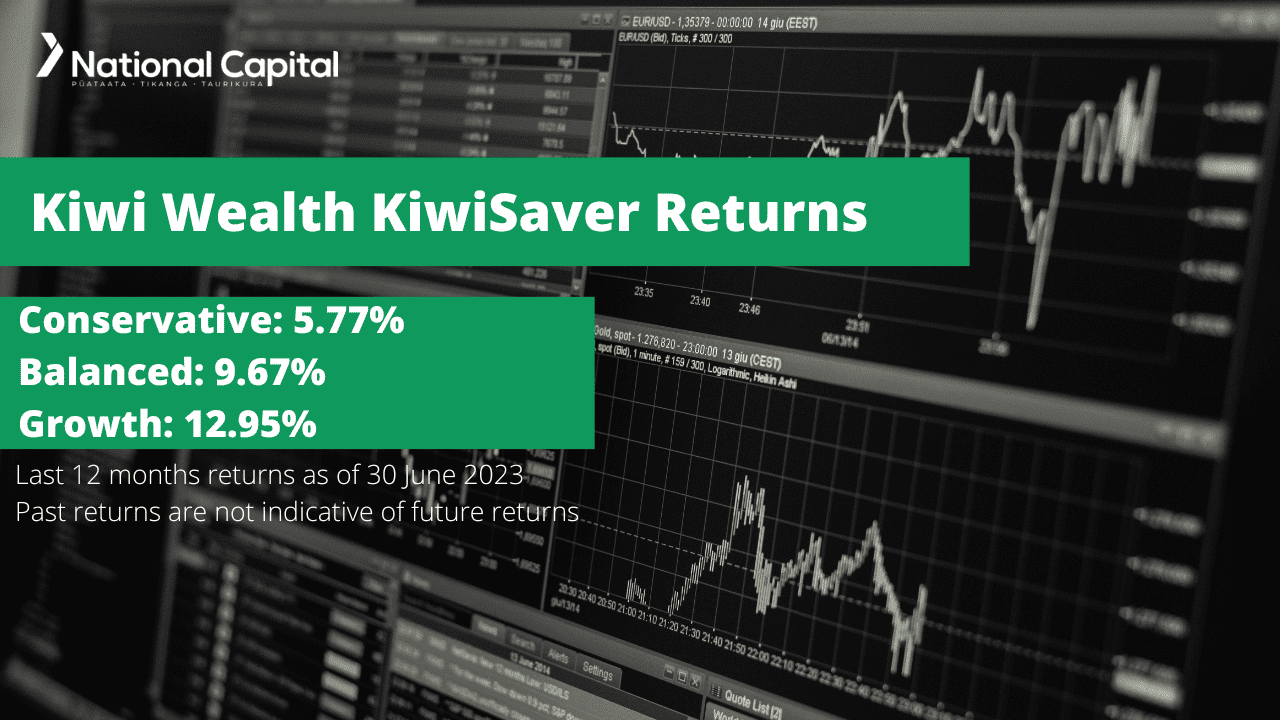

Using the most recent returns and fund update reports as of September 2023, we will examine Kiwi Wealth’s recent KiwiSaver Performance.

Kiwi Wealth KiwiSaver Scheme is the 5th largest KiwiSaver scheme in New Zealand, with approximately $7 billion in funds under management. They actively manage their investment funds and adopt a responsible investing approach to their investments. This includes identifying opportunities and voting for positive change on ESG issues through investment selection. Kiwi Wealth is undergoing a transitional period because of the recent change in ownership as the acquiring company, Fisher Funds, aims to identify new opportunities to grow the value of the combined businesses, which can be read in the news below.

Table of Contents

News about Kiwi Wealth

Performance of Kiwi Wealth KiwiSaver Funds

Kiwi Wealth Cash Fund

Kiwi Wealth Conservative Fund

Kiwi Wealth Balanced Fund

Kiwi Wealth Growth Fund

News about Kiwi Wealth

On August 15, Kiwi Group Holdings Limited (KGHL) announced the sale of Kiwi Wealth to Fisher Funds for NZ$310 million. Kiwi Wealth’s more than 270,000 members will be gaining access to Fisher Funds and are now the second-largest KiwiSaver provider in the country, managing up to $14 billion in funds.

Kiwi Wealth KiwiSaver customers will be integrated into Fisher Funds over the coming months, and Kiwibank will refer KiwiSaver customers to Fisher Funds via a strategic partnership. Fisher Funds is majority owned by the investment arm of Toi Foundation, a Taranaki-based philanthropic trust known as the TSB Community Trust before rebranding last year.

Performance of Kiwi Wealth KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Cash |

4.55% |

2.09% |

2.73% |

|

Conservative |

3.97% |

2.62% |

4.62% |

|

Balanced |

6.87% |

4.65% |

5.85% |

|

Growth |

9.09% |

6.20% |

6.43% |

Sourced from Kiwi Wealth fund performance report.

These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Kiwi Wealth Quarterly Fund updates published on June 2023.

Kiwi Wealth Cash Fund

The Cash Fund is invested 100% in cash assets to exceed the returns you would receive from investing 100% of your funds in New Zealand cash through the active selection of cash assets.

The following is Sourced from Kiwi Wealth Cash Fund Update.

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Cash Fund are 0.45% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a Cash Fund.

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Cash KiwiSaver Fund, which make up 55.39% of the fund.

Kiwi Wealth Conservative Fund

The Conservative Fund is invested up to 35% in shares and other growth assets, with the remaining proportion allocated to cash and fixed-interest assets.

The following is Sourced from Kiwi Wealth Conservative Fund Update.

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Conservative Fund are 0.88% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 18.38% of the fund.

Kiwi Wealth Balanced Fund

The Balanced Fund is invested up to 70% in shares and growth assets, with the remaining proportion allocated to cash and fixed-interest assets.

The following is Sourced from Kiwi Wealth Balanced Fund Update.

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Balanced Fund are 1.04% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Balanced KiwiSaver Fund, which comprise 15.79% of the fund.

Kiwi Wealth Growth Fund

The Growth Fund is invested up to 90% in shares and other growth assets, with the remaining proportion allocated to cash and fixed-interest assets.

The following is Sourced from Kiwi Wealth Growth Fund Update.

Returns

Fees

The total annual fees for investors in the Kiwi Wealth Growth Fund are 1.13% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Kiwi Wealth’s top 10 investments in the Growth KiwiSaver Fund, which comprise 18.59% of the fund.

Data for Kiwi Wealth KiwiSaver funds have been sourced from Kiwi Wealth KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Kiwi Wealth has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.