How To Increase KiwiSaver Contribution – All You Must Consider

Do you want the maximum KiwiSaver contribution? Are you getting the full KiwiSaver government contribution each year? Or maybe you want to learn how to increase KiwiSaver contribution gradually at an achievable and sustainable level over time. Below, you can find the answers you are seeking and more.

What KiwiSaver Fund Should I Be In?

The right fund depends on you — your goals, timeframe, and your capacity for volatility. Don’t leave your KiwiSaver on autopilot.

Struggling Financially? KiwiSaver Hardship & Better Ways Forward

Life can throw unexpected challenges — rising living costs, job loss, family emergencies. If you’re feeling financially stuck, you’re not alone. Thousands of Kiwis are in the same boat.

Why Is My KiwiSaver Balance Going Up and Down? A Simple Guide to Market Volatility

Have you noticed your KiwiSaver balance jumping around lately? Don’t worry—it’s likely due to something called market volatility.

Can employees opt out of KiwiSaver?

Can employees opt out of KiwiSaver?

How is KiwiSaver treated in divorce?

How is KiwiSaver treated in divorce?

Can I Use My KiwiSaver To Pay Off Credit Card Debt?

Can I Use KiwiSaver To Pay Off Credit Card Debt?

What Reasons Can You Withdraw From KiwiSaver?

What Reasons Can You Withdraw From KiwiSaver?

Want to bring your AU Super home to KiwiSaver? Here’s how to get started!

Bringing your Australian Superannuation (AU Super) home may be a smart financial choice if you have decided to stay in New Zealand permanently. You can consolidate your retirement savings and benefit from the KiwiSaver scheme’s advantages. This article will provide you with all the information to check your eligibility for transfer and guide you through […]

Differences Between KiwiSaver and Australian Superannuation

KiwiSaver’s Tax and Contributions Policies If you’re preparing for retirement in New Zealand, it’s vital to get to grips with the tax and contributions linked to KiwiSaver.

KiwiSaver’s Ethical Investing Approach Proves Profitable: Maximising Returns With Conscience

Ethical investment has become the centre of attention in New Zealand since more investors have started prioritising how funds affect the environment, society, and governance. Ethical investing helps to hold companies accountable for their actions and can lead to long-term sustainability. When investing ethically, there are benefits to the environment and society, but ethical investing […]

One investor – Multiple KiwiSaver Providers at Once. Good or Bad?

KiwiSaver, New Zealand’s largest saving scheme, stands on the verge of a potential transformation. The National Party’s new KiwiSaver policy proposes allowing individual Kiwis to split their KiwiSaver retirement funds across multiple providers. The proposal has ignited a discourse that could reshape how Kiwis navigate their financial futures. As KiwiSaver continues to play a pivotal […]

Simplicity Investing Habits Changing?

Simplicity, a prominent KiwiSaver fund manager, has been undergoing a transformation in its investment strategies. This shift from passive to active management is noteworthy and deserves a detailed examination. This article delves into the various facets of Simplicity’s investment approach, exploring the transition, the areas where Simplicity believes it has an advantage, and the justifications […]

Pay off Mortgage or contribute to KiwiSaver?

Recently, BusinessDesk received an email from a reader seeking financial advice. It turns out her stepfather had some questionable suggestions for her and her husband. The reader and their husband earn around $150,000 pre-tax, have a huge mortgage of $600,000 and currently cannot contribute more than 3% to their KiwiSaver. According to her stepfather, they […]

How KiwiSaver Compares To Australian Superannuation Funds

KiwiSaver was introduced in 2007 by the Fifth Labour Government to combat the lack of household savings in New Zealand. We had some of the lowest savings per household within developed countries until it was introduced.

Can ChatGPT Replace Your Investment & KiwiSaver Adviser?

ChatGPT has taken 2023 by storm. The open language model “chatbot” developed and launched by OpenAI in 2022 has certainly generated mass interest. It is almost surprising how quickly it has been adopted by individuals and companies alike.

5 Common Misconceptions About KiwiSaver

Kiwis from all walks of life have been able to save for retirement and buy their first home thanks to the introduction of KiwiSaver in 2007. Since then, it has been deeply ingrained in the culture of the New Zealand financial system.

Who do I contact regarding KiwiSaver?

Saving for your retirement can be a daunting topic for anyone, especially when you feel as though you are being left behind by those people who have it all sorted out. However, everyone deserves to feel stable, and that they will move into retirement with the money they need to remain that way.

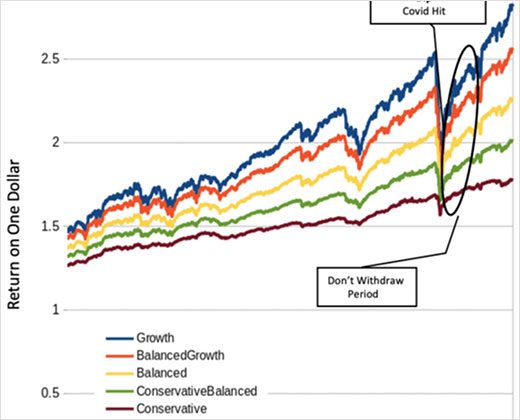

My KiwiSaver has lost money, should I change to a lower volatility fund?

It can be daunting and downright worrying when you see your investments such as KiwiSaver drop in value. Naturally, we think to ourselves “Should I withdraw my funds before it drops even further?” or “Do I change to a lower volatility fund?”. We suggest that you shouldn’t and here is why.

What will my weekly expenses in retirement be?

Weekly Expenses in Retirement

Where the best place to safely invest your money is?

The safest place to invest your savings is somewhere you feel most comfortable and that helps you achieve your financial goals. No matter where you invest, you will always be facing risks. However, there are ways you can reduce these risks.

Buying land and building with KiwiSaver

Many Kiwis dream about owning their own home, but not everyone dreams of their first home purchase being an existing property. It is becoming an increasingly popular option for first home buyers to have their sights set on purchasing land and building. Luckily, KiwiSaver includes land purchases in the First Home Withdrawal scheme, meaning you […]

What exactly is your KiwiSaver money invested in? (Asset Breakdown)

If you’re like me, from time to time, you wonder where your KiwiSaver money is invested.

Can I Transfer QROPS Money from one KiwiSaver Provider to Another?

Can I transfer QROPS money from one provider to another?

How Global Markets and Events Impact Your KiwiSaver Balance

A lot has happened during the last few years. You may have noticed your investment go through a rollercoaster ride at the same time. Above all, I want to point out that the investment volatility you experience is normal during times of global instability.

What happens to my KiwiSaver once I turn 65?

What happens to my KiwiSaver once I turn 65?

What is Volatility Capacity and the Investment Horizon?

What is Volatility Capacity?

Why is your KiwiSaver balance dropping?

The stock market has had very good returns in the past few years. However, due to various factors, it has dropped in the last month. One of these factors is rising interest rates. Normally when interest rates rise, the attraction to stocks goes down which causes a drop. It is impossible to predict the timing and […]

Can you lose money in KiwiSaver?

With chatter about Cryptocurrency and Sharesies becoming a popular conversation during summer BBQs and potluck dinners …

What Stops You From Using KiwiSaver For First Home

What Stops You From Using KiwiSaver For First Home

How KiwiSaver Schemes are Diversified

So what is Diversification?

What Happens to my KiwiSaver money if I Die?

How often do you ask yourself what would happen to your KiwiSaver account after you pass away? Probably not often right? There are quite a few misconceptions when it comes to the discussion on ‘What will happen to my KiwiSaver money if I die?’ and we would like to debunk the myths below right off […]

What Happens to my KiwiSaver Money If I Die?

How often do you ask yourself what would happen to your KiwiSaver account after you pass away? We bet not very often.

Does Your KiwiSaver Provider offer Independent Financial Advice?

KiwiSaver managers are currently not required to provide or offer financial advice for their customers like yourself. Of the 30+ KiwiSaver providers, there is a wide variety of levels of advice offered; from no advice at all right through to personalised advice from independent financial advisers. We’ll investigate what that means for you and whether providers […]

Have KiwiSaver Managers reacted since the FMA tightened their belt?

In April 2021 the Financial Markets Authority (FMA) released guidance for KiwiSaver scheme providers managed fund fees and value for money. What does this mean for you? Let’s find out! In its guidance, the FMA made it clear that some schemes were not delivering value for money. KiwiSaver providers continue to generate increasing fee revenue […]

I want my KiwiSaver money invested ethically, should I invest with Fisher Funds?

The demand for ethical investments in KiwiSaver is becoming increasingly popular, with 49% of Kiwi’s looking for a responsibly invested KiwiSaver fund. New Zealanders are clearly making a shift towards ethical investments of their KiwiSaver accounts, so let’s find out how Fisher Funds is achieving ethical status.

Is the ‘Risk Indicator’ on your KiwiSaver PDS useful or not?

One of the things that we take pride in here at National Capital is our constant drive to research everything and anything that has to do with KiwiSaver in order to give our clients a full picture of their investment position.

What Happens to My KiwiSaver Account on My 65th Birthday?

What happens to your KiwiSaver Account on your 65th Birthday? It’s not often we adults get excited about turning another year older, but turning 65 is a milestone we should all look forward to, and deserves congratulations. You may be planning to put down the tools or perhaps you want to keep on working, either […]

Is Using KiwiSaver For Your First Home Deposit a Good Idea?

Buying your first home, like any other big life decisions can be exciting but also a little bit daunting. After all, there’s a lot to think about. How to finance it is one of the big questions. If you are a New Zealand resident or citizen living in our lovely Aotearoa and you have been […]

How much return do I need from my KiwiSaver account?

In our last post we showed you how to find the amount you need as a lump sum at retirement. Finding that goal is half the battle, the next step is figuring out the rate of return you need from your KiwiSaver fund to achieve that lump sum. That will allow you to choose the […]

When is the Best Time to Retire?

Unfortunately the answer is not tomorrow… Retirement is a question that is on everyone’s mind whether it be in a few short years or a lifetime in the workforce away. Working out what you will need to have sorted and saved for your retirement can be daunting and overwhelming, not to mention deciding on when […]

How ‘Compounding’ Can Increase your KiwiSaver Return

The basic concept of investing can be quite simple at the surface level. Invest X dollars, make a certain rate of return during the year and end up with X dollars plus that return. But what happens next year? Would you earn the same return the following year? The frustrating answer to this question is […]

Is KiwiSaver The Best Option For Your Extra Savings To Go Towards?

Having some extra money lying around after you pay for all the necessities and any debt or mortgage is taken care of is a great thing. So when you do have that money available to you what should you be doing with it? A question we get from our clients is if they should invest […]

What Happens to Your KiwiSaver After Bankruptcy?

Bankruptcy is not something one would wish to go through but for people who are inundated with debt and have no other option this could be their saving grace. Bankruptcy is a way of clearing out your debt score if you do not have the means to pay back the people or organisations you owe […]

What happens to my KiwiSaver after a divorce?

Breakups are hard and divorce in particular is not an easy thing to go through, what with the couple’s belongings having to be divided fairly between the two on top of the emotional trauma. Although we do not wish that upon anybody, according to Statistics NZ over 82,000 couples a year divorce and many more […]

What Happens to my KiwiSaver money if I Die? (Part 2)

How often do you ask yourself what would happen to your KiwiSaver account after you pass away? We bet not very often.

How does National Capital Research Different KiwiSaver Providers?

Choosing the right KiwiSaver provider to manage your life savings is a very important decision. But with the vast range of options available, choosing the right provider and fund can seem overwhelming. Doing the right research can be tricky. However, with some guidance from National capital and our approach to the research process it can […]

How Dollar Cost Averaging can Help make more Money in your KiwiSaver

How Dollar Cost Averaging Helps you make more money in your KiwiSaver account What if there was a way to time the markets perfectly – by investing more when the markets are at a low and investing less when the markets are expensive. Buy low, sell high!

Recession NZ: Is your KiwiSaver ready?

Your KiwiSaver funds are a very important investment. Whether you’re saving for your first home or teeing up that retirement down the track. So it begs the question, what will happen to your KiwiSaver if things go bad? Are you all set up in preparation for the next recession?

Can I access KiwiSaver money early if I have health issues?

So let’s imagine you have some health problems.

What happens to KiwiSaver money if I emigrate?

Let’s do a bit of KiwiSaver trivia here.

What happens after you fill out our KiwiSaver HealthCheck?

So let’s say you’ve filled out our KiwiSaver HealthCheck. You understand that by doing so, you can get free financial advice regarding your KiwiSaver.

Invest more in KiwiSaver, or spread your investments out?

So, you’re on board with the idea you should invest your money.

3 different KiwiSaver investing terms that people mix up

Investing can be considered as a tricky topic for some. However, even for investors that have got their head around the basics, there is still some room for confusion. In this blog post, you will hear about three different sets of KiwiSaver terms that people get mixed up.

We Kiwis aren’t as financially literate as we may think

Us Kiwis may not be as financially literate as we’d like to be.

Asset allocations of different KiwiSaver types of funds – what’s the difference?

Imagine you have taken a personal finance quiz on the internet and it tells you that you should invest in a “growth fund”. So does that mean you can pick any growth fund to invest into, because all of them will be the same? Not exactly. While there are guidelines, there is no single specific […]

Employment restricted KiwiSaver schemes – are they worth joining?

Most KiwiSaver schemes are open to the general public. Anyone that is eligible to join KiwiSaver can invest their money with most providers.

Are there KiwiSaver Schemes that invest as per our religious beliefs?

Are you aware that religion oriented KiwiSaver schemes exist?

How do you know if your KiwiSaver fund is ethical?

Is your KiwiSaver scheme really that ethical?

How does your KiwiSaver provider choose what assets to buy?

Not all providers actively choose their investments.

KiwiSaver awards – do they really matter?

There’s a fair amount of award ceremonies for different Kiwi industries. There’s the New Zealand Music Awards, the New Zealander of the Year Awards, and even the New Zealand Ice Cream Awards.

Joining your employer chosen KiwiSaver scheme – a mistake?

Do you remember why you are with your current KiwiSaver provider? Did you choose your KiwiSaver fund manager, or did your employer choose it? Or do you think you were randomly assigned one and you don’t even know why?

Why you shouldn’t ignore your investments outside KiwiSaver

“If you’re young, you should be in a growth fund. If you’re old, you should be in a conservative fund.” Sounds like familiar advice to you?

What can retirees do to get returns when interest rates go negative?

Bank deposits used to be the go to option for retirees. Many, like yourself, had a simple investment strategy which consisted of putting the majority of their savings in the bank while earning a small interest rate. It was considered a safe investment strategy that delivered enough returns for retirement. Now the interest rates from […]

Who are the providers managing your KiwiSaver money?

Have you done enough research about the provider managing your KiwiSaver money?

Who are the people managing your KiwiSaver money?

What do you know about the different people managing your KiwiSaver money?

Investment processes of KiwiSaver providers – how does yours compare?

How does your KiwiSaver provider compare to others in how they invest your KiwiSaver money?

我应该先还贷款还是多投资一些到KiwiSaver里?

成年人的生活都不容易,有很多事情要去平衡,其中一件事就是财务。假设要问自己一个问题-我有闲钱的话,会把钱投资在KiwiSaver还是还我的贷款? 为了回答这个问题,我们需要考虑自己和社会的经济状况。主要的考量指标比如说现在的贷款利息,你的KiwiSaver预计回报率。你可能要比较的一件事就是在KiwiSaver上能够得到的回报和在贷款利息上需要付多少钱。

KiwiSaver是如何帮助首套房购买者的?

第一次买属于自己的房子一定很激动人心,不过高额的房价和过程有可能很辛苦和充满压力。现在新西兰政府和KiwiSaver有一些能够帮助第一次购房者的一些措施,使他们尽可能轻松地买房。 如果你已经在KiwiSaver里投资了至少三年,那么你有可能有资格提取KiwiSaver首购房基金和政府的首套房资助计划。

Kiwis ‘need advice more than ever before’, but are not getting it – Financial Services Council

While financial advice offers clear benefits, many Kiwis are not taking advantage of it.

Should I be in a Bank KiwiSaver scheme or a NZ owned KiwiSaver scheme?

As of 31 March 2020, there were 33 KiwiSaver providers (source: KiwiSaver Annual Report 2020). Some of them are run by banks and some of them are run by other New Zealand owned companies. So what are the differences and which one should you choose? That’s what we’ll be covering in this blog post today.

KiwiSaver缴税以及税率的计算

说到缴税,很多人可能都已经开始皱起了眉头,不过掌握一些正确的税收信息或许能够帮你省掉一大笔钱。与其毫无准备地收到一张你的KiwiSaver缴税单,不如现在开始先了解KiwiSaver基金的一些税收知识,比如哪个是属于自己的税收等级,以防止日后会欠IRD很大一部分钱。为你的KiwiSaver正确纳税的第一步,就是学习KiwiSaver基金是如何缴税的。

What’s in our KiwiSaver HealthCheck?

You may be curious to know the types of questions we ask while pondering over whether to begin our KiwiSaver HealthCheck or not. To be more transparent, and to take away some concerns you may have, we would like to give you a rundown of the details we ask you and why we ask them. […]

理财咨询的未来将会是真人为主还是机器人?

现代科技高速发展并且正在改变很多行业的轨道,其中一个影响就是,未来你的理财咨询师很大可能会是一个机器人。所谓机器人咨询师,就是实现完全在线自动化的理财投资咨询师。在人为干涉趋于最小化的情况下,机器人咨询的优点尤为突出,包括成本高效,服务连贯性以及可得性。

Are KiwiSaver glidepath or lifestages funds right for you?

Glidepath funds, lifestages or lifetime (age-based) fund options, are a different way to manage your KiwiSaver savings compared to more traditional ways. Glidepath funds have got some media attention over the past few years, and are offered by a few New Zealand KiwiSaver providers. In this blog post, you will learn about this more recent […]

Should I just choose a KiwiSaver fund with the lowest fees?

Your KiwiSaver provider may charge you many different types of fees such as account membership, management, performance, and administration fees. These are combined into one small percentage amount, excluding any fixed fees, such as an annual membership fee. The amount charged varies between providers and their different types of KiwiSaver funds. It is important to […]

我的KiwiSaver账户会不会破产?

如今有很多关于讨论KiwiSaver好处的声音,然而,有时我们也要想想它的另一面,比如说如果你的KiwiSaver服务提供商公司破产倒闭了呢?

Taking a look at Fisher Funds’ responsible investing policy

Ethical investing is the practice of aligning your investments based on your personal values. Investing ethically or responsibly can have various meanings, and different organisations have a variety of approaches when it comes to this. For example, Fisher Funds have a framework in place to exclude investments that they believe are unethical. The company was […]

选择KiwiSaver基金时要考虑的三要素

在我们之前的博客中向大家介绍了如何计算退休时的需要储蓄的总额,回报率以及缴纳百分比。这些数字本质其实是我们的KiwiSaver需要达到的收益是多少。但是这些数字能够告诉我们到底投资哪个KiwiSaver基金吗?答案是不能。KiwiSaver回报率只是我们考虑的第一个因素,还有其他因素需要纳入考虑范畴。

Should I contribute more to KiwiSaver or pay off my debt?

If you have some extra cash on your hand, should you focus more on investing the money in your retirement or using that money to pay off your debt? What would help you get ahead more? Before you can answer these questions, you need to take other factors into consideration. You can, for example, look at […]

What is an index fund and how does it work?

An index fund is a type of mutual fund whose holdings are structured to track a particular financial market. In order to reflect the collective performance of the companies in that market, the funds try to follow the benchmark by buying stocks of every company listed on the chosen index. One of the most commonly […]

How do we choose the most suitable KiwiSaver fund for you?

With almost 30 different KiwiSaver providers and over 250 funds available between them, selecting the most suitable fund for you may feel overwhelming. But, taking time to pick the right fund to fit your personal situation and goals is crucial in optimising your investments. A lot of Kiwis would look at a few different KiwiSaver funds […]

KiwiSaver我到底应该缴纳工资的百分之多少呢?

我们都知道KiwiSaver基金的表现不尽相同,最好的和最坏的相差很多。网络上也有很多讨论关于手续费的多少对你退休时的KiwiSaver余额的影响。不过,影响最大的因素很有可能是那个贡献率。

4 ways to get the most out of KiwiSaver

KiwiSaver is a great tool for Kiwis to save and invest for the future. Here are 4 things you can do to optimise your KiwiSaver investments. Taking the time to make these changes now could undoubtedly benefit you when it comes to your retirement or buying your first home.

How Kiwi women are missing out on $60,000 in retirement savings

There is a lot spoken about the gender pay gap. The gender pension gap, however, is actually much larger compared to the gender pay gap. In 2015, the average New Zealand woman would retire with $60,000 less than men in their KiwiSaver account, according to ANZ. The gap is widening, as in 2017 the average […]

6 scary things about investing that are not actually scary

Starting your investment portfolio can be quite intimidating and scary. For investors, getting over the fear of losing money in the stock market can be difficult. There are many fears surrounding the stock market and investing in general, but they may not be as scary as you think. A lot of people know that investing […]

7 common myths about KiwiSaver

Millions of kiwis are members of KiwiSaver, but there are still some misconceptions about what it is and how it operates. Here we will talk about some common myths and misunderstandings about KiwiSaver and debunk them.

KiwiSaver’s saving suspension: a good idea?

To prepare for retirement, we save and invest a small portion of our income to our KiwiSaver account regularly. While it makes saving easy, sometimes financial hardship can mean we need to take a break from our regular contributions into KiwiSaver. This is made possible by a ‘savings suspension’. On a savings suspension, your income […]

What is a negative interest rate and how will it affect your KiwiSaver fund?

You may have heard some discussions earlier this year about the possibility of New Zealand’s OCR (Official Cash Rate) to drop below zero. Currently, the OCR set by our Reserve Bank is very low at 0.25 and it has been decreasing since 2015. Negative interest rates is an unusual scenario, but it is likely to […]

退休时你需要在kiwisaver里存够多少钱呢?

无论是那些已经接近退休年龄,还是仍有十多年才退休的人,我们都要回答这样一个问题:退休时到底应该存够多少钱呢?

What is diversification and why is it important in your KiwiSaver fund?

Let’s say your KiwiSaver fund consists of only stocks within the mining industry. If the government announced that coal mining would be banned and that energy sources would now come from renewable energy, share prices of mining stocks will collapse. Since you only have one type of industry in your investment portfolio, it will experience […]

Active vs Passive KiwiSaver Funds: Which is Better?

Depending on your KiwiSaver provider, your KiwiSaver funds can be actively managed or passively managed. Actively managed funds are where investment managers make active decisions on what investments to buy or sell in your KiwiSaver. On the other hand, passive investments copy what the market is doing by tracking and buying the index. Ongoing fees […]

Are all KiwiSaver Providers the same and how do I choose?

There are a range of KiwiSaver providers out there, from big banks and insurance companies, to specialist and boutique investment managers. With more than 20 KiwiSaver providers and more than 200 different KiwiSaver funds, how do you choose? Fees, returns, the way the funds are invested, and your final KiwiSaver balance at retirement can vary […]

Can I Withdraw My KiwiSaver Savings Early?

Needing to withdraw your KiwiSaver savings early? The main purpose of KiwiSaver is to help you save for retirement so you can live comfortably when the time comes. However, for some of us, retirement may be years away. Many things can happen between now and 65 that could lead to withdrawing your KiwiSaver funds early. […]

Be Like Jane – Sort Out Your KiwiSaver Account with National Capital

Meet Jane* – one of National Capital’s clients. In this blog post, we’ll take a look at how Jane used National Capital’s KiwiSaver recommendations to better align her KiwiSaver strategy with her current situation and goals. *The names and identifying details in this blog have been changed to protect the privacy of individuals.

Investing in KiwiSaver: How Risky Is It?

KiwiSaver is an investment. And with all investing, comes risk. We’ve explained here what these KiwiSaver risks are and how to minimise them.

KiwiSaver: How do I spend it in retirement?

Once you turn 65, you have the chance to finally withdraw the KiwiSaver balance that you’ve accumulated throughout your working life. Where and how will you spend it? It’s tricky to figure out how much of your KiwiSaver funds you should spend vs save as there are so many uncertain factors. These decisions depend on […]

What Happens to your KiwiSaver Balance on Your 65th Birthday?

Once you turn 65, congratulations! You are now eligible for NZ Super and have access to your KiwiSaver account. At National Capital, we talk a lot about planning your retirement and sorting out your investment. But what happens to your KiwiSaver account once you hit 65? Do you have to withdraw your entire retirement lump sum? […]

Best Performing KiwiSaver Funds – June 2020

National Capital understands that there is an abundance of KiwiSaver providers to choose from and that reading about the differences in hundreds of KiwiSaver funds aren’t exactly written out in your weekend plans. This is why we’ve put together some detailed information on the top-performing KiwiSaver funds based on their 5-year returns for each category. […]

Digging Deeper To Find Out If Your KiwiSaver Fund Is Truly Ethical

At National Capital, we don’t just look at ethical investing as a checkbox exercise but engage with various KiwiSaver providers, to really understand what their ethical investing stance is and how it translates into their investments. As an example, we did further research into CareSaver to see if they truly walked the talk about being […]

Ethical KiwiSaver Providers – Do you know what you’re investing in?

Now, more so than ever, we have seen a shift in how we consume and how we invest. When investing funds in KiwiSaver, many of us are curious about what companies and sectors our KiwiSaver funds are investing in and whether these are sustainable or not. You would have heard a lot of talk regarding […]

Lockdown II: How Will My KiwiSaver Account Be Affected?

Chaotic. Unprecedented. Turbulent. If you used one word to describe 2020, it would probably be one of those. We’ve learned some lessons from the last lockdown, but there are still many uncertainties as to how everything will play out. At National Capital, we understand that you may have concerns about the impact of these recent […]

Kids in KiwiSaver

Although being a first homeowner or retiree may be a foreign concept to kids, it’s never too early to start saving. Many parents try to give their children a head start through setting up savings and investments from early in their lives. KiwiSaver is just one of many savings options. With the government no longer […]

Start Saving For Retirement Today, Your Future Self Will Thank You!

This is a message sent to you from your future self, it reads: “Start saving for retirement, now!”. In your twenties or thirties, you may have other financial priorities that have your immediate attention. However, let’s talk about why putting away small sums such as contributing to your KiwiSaver account on a regular basis will […]

Procrastination: The Thief of Time

The temptation of procrastination – it’s something we know all too well. If the deadlines seem far away, we aren’t as urgent to complete the tasks piling up on our to-do list – like the one that reads “sort out KiwiSaver”. Even if retirement seems like a lifetime away, you may have two very different […]

Sex, divorce and weightloss take priority over financial security for Kiwis

A recent survey of 1,000 New Zealanders has revealed that Kiwis are more concerned about shedding the extra kilos than ensuring they have enough money to retire.

You May Have Less Money in KiwiSaver Than You Think You Do

It’s the year 1970, you walk into the shops to buy a loaf of bread costing you 15 cents. Now fast-forward to 2020, you’re at your local supermarket picking up another loaf of bread, you take a look at the cost and it’s no longer 15 cents – it’s now $2.50. Why did the cost […]

How to Invest in KiwiSaver if You’re Planning to Buy a House

So you’ve been saving hard to buy a house. You’ve controlled your spending, put in more time at work, and invested aggressively in KiwiSaver. It’s your first home so you plan to use KiwiSaver’s first home withdrawal to help reach your deposit amount. Finally, after all your hard work, it’s time to buy a house. You […]

Should I Contribute More to KiwiSaver or Pay Down my Mortgage?

Adulting is hard, there are so many things to balance! One of them is our finances, specifically the question – if I have extra savings, should I contribute more to KiwiSaver or pay down my mortgage? To answer that question, we need to consider a few aspects of our financial lives and the economy in […]

How KiwiSaver Can Help You Buy Your First Home

Buying your first home is exciting – but it can also be expensive and stressful. Here are some ways in which KiwiSaver and the NZ government can help first home buyers get their foot in the property ladder. If you have been contributing to KiwiSaver for at least three years, you may be eligible for […]

How is my KiwiSaver account taxed?

KiwiSaver Tax – Please click here for an updated version of this page. Tax is not the most riveting subject in the world, nor is it something we like paying, but having the right information when it comes to tax can save you a lot of money. Instead of receiving a shock after viewing the […]

Stop Looking for the Best Performing KiwiSaver Fund

The best performing Growth fund in the last 5 years was the Milford KiwiSaver Plans Active Growth Fund. As of June 2020, it returned 9.8% annually over the last 5-years (Source: MorningStar). You can find a complete table of the best performing funds in the various KiwiSaver fund categories here on our website. But it’s […]

Can a KiwiSaver portfolio go Bankrupt?

There is a lot of talk about all the potential benefits of KiwiSaver, but what about the other side of the story. What if it all goes wrong and your provider goes bankrupt?

3 factors in choosing a KiwiSaver fund

In our previous posts, we showed you how we calculate what lumpsum you need at retirement, what rate of return you need from your KiwiSaver Fund and the amount you need to contribute to get you there.

How much do I need to contribute?

We hear a lot about how different KiwiSaver funds are performing, who is the best, who is the worst. There is also a lot of chatter in the media about fees and the effect that it can have on your KiwiSaver balance at retirement. However, among all the noise there is one factor that has […]

What KiwiSaver lump sum do you need at retirement?

Retirement. For some of us it may be very close, for others, it might still be 10 years away. But the question we all need to answer is how much money do I need to have saved for my retirement?

Best Performing KiwiSaver Funds – Mar 2020

To help our readers, National Capital has researched the KiwiSaver market and have come up with top-performing KiwiSaver Funds based on their 5-year returns in each category below. This page has detailed information on each of those funds which have had the best 5 year performance as of March 2020. Looking for an updated list? […]

How long is long-term investing?

“KiwiSaver is a long term investment.” We have all heard this phrase, but what exactly does long-term mean? What would you classify as a long time? A month? A year? 5 years? Right now a month in isolation seems like a long time! The definition of ‘long-term’ in the oxford dictionary is ‘over a long […]

Accurate KiwiSaver predictions or a lucky guess?

What is the easiest way to get rich quickly using the stock market? By selling high and buying low. So how do you do this? By using a magic crystal ball that can see into the future. It is the perfect solution. You will never make an incorrect decision as you already know the outcome.

How to make a good KiwiSaver Investment decision

6 steps to help you make that decision

When is the best time to invest in KiwiSaver?

The current market volatility has many kiwis wondering if they should stay away from the markets and wait for the perfect time to invest, or whether they should withdraw their investments now and reinvest later to avoid further losses. In theory this strategy has merit, but in reality there is a major flaw; timing the […]

Coronavirus update – what is your KiwiSaver provider doing?

In the previous article I wrote about Coronavirus and KiwiSaver, my message was as long as you are invested in the appropriate fund, the best course of action for you will be to do nothing!

‘Build-your-own’ KiwiSaver scheme: Yay or Nah?

Most KiwiSaver providers are set up in a way that allows members to choose from one fund manager. For example, in the case of Milford KiwiSaver Plan, you can choose from various funds, but every fund is managed by Milford Asset Management, the provider of the KiwiSaver scheme.

How does the Coronavirus affect your KiwiSaver account?

There’s a lot of talk in the media about Coronavirus and it’s effect on the stock market. Every time there is an epidemic, tales of doom and gloom start popping up.

Why I based my company on these three Māori principles

Back in 2018, when I started building National Capital with the goal of helping 1 million Kiwis become financially secure, I based the company on three principles which I hoped would form the bedrock of our organisation’s culture. It would also help us to make the difficult decisions that would invariably crop up in the […]

KiwiSaver: Are you missing out on money?

A recent article by Stuff explained how Kiwis can lose thousands of dollars by investing in the wrong fund. However, many Kiwis felt they were not getting enough information on choosing the right fund for their investments.

IRD sending one million letters to Kiwis on wrong KiwiSaver tax rate

The Inland Revenue Department will send more than one million letters to people on the wrong tax rate for KiwiSaver this year.

Is It Compulsory For Employers To Pay KiwiSaver?

Is It Compulsory For Employers To Pay KiwiSaver?

Can I opt out of KiwiSaver and get my money back?

Can I opt out of KiwiSaver and get my money back?

Can I Gift My KiwiSaver To A Family Member?

Can I Gift My KiwiSaver To A Family Member?

What Is The Lowest KiwiSaver Rate?

What Is The Lowest KiwiSaver Rate?

What Happens To Your KiwiSaver When You Turn 65?

What Happens To Your KiwiSaver When You Turn 65?

Navigating Volatility: KiwiSaver’s Resilience and Rising Returns

KiwiSaver is a voluntary saving initiative to help set you up for retirement. KiwiSaver has been designed to supplement the government’s retirement income support and to reduce the burden on the public pension system.

How Did KiwiSaver Start?

How Did KiwiSaver Start?

What happens to your KiwiSaver if you don’t have a will?

What happens to your KiwiSaver if you don’t have a will?

What is considered hardship for KiwiSaver?

What is considered hardship for KiwiSaver?

What Is The 3-Year Rule For KiwiSaver?

What Is The 3-Year Rule For KiwiSaver?

How Do I Transfer My NZ KiwiSaver To Australia?

How Do I Transfer My NZ KiwiSaver To Australia?

Are KiwiSaver Contributions Taxed?

Are KiwiSaver Contributions Taxed?

What Are The Potential Disadvantages Of KiwiSaver?

What Are The Potential Disadvantages Of KiwiSaver?

Does the government still contribute to KiwiSaver after 65?

Does the government still contribute to KiwiSaver after 65?

How much of my KiwiSaver can I use for my first home?

How much of my KiwiSaver can I use for my first home?

Where Can I Get Help For KiwiSaver?

Where Can I Get Help For KiwiSaver?

What Is The Best KiwiSaver Fund To Be In?

What Is The Best KiwiSaver Fund To Be In?

What’s the difference between mysuper and KiwiSaver?

What’s the difference between mysuper and KiwiSaver?