In the wake of COVID-19, financial markets and the economy have shown high levels of uncertainty. Current stock prices have fluctuated more in the past 6 months than in the past decade. High market volatility can indicate higher risk in the financial markets – but that’s not always a bad thing.

The Market Will Recover

We’re only human, so high volatility, falling markets and rollercoaster-like price changes can seem alarming. However, historically speaking, markets have always recovered. Similar events such as SARS in 2003 and the Zika virus in 2016 saw a significant drop, followed by a rapid rebound.

In falling markets, investors may be discouraged by their falling portfolio value and may want to sell to avoid further losses. However, it is worth mentioning that investors don’t actually realise their losses until they sell their securities. The loss seen in their portfolio is only paper loss, it is liquidated when they change their position. Investors that sell miss out on the significant gains experienced by securities when the markets rebound. Therefore, it is advised for investors to simply sit tight, and ride out the market volatility.

Another important aspect to note is that bear markets provide a unique opportunity. Investors are able to purchase certain securities at a discounted price which will ultimately recover in value.

The Trend Is Increasing

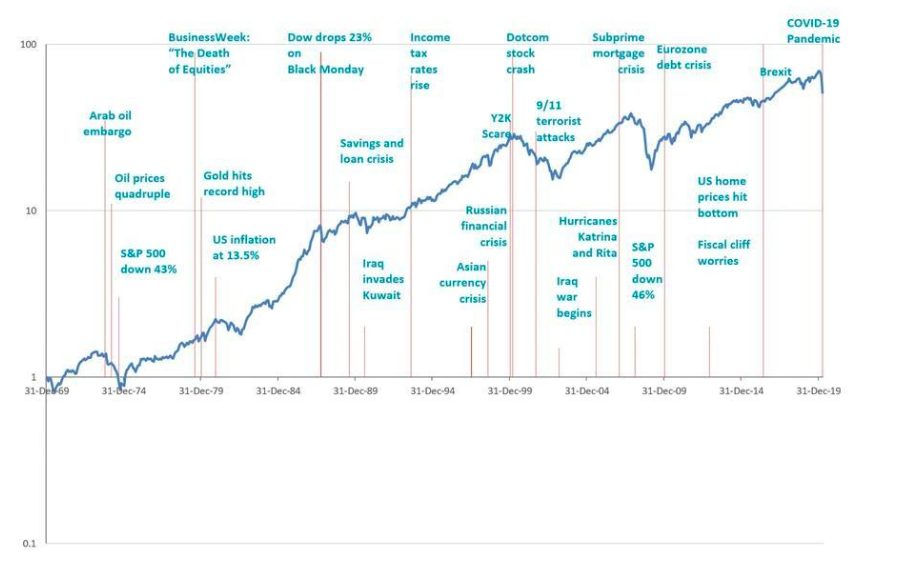

The chart below shows how different events have impacted the financial markets over the past 50 years. Even though there are periods of financial uncertainty with significant drops, the overall trend is increasing. The markets have always recovered from global events and come back stronger.

It took the market over a year to recover from the Global Financial Crisis and only a few weeks after the initial announcement of Brexit. In unprecedented times like these, it is difficult to predict the length of economic uncertainty. But, we can take comfort in knowing that global markets have historically recovered and thrived from unusual events.

Navigating Uncertainty

All forms of investing involves risk. However, as we have seen, risk is not necessarily a bad thing. Our worst enemy in times like these are our emotions. Changing your investment strategy because of uncertainty is detrimental to your returns. Structuring and sticking to a sound financial plan is the key to navigating the market volatility.

National Capital can help you structure a KiwiSaver investment plan that is tailored to your situation and financial goals.