Who Is The Best KiwiSaver Provider For You?

Best KiwiSaver Providers - Updated Quarter of August 2025

National Capital regularly conducts research on the best KiwiSaver providers and updates figures based on the latest data. Each fund type differs in risk profile and returns, therefore, the table below lists the best KiwiSaver provider based on the different fund types.

| Fund Type | KiwiSaver Providers & Fund Name | 5-Year Average |

| Conservative | Pathfinder Conservative | 3.65% |

| Moderate | Milford Moderate | 5.15% |

| Balanced | Quaystreet Socially Responsible | 7.76% |

| Growth | Milford Active Growth | 10.12% |

| High Growth | Milford Aggressive | 10.07% |

Above is the list of the best KiwiSaver providers based on fund performance.

It is important to note that comparisons between KiwiSaver providers are based on past performance. They are not an indicator of how they will perform in the future.

Although finding the best KiwiSaver providers is subjective, we can compare overall performance. National Capital has broken down the best performing KiwiSaver funds ranging from low, medium, to high-risk investments.

However, the best KiwiSaver provider is about more than just annual returns. That all depends on your circumstances and lifestyle.

Choosing the right KiwiSaver provider means you need to consider:

- Fees, rules, and terms and conditions of the KiwiSaver provider.

- How and where your money is invested.

- The KiwiSaver provider’s investment approach to social and environmental issues.

- Who manages your funds.

Different KiwiSaver providers perform better in different funds. This means that depending on your risk appetite and circumstances, you may change KiwiSaver provider, fund category, or both. Yes, I agree, it can be overwhelming. That is why we’ve made it easy. Simply complete our Free KiwiSaver Recommendations form to receive your personalised recommendations.

The right KiwiSaver provider will make a big difference to your payout.

Spending 10 minutes to complete our KiwiSaver provider HealthCheck may be the most important thing you can do for your long-term financial freedom.

Who Are The Default And Other KiwiSaver Providers?

Default KiwiSaver Providers

There are several KiwiSaver providers to choose from. If you don’t pick your own KiwiSaver provider once set up, you are automatically appointed one. As at 26 February 2025 there are six default KiwiSaver providers:

- BNZ

- Booster

- BT Funds (Westpac)

- KiwiWealth

- Simplicity

- Smartshares (NZX)

June 2024 data from Inland Revenue shows over 3.1 million Kiwis are invested with a KiwiSaver provider. More than 19% of them joining through default KiwiSaver providers.

The six default KiwiSaver providers were appointed after a competitive tender, where each KiwiSaver provider was assessed based on criteria such as investment ability, user fees, customer experience, managing of transitional arrangements, and organisational structure.

Default KiwiSaver providers must engage with clients at key stages to help them make informed decisions on retirement savings and must not invest in fossil fuels or illegal weapons.

If a member was paired with a default KiwiSaver provider prior to December 1st, 2021, who is no longer on the list, they were transferred. This is of course if they haven’t made an active choice to stay with their existing KiwiSaver provider. This transfer occurred to ensure that members who opted for a default KiwiSaver provider continue to enjoy the benefits.

These benefits include the aforementioned low fees and service standards default KiwiSaver providers must adhere to. This transfer was done automatically with no action needed from members.

For the most up-to-date information on default KiwiSaver providers, you can go to the Inland Revenue website.

List of KiwiSaver Providers

With that said, here is a list of current KiwiSaver providers:

| 1. AE | 16. Kōura Wealth |

2. AMP | 17. Medical Assurance Society (MAS) |

| 3. Anglican Financial Care | 18. Mercer |

| 4. ANZ | 19. Milford |

| 5. ASB | 20. New Zealand Funds Managment |

| 6. BNZ | 21. Nikko |

| 7. Booster | 22. Pathfinder |

| 8. BT Funds (Westpac) | 23. PIE KiwiSaver Scheme |

| 9. Civic Financial Services | 24. SBS |

| 10. Consilium NZ | 25. Sharesies |

| 11. Craigs Investment Partners | 26. Simplicity |

| 12. Fisher | 27. Smartshares |

| 13. FundRock NZ | 28. Summer |

| 14. Generate | |

| 15. Kernel Wealth |

If you wish to find out more about each KiwiSaver provider you can check out their websites for more information.

Choosing the right KiwiSaver provider is not an easy decision.

Spending 10 minutes to complete our KiwiSaver provider HealthCheck could be the best thing you do right now.

Best KiwiSaver Providers - Everything You Need To Know

When you first start working between the ages of 18 and 65 you are automatically enrolled with a KiwiSaver provider. Unless of course, you decide to opt out. From the date you register with a KiwiSaver provider, you have eight weeks to opt out. You can apply for a KiwiSaver opt-out request through Inland Revenue (IRD).

This freedom of choice extends to your ability to switch KiwiSaver providers too. Although we don’t suggest you shift between schemes and funds often, you can change KiwiSaver providers to find the best KiwiSaver provider for you. Furthermore, changing KiwiSaver providers is very easy to do.

When choosing a KiwiSaver provider, you may consider many factors. After all, investing a portion of your savings from the age of 18 to 65 can lead to significant returns. Choosing the best KiwiSaver provider and fund for you is very important to securing financial freedom. It can mean the difference between below or above-average results. It’s not just about a KiwiSaver provider’s overall performance. Other factors such as fees, timing, and investment fund, are all important. We consider all aspects when analysing your unique circumstances to provide Free Recommendations on the best KiwiSaver providers.

National Capital is a financial advisor specialising in KiwiSaver provider research to help Kiwis make smart financial decisions. If you’re currently in research mode and are unsure about selecting amongst the best KiwiSaver providers, you’ve come to the right place. We take the time to ask about your current situation and goals in order to make a qualified recommendation. Get in touch with us if you need help along your KiwiSaver provider research process.

Best KiwiSaver Providers - Frequently Asked Questions

Another aspect to touch on is the difference in overall customer satisfaction between the best KiwiSaver providers.

According to Consumer NZ’s annual KiwiSaver provider satisfaction survey, Generate ranked the highest with 80% overall satisfaction in 2025. Customers of the Generate KiwiSaver provider were particularly impressed with ease of access and features in its digital platform. Milford Funds and Simplicity were other KiwiSaver providers that ranked high in consumer satisfaction. The second ranked KiwiSaver provider, Milford, in part due to strong communication and customer confidence in returns. Whereas the third ranked KiwiSaver provider, Simplicity was appreciated for the fairness of its fees and ethical focus.

Mercer took last place amongst KiwiSaver providers with the lowest customer satisfaction rating. Customers were particularly not impressed with service quality and value for money. Smart came second last amongst KiwiSaver providers. It scored particularly poorly with engagement and customer support. ANZ was ranked the third worst amongst KiwiSaver providers with a continued decline in satisfaction year on year. Particularly about not addressing transparency and fee concerns.

The ratings are essentially given based on KiwiSaver providers keeping customers informed with their balance and performance. Additionally, the ease in which they can access their accounts and their enquiry response time. Ultimately, your KiwiSaver provider should make it as easy as possible for you to track your account and performance and minimise disruption.

You’re ready to make an active decision on your scheme but are left wondering how on earth I find my KiwiSaver provider.

You may have a default KiwiSaver provider but you’re not sure which one. Alternatively, some businesses have their own preferred KiwiSaver providers that you can join if you have no preference. Regardless, if you do not know who your KiwiSaver provider is, there are multiple ways to find out.

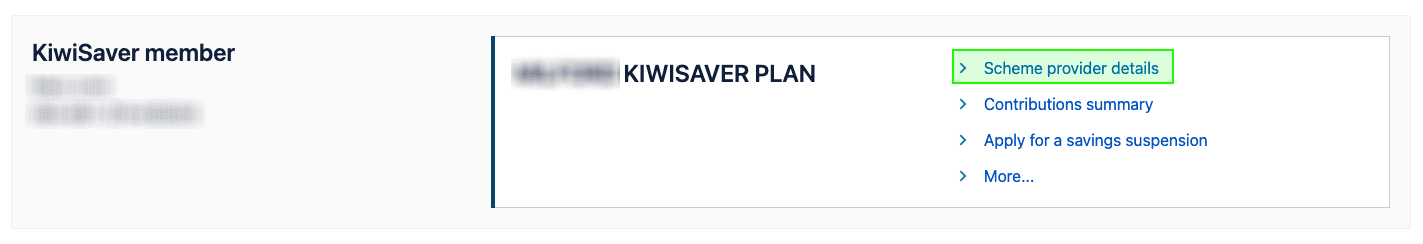

- Log in to your My IR Account through Inland Revenue. Once you are on the Summary Dashboard, if you’re a KiwiSaver member, you can see your KiwiSaver provider details. Simply click through ‘Scheme provider details’ to find the name of your KiwiSaver provider, website, and phone number.

- If you don’t know your My IR Log In details, you can contact Inland Revenue and ask them which of the KiwiSaver providers you’re with. Having your IRD number ready will come in handy when contacting Inland Revenue.

- If you were automatically enrolled with your employer’s preferred KiwiSaver provider, you can ask them for the provider’s details.

Ultimately, to find your KiwiSaver provider, shouldn’t be too difficult. Inland Revenue is your best option to track down the correct details.

Of course, you can change your KiwiSaver provider at any time. As per IRD statistics, more than 143,000 people changed between providers in 2023-24.

There are many people like myself that get paired with a default provider and may consider changing later. Once I find my KiwiSaver provider details and performance results, I can start gathering information to make an informed decision. You don’t have to go through this alone though. A financial advisor, like National Capital, is here to make the process easy by offering you advice and comparison data.

There are many reasons why you may decide to make the move. You may be after a KiwiSaver provider offering the cheapest fees. Alternatively, you may want to move to the top performer in any particular fund. Your decision can also rest on how ethical their investment strategy is. Although, most KiwiSaver providers are increasingly aware they are open to scrutiny on their investment decisions on an ethical basis. You may also decide to pick one depending on their customer service rating and overall user experience.

Most people who come to us regarding their KiwiSaver provider will make a decision based on their short and long-term goals. If you are wanting to withdraw your balance to use for a first home deposit, you may consider picking a less volatile fund. The National Capital team uses the latest performance data to recommend the best KiwiSaver provider for that scenario. On the other hand, you may be after long-term high returns. Once again, National Capital crunches the latest data comparing all KiwiSaver providers to recommend the best option.

We wrote a detailed article on how to switch providers. In fact, you may be surprised by how easy and quick the process can be. Alternatively, contact us to find the best KiwiSaver providers for you.

The short answer is no. You can only have one KiwiSaver provider at any one time. The current rules have been in place since launch and there’s no indication they are about to change.

However, we often talk about diversification and how important it is for a successful long-term strategy. With diversification in mind, I am able to split my investment between multiple funds offered by my KiwiSaver provider. Of course, you can too.

Most KiwiSaver providers invest your funds in multiple asset classes ranging from cash, fixed interest, and international shares. Moreover, they offer different funds depending on your risk tolerance and financial goals. As mentioned, all KiwiSaver providers allow you to split your investment in multiple funds if you wish to do so.

According to Interest, there is currently no intention or discussion to allow people to have two or more KiwiSaver providers. That goes for the government as well as KiwiSaver providers themselves.

If you aren’t in the finance industry, you may not know how and why to choose between providers. The government selects a number of default options for people that haven’t actively chosen their KiwiSaver provider. However, that doesn’t necessarily guarantee the best performance or may not align with your financial goals. National Capital was founded with the mission to help Kiwis make an informed choice when selecting their provider.

We’ve established that you can only select one KiwiSaver provider. Naturally, to make an active choice, there are certain criteria that you should consider. Of course, fees are one factor. Investment performance and ethics are other important factors. You should also consider your short and long-term financial goals. National Capital offers free recommendations to find out which provider best fits your needs.

We must stress, that the cheapest fees don’t necessarily sway performance one way or another. A KiwiSaver provider can have the cheapest fees but offer significantly lower returns than the provider with slightly higher fees. The opposite is also true. A KiwiSaver provider with higher fees may also offer lower returns than another with lower fees.

The moral of the story is, that you shouldn’t be making your choice based on fees. We break down exactly why in this article here. Nonetheless, here’s a list of the cheapest KiwiSaver providers for each fund offered according to the Morningstar – March 2022 Report:

Provider & Fund | Admin & Other Fees | Management Fees | (Fees) Industry Av. | 5-Year Average Annual Return | (Return) Industry Av. |

Conservative Fund – Simplicity (Default) | $0 | 0.31% | $0 + 0.66% | – | 3.60% |

Moderate Fund – BNZ | $0 | 0.58% | $18 + 0.90% | 5.10% | 4.60% |

Balanced Fund – SuperLife (Default) | $0 | 0.20% | $23.40 + 0.20% | – | 6.60% |

Growth Fund – Simplicity | $20/year | 0.30% | $21.70 + 1.16% | 9.60% | 8.60% |

Aggressive Fund – SuperLife High Growth | $30/year | 0.63% | $26.70 + 1.24% | 8.30% | 9.30% |

We can see the BNZ Moderate Fund has one of the lowest fees and is yet outperforming the industry average. On the other hand, the SuperLife Aggressive Fund has the lowest fees but has been underperforming against the industry average.

Some KiwiSaver providers structure their fees differently from the standard fixed admin fee plus a management fee. JUNO for example structures its admin fee based on the dollar value of your investment portfolio. Their admin fee ranges from $0 to $600 depending on the total value of your portfolio. Therefore, making it more difficult to compare KiwiSaver provider fees, much like apples and oranges.