“KiwiSaver is a long term investment.” We have all heard this phrase, but what exactly does long-term mean? What would you classify as a long time? A month? A year? 5 years? Right now a month in isolation seems like a long time! The definition of ‘long-term’ in the oxford dictionary is ‘over a long period of time.’ Rather specific, don’t you think? In reality, long-term investments should be thought about in terms of multiple years, decades even.

Since the global financial crisis, investors have seen steady positive returns for the past 10 years. Over this time, it was difficult to get ‘bad’ investment advice because most investments were just being carried up by a rising tide. In a sense it created a false narrative for investing as ‘risky’ investments were simply thought of as a high return earning savings.

The repercussions of this fantasy became evident when COVID-19 started affecting the financial markets. As the markets dipped, investment portfolios dropped thousands of dollars. Panic ensued and people began switching their investments to more conservative funds to protect the remaining amount. This may seem like a logical reaction, but it will cost users even more in the long run. Investing is incredibly complex and relies on strategy rather than impulse decisions.

Understanding long-term investments.

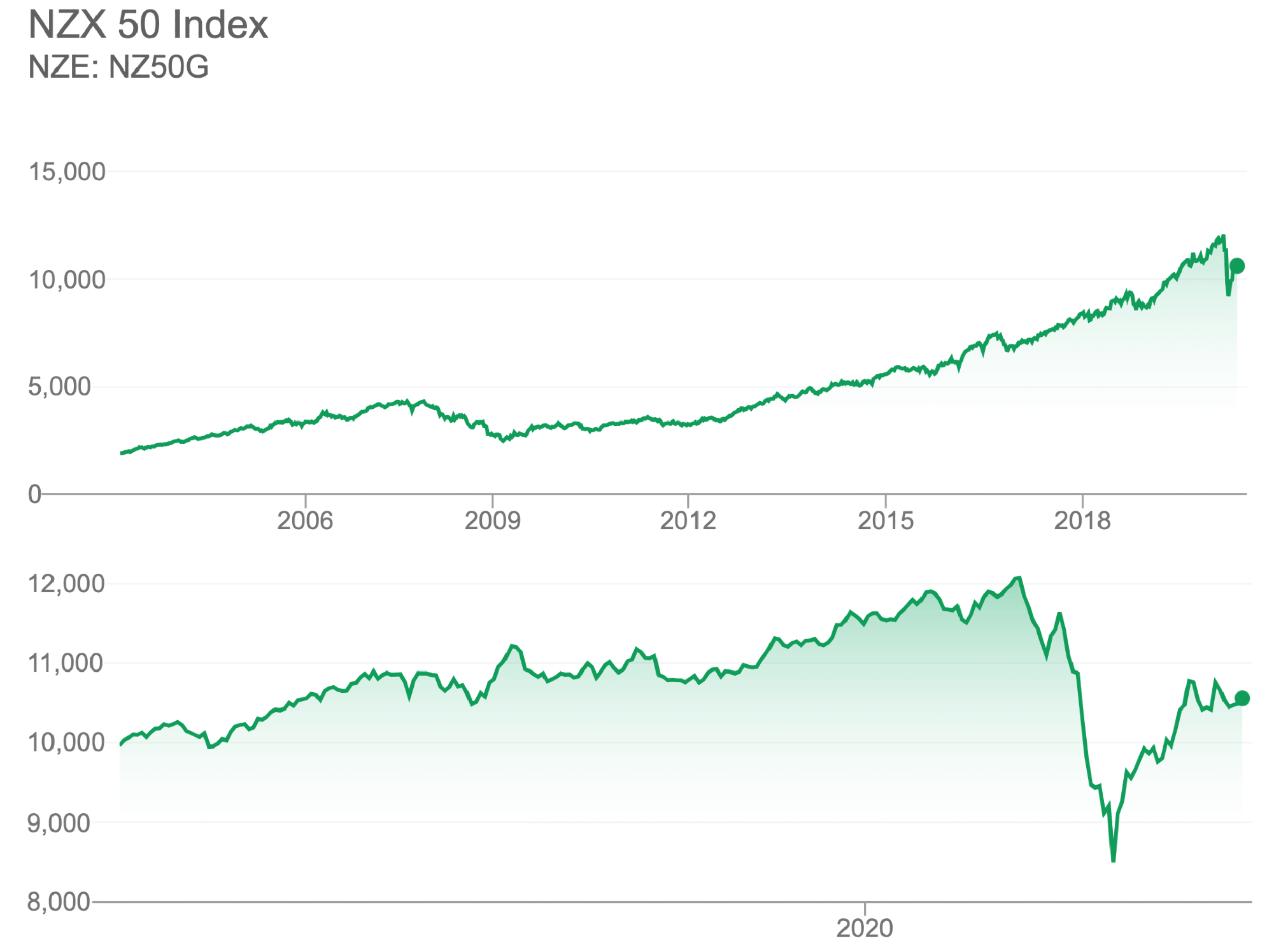

While over the short-term, the stock market can be very volatile, the overall long-term trend is increasing. The graph below shows a comparison between the NZX50 over 15+ years and over 1 year. The longer your investment horizon (how long until you need to withdraw your investment), the longer you can reap the rewards of the overall trend instead of worrying about the short-term trend. As you can see in the graph below, the current stock market drop is nothing but a blip in the long term.

NZX50 Max timeframe vs 1 Year

(Source: S&P Global).

What does this mean for KiwiSaver?

For the majority of our lives KiwiSaver is a long-term investment. Although each year retirement draws closer, kiwis have at least 65 years to prepare! When preparing for retirement & considering KiwiSaver investment options we need to think in terms of decades instead of years.

If a 62 year old is planning to retire at 65, but only withdraw their KiwiSaver investment at 67, then they have an investment horizon of 5 years. Their investment is much more susceptible to short-term volatility which can be harmful to their financial goals. A drop in market can significantly impact their investment value which is needed in the short-term when they need the money. There is not a lot of time to recover from periods of economic downturn. To protect themselves they should be in a fund that invests in more stable assets.

Someone who is 30 has a longer investment horizon. Their KiwiSaver has 35+ years to ride the stock market ups and downs. There is the ability to invest in riskier assets as the investment is not needed for another 35 years. Any major market falls have a minor impact on the investment value in the long-run. There is time to recover from economic collapse and benefit from periods of economic growth.

While many factors are considered when determining the type of KiwiSaver fund you should be in, volatility capacity plays a big role in deciding this. A drop in the market can be alarming but it should not be a cause for concern if you are thinking in terms of decades, not years. Being a long-term investment, your KiwiSaver is able to withstand short term volatility in order to make large gains over a long period of time.

What can I do?

Long-term investing, such as KiwiSaver, can be daunting, especially with the current market volatility. If you’ve got a long-term investment horizon then it’s nothing but a small blip in the road. Panic changing fund types to avoid volatility will cause you to lose out on potential gains in your investment in the long run.

Being in the right KiwiSaver fund is essential if you want to meet your financial goals. This choice should be specific to not only your age and volatility capacity, but also your volatility tolerance, required returns and other personal financial situations. You may need to consider changing your financial plan to lock-in gains and protect losses as you get closer to retirement.