Using the most recent returns and fund update reports as of August 2023, we will examine Pathfinder’s recent KiwiSaver Performance.

Pathfinder KiwiSaver Scheme, formerly known as Caresaver Kiwisaver, is an independent fund manager focusing strongly on Responsible Investment (RI). A conservative fund is one of three actively-managed KiwiSaver funds offered by the company, which range from low-risk to high-risk. Pathfinder believes in ethical investing and only invests in companies with high ESG ratings. This is because they believe these businesses benefit our planet and its people.

Table of Contents

Performance of Pathfinder KiwiSaver Funds

News about Pathfinder

Pathfinder has achieved an A+ rating from the UNPRI for the second year, aligning with the UN’s Sustainable Development Goals (SDGs). They prioritise ethical investments that address global challenges such as climate change and poverty. By investing in renewable energy, water infrastructure, and companies working on global issues, they aim to promote sustainable development. In addition, Pathfinder recognises the risks of overconsumption and encourages businesses to innovate for cost savings and efficiency. Their mission is to generate solid returns for investors while promoting the SDGs and a better planet.

Performance of Pathfinder KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Conservative |

3.0% |

N/A |

3.3% |

|

Balanced |

5.7% |

N/A |

6.4% |

|

Growth |

6.5% |

N/A |

9.3% |

Sourced from Pathfinder fund performance report

* These returns are to 31 August 2023 before tax and after fund management fees. Past performance does not necessarily indicate future performance and return periods may differ.

Note: The following information is sourced from Pathfinder Quarterly Fund updates published on 30 June 2023.

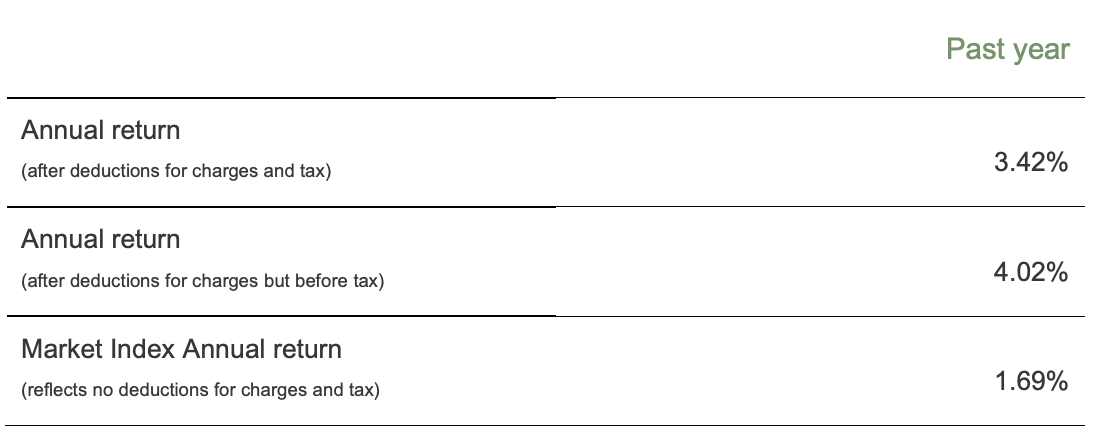

Pathfinder Conservative Fund

The Fund is an ethically sound investment portfolio with greater exposure to income assets and lesser exposure to growth assets. As opposed to the Pathfinder KiwiSaver Balanced Fund or Pathfinder KiwiSaver Growth Fund, this Fund’s value is unlikely to change as much.

*The following is Sourced from Pathfinder Conservative Fund Update.

Returns

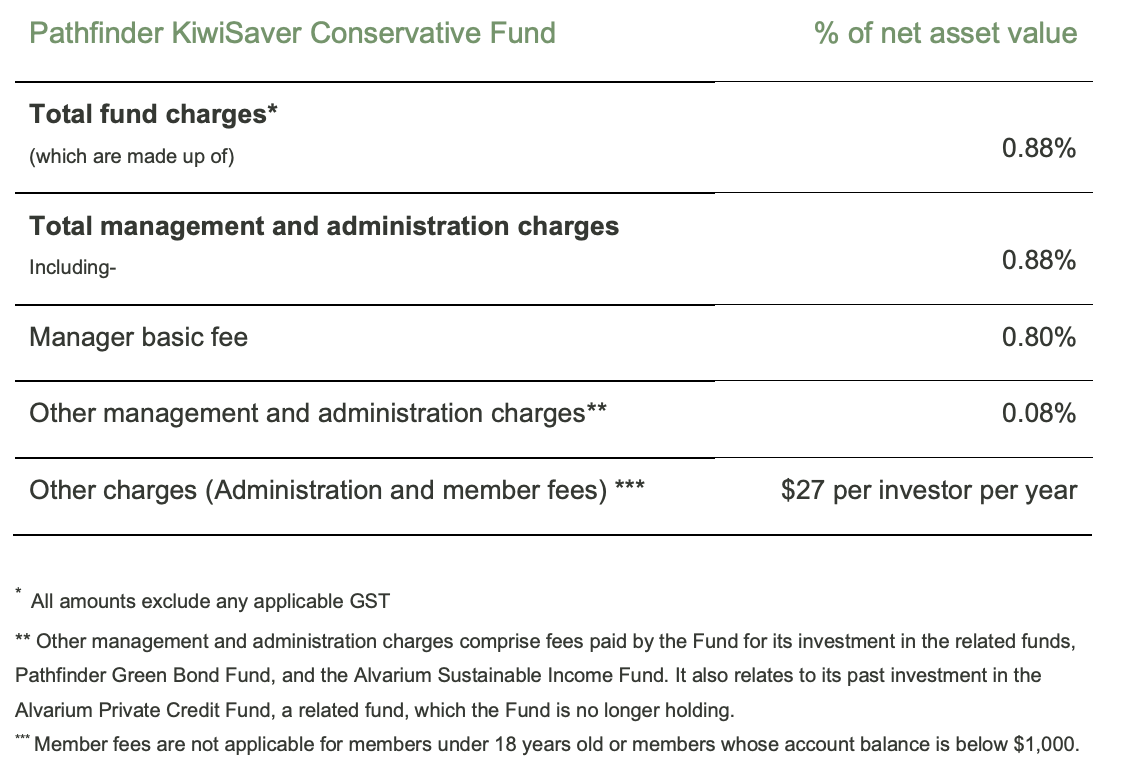

Fees

The total annual fees for investors in the Pathfinder Conservative Fund are 0.88% per year, with an additional $27 administration and membership fee.

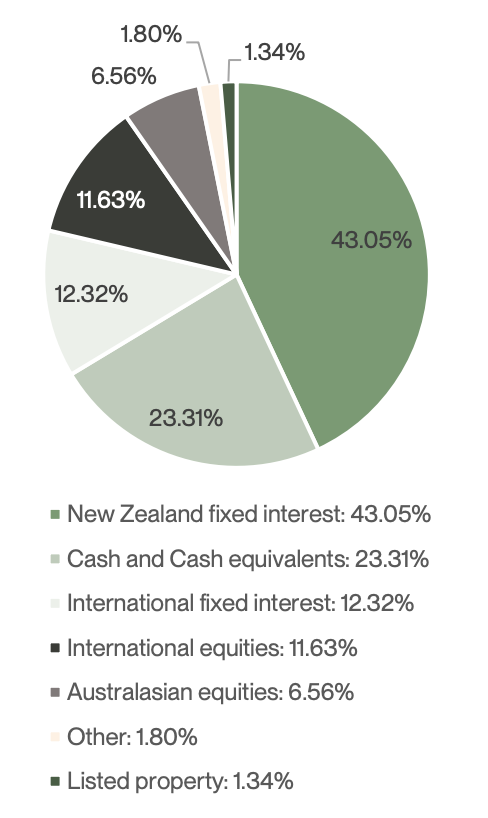

Investment mix

The investment mix shows the type of assets that the fund invests in.

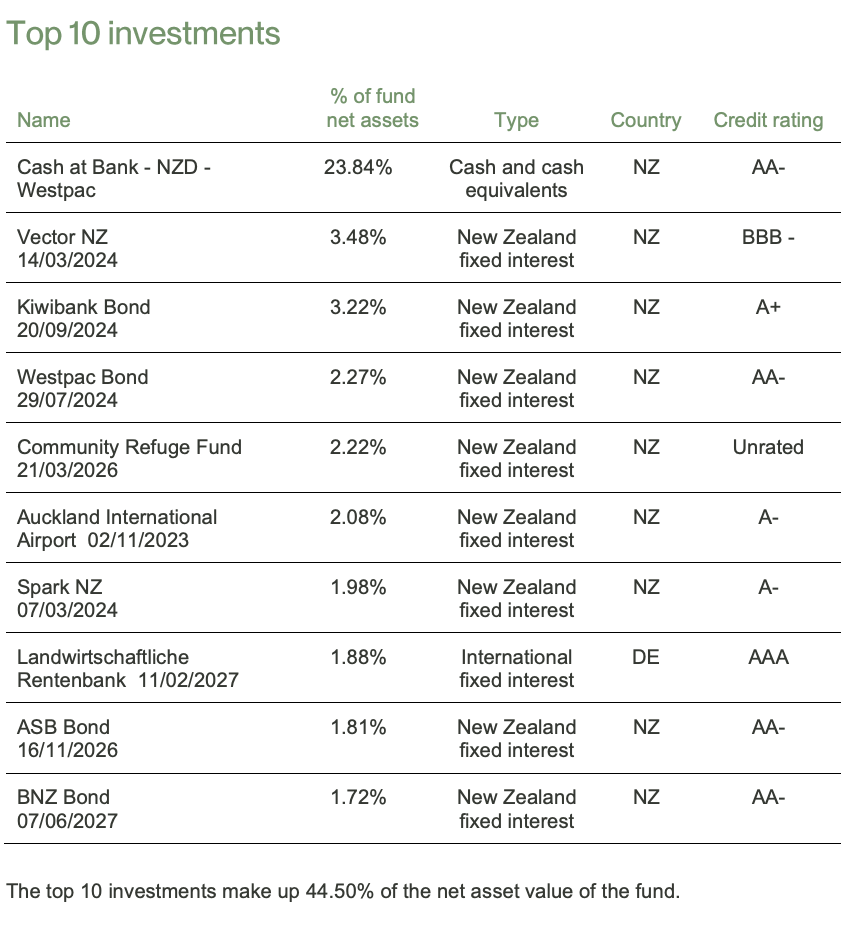

Top ten investments

This table shows Pathfiners’s top 10 investments in the Conservative KiwiSaver Fund, which comprise 44.50% of the fund.

Pathfinder Balanced Fund

The Fund is an ethical investment portfolio with a proportionate exposure to growth and income assets. Compared to the Pathfinder KiwiSaver Conservative Fund and the Pathfinder KiwiSaver Growth Fund, this Fund’s value is more likely to change.

*The following is Sourced from Pathfinder Balanced Fund Update.

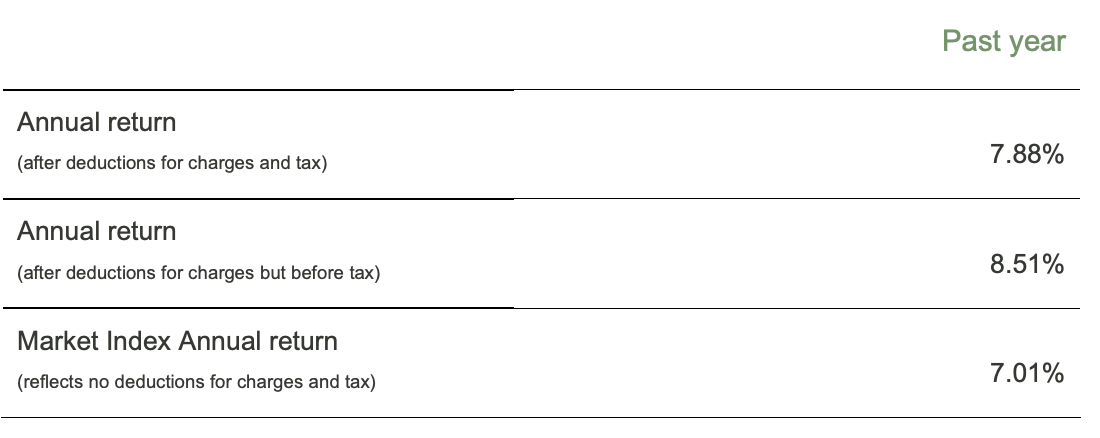

Returns

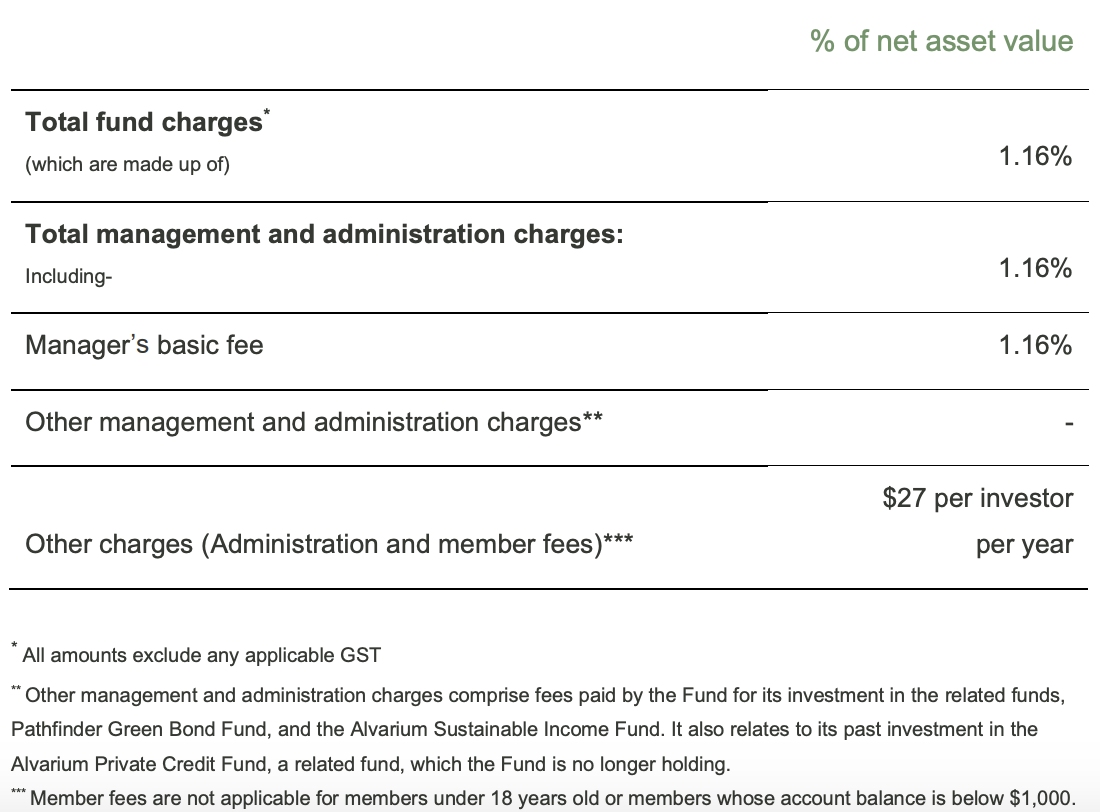

Fees

The total annual fees for investors in the Pathfinder Balanced Fund are 1.16% annually, with an additional $27 administration and membership fee.

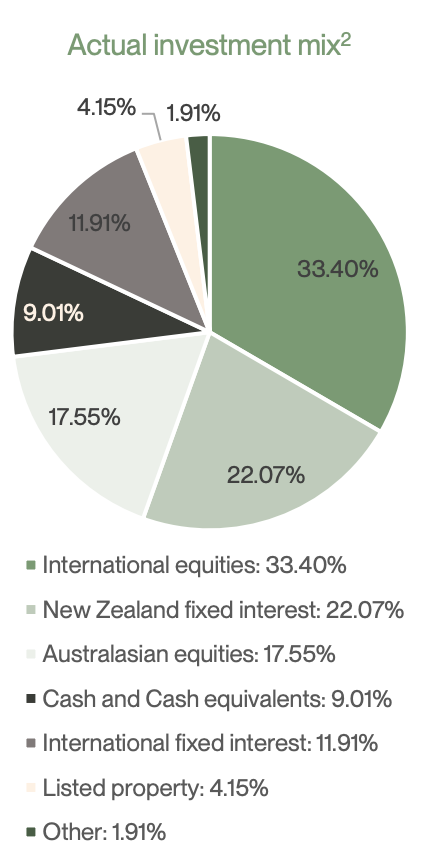

Investment mix

The investment mix shows the type of assets that the fund invests in.

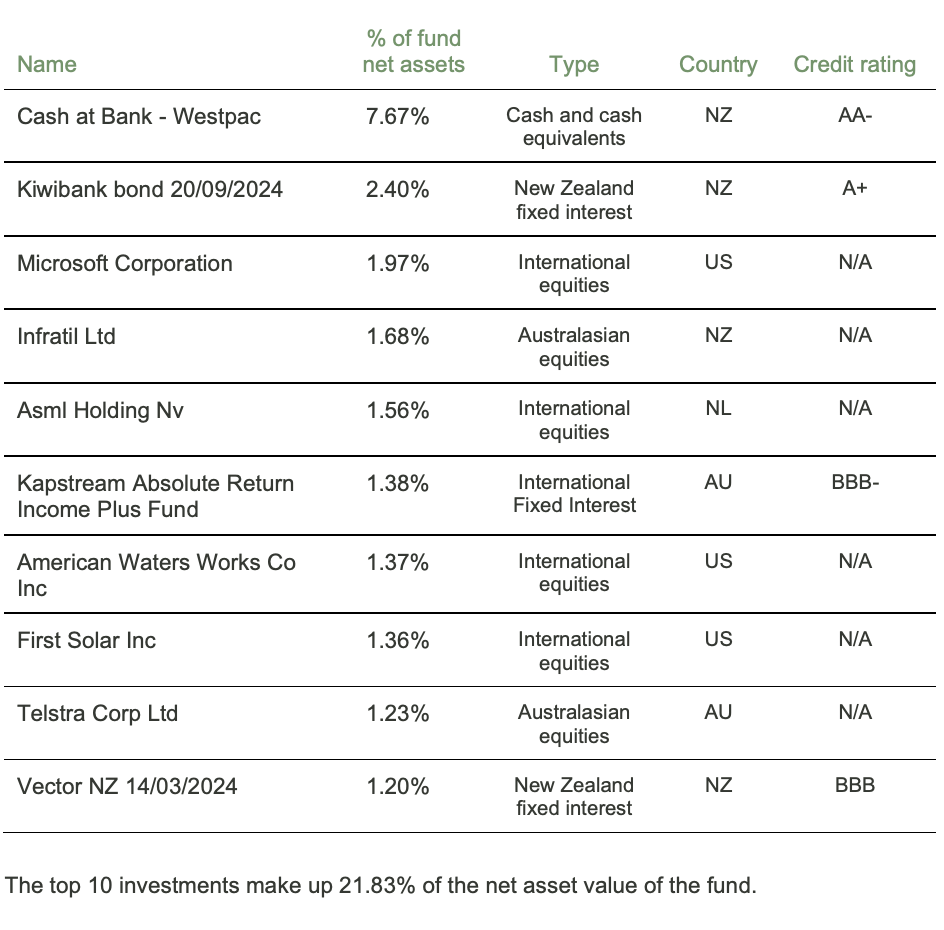

Top ten investments

This table shows Pathfinder’s top 10 investments in the Balanced KiwiSaver Fund, which make up 21.83% of the fund.

Pathfinder Growth Fund

The Fund is an ethical portfolio that invests more in growth assets and less in income assets. Compared to the Pathfinder KiwiSaver Conservative Fund and Pathfinder KiwiSaver Balanced Fund, this Fund’s value is expected to fluctuate more.

*The following is Sourced from Pathfinder Growth Fund Update.

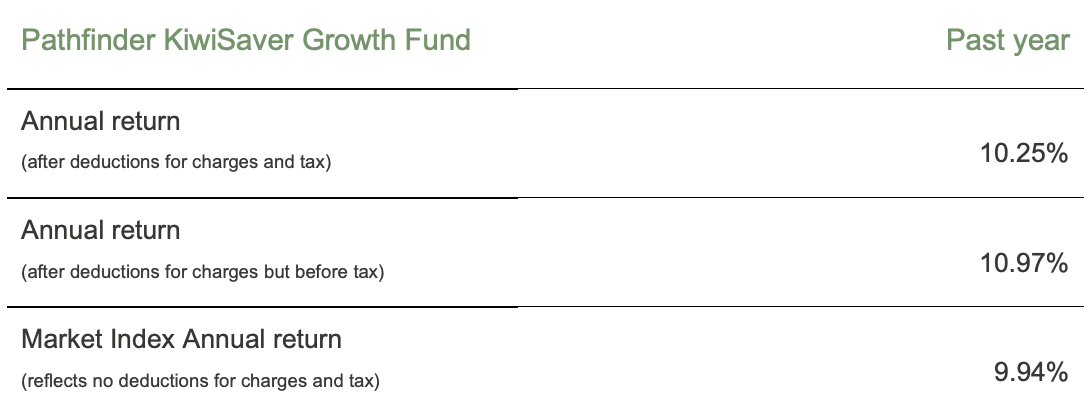

Returns

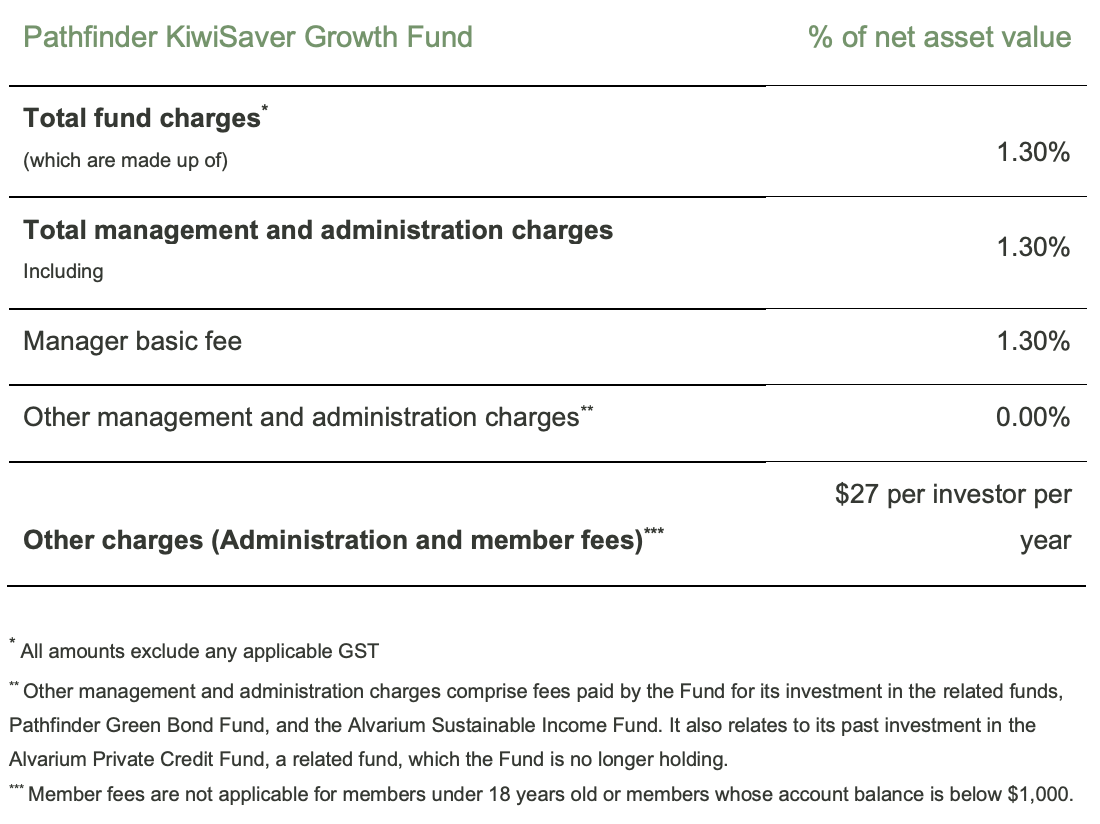

Fees

The total annual fees for investors in the Pathfinder Growth Fund are 1.30% per year, with an additional $27 administration and membership fee.

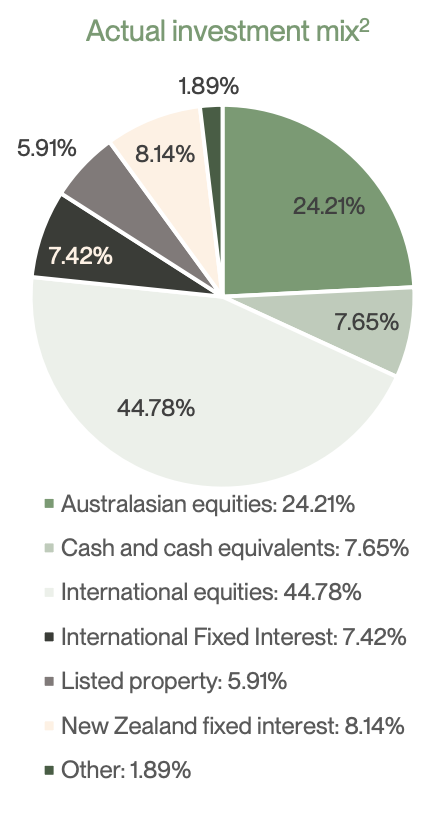

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Pathfinder’s top 10 investments in the Growth KiwiSaver Fund, which comprise 23.35% of the fund.

Data for Pathfinder KiwiSaver funds have been sourced from Pathfinder KiwiSaver Funds. Past performance does not necessarily indicate future performance and return periods may differ.

To see if Pathfinder has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.