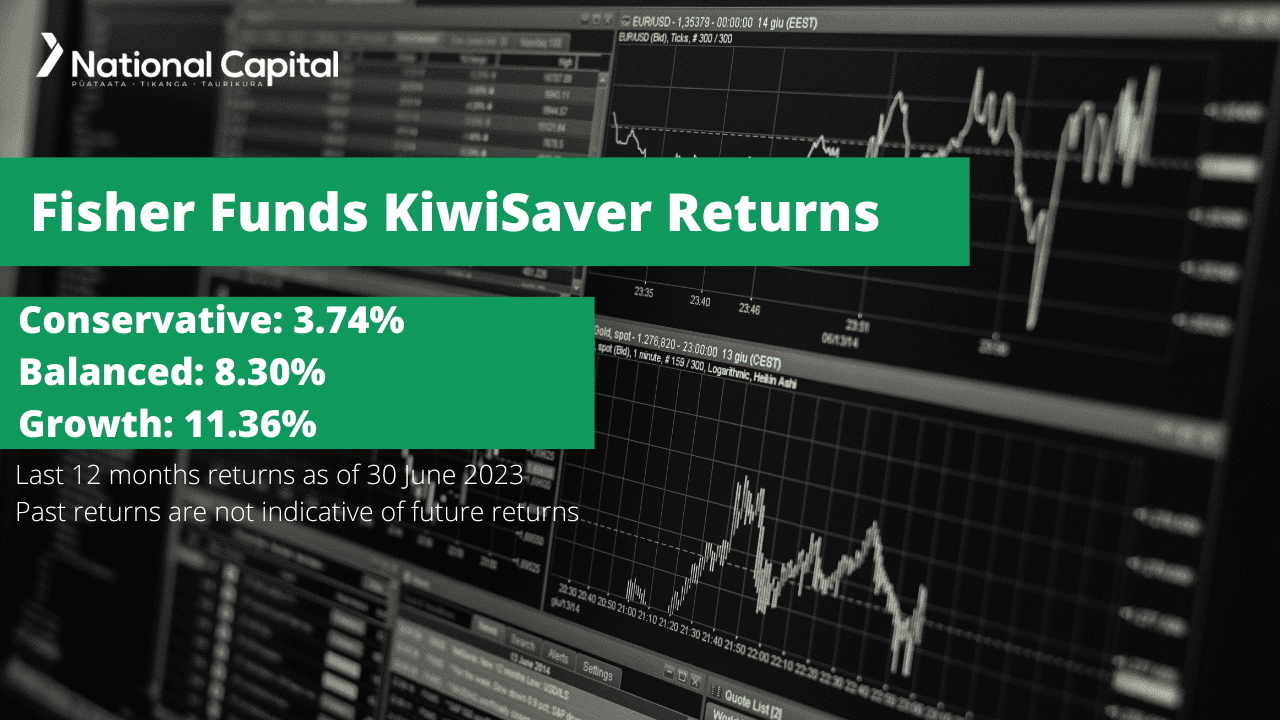

Using the most recent returns and fund update reports from September 2023, we will examine Fisher Fund’s recent KiwiSaver Performance.

Fisher Funds is a fund management company that was founded by Carmel Fisher in 1998 that provides a number of services. These services include KiwiSaver funds, managed funds, premium services tailored to high net worth individuals, workplace LifeSaver plans geared towards retirement, and financial advice.

Table of Contents

News about Fisher Funds

Performance of Fisher Funds KiwiSaver Funds

Fisher Funds Conservative Fund

Fisher Funds Balanced Fund

Fisher Funds Growth Fund

News about Fisher Funds

On August 15, Fisher Funds announced the acquisition of Kiwi Wealth, Kiwibank’s KiwiSaver scheme, for NZ$310 million. After this acquisition, Fisher Funds still holds the fourth largest KiwiSaver provider position and is now managing up to $14 billion in funds.

Fisher Funds CEO Bruce McLachlan has said regarding this acquisition, “As a business founded in New Zealand, we’re delighted to welcome another great New Zealand business of the calibre of Kiwi Wealth into the Fisher Funds family”. Additionally, Mr McLachlan has stated that their top priority is working closely with Kiwi Wealth to provide support throughout this transition period for all members of the KiwiWealth KiwiSaver scheme.

Performance of Fisher Funds KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Conservative |

2.6% |

2.4% |

4.4% |

|

Balanced |

5.4% |

4.5% |

6.9% |

|

Growth |

7.2% |

6.1% |

7.3% |

Sourced from Fisher Funds fund performance report.

* These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Fisher Funds Quarterly Fund updates published on 30 June 2023.

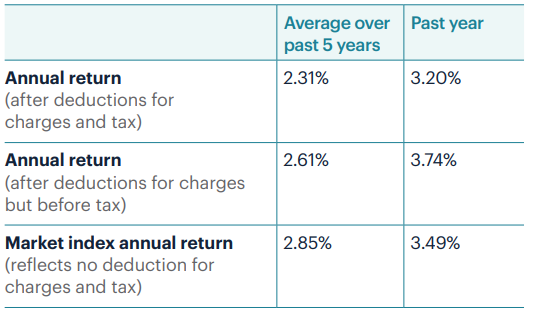

Fisher Funds Conservative Fund

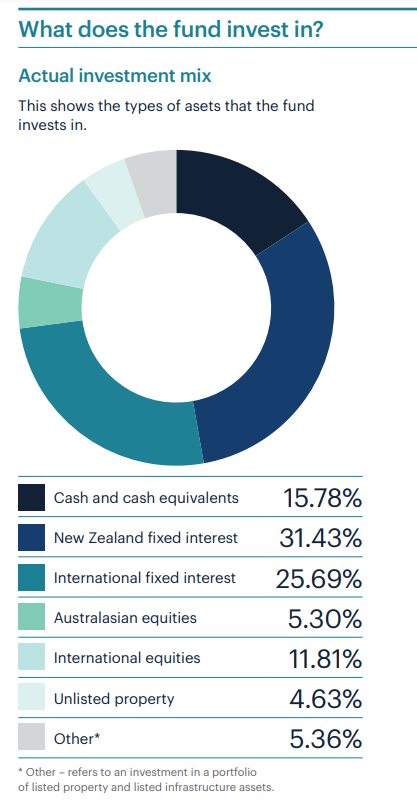

The Conservative Fund invests mainly in income assets, which include cash and cash equivalents and fixed interest, with minor exposure to growth assets such as equities, listed property, and listed infrastructure.

*The following is Sourced from Fisher Funds Conservative Fund Update.

Returns

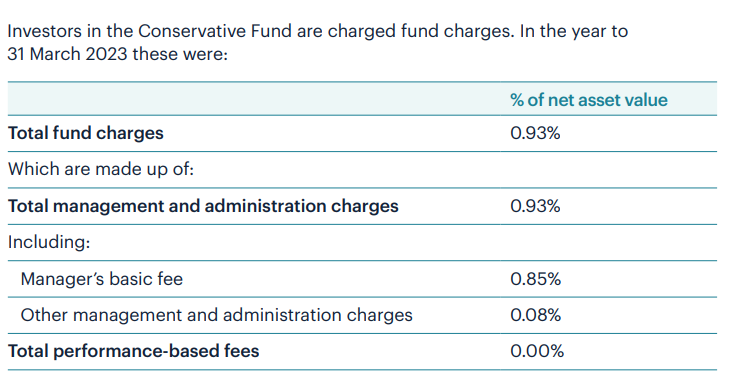

Fees

The total annual fees for Fisher Funds Conservative Fund investors are 0.93% per year.

Investment mix

Top ten investments

This table shows Fisher Fund’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 13.66% of the fund.

Fisher Funds Balanced Fund

The Fund invests like the Balanced Fund, focusing on a balance of income assets (cash and cash equivalents and fixed interest), and growth assets, and is aimed at investors with balanced volatility.

*The following is Sourced from Fisher Funds Balanced Fund Update.

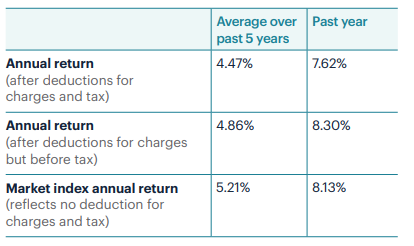

Returns

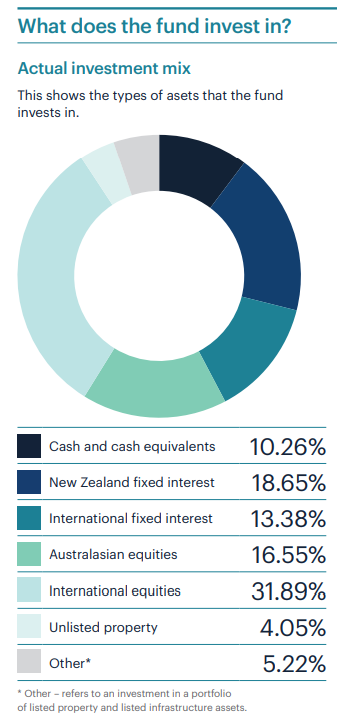

Fees

The total annual fees for investors in the Fisher Funds Balanced Fund are 0.98% per year.

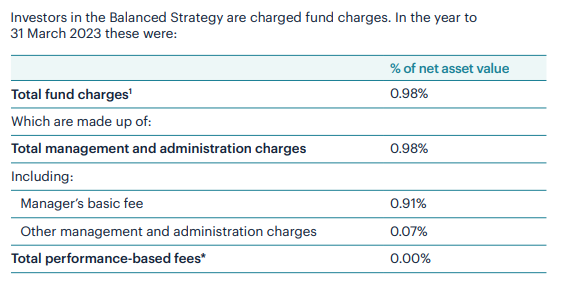

Investment mix

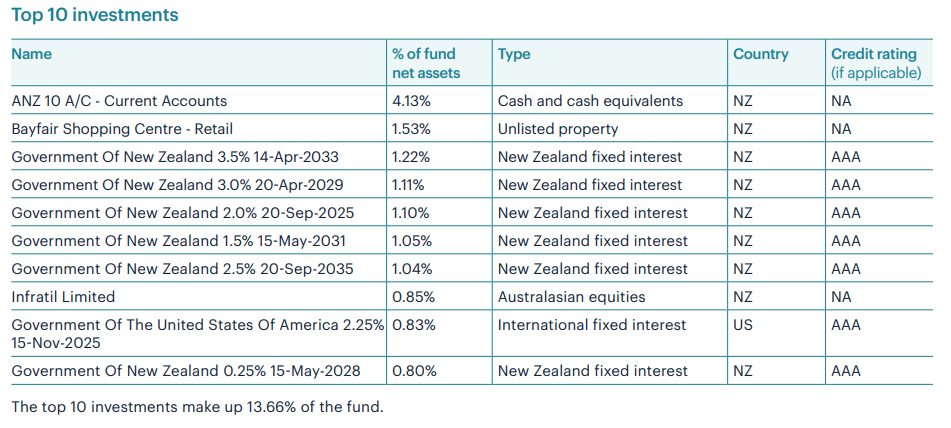

Top ten investments

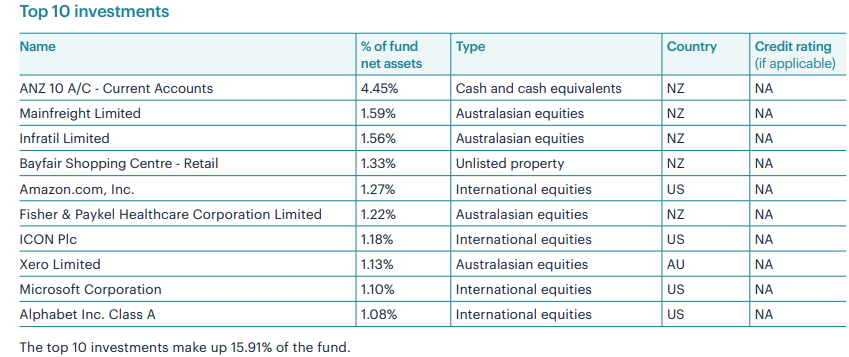

This table shows Fisher Funds’ top 10 investments in the Balanced KiwiSaver Fund, which comprise 15.91% of the fund.

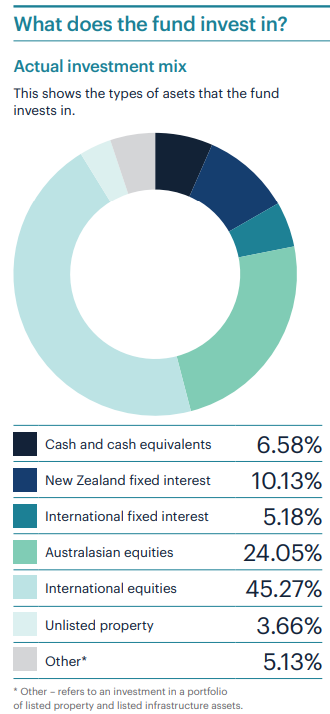

Fisher Funds Growth Fund

The Growth Fund invests mainly in growth assets, including equities, listed property, and listed infrastructure, with a smaller exposure to income assets.

*The following is Sourced from Fisher Funds Growth Fund Update.

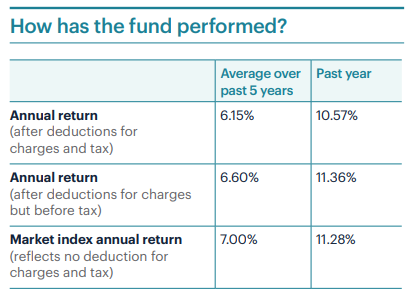

Returns

Fees

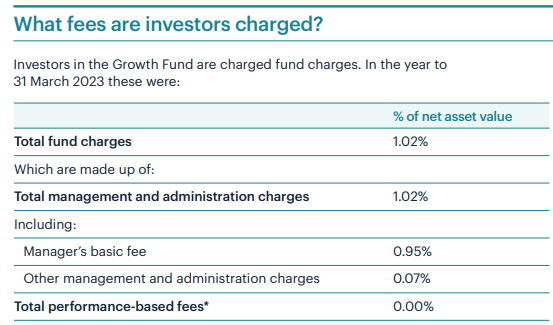

The total annual fees for investors in the Fisher Funds Growth Fund are 1.02% per year.

Investment mix

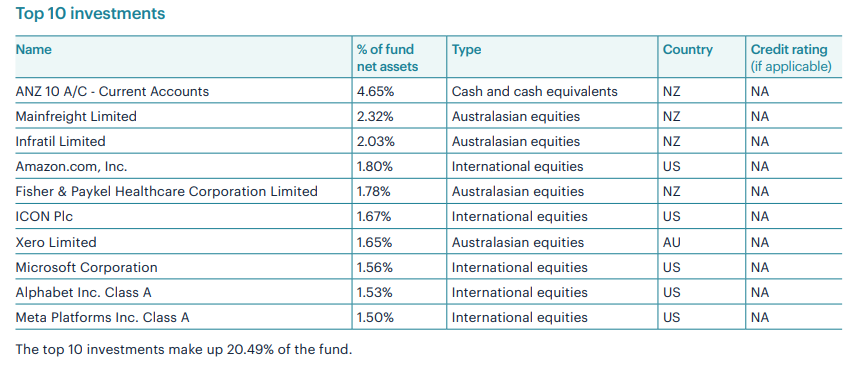

Top ten investments

This table shows Fisher Funds’ top 10 investments in the Growth KiwiSaver Fund, which comprise 20.49% of the fund.

Data for Fisher Funds KiwiSaver funds have been sourced from Fisher Funds KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Fisher Funds has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.