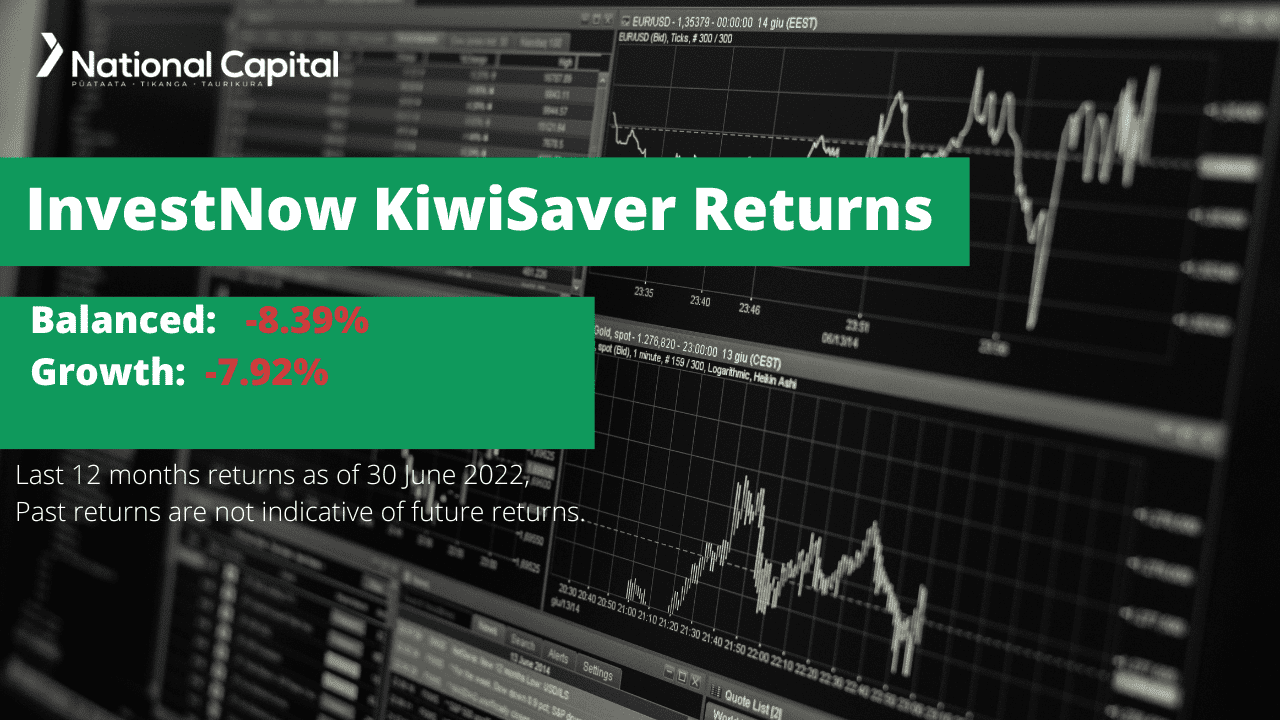

InvestNow KiwiSaver Performance – June 2022

Using the most recent returns and fund update reports from June 2022, we will examine InvestNow’s recent KiwiSaver Performance.

Foundation Series is run by InvestNow, which is a New Zealand-based online investment platform that allows Kiwi investors to invest in KiwiSaver, Managed Funds and Term Deposits from fund managers and banks around the world. It is designed specifically to enable everyday New Zealanders to invest without going through a financial advisor or broker. However, you will not receive financial advice.

In July, the New Zealand market underperformed due to the repercussions of the coronavirus pandemic. The negative returns provided in this period demonstrate the nationwide effects, such as the increase in the cost of living and inflation increases. Despite this, there is a more positive outlook for the future performance of these funds as border restrictions in New Zealand are opening and markets slowly readjusting after numerous lockdowns.

Table of Contents

News about InvestNow

Performance of InvestNow KiwiSaver Funds

InvestNow Balanced Fund

InvestNow Growth Fund

News about InvestNow

In June, InvestNow has four new funds available for investors, including Russell Investments Global Listed Infrastructure Fund, Russell Investments Hedged Sustainable Global Shares Fund, Russell Investments Sustainable Global Shares Fund and the Devon Sustainability Fund. This gives more opportunities for investors using InvestNow to diversify and allocate funds with companies they align with.

Performance of InvestNow KiwiSaver Funds

|

1-Month |

3-Month |

6-Month |

1-Year |

|

|

Balanced |

-3.87% |

-7.94% |

-12.26% |

-8.39% |

|

Growth |

-4.48% |

-9.15% |

-13.48% |

-7.92% |

Sourced from InvestNow fund performance report

* These returns are to 30 June (date of returns) and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from InvestNow Quarterly Fund updates published on Date published 30 June 2022.

InvestNow Balanced Fund

The Foundation Series Balanced Fund is intended to perform in line with the return of its investment benchmark over the long term. The Balanced Fund’s strategy aims for mid-range long-term returns by investing in a diversified portfolio with balanced income and growth assets for investors with a balanced tolerance.

The 1-month return for the fund was -3.87%, and the 1-year return was -8.39%. This is because the is a relatively new fund (2nd Sep 2020). Therefore there is no long-term past performance to indicate future performance.

*The following is Sourced from InvestNow Balanced Fund Update

Returns

Fees

The total annual fees for investors in the InvestNow Balanced Fund are 0.37% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows InvestNow’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 100% of the fund.

InvestNow Growth Fund

InvestNow aims to perform broadly in line with the return of its investment benchmark before fees and tax over the long term. Strategy: aims for high long-run returns by investing in a diversified portfolio weighted towards growth assets but with some income asset exposure.

The Fund had a 1-month return of -4.48% with a 1-year return of -7.92%, and like the Balanced Fund, the Growth Fund has only accepted contributions since the 2nd of September 2020.

*The following is Sourced from InvestNow Growth Fund Update

Returns

Fees

The total annual fees for investors in the InvestNow Growth Fund are 0.37% per year.

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows InvestNow’s top 10 investments in the Growth KiwiSaver Fund, which comprise 100% of the fund.

Data for InvestNow KiwiSaver funds have been sourced from InvestNow KiwiSaver Funds (Link to fund documents). Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if InvestNow has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.