Using the most recent returns from 30th September 2021, we will examine Amanah’s recent KiwiSaver Performance.

Amanah Kiwisaver is a boutique fund management group based in Auckland, specialising in providing ethical investment solutions to New Zealand and international investors. The AE group currently consists of two companies, Always-Ethical Limited and AE KiwiSaver Limited, with solid investment views. They believe that safe investments are good business and sound real estate.

In the months leading up to the end of September, the share market and Amanah’s KiwiSaver Fund returns decreased. The decrease could be due to Auckland’s lockdown, the market calming down after last year’s considerable returns or another external factor. However, the decreased returns are not something to worry about as it is natural for the market to fluctuate, and the fluctuation doesn’t indicate the long-term performance of these funds. If you want to learn more about your provider’s performance, complete the KiwiSaver Healthcheck.

Performance of Amanah’s KiwiSaver Fund

|

1 month |

3 months |

1 year |

3 years (p.a) |

5 years (p.a) |

|

|

Amanah Ethical Fund |

-1.17% |

-2.75 |

9.28% |

13.13% |

11.24% |

*past performance is no guarantee of future performance

* These returns are to 31 October 2021 and are before tax and after fees.

Note: The following information is sourced from Amanah Kiwisaver fund updates published on 29th October 2021.

Amanah Ethical Fund

AE Growth Fund may only hold investments that comply with the Ethical Mandate of the AE KiwiSaver Plan. AE Growth Fund currently is approved to invest in AE Investor, an international equities fund and may also hold cash (New Zealand dollars). AE Growth Fund’s investment objective is to provide an ethical return to investors over the long term while strictly complying with the Ethical Mandate. Amanah has had poor 1-month returns and quarterly returns of -1.17% and -2.75. The Covid-19 lockdown and the current economic state may have influenced the returns of the fund. However, the 1-year performance also falls short of reaching the same returns as the 3-year and 5-year returns. Unfortunately for Amanah’s Ethical Fund, this means the returns of the fund have been underperforming. Still, this past performance does not necessarily mean the returns will continue to underperform in the future.

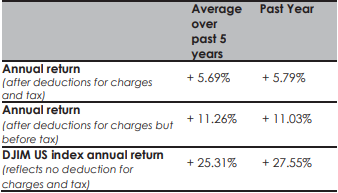

Returns

*Source Amanah fund update

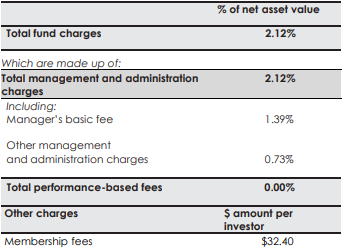

Fees

The total annual fees for investors in Amanah’s Ethical fund are 2.12% per year, with an additional $32.40 membership fee.

*Source Amanah fund update

Investment mix

The investment mix shows the type of assets that the fund invests into.

*Source Amanah fund update

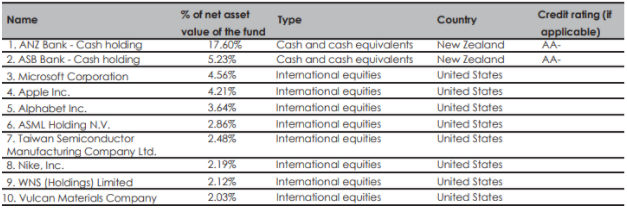

Top ten investments

This table shows Amanah’s top 10 investments in the Ethical KiwiSaver fund, which make up 46.91% of the fund.

*Source Amanah fund update

Amanah’s KiwiSaver fund information has been sourced from Amanah KiwiSaver Key Documents. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Amanah Ethical is the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver HealthCheck.