Unfortunately the answer is not tomorrow…

Retirement is a question that is on everyone’s mind whether it be in a few short years or a lifetime in the workforce away. Working out what you will need to have sorted and saved for your retirement can be daunting and overwhelming, not to mention deciding on when the best time to retire will be. Hopefully I can shed some light on a few variables that contribute to finding the best time to enjoy retirement

I cannot admit that the secret best age to retire is actually 62, nor can I say it 63 or 74. The answer just isn’t that straightforward. The status quo retirement age in New Zealand is 65 and there is some logical reasoning behind that which goes hand in hand with some of the Country’s policies around superannuation and KiwiSaver.

Superannuation and KiwiSaver

Superannuation and KiwiSaver are both very useful tools for funding retirement. They are two very different systems that are both set up to aid in the financial security of retirees. Superannuation New Zealand is a pension fund intended for New Zealand Citizens over the age of 65. Fortnightly payments are made with rates depending on marital status, regardless on whether you are still working or not. This means that your superannuation can make a great addition to your savings if you decide to keep working after 65 as you can receive the fortnightly payments from the government alongside your regular work income. An important side note to take into account is the maximum you can earn before your income can affect your NZ super payment amounts. Work and income states that before the 1st of April 2021 your NZ super would start being reduced when weekly income before tax exceeded $115NZD. But after the 1st, this amount was increased to $160NZD. After exceeding this amount, your payments will decrease by 35 cents on every extra dollar you earn.

To explain, it is a scheme set up by the New Zealand government to help kiwis save for their own retirement. Employees can decide on a certain amount of their paycheck to be automatically deposited in their KiwiSaver account each payday. In accordance with government policy, employers must match this contribution up to 3%. Though it isn’t a pension fund like the NZ Super, the government does follow a ‘50 cents to the dollar’ type contribution for New Zealand permanent residents and Citizens where for every dollar an individual puts into their account the government will match it up until a maximum of $521.43 (meaning you need to contribute $1042.86 to receive that amount). Both employer and government contributions are incentives for kiwis to invest in their kiwiSaver funds and therefore their retirements.

How do they Relate to Early/Late Retirement

So we have established how the combination of Superannuation New Zealand and KiwiSaver are very handy tools in the retirement belt, how do they come into play in terms of early or late retirement?

Though these two are quite different in nature, they do share a specific characteristic that does affect the decision to retire early or late. They are both only accessible at the age of 65. This means that if you decide to retire at 60, you will not be able to access and use either of the retirement schemes for the next 5 years. So this definitely joins the ‘cons’ side for early retirement. This doesn’t however mean that you cannot retire at 60, but it then comes down to specific financial position. If you have some savings set aside and wish to use that for the five years before you can withdraw your Kiwisaver and other retirement assets then that’s perfect! But not everyone is in the same position and it could quite potentially not be an option for a lot of kiwis out there.

Why I Shouldn’t Retire Early

A downside that occurs when opting for an earlier retirement is having your investment horizon shrink. Having a smaller amount of time in the market opens you, as an investor, up to more market volatility. This means that the short term market dips could have a larger influence on your long term investment. Though this only really has a significant impact if your investment window is 8-10 years or under, it is still something to think about when looking at the retirement factors.

Facing away from what happens before retirement and looking more into what happens after the fact; there are still a couple things that you need to consider.

One, is the inability to predict the future. Being well organised and having a good plan with weekly expenses designed to allow you to enjoy the years of freedom is certainly a good position to be in. Yet, so many unforeseen circumstances can veer the budget right off course.

An unfortunate side effect of growing older is the increased probability of expensive hospital bills and medical expenses. Nobody knows what tomorrow might bring, not to mention the next 10 years. Having a reserve of savings for such things could be a good move, despite it being very hard to determine how much you will actually need when and if the time should come. .

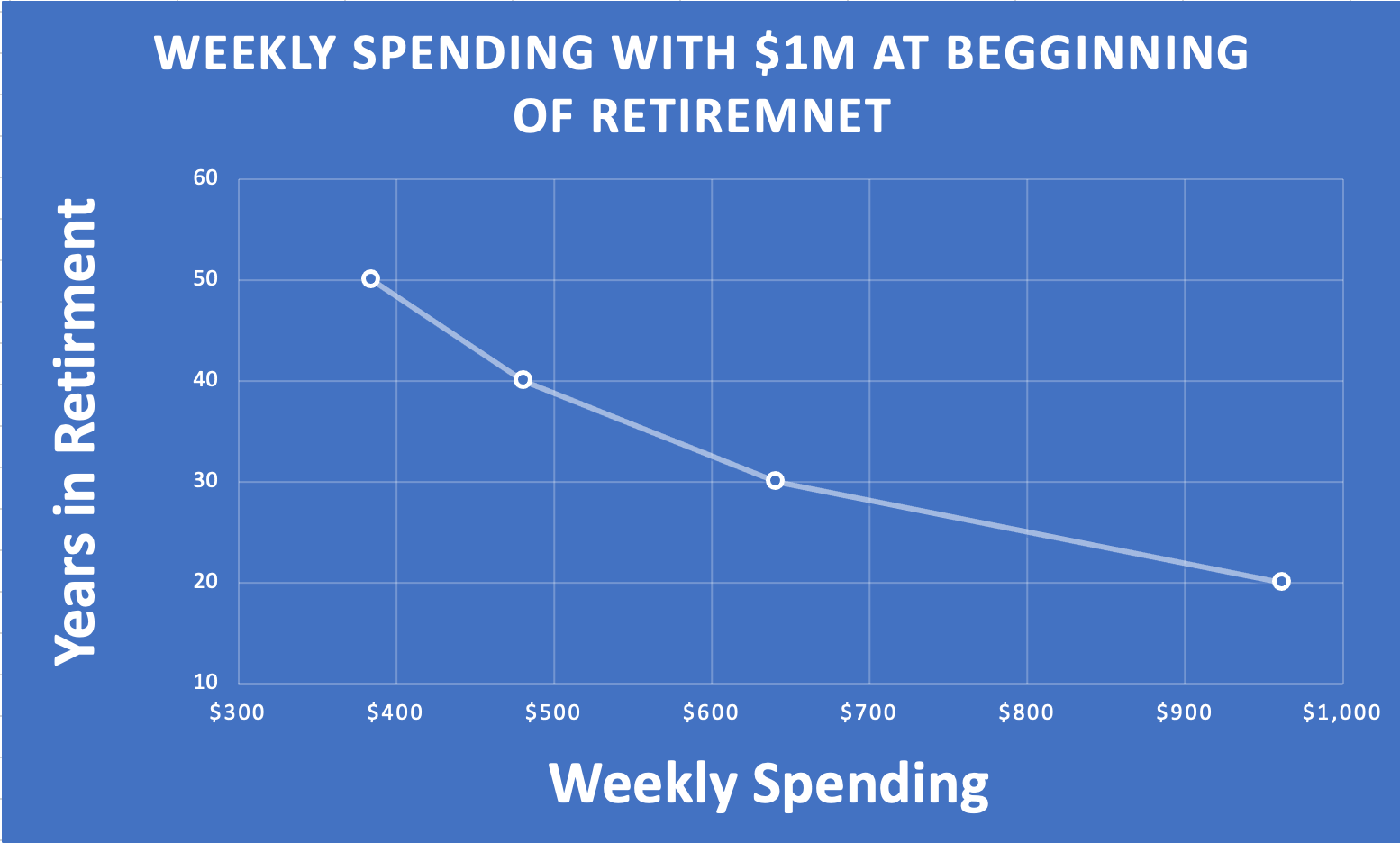

Retiring early is certainly possible but it definitely stretches out your finances a little bit more. Retirement assets might supply you a pretty luxurious 30 odd year retirement. But when you decide to retire 10 years early, your weekly spending immediately gets cut down by about 30%. If your plan was going to provide you with $650 in expenses from 65 to 95 and you have now decided you were over work at 55 instead, then you would be looking at a new weekly budget of $450 (which can really impact the enjoyment of the glory years).

This does however flip around on the other side. When thinking about a later retirement, you won’t need as large of a nugget to sustain your retirement. You will either live it up a little more in your shorter retirement timeframe, or you won’t have to work as hard to save in the years leading up to retirement. Furthermore, the years after 65 that you do continue to work (if you do decide to keep saving) will result in an increase in your lump sum available for when you do decide to ‘put down the tools

This really comes down to the calculation around what you will have available to you at retirement. Fortunately, a part of what we do at National Capital (aside from placing you in the Kiwisaver fund best suited to your position) is run a series of calculations based off of your specific financial details which we use to project your expected lump sum at retirement along with what you could potentially spend weekly during your retirement. If you’re interested in seeing what that might look like for you in your current situation, then go enter your details into our KiwiSaver HealthCheck to find out.

Why I Should Retire Early

What we have seen so far has definitely been more of the downsides of retiring early. Which doesn’t bring about the best of moods but it does need to be part of the comparison to properly weigh up the options. The good news is, there are many positives to early retirement as well.

The first big one that springs to mind being - free time. It’s no secret that many Kiwi’s would much rather be out fishing, or soaking up some sun rather than being stuck in an office all day. An early retirement gives you the freedom to spend your time doing things that you really enjoy whether that be spending time with family, rediscovering past passions and hobbies, or even staying in bed all day! Though leaving work doesn’t automatically improve quality of life, it can certainly contribute to it if you are doing things you enjoy.

Another benefit that could quite possibly correlate with the reason above is the improved mental well being and lower levels of stress. There are some contradictory studies about how this may not be true, or that it could be more accurate for males but not females, but the general consensus is that retirement brings about an ease of mind. This is due to work related pressures such as deadlines, quality of output, performance and other factors that are common contributors in work related stress. This stress being negligent upon retirement. The constant daily struggles to achieve tough goals and satisfy employers or clients simply don’t exist when you exit the workforce.

So, if you are feeling run down or unhappy due to work related stress or a long stint in the workforce, then an early retirement could bring about many benefits for you. On the other hand, if your work brings you energy and a sense of accomplishment or purpose then this might not be the best call, and forcing an early retirement could contraire in a stress free environment.

How do these Factors Affect Me?

A noticeable pattern in the reasons for and against an early retirement are the financial and non financial benefits and constraints. Though there are a lot of positives to do with quality of life and general wellbeing in retiring early, on the flipside there are many financial benefits to retiring late. The decision to do one or the other comes down to personal preference and situational factors.

To help work out if early retirement is for you then perhaps these are some question you could discuss:

-

Would I be able to finance my retirement independently before my KiwiSaver and NZ Super becomes accessible?

-

Would I be content having less to spend on a weekly basis over a longer time period?

-

Do I have sufficient cash reserves for unforeseen expenses?

-

Am I Unhappy or overly stressed in the workplace?

-

Does my workplace bring me a sense of achievement and satisfaction resulting in higher energy levels

-

How else could I spend my day to better enjoy my time?

Remember, Having your finances and KiwiSaver worked out is a big part in making an early retirement possible and easy. If you are unsure about whether it’s working in the best interests for your specific retirement timeline, then have a chat with one of the advisors at National Capital. By answering a few questions in our KiwiSaver HealthCheck we can help you workout where you are now, and where you need to be to help achieve your retirement goals.