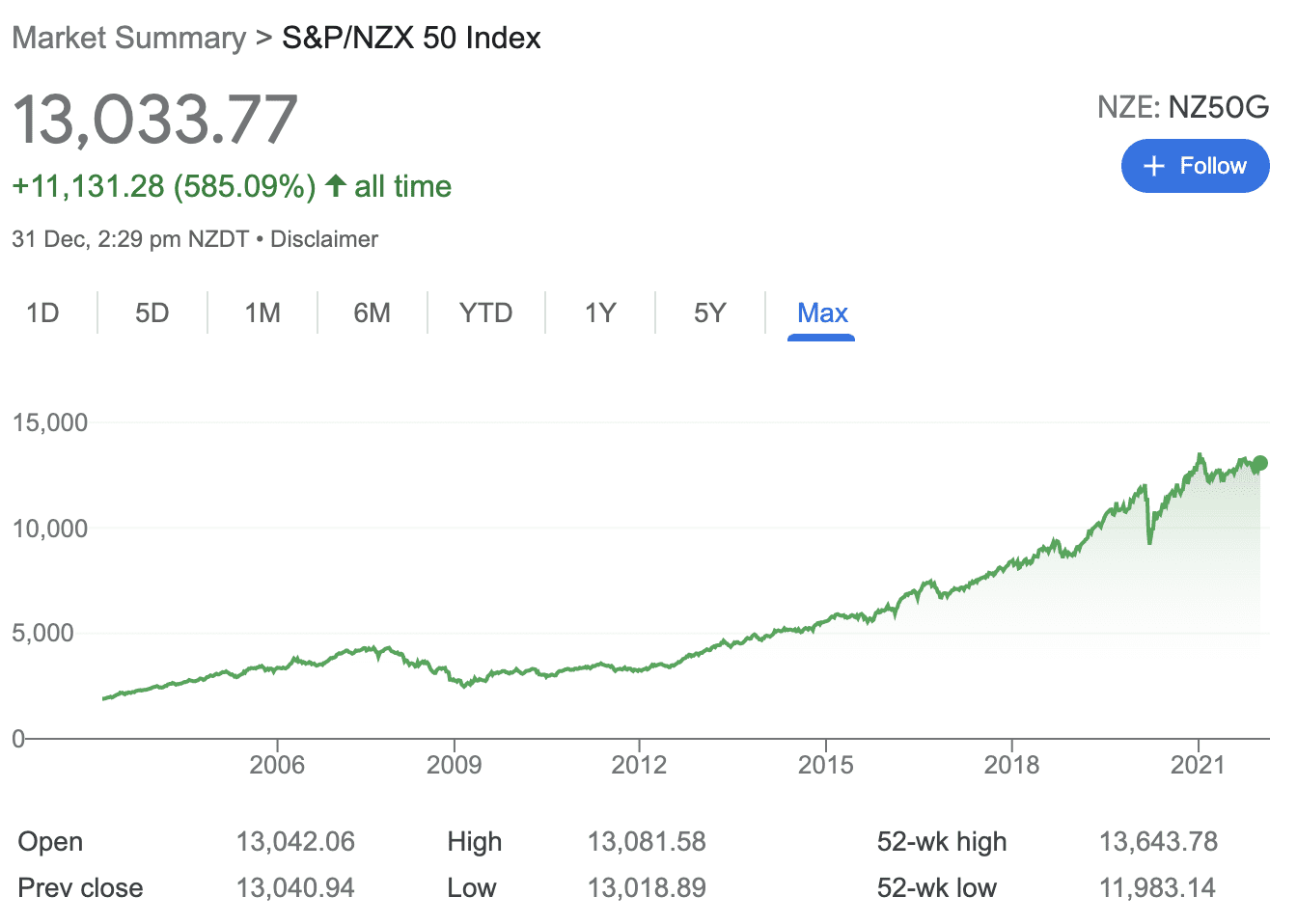

Source: Google Finance

In conclusion, as company valuations are susceptible to downgrades, you can lose money on the scheme. However, history tells us that investing in stable markets, KiwiSaver has grown in value in the long term. Let’s take a look at the NZX50 Market Index from inception in 2003 to the end of 2021. We can see dips and drastic loses along the way but the value over those 18 years has increased 585%. This leads us to the ultimate point in this topic. Timing is everything and plays an important role in answering how does KiwiSaver work to your benefit.

Join KiwiSaver - Making A Difference

It’s been a joy to help some great New Zealanders reap their KiwiSaver benefits through long-term financial security. Here are a few of their stories since joining KiwiSaver through National Capital.

Are you ready to reap the complete KiwiSaver benefits?

Important Questions Regarding The KiwiSaver Scheme

All in one breakdown of everything KiwiSaver related. From how to join KiwiSaver, its benefits, how does KiwiSaver work, and more.

More I need to know about opting in to join KiwiSaver or opting out.

What if I’m not an NZ Citizen?

Only New Zealand citizens or residents entitled to live in New Zealand indefinitely have the possibility of joining KiwiSaver. If you are only residing temporarily, a visitor, or on a work or student visa, you can’t participate in KiwiSaver. If these conditions do not apply, you may be able to join KiwiSaver.

This is because KiwiSaver is intended for people with a long-term and post-retirement future in NZ. Naturally, someone who’s residing in New Zealand temporarily won’t truly benefit from a long-term savings scheme.

Although you must be a resident or NZ citizen to be eligible, there are alternative options. Milford is a KiwiSaver firm that also offers other investment funds. These investment funds generally run parallel to KiwiSaver and have a similar return record. Therefore, as a non-resident or citizen, you have the option to invest in funds similar to joining KiwiSaver. The difference is that you can withdraw your investment from these funds at any time, unlike KiwiSaver. Fixed-term deposits are another way utilise your existing savings and generate returns. They typically offer lower returns than joining KiwiSaver or investment funds but are seen as a less risky option.

Before joining KiwiSaver, you should consider the possibility of applying for New Zealand residency if eligible. Once you receive NZ residency, you can then apply to join. If that is not possible, remember that you do have other investment alternatives out there. It is simply advised to do your research beforehand and get tailored financial advice.

Joining KiwiSaver self employed.

Yes, you can join KiwiSaver self employed. Much like someone under 18 or not working, you can join directly via a scheme provider. Joining KiwiSaver self employed means that you may pay contributions directly to the provider or through IRD. If you are enrolled in KiwiSaver self-employed and choose to pay via IRD you can do so via internet banking. Simply set up an automatic payment by using the “Pay Tax” option and selecting “KiwiSaver” through your internet banking provider.

You can join KiwiSaver self employed at any time by completing a KiwiSaver sign up form from your chosen provider. Furthermore, you can change your contribution rate at any time by contacting your provider.

You won’t get employer contributions investing in KiwiSaver self employed, as compared to when working for a company. Thus, missing out on one of the KiwiSaver benefits. However, you may still qualify for the annual government contribution. This includes a minimum yearly contribution of $1042.86 by you to get the maximum government contribution (currently $521.43). If you don’t make regular payments through KiwiSaver self-employed, remember to make this lump sum payment before 30 June. You should allow for a few days of processing time before the cut-off date.

Joining KiwiSaver self employed means you can choose a contribution rate that suits your situation and set payment intervals accordingly. You can set up an automatic payment through to your KiwiSaver.

Is it voluntary? How can I opt out?

It is indeed voluntary to join KiwiSaver. That means that you can decide whether or not you want to be a part of it. While the decision rests with you, KiwiSaver scheme participation figures continue to rise year on year. That is because the KiwiSaver benefits far outweigh any negatives.

If you don’t want to join, when you are employed for the first time and your employer gives you the KS2 form, do not fill it in. If you are currently with KiwiSaver and want to opt-out, you can use Inland Revenue’s website to go through the steps required to opt out. You can apply through myIR online as well.

This Requires:

- IRD number, address, and contact details

- Bank account details for any refunds

If applicable, you also need your:

- Employer’s business or trade name

- Employer’s address or IRD number

- Employment start date

- Written consent from guardians or parents

- Reason for the late opt-out, this needs to be a valid excuse and go through IRD.

- You cannot opt out if you joined directly through a provider instead of your employer

- This needs to be within 2 to 8 weeks after being enrolled

What happens if I move?

If you move overseas (apart from Australia) for more than 12 months, you can apply to withdraw your funds after you’ve emigrated. If you have migrated overseas to a country other than Australia for at least a year, you can do two things.

You can choose to:

- Withdraw your savings, or

- Transfer them to an approved superannuation scheme

If you are not planning to move permanently overseas or are moving within New Zealand or Australia, you do not need to worry about transferring to another scheme. If you plan to permanently move to Australia, you can transfer your account to the Australian superannuation scheme. But if you want to, you can remain in the scheme indefinitely.

After you have been overseas for over a year, you can apply to withdraw most funds from your KiwiSaver. Things like your savings, employee contributions, and interest earned can all be withdrawn. However, government contributions towards your KiwiSaver cannot.

If you don’t want to make a definite decision, keeping your balance within NZ can be a great option. Your savings are invested and work to generate annual returns. If you ever decide on returning to NZ, you won’t have to worry about re-joining a KiwiSaver scheme once again.

How do I manage/view KiwiSaver performance?

Can I put extra money in KiwiSaver?

Outside of your and your employer’s regular contributions, you can make additional voluntary contributions towards your account at any time. This is a great tool when wondering how does KiwiSaver work. However, once you have made the payment, it is locked in until you’re eligible to withdraw your KiwiSaver benefits.

When you join a KiwiSaver scheme, its fundamental purpose is to stimulate good savings habits. That is the key intention of the question of how does KiwiSaver work. Therefore, of course, you can put extra money into your KiwiSaver scheme to be in a better financial position post-retirement.

With technological advances happening quicker than ever before, it’s becoming easier and easier to make additional contributions at your convenience. You can set up extra periodic payments from the get-go or at any other time. This is particularly useful for people who are self employed and may forget to contribute otherwise.

You can make these voluntary KiwiSaver NZ payments by either:

Transferring the money directly to your KiwiSaver scheme provider’s bank account. This is a preferred method as this avoids additional transfer time. The quicker it gets into this account, the quicker you can reap the KiwiSaver benefits.

Alternatively, via the Inland Revenue with the ‘Pay tax’ function offered by most New Zealand banks. Although this adds another layer to the process, it is a convenient way for some people. And, for those who are confused about how does KiwiSaver work, it can be a good solution.

If you join KiwiSaver through an employer, you can contribute this way too. Simply let your employer know of the amount you’d like to pay extra, and they will handle it for you.

Most KiwiSaver scheme providers will also have instructions and alternative solutions through their online portals. These are features you can check when joining KiwiSaver and at any time thereafter after registering for an account. Importantly, they are accessible to all, from those joining as self employed or through their employer.

How can I check on how my KiwiSaver is performing?

All providers are required to release quarterly and annual reports on how their KiwiSaver scheme performs. Transparency is a key component of the scheme. The reports give details, including returns, investment mix, fees, and their top investments. Providers release these on their websites, or you can compare with the Best Performing KiwiSaver Funds on our dedicated page.

In addition, most KiwiSaver schemes now have their own portal system you can register for and receive up-to-date performance information. From the moment you join KiwiSaver, you should get an online account and keep track of your returns periodically. As this is a long-term investment, we do not advise checking every day, but once a month is reasonable. Comparing your provider’s performance to the industry leaders may also motivate you to seek out better results. National Capital can help pinpoint the right KiwiSaver scheme for you if that is the case.

If you do decide to get advice from National Capital, we will also provide a yearly impartial revision. We’re happy to answer any questions, from how does KiwiSaver work, to maximising KiwiSaver benefits, particularly for your circumstances. It’s safe to say we’ll be there every step of the way, from setup, right through to retirement.

What if I don’t like what the KiwiSaver NZ scheme is investing in?

It’s not unusual to feel uncomfortable with your current KiwiSaver strategy and doubt if it’s the best for your savings. There are plenty to choose from, and some KiwiSaver schemes may align more with your views. By having a sit-down with your advisor, they can assess which KiwiSaver best fits your expectations and values. It is important to remember that by changing funds and or panic switching, you may lose some returns. That is something that people who wonder how does KiwiSaver work can get penalised for. You can change your KiwiSaver at any time, but you can only belong to one at a time. Finding the right time to switch is easier said than done.

When joining KiwiSaver, you may have different reasons than someone else for picking one company over another. While some people only focus on the investment returns, others choose one that aligns with their religious or social values. Moreover, you can also choose one scheme because it is easier to manage KiwiSaver with them, for example. User experience and customer service play a key role in many people’s choices during and after joining KiwiSaver. If you’re wondering how does KiwiSaver work, it may be the best choice to choose a scheme easy to navigate.

As mentioned previously, National Capital’s HealthCheck lets you see if your current provider is best for you. If not, we recommend joining KiwiSaver NZ choices that fit your needs.

What are the disadvantages of joining KiwiSaver?

When considering how does KiwiSaver work, it is safe to assume that the benefits far outweigh any disadvantages. However, it is still important to be aware of them. Especially when first joining KiwiSaver and figuring out how does KiwiSaver work, these shouldn’t come as a surprise.

KiwiSaver is generally considered a non-liquid asset. A liquid asset is one that can be quickly and easily turned into cash. As an example, money in your bank account is very liquid as it can be withdrawn at any time. On the other hand, a house is considered a non-liquid asset. A house takes time on the market and a bigger effort to turn into cash. You can withdraw your savings under only a few circumstances. Such as when you are over the age of 65 and it’s been at least 5 years since joining KiwiSaver. Alternatively, you can apply for withdrawal when purchasing your first home or in rare circumstances in extreme financial situations.

For many New Zealanders, it is the only investment ‘basket’ they put their hard-earned savings into. When it comes to financial freedom and investment, KiwiSaver NZ should not be your only move. It’s a great initiative as the minimum step towards financial freedom into your retirement. But, you should also be looking at diversifying with different investments. Have you done any research into property investment? Is there a business with a strong outlook but in need of cash, which you can invest in? Are there other high-performing mutual funds to invest in? Ultimately, if you are investing more than 3% of your wages, you should be asking yourself why.

KiwiSaver benefits are a no-brainer. It can play a big role in important stages of your life. But, KiwiSaver isn’t the ONLY tool for financial freedom.

What happens to my savings if I leave the country?

If you’re planning to move permanently out of NZ, it’s fair to ask what will happen with your KiwiSaver. Well, there are two answers depending on where you emigrate to. Different rules apply when you are moving permanently to Australia compared to the rest of the world.

If you move to Australia permanently, you can request to transfer from your KiwiSaver to an Australian superannuation scheme. Simply reach out to your KiwiSaver provider and they will guide you through the process. Your selected Australian superannuation scheme must be regulated by the Australian Prudential Regulation Authority (APRA). In addition, they must also be willing to accept the transfer from KiwiSaver. All contributions and the interest you’ve earned since joining KiwiSaver are eligible for the transfer into an Australian superannuation scheme. You can also leave your savings with your current scheme provider. However, you can’t request an early withdrawal when moving to Australia.

If you move to any other country permanently, you can request an early withdrawal. You can withdraw your, and employer contributions, interest earned, and any fee subsidies or $1000 kickstart since joining KiwiSaver. However, you cannot withdraw any government contributions since joining KiwiSaver. You can normally withdraw your KiwiSaver balance balance after living overseas for 1 year (not including Australia). If the foreign country has an approved superannuation scheme, you can apply for a transfer. The foreign scheme must comply with regulations as per the KiwiSaver Act 2006 (section 228).

If you move overseas short-term or plan to eventually return to NZ, you can leave your KiwiSaver open. While you aren’t employed in New Zealand, you can continue to make contributions.

Can I transfer my KiwiSaver balance to another person?

The short answer is no, you cannot gift your savings to someone else directly. As we’ve mentioned once you join KiwiSaver, you can only withdraw under certain circumstances. Those are when you reach the age of retirement (65), purchase your first home, or are under financial hardship.

However, you can switch KiwiSaver and funds, and we can help identify the best options available to you. For example, if you’re joining KiwiSaver self employed and after a while, you are employed by someone else, you can change to your employer’s preferred provider. However, your decision should be made based primarily on your circumstances rather than external factors.

KiwiSaver was created to serve as a way for Kiwis to enjoy a comfortable retirement without financial stress. Thus, since setting up KiwiSaver, strict limitations over account transactions were introduced to ensure you’re secure in the long run.

If you want to support someone else by gifting to their KiwiSaver, you can make additional contributions on their behalf. Most providers have a direct deposit option available for additional contributions. You simply need to ask the person you want to gift it to and they should have those details available. Similarly, they also can’t withdraw or transfer their balance to someone else.

Your intention may be to use your savings as your first home deposit. When purchasing a home for the first time with someone else, you can both apply for a withdrawal. That way, you can combine to contribute towards your house deposit.

Once again, you can reap KiwiSaver benefits to purchase your first home or retirement. Your goal should be to save and invest for a better and stable future.

In what circumstances can I get KiwiSaver money early?

I’m sure this isn’t a question that comes to mind when you join KiwiSaver but rather later on in life. It doesn’t matter how much you have saved. However, there are a few things to be taken into consideration.

In the event of your passing, your KiwiSaver savings can indeed be inherited. Contrary to some myths, the government does not automatically claim your KiwiSaver. Nor can you nominate a beneficiary directly within the KiwiSaver system.

From the moment of joining KiwiSaver, it is treated as an asset of your personal estate. With that in mind, it’s crucial to have a valid Will in place. With a Will, you can specify who should inherit your KiwiSaver and other assets. This legal document allows you to name beneficiaries and streamline the administration of your estate. This is done by appointing executors and trustees to carry out your wishes.

If you pass away without a Will and your total assets, including KiwiSaver, are valued at more than $15,000, the assets will be held until Letters of Administration are granted by the court. This can be a lengthy and expensive process for your loved ones to deal with.

Having a Will in place ensures that your KiwiSaver, along with your other assets, is distributed according to your wishes. While estate administration may still involve legal formalities like Probate, it’s generally quicker and more cost-effective when a pre-existing Will. This way, you can help ensure that your assets, including your KiwiSaver, benefit the people you intend to support.

How do I claim a deceased KiwiSaver?

Claiming a deceased KiwiSaver involves navigating a thoughtful and administrative process to ensure a smooth transition of funds. Promptly notifying the KiwiSaver scheme about the member’s passing is the initial step. This is done by contacting the customer service or bereavement support team, which guides you through the subsequent procedures.

Gathering the required documentation is crucial. A death certificate, details of the deceased’s KiwiSaver, and relevant legal documents (Will or grant of probate), should be compiled. The provider will furnish the necessary claim forms, which need to be meticulously filled out by you.

Proof of the relationship to the deceased, especially if you are the executor of the estate, is typically required. This could include being named in the will or having been granted probate. Additionally, bank account details must be submitted, specifying where the funds should be transferred, usually to the deceased’s estate.

Upon completion, a waiting period ensues as the KiwiSaver company reviews the documents and processes the claim. This can be a very stressful and difficult time, dealing with the loss of someone close to you. Unfortunately, these processes can take time, and it’s important to stay patient. Once the claim is approved, the funds will be distributed according to the deceased member’s will. In cases where there is no will, distribution follows the laws of intestacy.

It’s essential to recognise that the specific process might vary slightly across the KiwiSaver industry. Therefore, reaching out directly to the relevant company for precise instructions and forms is advisable. It’s good to know such a procedure even when first joining KiwiSaver. Seeking legal advice or assistance in handling deceased estates can also prove invaluable throughout this intricate process.

How much does the average person have in their KiwiSaver scheme?

According to the Financial Markets Authority KiwiSaver NZ 2024 Annual Report, the average person has a balance of $33,514. This figure is up 16.5% from the previous year.

Meanwhile, the total number of people who have joined and are currently members is 3,334,654. People joining KiwiSaver lifted this figure up by 2.5% from the previous year.

Your balance is a combination of your own contributions, plus your employer and the government, and your KiwiSaver performance. When using KiwiSaver self employed, your own and employer contributions are the same thing. The three types of contributions (you, employer, and government) collectively make up your overall contributions. Your KiwiSaver company invests contributions in your chosen funds to yield a positive return on your investment. Thus, the purpose of joining KiwiSaver is to incentivise Kiwis to save and invest for the future.

Out of 3,334,654 people registered in KiwiSaver, only 2,036,384 members contributed to their accounts. If they don’t contribute themselves, this means they don’t receive any government or employer KiwiSaver benefits either. Thus, they are solely reliant on investment performance for their balance to increase. When answering how does KiwiSaver work, this is a crucial point to grasp.

With KiwiSaver NZ being established in 2007, it is relatively young compared to other retirement schemes. Therefore, the median KiwiSaver scheme balance is still relatively low (although growing at a good rate). Consistent contributions and incremental returns will undoubtedly lead to growth in the average balance and maximisation of KiwiSaver benefits.

It’s never too late to start saving for retirement, and joining a KiwiSaver scheme is a great way to start.

Prefer speaking to a KiwiSaver Adviser?

Book a phone call with one of our KiwiSaver specialists.

We’ve helped hundreds of Kiwis sort out their retirement plan.