The Value of Financial Advice and What It Means for Your KiwiSaver

We wanted to share an interesting insight from Russell Investments’ 2025 Value of an Adviser report.

Are You Paying for KiwiSaver Advice You’re Not Getting?

There are many Kiwis paying for advice they’re either not getting or not using.

Booster Socially Responsible Funds

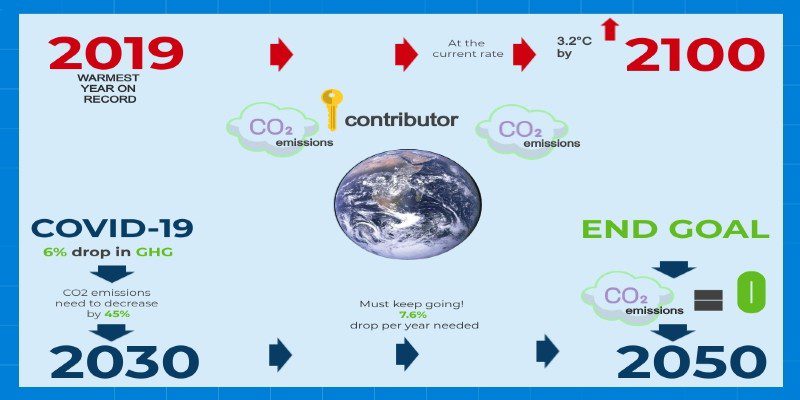

As a KiwiSaver provider, Booster considers environmental, social, and governance risks when they asses investments for their Investment and KiwiSaver Funds. And, if you want to go one step further, you can invest in Boosters Socially Responsible Investment Funds (SRI).

Opportunity Cost vs Realised cost

The opportunity cost and the realised cost are very important factors to consider when choosing the appropriate fund to invest in. First let’s examine the opportunity and realised cost, as well as explain what these two costs are. Then let’s take a look at how these costs affect which fund is right for KiwiSaver investors […]

Socially conscious investing in KiwiSaver to enhance your sustainability

Your KiwiSaver savings is a fund that often comprises of companies that you’ll find listed on a stock exchange be it the New Zealand Stock Exchange (NZX), the Australian Stock Exchange (ASX) or even further afield like the New York Stock Exchange (NYSE).

New Zealand Inflation Rate – How your Savings could be Losing Value

Kiwis work hard for their savings. Whether it be working longer tireless hours, or cutting down on expenses to find that extra bit of dough to put away. Saving takes dedication and discipline, so it isn’t fair that a lot of people actually lose money while trying to do so.

KiwiSaver investors must know this about asset allocation

Asset allocation is an important part of your KiwiSaver strategy. However, despite its importance, it is not understood well enough by investors. Additionally, if you don’t pay enough attention to asset allocation, it could cost you hundreds of thousands of dollars over the course of your lifetime. You might be wondering: how does asset allocation […]

How Much More Money Will You Have If You Get Financial Advice?

The ‘Money and You – Literacy, Insight & Advice’ research report commissioned by the Financial Services Council have found that Kiwis’ reluctance in seeking financial advice has come with significant financial and personal costs. So how much more money do Kiwis who get financial advice have, compared to those who don’t?

Just Looking at a Fund’s Performance Isn’t Enough

Some people are happy to do KiwiSaver research themselves. However, most times that research stops at just comparing what the past returns and current fees are. This is not enough. KiwiSaver is a large investment for most Kiwis and getting professionals to research and present you with options can make a big difference to your final […]

What is Swing Pricing and how does it affect KiwiSaver?

When researching KiwiSaver funds, it is important to look at more than simply past performance and general fees. Factors such as internal processes and trading costs will impact your final outcome. For example, in their latest Product Disclosure Statement, Milford Asset Management mentioned they will be introducing swing pricing. What does that mean and will […]