We will be examining Fisher Funds KiwiSaver Performance by taking a look at the latest news, information, fees, fund investments, and data, such as fund performance and returns. Overall, the past quarter provided Fisher Funds with good returns across all funds, and it’s forecasted to continue producing profitable performance in the following months.

Note: The following information is sourced from Fisher Funds Kiwisaver Schemes fund updates published in July 2021 & September 2021.

Important News for Fisher Funds KiwiSaver Scheme

Default KiwiSaver Provider Changes

The Government announced changes to the KiwiSaver default provider arrangements, on Friday 14 May. Consisting of condensing the amount of default KiwiSaver providers. Accordingly, as of 1 December 2021, Fisher Funds will no longer be a default KiwiSaver provider. Bruce McLachlan said, “It is surprising and naturally somewhat disappointing not to have been reappointed as Fisher Funds is evidently a highly capable default fund provider, our track record of providing outstanding value to clients is unquestionable.” The changes do not impact Fisher Funds core KiwiSaver and fund management services, and for the majority of Fisher Funds clients, nothing will change. You can read more on Fisher Funds website.

The Performance of Markets and Funds in the month of September.

-

The New Zealand Growth Fund was up 0.9% for the month.

- The Australian Growth Fund returned -0.7% in September.

- The International Growth Fund ended the month down -3.3% versus the benchmark down -2.8%. Global equity markets were 4.3% lower in September on a myriad of concerns.

- The Income Fund’s September highlight was the investment in Dell Technologies Inc. The company has benefited from the surge in demand for IT hardware and software solutions reflecting the increase in work from home trends stemming from the pandemic.

You can read more on Fisher Funds investing highs and lows for the month of September.

Performance of Funds

This section will highlight key information about each fund by providing information on the fund returns, what fees are charged, and fund investments. You can use this information to compare it with other funds to help you make an informed decision on which fund is most suitable for your needs.

Fund Performance of Fisher Funds KiwiSaver Scheme’s Funds – September 2021

*The Fisher Funds KiwiSaver Scheme does not have a separate Balanced Fund. A Balanced investment strategy is available and currently reflects a 45% weighting in our KiwiSaver Conservative Fund and a 55% weighting in our KiwiSaver Growth Fund. This option has only been available since the launch of the KiwiSaver Conservative Fund in June 2009.

*Past performance is not necessarily indicative of future performance.

*After fees and before tax returns as at 30 September 2021

*Source: Fisher Funds Fund Performance

Conservative Fund

The Conservative fund aims to supply stable returns over a long term period by investing primarily in income assets with a modest allocation to growth assets.

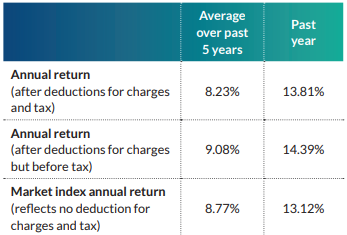

Despite the Conservative Fund having a 1 month return of -0.7%, this is still exceeding the returns for other funds over this same period.

This may have come from it’s stable investments with Dell Technologies Inc. A surge in demand for IT hardware and software solutions reflecting the increase in work from home trends stemming from the pandemic. This caused the value of the company’s bonds to rise.

Average Returns

*Source: Fisher Funds Fund Update

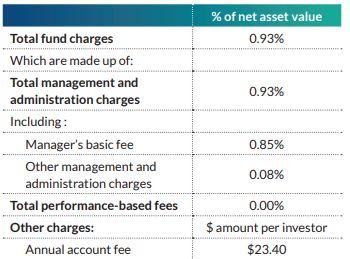

Fees

The annual estimated fees for investors in the Conservative fund is 0.93%. Fees and charges can have a big impact on your investment over the long term.

*Source: Fisher Funds Fund Update

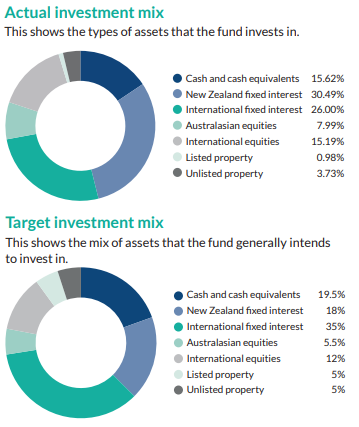

The Conservative Fund Investment Mix

*Source: Fisher Funds Fund Update

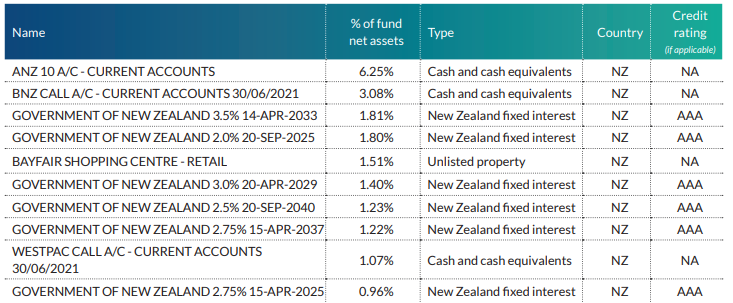

Fisher Funds Conservative Fund Top 10 Investments

Following are Fisher Funds top 10 investments which make up 20.33% of the Conservative fund.

*Source: Fisher Funds Fund Update

Balanced Fund

This balanced fund aims to provide a balance between stability of returns and growing your investment over the long term by investing in a mix of income and growth assets.

The Balanced Fund’s 1-month return was -0.9% for September. The negative returns experienced in the month can be due to the current lockdown restrictions and economic state. The fund’s returns is forecasted to pick up in the next months as lockdown restrictions lessen. The investment fund mix is currently 45% Conservative Fund and 55% Growth Fund. This mix could have provided the fund with as little loss as possible due to the balanced investment nature.

Returns

*Source: Fisher Funds Fund Update

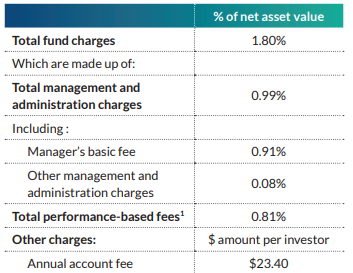

Fees

The annual estimated fees charged to Investors in the Balanced fund is 1.80%. Fees and charges can have a big impact on your investment over the long term.

*Source: Fisher Funds Fund Update

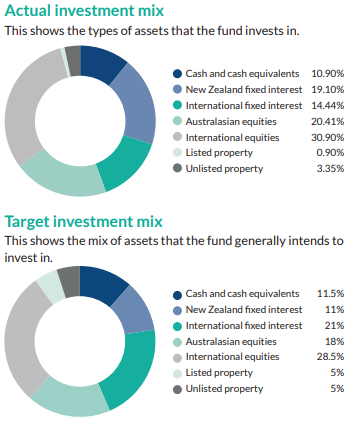

The Balanced Fund Investment Mix

*Source: Fisher Funds Fund Update

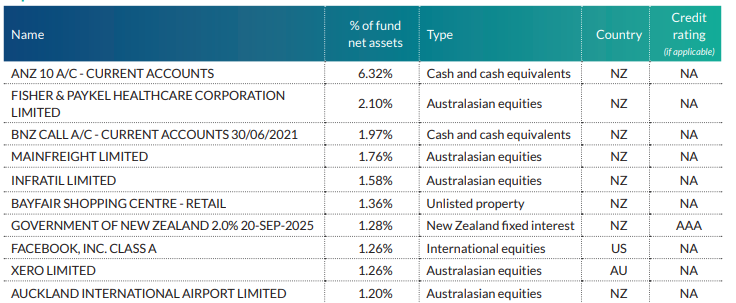

Fisher Funds Balanced Fund Top 10 Investments

Following are Fisher Funds top 10 investments which make up 20.09% of the Balanced fund.

*Source: Fisher Funds Fund Update

Growth Fund

The purpose of a Growth fund is to grow your investments over the long term by investing predominantly in growth assets.

The 1-month return of -1.1% could, as mentioned earlier, be due to current economic circumstances. Going forward, Growth fund returns are forecasted to pick up in the next quarter by greater economic activity sustained by active external demand, such as the role out of vaccines globally and the reopening of companies.

Returns

*Source: Fisher Funds Fund Update

Fees

The annual estimated fees in the Growth fund is 2.51%. Fees and charges can have a big impact on your investment over the long term.

*Source: Fisher Funds Fund Update

The Growth Fund Investment Mix

*Source: Fisher Funds Fund Update

Fisher Funds Growth Fund Top 10 Investment

Following are Fisher Funds top 10 investments which make up 24.21% of the Growth fund.

*Source: Fisher Funds Fund Update

Check out Fisher Funds Fund updates for more information. This information and past performance does not tell you and is not indicative of how the fund will perform in the future.

To see if Fisher has a fund that aligns with your values, retirement goals and situation complete the HealthCheck.