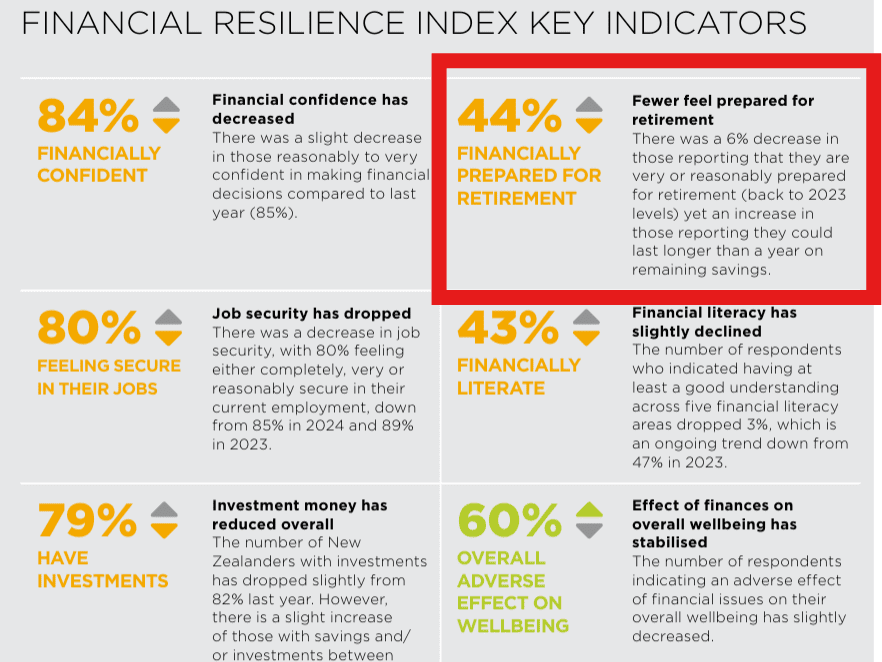

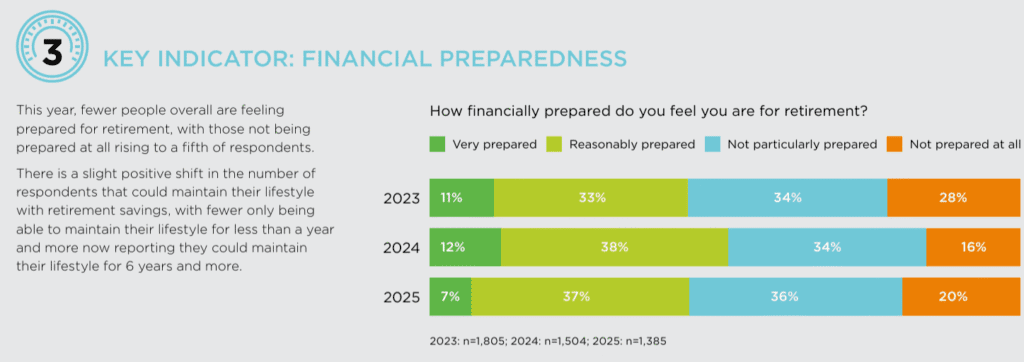

The 2025 Financial Resilience Index from the Financial Services Council (FSC) has revealed a worrying trend: fewer New Zealanders feel prepared for retirement. In 2025, just 44% say they feel very or reasonably prepared—a drop of 6% from last year, taking us back to levels reported in 2023.

Source: FSC Financial Resilience Index, 2025

This decline comes even as some financial pressures like inflation and interest rates begin to ease. Even more concerning, one in five people say they don’t feel prepared at all for retirement. Many also believe their retirement savings would only last a few years which isn’t enough for the decades many Kiwis will spend in retirement.

This brings to attention a key issue: while most Kiwis are enrolled in KiwiSaver, many aren’t confident they’re saving enough. Some may not be contributing regularly or enough, or don’t know if their current investment settings are right for their goals. And although KiwiSaver is the most common investment Kiwis hold, not everyone is making the most of it.

When people aren’t confident about their retirement prospects, it can lead to difficult trade-offs in the future: delaying retirement (if they can), relying more heavily on government assistance, or lowering their expected standard of living.

KiwiSaver was designed to help Kiwis build a better future, but it’s clear that more support and education are needed. Providers, employers, and advisers all have a part to play in helping New Zealanders understand how much they’ll need and what steps they can take now to improve their outcomes.

If we don’t act today, more people could find themselves reaching retirement without the savings they need. Now is the time to re-engage with your KiwiSaver investments: check your contribution rate, make sure your fund suits your age and goals, and seek advice if you’re unsure. Small steps today can make a big difference tomorrow.

One way to check you are on track is to complete the National Capital financial HealthCheck. It only takes 15 minutes to complete, you’ll receive a recommendation from us and we can even help you transfer to the right KiwiSaver fund for your circumstances. Best of all, our service is free to you as we are paid by KiwiSaver providers. What are you waiting for? It could be the best decision you make today!