- The stock market has had very good returns in the past few years.

- However, due to various factors, it has dropped in the last month.

- One of these factors is rising interest rates. Normally when interest rates rise, the attraction to stocks goes down which causes a drop.

- It is impossible to predict the timing and amount of this drop.

- The important thing to remember is all of this is usually short-term and is what we refer to as market volatility.

Your KiwiSaver balance is likely dropping because of this increased market volatility. This is when financial markets experience periods of unpredictability, price movements, and increased risk. Market volatility increases when situations like the current Covid-19 pandemic cause international and local markets pressure. This makes prices go up and down and can cause your balance to fluctuate. Depending on what type of fund you are invested in the changes can be large or small.

Afraid of losing all your money? The good news is this is highly unlikely to happen. Although markets are volatile, historical research shows that in the long run, they always recover and rise. When market volatility goes up, so does risk, but money-making opportunities increase too. When you invest in Kiwisaver there is always an amount of financial risk. To help mitigate this risk independent financial advisors National Capital use AI technology to analyse your personal situation and offer recommendations on how to best reduce your risk and optimise your KiwiSaver fund. Advisors adjust for market volatility when providing long-term projections.

When Covid-19 first hit international and local markets over 256,000 Kiwi’s changed funds mainly from growth to conservative or cash funds. This cemented the loss made by growth funds and resulted in Kiwis losing over $820 million in their KiwiSaver account alone! If Kiwis had received trusted financial advice before changing KiwiSaver companies, a financial advisor could have explained that market dips are part of investing and that markets almost always fully recover.

Clive Fernandes, the Director of National Capital says “Simple to understand, expert advice is key to helping you make the right choices. Advisors ensure you make informed decisions, help reduce financial anxiety and build confidence regarding your KiwiSaver investment.”

Watch this video to see how emotions can affect investment decisions:

Key investment strategies

Three key strategies that can help you combat market volatility and emotional investment decisions are diversification, keeping the long game in view, and buying low.

Diversification

When current events like the Covid-19 pandemic cause markets to be volatile, National Capital advises investors to rely on diversification. It reduces risk by investing in a variety of assets, reducing the possibility that all bonds or shares will drop in price at the same time. As industries react differently to the same situation, diversification offers investors a safeguard against their entire KiwiSaver dropping completely in value. Additionally, some investments may even make small profits during the situation.

Long-term

You've been told to consider the long-term since joining KiwiSaver. It is uncertain how long Covid-19 will affect market volatility. Investors should take this situation as an opportunity to reflect on their investment strategies and take advantage of profit-making opportunities. History shows that when such circumstances affect markets they have always recovered. Huge, impactful events like the Global Financial Crisis have occurred, and investors made it through and even flourished after. So, now is the time to remain calm and weather the storm. To change KiwiSaver at times of uncertainty may lead to further avoidable losses due to sheer panic.

Buying Low

When market volatility increases, past events have shown that instead of selling this is when investors should hold tight or buy! Examples of such events are the SARS and Zika virus, both of which caused investors to sell off and prices to fall. The result was that those who sold, missed out on notable profits because markets recovered and exceeded previous prices. The fear of losing money tends to affect investors in uncertain and stressful situations and cause them to sell. However, those who put their fears aside and look at a situation from a logical investment point of view will see the potential for gains to be made. Buying shares or bonds at a discount means there is an opportunity to make a profit.

To sum up, markets are volatile for periods of time, which means that your balance may fluctuate from low to high. However, it is reassuring to know that historical data shows that it always recovers. In order to navigate market volatility, investors should diversify their investment portfolio, look at the situation from a long-term view and remain calm throughout times when the market is volatile and balances go up and down. Remember, from KiwiSaver sign up, until retirement, you are in it for the long game.

Why else might my balance be dropping?

Not all KiwiSaver funds are the same, so if your balance is dropping a lot it may be because of the allocation of your fund. You can check your allocation through your KiwiSaver login account. Generally, there are five or more types of funds: Conservative, Moderate, Balanced, Growth and Aggressive. There are also ethical funds, which only invest in ethically run assets, and Life Steps/Stages funds which automatically decrease the amount invested in Growth Assets as the investors get older.

Fund Types

When you invest in KiwiSaver, your money goes into a fund and the fund manager invests it into either Income or Growth Assets or both depending on the fund type. Income assets are cash and bond assets that pay interest and usually get their money back when the time frame of the asset expires.

Growth Assets are shares and property which pay dividends or rent and can grow in value. But, Growth Assets values can fall when markets are volatile. In the long run, Growth Assets have more ups and downs in value than Income Assets but bring higher average returns.

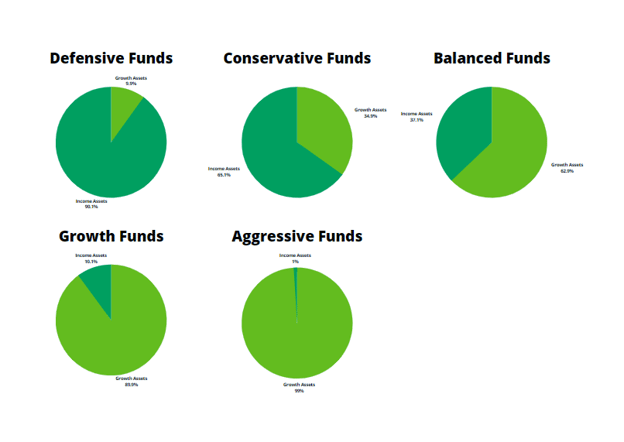

Different funds hold different percentages of Growth Assets:

- Defensive: 0% - 9.9%

- Conservative: 10% - 34.9%

- Balanced: 35% - 62.9%

- Growth: 63% - 89.9%

- Aggressive: 90% - 100%

If your balance is dropping it could be because of the type of fund you are in. If you are in a growth or aggressive fund which has more money invested in Growth Assets it is likely that your balance will experience higher and lower dips in value when markets are volatile.

With so many options available, deciding which KiwiSaver provider and fund to use can be overwhelming. This is where National Capital can help. National Capital is an independent KiwiSaver financial advisor who does the research for you. They offer you free personalised recommendations on which providers best suit your needs and situation. National Capital analyses funds past returns and performance to understand how the funds operate and the probability of keeping that level of performance in the future. They save you time and money and can help give you peace of mind about your KiwiSaver funds.

Will I lose all my money?

If you are worried that your KiwiSaver provider might go ‘bankrupt’ and you will lose all your savings, don’t be. All KiwiSaver providers are highly regulated by the government and have to comply with the KiwiSaver Act 2006. This makes them extremely secure. People might think that their provider can go ‘bankrupt’ and take their money, but this is wrong because these providers do not actually have your money, they just manage it. KiwiSaver funds are stored in trusts and you are the beneficiary of the trust. This means that if a provider goes ‘bankrupt’ your money is safe.

Increased market volatility can cause your balance to change. The result is prices that go up and down and subsequent profits and losses. Specific factors that can increase market volatility are changes in:

- Interest Rates

- Inflation Rate

- Monetary Policies

Read More:

Interest

Interest is the amount of money a lender gets for lending someone money. For example let's look at a bond, this is a loan taken by a company from investors who buy their bonds. The company pays interest to the investors and repays the loan on the agreed maturity date, the end of term. So if an investor bought $10 000 of bonds at an interest rate of %1 they would receive $100 interest payments until the end of term when the company repays the principal $10 000.

Inflation

Inflation is the loss of purchasing power of money that results in increased general prices. Basically yearly inflation causes your money to be worth less each year. Hence, low inflation is considered good. Inflation affects lenders and borrowers in different ways, lenders are hurt by increased inflation because the money they get paid back is worth less than the money they lent out and borrowers benefit because of the same reason, the money they pay back is worth less than the money they borrowed. If inflation is high, you shouldn’t pay off your debt but instead invest more money to have more buying power in future.

Monetary Policy

Monetary policies are used by governments through the central bank of a country to control inflation, promote long-term and moderate interest rates and manage unemployment. Changes in monetary policies affect interest rates and inflation and therefore indirectly market volatility. The overall goal of monetary policies is to promote healthy economic growth. Interest rates are affected by monetary policies because the central bank limits or increases the amount of money that banks can loan. This results in banks making loans more expensive by charging higher interest rates and means less people can get loans or banks charging lower interest rates which means more people can afford to borrow money to buy stuff which increases economic growth.

If it seems difficult to trust that you are making the correct financial decision, or to research and choose a suitable fund, don’t stress. National Capital gives free reliable and tailored KiwiSaver advice and researches more than 100 funds to recommend ones that suit your situation. We operate online and give free recommendations with the goal of helping 1 million people become financially secure.

Take National Capital’s free KiwiSaver HealthCheck now to find out the best KiwiSaver investment options for you.

How it works in 3 steps:

See the National Capital KiwiSaver Advice Process: