How To Change KiwiSaver - Step By Step

Transferring KiwiSaver from one provider to another is a relatively simple process. But, are you sure you are making the right decision? We make changing KiwiSaver a choice you can feel confident in by providing FREE advice tailored to you. Click below to get your customised recommendations.

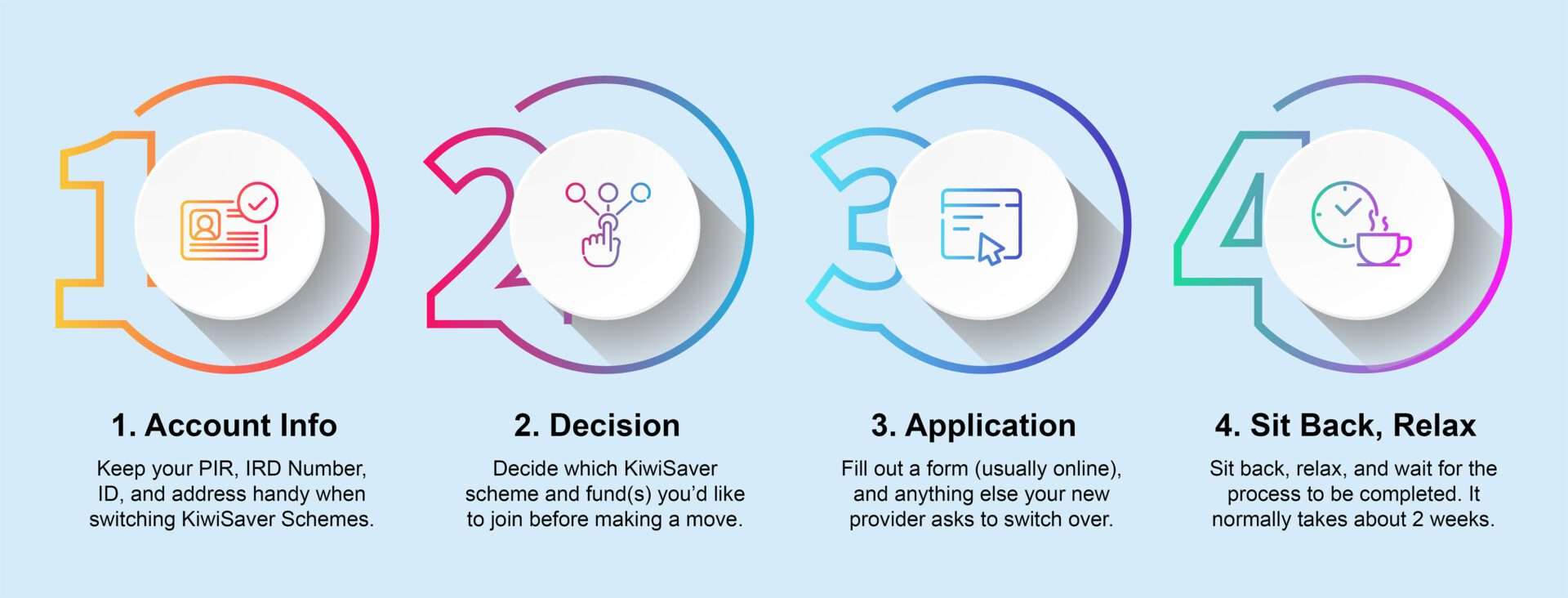

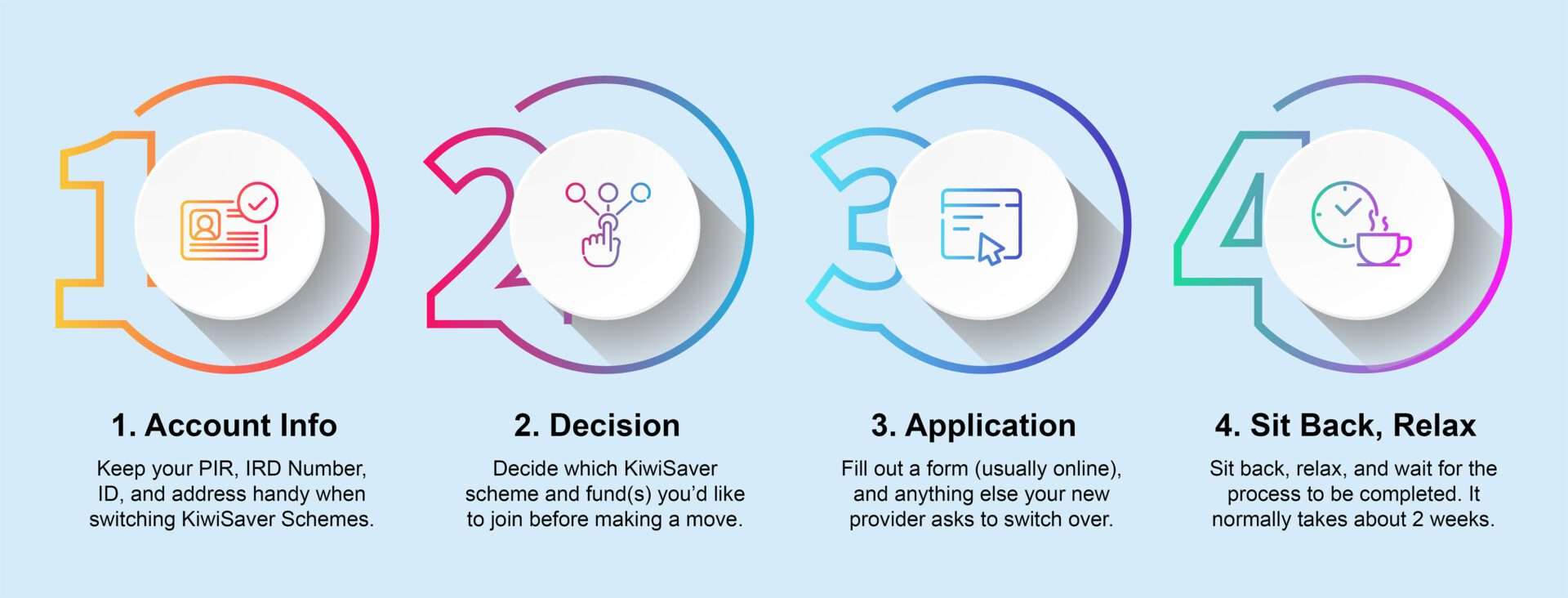

How to change KiwiSaver - Keep Your Details Handy

| 1. Account Information Required to change KiwiSaver: PIR, IRD Number, ID, and Address. |

| 2. Make a Decision: Which provider are you changing KiwiSaver to? |

| 3. Transferring KiwiSaver Application: Online form to register with your new provider. |

| 4. Sit Back, Relax: Usually takes about 2 weeks to change KiwiSaver. |

Changing KiwiSaver is a simple process that can be done by contacting your newly chosen provider. Transferring KiwiSaver requires you to fill out a form to change KiwiSaver and your new provider will take care of the rest. You can apply directly with the new provider or we can do it on your behalf if you’ve chosen us as your advisor. The new provider will then organise the transfer of funds as you change KiwiSaver schemes.

So let’s say you’ve gone through our KiwiSaver HealthCheck. Our team at National Capital have analysed your situation and recommended a KiwiSaver provider for you. And you’re happy to take our advice on board by changing KiwiSaver schemes.

But you’re wondering how much hassle this process of how to change KiwiSaver really takes. Additionally, you’re concerned changing KiwiSaver providers will be a lengthy process, and will take hours to do.

In that case, I’ve got some great news for you. The thing you should know about changing KiwiSaver schemes is that…

Transferring KiwiSaver – It’s a really simple process

One may think that to change KiwiSaver schemes, you must fill out tons of pages of paperwork.

In that case, I’ve got some great news for you! This isn’t the case when changing KiwiSaver companies.

Instead, the process of transferring KiwiSaver accounts is quite simple. When I decided to change KiwiSaver provider last year, it took me only about 20 minutes to do so.

Most KiwiSaver providers allow you to complete this process online. All you have to do is fill out a form with your name, your IRD number, and a few other things, and you’ll be good to go! The process to change KiwiSaver will only take a few minutes for you to action.

Your new provider will then do a lot of, if not all, the rest it takes in changing KiwiSaver. And you can relax, knowing your money will be transferred to your new scheme.

Transferring Kiwisaver process might not be as awkward as you may think.

There are some misconceptions regarding how to change KiwiSaver to another provider. For example, you don’t need to call your current provider and tell them why you’re transferring KiwiSaver while a salesperson tries to convince you to stay.

I understand how that feels because I originally used to think this. To my relief, when I decided to change KiwiSaver, I never received any awkward phone calls or messages from my old provider asking me to stay with them.

There is one “awkward” thing to keep in mind when changing KiwiSaver. A few providers charge “transferring KiwiSaver fees”. This means you pay your old provider a fee to leave their scheme, for things such as administration costs.

Although most do not charge fees for changing KiwiSaver, you should check with your provider to see if they charge them. Other than that, there is no other obvious reason to talk to your old provider before transferring KiwiSaver balances.

Changing to the right KiwiSaver will make a big difference to your payout.

Spending 10 minutes to complete our HealthCheck may be the most important thing you can do for your long-term financial freedom.

How to change KiwiSaver in four simple steps.

1. Keep your PIR, IRD Number, ID, and address handy when changing KiwiSaver firms.

These are all important things to have on hand because it is likely you will need them for your change KiwiSaver application form. The reason you give your new provider these details is so they have the information they need to verify who you are and complete the transferring KiwiSaver process.

Below is a description of what you need to know about these four things:

PIR (Prescribed Investor Rate): Your prescribed investor rate is the amount at which your investment returns will be taxed once you change KiwiSaver. You should put in some effort to make sure you are getting taxed at the correct rate after changing KiwiSaver. If you pay too little in tax for example, the IRD may contact you to give you a tax bill.

To help you find your PIR, National Capital has developed a PIR calculator you can use prior to transferring KiwiSaver.

Dig Deeper: KiwiSaver Tax – Everything you need to know

IRD Number: Your IRD number is an eight or nine-digit number that helps to keep track of the amount of tax you’ve paid, and how much you need to pay. Your IRD number is unique to you and you keep it for life and a must-have when changing KiwiSaver companies.

If you do not know your IRD number, you can check the following places for it:

- Your KiwiSaver statement from your previous provider

- Your payslip

- Log into your myIR Secure Online Services account

- Check any letters or statements from Inland Revenue

If you still cannot find it, you should call Inland Revenue. Click here for more information about their contact details. You can’t change KiwiSaver without providing your IRD number in your application.

Also, make sure you have your ID as well as address on you just in case you are asked while changing KiwiSaver.

2. Decide which fund(s) you’d like to change KiwiSaver to.

Sometime during the process of transferring KiwiSaver, you’ll need to decide which fund(s) you want to be invested in.

This is an important part of the changing KiwiSaver process because being in the wrong fund can cost you a lot of money over your lifetime. Many New Zealanders are making the mistake of being in the wrong fund, costing them lots of money. Therefore, it’s important you take some time to decide where to invest your money before you change KiwiSaver companies.

If this is a step you’re struggling with, we recommend you complete our KiwiSaver HealthCheck. It can provide important tips that help prior to transferring KiwiSaver. After filling out an easy-to-fill form, you can get information about what type of fund is best for you, as well as which provider is best suited for you.

This advice is given over the phone, which means you get the opportunity to clarify any questions you may have about our advice. And the advisory service on how to change KiwiSaver is free.

3. Fill out a form (usually online) to change KiwiSaver companies.

Most forms are online, simple and easy to fill out, provided you have prepared to change KiwiSaver in advance.

To find what you need to fill out, go to the website of your new scheme for more information. These forms can be usually filled out on your computer.

Take your time to complete the application form, following the instructions of the new provider, and make sure everything is correct to ensure there are no delays in the transferring KiwiSaver process.

Your new provider may ask for a few other things once you’ve submitted your application form. For example, when changing KiwiSaver last year, my new provider asked for proof of address. Be prepared for this to occur.

4. Sit back, relax, and wait for the transferring KiwiSaver process to be completed.

After submitting a request to change KiwiSaver companies, it usually takes up to 2 weeks for the switch to be fully completed. However, it doesn’t usually take this long at all.

When I decided on transferring KiwiSaver schemes last year, it took me within the two weeks to have my funds transferred.

Sometimes your KiwiSaver funds won’t come into your account all at once. However, rest assured that your money will be transferred in full and thus completing the transferring KiwiSaver process. You can normally check progress through your KiwiSaver Login.

Changing KiwiSaver solutions is not an easy decision.

Spending 10 minutes to complete our HealthCheck could be the best thing you do right now.

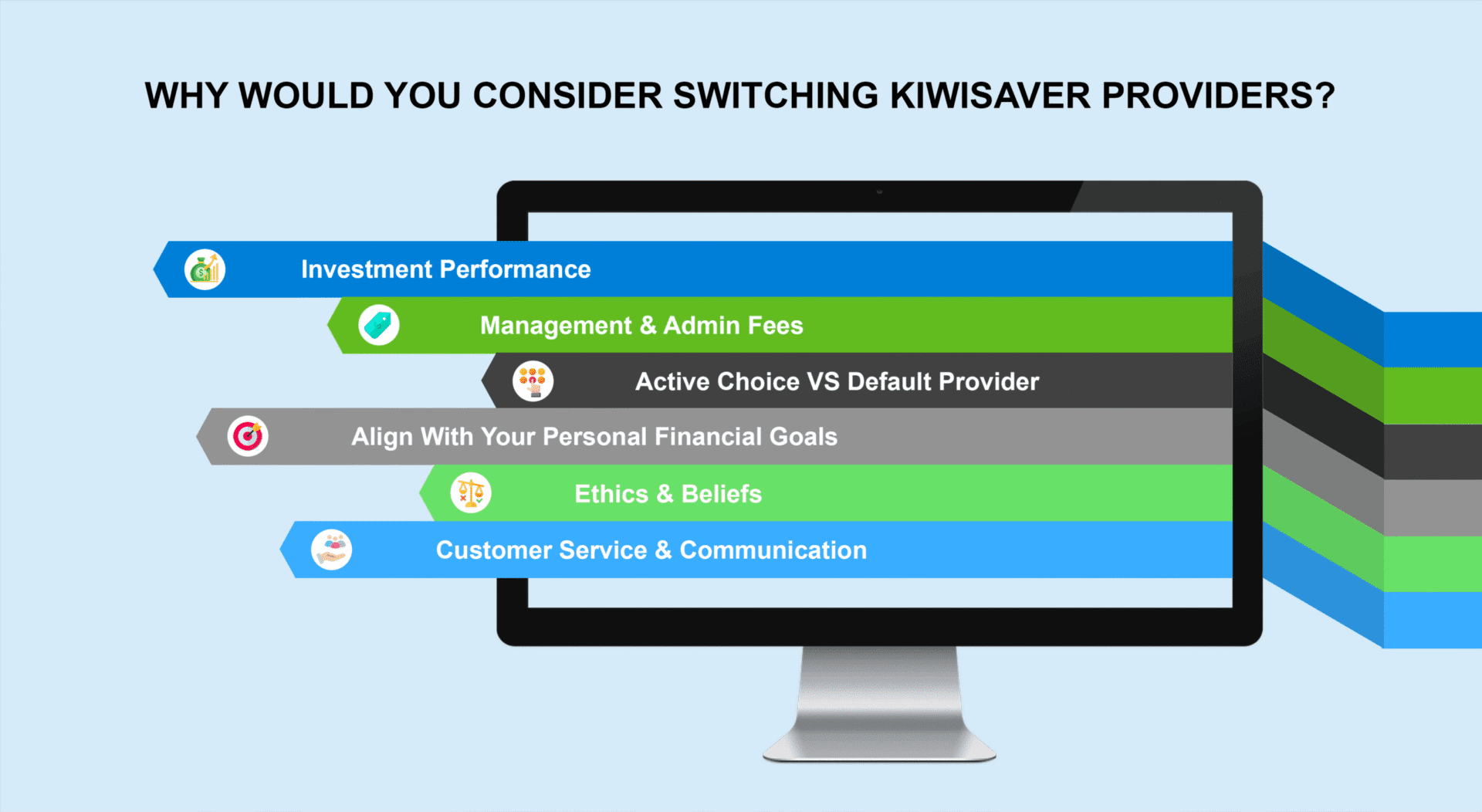

Why would you consider changing KiwiSaver?

The most common reason for changing KiwiSaver services is often performance related. National Capital tracks the latest market insights to establish a list of the best performing KiwiSaver funds. Some people will change KiwiSaver firms depending on the best performer in the fund they’re interested in. We recommend speaking with us and getting free advice to check if your goals and circumstances align with the decision.

Although we don’t typically recommend transferring KiwiSaver based on fees, it can often be a deciding factor. There has been a downward trend in fees these last few years, however, there are still clear differences. We have discussed the topic and tracked the cheapest KiwiSaver providers for you.

Others may take an active decision to change KiwiSaver from a default provider. Oftentimes, a default option means that you haven’t really taken an active approach toward investing in your future. Thus people may decide on changing Kiwisaver once they are ready.

Some may change KiwiSaver to one that aligns with their personal financial goals. One particular scheme may offer the best returns in a fund that aligns with your short-term goals. Alternatively, another can be the best fit for your long-term goals.

Most providers are placing an increased focus on ethical investing and avoiding assets in arms trading and human rights violations. Ethics and beliefs are other defining factors for people transferring KiwiSaver between companies. For example, the Christian KiwiSaver Scheme is designed for NZ’s Christian community and aims to invest according to their beliefs.

You need better service and communication. Non-bank funds continue to outrank bank funds on consumer satisfaction with Generate, Milford and Simplicity taking the top spots. Access to account information and investment updates are particularly highlighted by customers. Thus you may change KiwiSaver as you’ll feel more comfortable being kept in the loop effectively about your investment.

The good thing is that you can change KiwiSaver firms as many times as you’d like and at any time. Some scheme providers may charge a transferring KiwiSaver fee. Naturally, it’s important you make an informed decision with your goals in mind.

How To Change KiwiSaver - Frequently Asked Questions

Does it cost to change KiwiSaver?

It does not cost a thing to change between funds provided by the same provider. However, changing KiwiSaver companies may include a transfer fee depending on who your existing provider is. More specifically, Aon charges $35 and Booster charges $30 to change KiwiSaver to another provider. While others may not charge a fee for transferring KiwiSaver, they may have other structures in place like a yearly administration fee.

You should always check the new provider’s fees and services to ensure that there are no surprises after switching KiwiSaver. If you can’t find them, look through their disclosure statements on their website or contact them directly.

We must also discuss a cost that is rarely considered by a hands-off investor. Generally, it is not a good idea to switch KiwiSaver fund during a period of unforeseen and major instability. That is because you are turning those losses into reality and giving them no chance to recover. Take the Covid-19 pandemic for example, where some people saw 20% losses in a single day. Those who were changing KiwiSaver were actually realising those drastic losses. On the other hand, those who didn’t change KiwiSaver but held steady saw their investment recover and grow at rapid rates a few months later.

What we’ve just mentioned is a bad reason for switching KiwiSaver. A good reason will include consideration of your circumstances, goals, and your provider’s performance. Speaking to a financial advisor before changing KiwiSaver is a good way to make a confident decision. In any case, National Capital is here to help you and answer any questions regardless of whether you’re transferring KiwiSaver to another provider or deciding to stick to your existing one.

How many people are transferring KiwiSaver Schemes & Funds?

As per IRD, the number of times people were transferring KiwiSaver schemes equaled 164,929 in the 2025 financial year. That is a significant amount of changing KiwiSaver actions taken within a year. But why do people change KiwiSaver schemes? Well, some providers perform better than others overall or in particular funds. National Capital helps you analyse whether you need to switch KiwiSaver for better results or if you’re better off not changing KiwiSaver schemes.

KiwiSaver members now have more choices, too. New schemes are added in the mix from time to time with Sharesies and Kernel Wealth being two of the newest. These new choices add to the competitive reasons why people would consider switching KiwiSaver solutions.

As of December 2021, there has been a reduction in default fund fees. When comparing your options, reduced fees may well impact your decision to change KiwiSaver schemes or stay.

Many members also get automatically registered in a default scheme. This means the majority change KiwiSaver or make an active choice to stay. In fact, as at March 2025, the number of members who did not make an active choice increased 0.18% annually, totaling 341,453 (FMA Report 2025). National Capital strives to improve the financial literacy of everyday Kiwis and we’re happy to see them making active choices.

Switching KiwiSaver funds of different risk types within the same provider was even higher than transferring KiwiSaver schemes. The number of actions taken to switch KiwiSaver funds was almost 270,000 in the 2025 Financial Year. In total, almost $9 billion made the switch between funds. That represents a 50% increase in funds transferred from last year caused by the switch KiwiSaver process.

Before changing KiwiSaver, ask yourself: Have you chosen the correct provider?

This is a serious question because choosing the wrong provider can cost you tens of thousands of dollars over your lifetime. There are over 30 different schemes out there. So with that in mind, it’s important you make an informed decision to change KiwiSaver based on thorough research.

This is where National Capital’s KiwiSaver HealthCheck can help. Our HealthCheck can help you figure out which scheme and fund is best for you. This advice is based upon hours of research from our team, who investigates each fund to recommend the best one before you switch KiwiSaver.

The first step before switching KiwiSaver is to fill out our KiwiSaver HealthCheck. Don’t worry – it’s a simple, and easy-to-fill-out form. The reason we ask you to do this is because we want to understand more about you and give you personalised advice. After this, the next thing to do is to schedule an appointment with one of our advisors. By doing this, you can receive personalised advice about changing KiwiSaver over the phone. Our team is trained to give advice for your specific needs, so you will be taken care of. Then, you turn up to the call at the time you have scheduled. By doing this, you can find out what the best course of action before transferring KiwiSaver is. You may or may not need to proceed with changing KiwiSaver.

Lastly, you will be asked whether you’d like to implement our recommendations. If for example, you’d like to begin transferring KiwiSaver providers, we can take care of that for you. And if you choose to not do so, that’s perfectly fine! You are not obligated to do so. Want to hear the best part of this all? This service is all for free. So what are you waiting for? Fill out our KiwiSaver HealthCheck and get yourself some free financial advice. Your future self will thank you for it.

Should I change KiwiSaver to Conservative?

Many people consider changing KiwiSaver to a conservative option, particularly in volatile socio-economic conditions. Essentially, deciding to jump ship if they see their fund performance has declined quickly.

The answer to this question is that you consider transferring KiwiSaver for the right reasons and avoid making uninformed decisions. Once you learn how to change KiwiSaver, it can be tempting to switch every time your investment is underperforming. However, perfect timing is near impossible to achieve, and you end up losing more money by making that change.

It may be a good idea transferring KiwiSaver to a conservative solution when you’re about to withdraw money. In most cases, this is when you are going to use it for a first-house deposit or after retirement. Conservative solutions are usually less volatile, so you can be more confident of your savings at the time of withdrawal. High-growth options are more volatile in the short term and thus could go down in value right before you withdraw. Therefore, in this instance, changing KiwiSaver to a conservative solution makes perfect sense.

Another perfectly fine reason for changing KiwiSaver is a low risk tolerance. If you can’t stomach big swings in your savings balance and want peace of mind, conservative solutions are good. They are professionally prepared to be much more immune to gloomy headlines and offer steady returns.

In short, when you are learning how to change KiwiSaver, it must also be done for the right reasons. An uninformed decision based on a friend’s praise or sensational headlines is not the best reason for transferring KiwiSaver. Personalised, professional financial advice takes into account your personal circumstances to lead towards an informed and confident decision.

Are you making the right decision when transferring KiwiSaver?

Spending 10 minutes to complete our HealthCheck form may be the most important thing you can do for your long-term financial freedom right now.