Using the most recent returns and fund update reports from December 2021, we will examine Booster’s recent KiwiSaver Performance.

Booster KiwiSaver Scheme is one of the six default KiwiSaver providers. They are Kiwi owned and operated, offering 14 KiwiSaver funds ranging from a more conservative cash fund to a higher-risk growth fund.

Bond markets continued to sell off as investors bet on aggressive hikes in interest rate. On the other hand, for New Zealand based investors, the volatility of the global share markets was offset by the NZ dollar falling. The NZ dollar depreciated against most major currencies, supporting the returns of assets that are free to move with exchange rates. As a result, there was a positive return of 3.2% for those assets.

Table of Contents

Performance of Booster KiwiSaver Funds

News about Booster

Booster is one of the newly appointed KiwiSaver default providers under a new seven-year contract with the government. It is stated that those providers were selected because they offer the best value for money for their members in terms of lower fees and higher service levels.

Performance of Booster KiwiSaver Funds

|

1 month |

3 months |

1 year |

3 years |

5 years |

|

|

Conservative |

-0.46% |

-3.54% |

-0.51% |

3.18% |

3.89% |

|

Balanced |

0.72% |

-4.37% |

2.52% |

7.05% |

7.02% |

|

Growth |

1.45% |

-4.88% |

4.22% |

9.29% |

8.99% |

Sourced from Booster fund performance report

*These returns are to 31 March 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Booster Quarterly Fund updates published on 14 February 2022.

Booster Conservative Fund

The Conservative Fund invests mainly in income assets, but also includes some growth assets. It is suitable for investors with low volatility tolerance and those who are willing to accept a relatively modest level of returns. The Fund has had a 1-month return of -0.46%, a 1-year return of -0.51%, and a 5-years return of 3.89%.

*The following is Sourced from Booster Conservative Fund Update

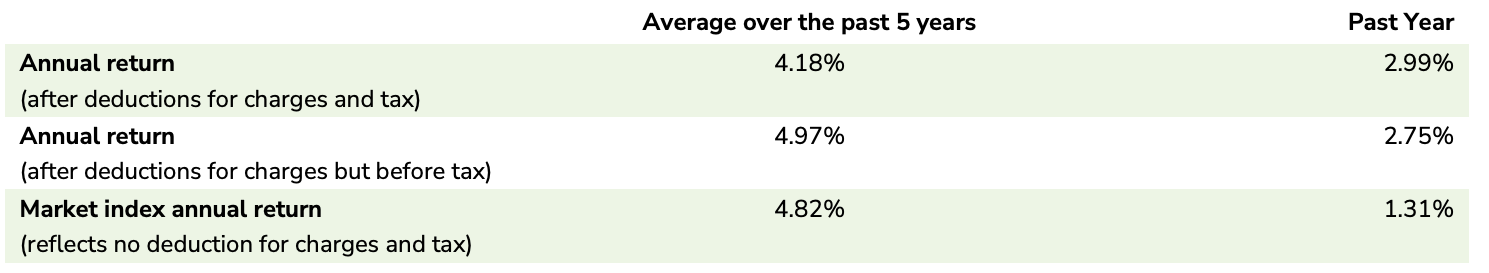

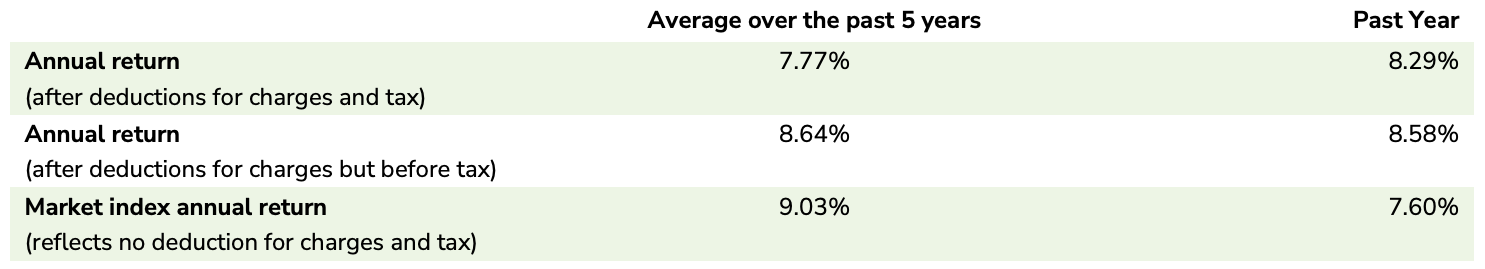

Returns

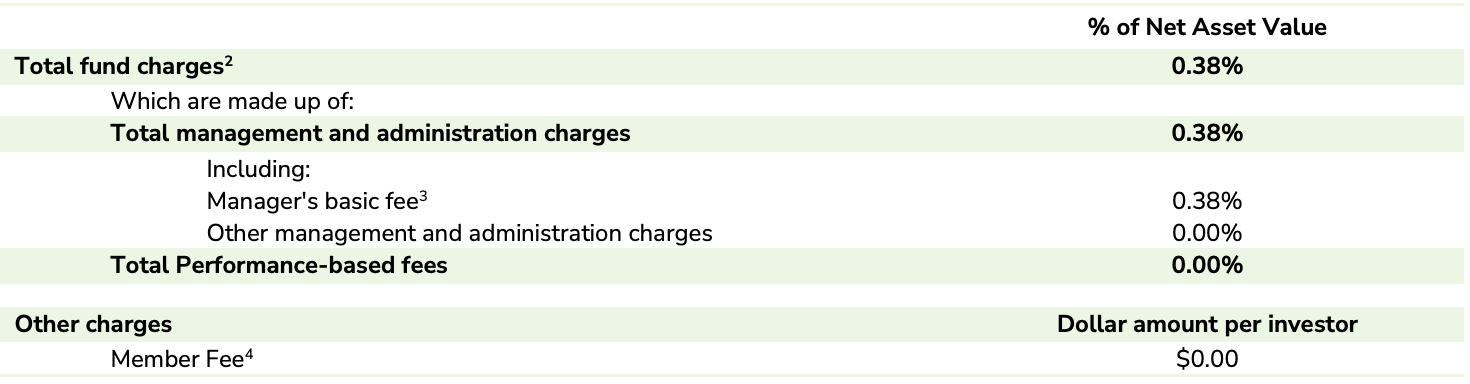

Fees

The total annual fees for investors in the Booster Conservative Fund are 0.38% per year.

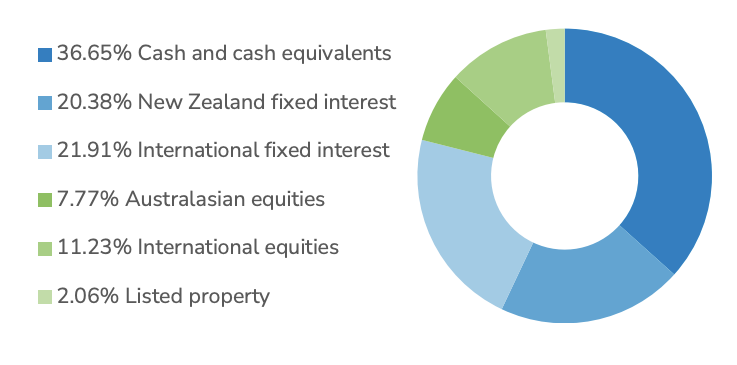

Investment mix

The investment mix shows the type of assets that the fund invests into.

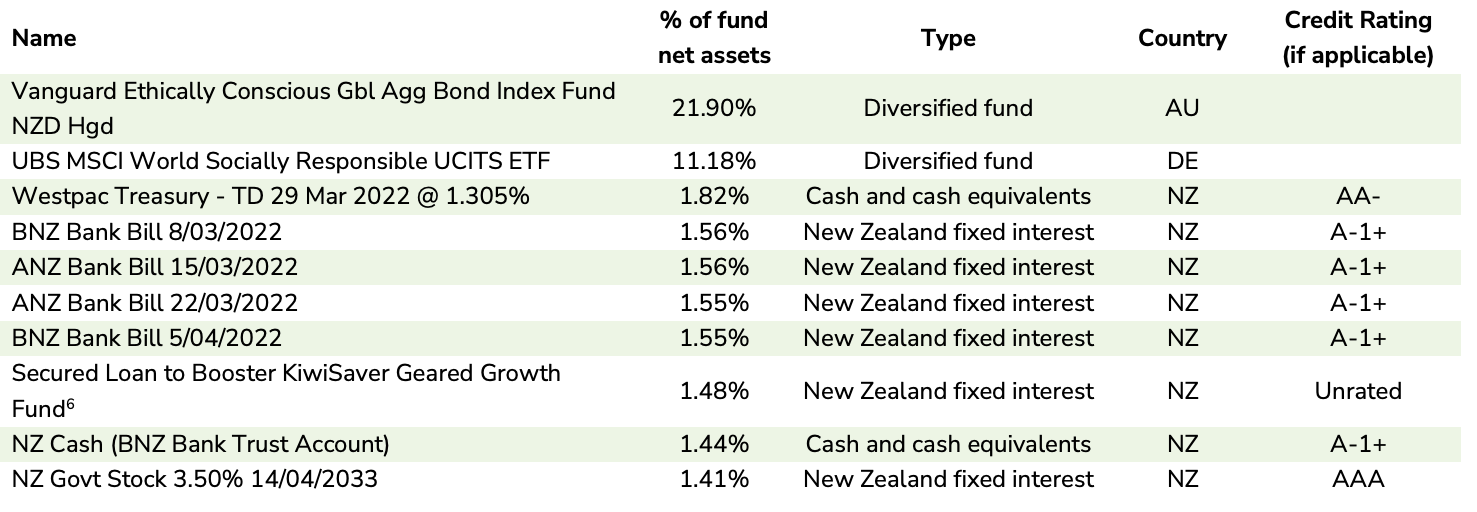

Top ten investments

This table shows Booster’s top 10 investments in the Conservative Fund, which make up 45.45% of the fund.

Booster Balanced Fund

The Balanced Fund invests in a balanced proportion of income assets and growth assets. It is suitable for investors with balanced volatility tolerance and those who are willing to accept a medium level of returns. The Fund has had a 1-month return of 0.72%, 1-year return of 2.52% and 5-years return of 7.02%.

*The following is Sourced from Booster Balanced Fund Update

Returns

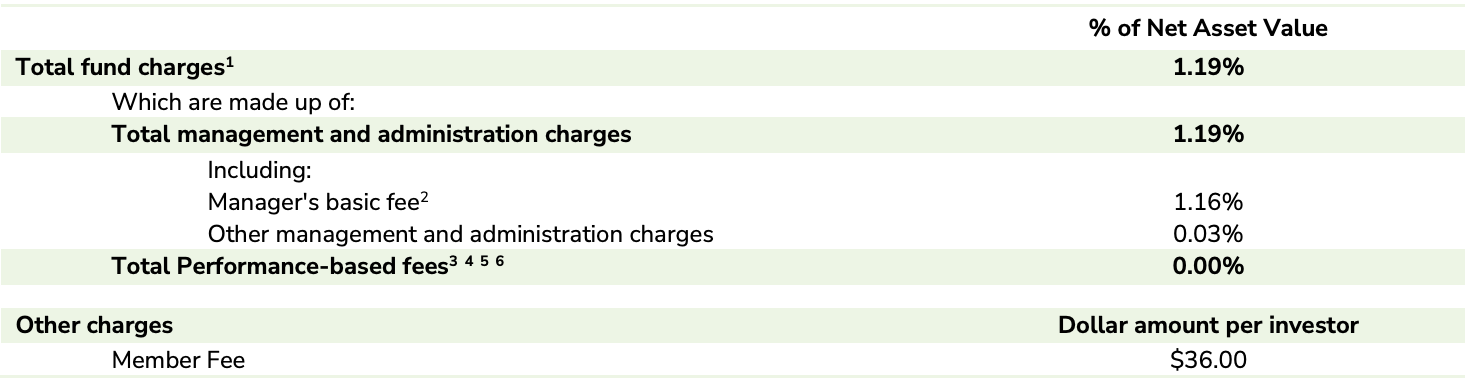

Fees

The total annual fees for investors in the Booster Balanced Fund are 1.19% per year, with an annual membership fee of $36.

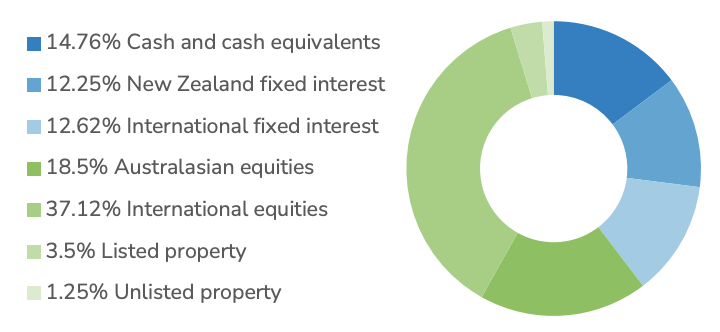

Investment mix

The investment mix shows the type of assets that the fund invests into.

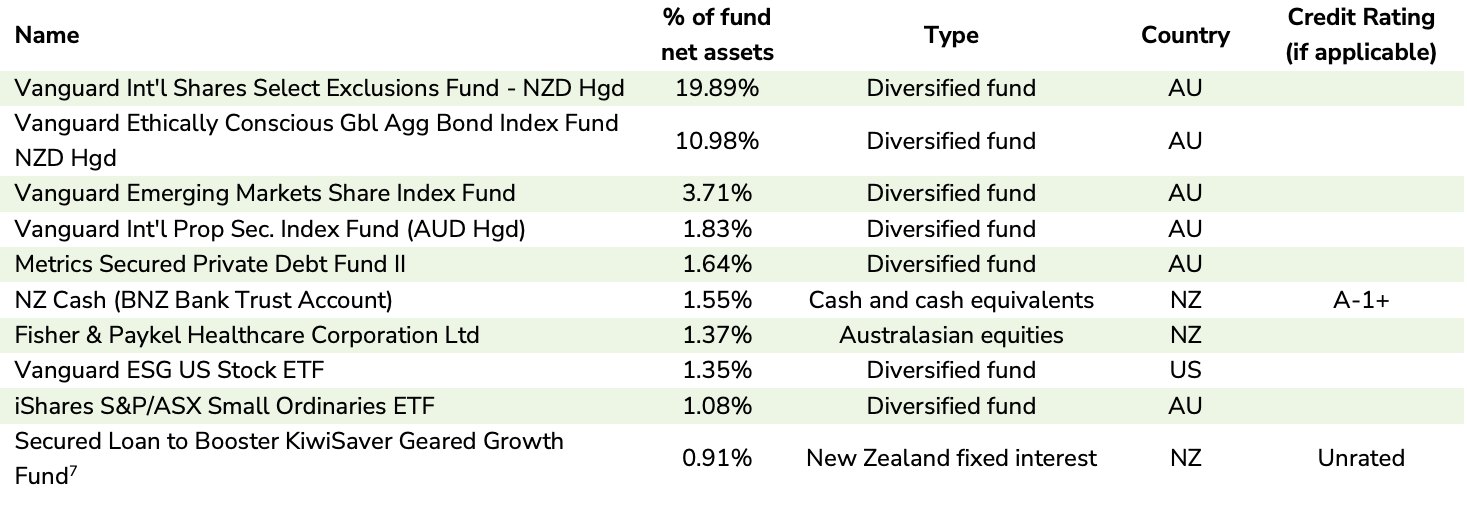

Top ten investments

This table shows Booster’s top 10 investments in the Balanced Fund, which make up 44.31% of the fund.

Booster Growth Fund

The Growth Fund invests mainly in growth assets, but also includes some income assets. It is suitable for investors with medium to high volatility tolerance in order to potentially receive a relatively higher returns. The Fund has had a 1-month return of 1.45%, 1-year return of 4.22% and 5-years return of 8.99%.

*The following is Sourced from Booster Growth Fund Update

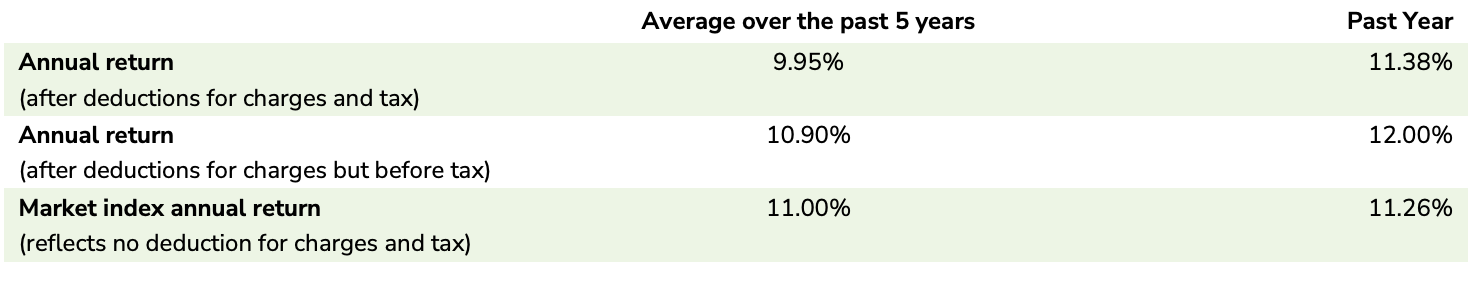

Returns

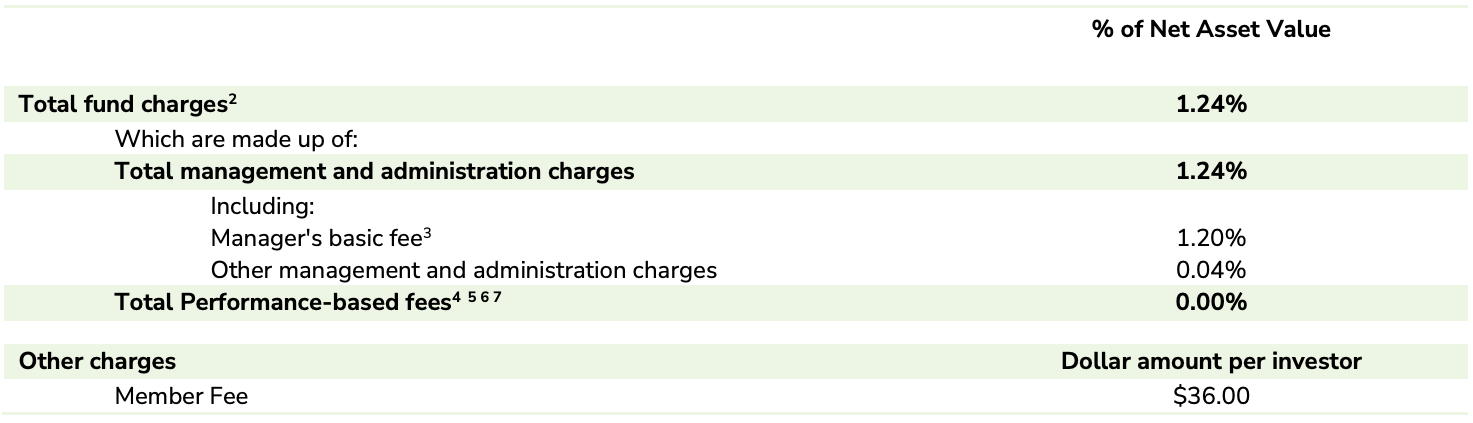

Fees

The total annual fees for investors in the Booster Growth Fund are 1.24% per year, with an annual membership fee of $36.

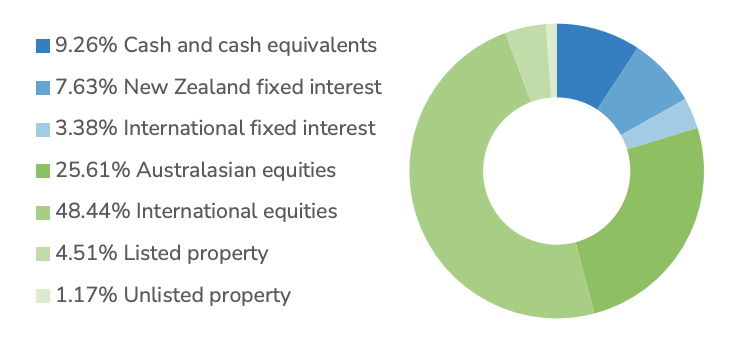

Investment mix

The investment mix shows the type of assets that the fund invests into.

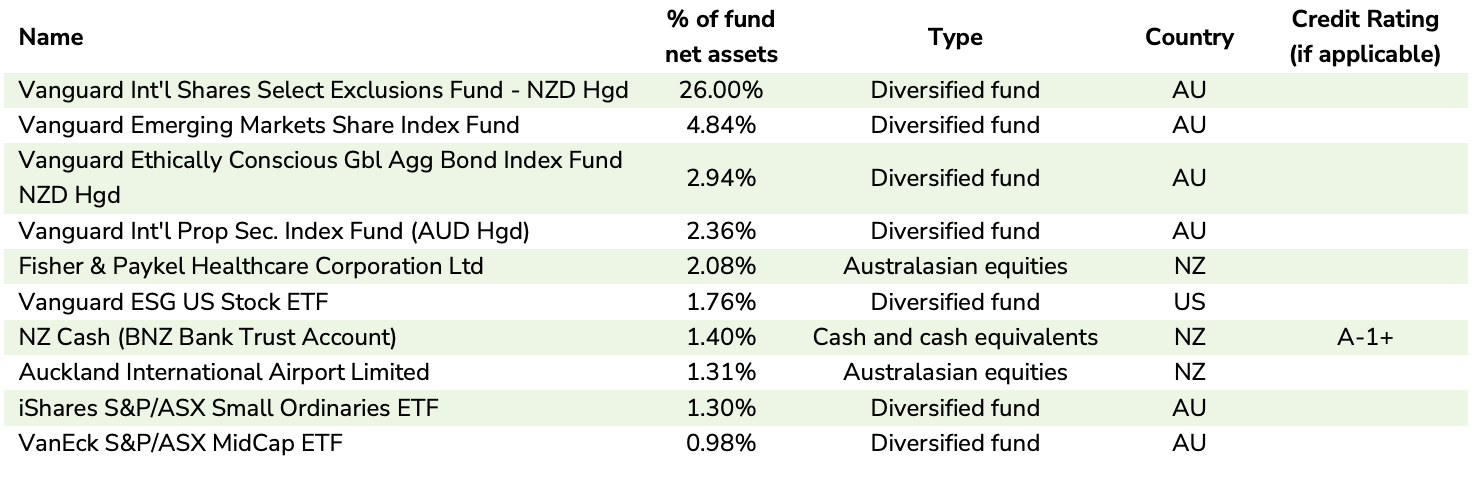

Top ten investments

This table shows Booster’s top 10 investments in the Growth Fund, which make up 44.97% of the fund.

Data for Booster KiwiSaver funds has been sourced from Booster KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Booster has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.