Is Artificial Intelligence a Bubble? What New Zealand Investors Should Consider

This article explores how investors can think about AI from a risk-aware, long-term perspective and what practical considerations matter most.

Is Your KiwiSaver Ready for 2026?

A small step today could make 2026 feel more confident, more intentional, and more in control.

The Value of Financial Advice and What It Means for Your KiwiSaver

We wanted to share an interesting insight from Russell Investments’ 2025 Value of an Adviser report.

Investment Scam Alert: What Every Kiwi Needs to Know

Recently, the Financial Markets Authority (FMA) has warned of a surge in impersonator investment scams.

Are You Paying for KiwiSaver Advice You’re Not Getting?

There are many Kiwis paying for advice they’re either not getting or not using.

What is KiwiSaver?

The answer to the question of what is KiwiSaver is a simple one. It is a voluntary investment scheme where you can choose to contribute towards a more financially sound future. The answer to what is KiwiSaver aims to help you save and invest for to major milestones in your lifetime. Those being a deposit […]

What KiwiSaver Fund Should I Be In?

The right fund depends on you — your goals, timeframe, and your capacity for volatility. Don’t leave your KiwiSaver on autopilot.

Struggling Financially? KiwiSaver Hardship & Better Ways Forward

Life can throw unexpected challenges — rising living costs, job loss, family emergencies. If you’re feeling financially stuck, you’re not alone. Thousands of Kiwis are in the same boat.

Fewer Kiwis Feel Prepared for Retirement: Time to Strengthen KiwiSaver Engagement

The 2025 Financial Resilience Index from the Financial Services Council (FSC) has revealed a worrying trend: fewer New Zealanders feel prepared for retirement.

Why Is My KiwiSaver Balance Going Up and Down? A Simple Guide to Market Volatility

Have you noticed your KiwiSaver balance jumping around lately? Don’t worry—it’s likely due to something called market volatility.

What the protests in France can teach us about retirement & KiwiSaver

You may or may not have heard about the ongoing protests against plans to raise France’s retirement age. Now you may be thinking, what does this have to do with us here in New Zealand or my KiwiSaver?

Get Your Finances and KiwiSaver Ready For 2023

If you like to make resolutions on New Year’s Day, you already know how hard it is to stick to them. The New Year brings around an opportunity for change. This January can provide a chance to have a look into your financial situation and hopefully inspire you to stay committed to new financial resolutions […]

How missing out on just few days can have disastrous effects

There is a common reaction in times of high volatility within the market you’re invested in, which is to withdraw or sell out of the market due to panic in order to avoid further losses. But this can actually have a negative impact on your investment in the long term.

Savings Rate vs. Investment Return Rate

Introduction I think it’s time to take a look at what makes the most difference to your overall wealth and ability to retire comfortably: Savings rate or Investment return rate.

Comparing KiwiSaver Fees & Taxes

Comparing KiwiSaver fees and taxes can be a little confusing. This is because the fees fluctuate and vary by fund type. In addition, your Prescribed Investor Rate (PIR) is your investment tax rate which is dependent on income and residency status. This article aims to cover the most common terms regarding KiwiSaver fees and taxes, […]

Opportunity Cost vs Realised cost

The opportunity cost and the realised cost are very important factors to consider when choosing the appropriate fund to invest in. First let’s examine the opportunity and realised cost, as well as explain what these two costs are. Then let’s take a look at how these costs affect which fund is right for KiwiSaver investors […]

Te Tūranga o KiwiSaver – KiwiSaver Basics

Nau mai, haere mai!

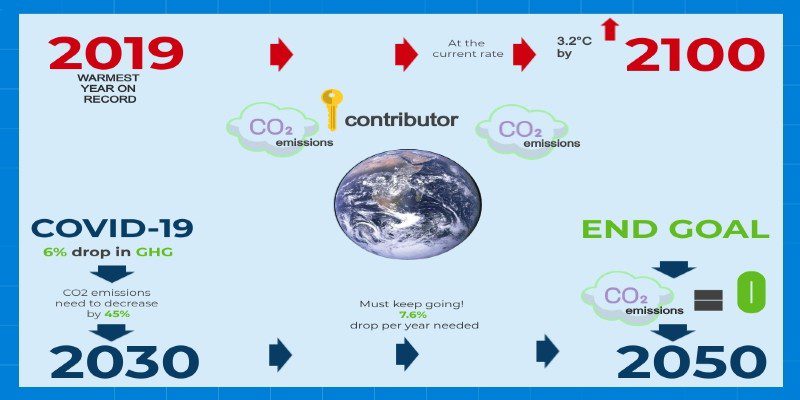

Socially conscious investing in KiwiSaver to enhance your sustainability

Your KiwiSaver savings is a fund that often comprises of companies that you’ll find listed on a stock exchange be it the New Zealand Stock Exchange (NZX), the Australian Stock Exchange (ASX) or even further afield like the New York Stock Exchange (NYSE).

New Zealand Inflation Rate – How your Savings could be Losing Value

Kiwis work hard for their savings. Whether it be working longer tireless hours, or cutting down on expenses to find that extra bit of dough to put away. Saving takes dedication and discipline, so it isn’t fair that a lot of people actually lose money while trying to do so.

KiwiSaver Tax – The Complete Guide

Tax is not the most riveting subject in the world, nor is it something we like paying, but having the right information when it comes to tax can save you a lot of money. National Capital has done the research so instead of receiving a shock after viewing the tax cuts on our KiwiSaver funds […]

New Fee Regulations on KiwiSaver Managers implemented by the Financial Markets Authority

Solo Parents and KiwiSaver

In recent times, newspapers have picked up on the petition a single mother has created regarding her ability to sign her kid up to KiwiSaver without having to receive permission from the child’s father. She is the sole contributor to her child’s life, including financially. She found it unacceptable that she would have to receive […]

One Year From Our First Lockdown – 4 Important Financial Lessons Kiwis Have Learned

The Dangers of Following Generalised KiwiSaver Advice

It’s so easy to jump on google and pick up a few bits of seemingly good advice on just about any topic of interest. This is perfect for figuring out the latest ‘fashion advice’ or learning ‘how to get more out of your workout’ but does it apply to KiwiSaver advice?

Don’t miss out on your ‘free’ KiwiSaver money!

Want to get some extra cash into your KiwiSaver account?

Contributing to KiwiSaver if you are unemployed

Many businesses are facing tough times at the moment and may need to make hard decisions around staffing. This may result in some Kiwis being at risk of losing their jobs and facing unemployment. Your retirement savings in KiwiSaver perhaps isn’t the first thing that comes to mind when you are at risk of losing […]

The hidden danger in the FMA’s proposal to reduce KiwiSaver fees

The FMA has recently released a consultation document on KiwiSaver fees and value of money for all members. They emphasise the importance of maintaining fair, efficient and transparent financial markets, and growing market confidence (Source: Financial Markets Authority). They also warn fund providers that they will be held accountable for charging unreasonable fees and regular […]

How do wealth managers differ from financial planners?

When it comes to managing your finances, doing it alone can sometimes be overwhelming, as you try to come up with a plan. A professional adviser can be a great help to you, especially with investment advice and financial planning. When you are seeking financial advice, make sure that you are getting advice from the […]

如何计算你的KiwiSaver收益率?

在上一篇博客中,我们解释了如何计算出你退休时需要的存够的钱。然而知道了这个数字只是成功了一半,下一步就是要找到你想要的KiwiSaver收益率去实现这个数字。这样你就能知道知道哪种KiwiSaver基金适合你。

How choosing the right fund helps you pay less tax in KiwiSaver

The amount of tax you have to pay plays a big part in what your KiwiSaver balance will look like in retirement and it’s always good to have a better understanding on how our KiwiSaver investments are taxed. It might seem simple, as your KiwiSaver providers automatically deduct fees and taxes from your investment to […]

KiwiSaver到底是什么?

绝大多数新西兰人到了65岁后,都能够享有新西兰养老金的权利,也就是NZ super,这笔退休金将会以每两周发放一次的形式发放到他们的银行账号。但是,这笔钱的数目大小不一,会根据个人情况而定。而通常,新西兰人能拿到的养老金都是不足以支撑他们在退休后也有退休前的生活水平。因此,为了帮助大家能有更好的退休生活,新西兰政府推出了KiwiSaver。

Why Real Investing Makes More Money Than Pretend Investing

The main goal of Investing is to grow your wealth. However, a study by Richard Bernstein Advisors showed that the average individual investor didn’t even outperform inflation – meaning they had negative real returns. Why is that? All too often, it’s because of the difference between ‘real investing’ and ‘pretend investing’. When kids put on a […]

KiwiSaver Performance Improved With Diversity in Companies

You may be familiar with the term “diversity and inclusion”. Many companies have “diversity policies” available on their websites. These outline their approaches to how they’re going to achieve equality within their company. The recent growth of diversity policies has come, largely, from the United Nations creation of their 17 Sustainable Development Goals. These universal […]

How Much More Money Will You Have If You Get Financial Advice?

The ‘Money and You – Literacy, Insight & Advice’ research report commissioned by the Financial Services Council have found that Kiwis’ reluctance in seeking financial advice has come with significant financial and personal costs. So how much more money do Kiwis who get financial advice have, compared to those who don’t?

Just Looking at a Fund’s Performance Isn’t Enough

Some people are happy to do KiwiSaver research themselves. However, most times that research stops at just comparing what the past returns and current fees are. This is not enough. KiwiSaver is a large investment for most Kiwis and getting professionals to research and present you with options can make a big difference to your final […]

Types of KiwiSaver Choices

We talk a lot about finding a KiwiSaver fund that suits you and your needs. What types of KiwiSaver funds are out there? And why is it so important to select a KiwiSaver fund that is suited to your situation?

5 Reasons You Shouldn’t Take KiwiSaver Advice From National Capital

Do I really need KiwiSaver advice? Here are 5 common reasons why you may be avoiding getting KiwiSaver advice and

How Can I Prepare for a Great Mortgage Rate as a First Home Buyer?

Buying your first home is an exciting process! There are many things to think about when planning to buy your first home, one important one is – how can I get a great mortgage rate on my home? In preparation for going to the bank, here are eight things our friends at Greenlight Mortgages recommend […]

KiwiSaver members could miss out on $3.5 billion in retirement

Amidst the economic turmoil caused by the coronavirus pandemic, falling KiwiSaver balances may be a nerve-wracking sight for KiwiSaver members. An estimated 50,000 New Zealanders panic moved into more conservative KiwiSaver funds in an attempt to minimise potential further losses on their KiwiSaver account. Here’s why panic switching your KiwiSaver fund type may lead to […]

The Future of Financial Advice: Robots or Humans?

Modern technology is paving and changing the path of many industries. In the future, your financial advisor will most likely be a robot – a Robo-advisor. Robo-advisors are automated, online financial and investment advisors. Using minimal human intervention, the advantages of Robo-advice include cost efficiency, consistency, and accessibility.

Why we only work with KiwiSaver providers who pay us

At National Capital, our mission is to help Kiwis become financially secure. To achieve this, our first step is sorting out their investments.

COVID-19 and 5 KiwiSaver mistakes

As the economy experiences a downturn, so do the financial markets and so does KiwiSaver. This causes unease and discomfort among investors which leads to some questionable decisions.

Milford KiwiSaver Active Growth Fund management through COVID-19

The COVID-19 pandemic has caused an unprecedented human and health crisis. Measures have been taken across the globe to fight and contain the spread of the virus which has triggered a major economic downturn. Global markets have fallen like dominoes in a matter of days and countries around the world are suffering due to the […]

More time during the lockdown? Why not sort out your KiwiSaver account!

Being in lockdown is boring – who knew there was so much time in one week! The silver lining is that now is the perfect time to do all those odd jobs you said you would do, but haven’t actually been able to get around to doing them. Sorting out your KiwiSaver account fits perfectly […]

Tuning out market noise

Coronavirus Commotion At the moment, it’s impossible to go a day without hearing something about the coronavirus; it’s everywhere! It is not just impacting our health, but also how we work, socialise and consume. And it doesn’t stop there; financial markets and even the environment are also caught up in the effects of COVID-19.

How Coronavirus could affect your first home dream?

Jill MacDonald and her fiance were on the cusp of buying their first home. Then the stock markets fell due to fear and uncertainty caused by COVID-19 which mean they lost 12% of their KiwiSaver savings ( approx $10,000) leaving them short on funds for a mortgage deposit. They had to delay their plans for […]

This time is different.

During every financial bubble, we will come across ‘experts’ in the media who are utterly convinced and try to convince the rest of us, that in terms of our economic future, “this time is different.”

How to save more in your KiwiSaver account in ‘Small Steps’

All of us want to have a financially secure retirement. Because of rising expenses and inflation, NZ superannuation is not going to be enough to fulfil all our retirement expenses. In such a scenario KiwiSaver plays a very important role in our lives.

Over 400,000 KiwiSaver members missed out on $1b, warn advisers

As per an article by the NZ Herald, over 400,000 KiwiSaver members who are in default funds may have missed out on $1 billion over the last six years because they are in the wrong type of fund and are being over-taxed. This was based on a report by a group of nine financial advisers.