Bank deposits used to be the go to option for retirees. Many, like yourself, had a simple investment strategy which consisted of putting the majority of their savings in the bank while earning a small interest rate. It was considered a safe investment strategy that delivered enough returns for retirement. Now the interest rates from banks are dropping and that is why putting all of your money in the bank might not be a feasible option anymore.

The OCR (Official Cash Rate) is currently very low at 0.25% with the possibility of going negative next year. As an investor, negative interest rates sound quite terrifying. So what are the options for a retiree in a negative interest rate scenario?

What can I invest in?

The other major asset class options are bonds, equities and property.

Unfortunately , the interest rates or returns on newly issued bonds are expected to be low given the low interest rate environment. Alternatively, if you buy bonds now, and interest rates start rising, you risk the value of your bonds falling resulting in capital loss. This is because the price of bonds in most cases moves inversely to interest rates.

Equities on the other hand could give you higher returns, due to the expected increase of prices in the share market when interest rates are falling. Since there are less attractive investment options available for investors in a low interest rate environment, they may rush to invest more in shares causing prices to increase. Another factor contributing to this is that the cost of borrowing for companies will decrease, and with less debt, these companies could increase their profit and consequently, their share price.

Of course, there is also property. Kiwi’s love buying investment properties. Historically, property has been a good investment, however, demand for housing, and therefore prices, are currently very high due to low mortgage rates. Property is also considered an ‘illiquid’ investment; meaning it could be tricky to sell at short notice when you need the funds. Additionally, because many of us will need to put almost all or a large chunk of our savings to buy a rental property, this results in a total lack of diversification. Essentially you are putting all your eggs in one basket. This lack of diversification leads to increased risk, which is not what you want when you are getting closer to retirement.

So, is there a suitable investment strategy?

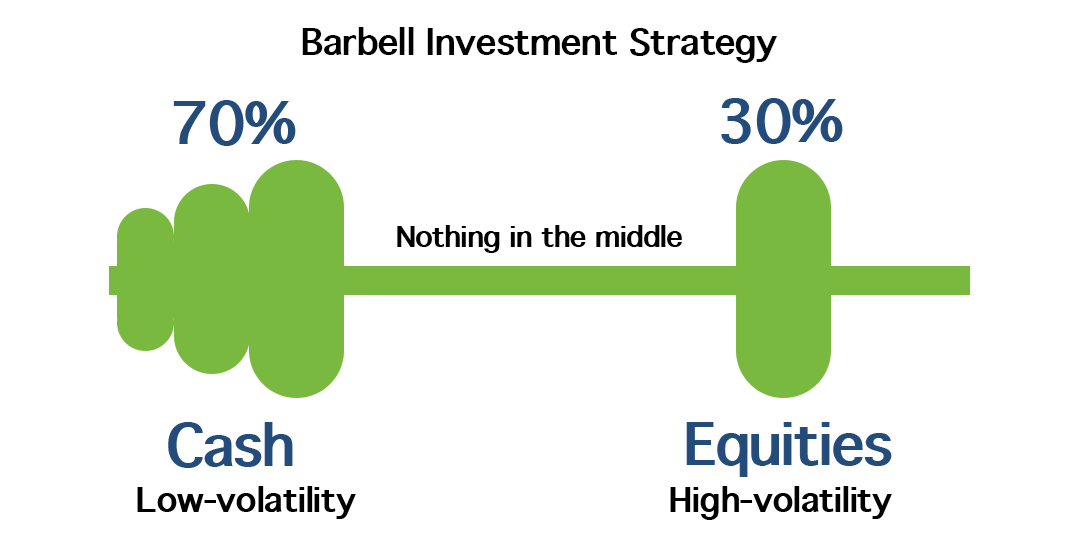

One option to consider is a barbell investment strategy. This suggests that, as an investor, you should put your money into high volatility, high return assets and low volatility, low return assets with nothing else in the middle. If a typical portfolio has a 60/20/20 split in low, medium, and high volatility assets, a portfolio following the barbell strategy might have a 70/30 split. That is 70% of your investments in cash and the other 30% placed in equities. It would look something like this:

Your cash investments would not have much of a return because of low interest rates. However, your additional exposure to equity would give you the growth to balance out your cash investment.

How do I execute this strategy?

At 65 or over, you could still execute this strategy using KiwiSaver. For example, you could have X% of your investments in a Cash KiwiSaver Fund and the remaining in an Equity KiwiSaver Fund. The funds you chose and proportions of your asset allocation would highly depend on your risk appetite, income requirements and the timeframe of your investments.

How National Capital can help

If you’re a retiree, National Capital offers a free advisory service through our KiwiSaver HealthCheck to help you create a strategy for your needs. It is never too late to sort out your retirement plan, even if you are over 65. You can still allocate your money in KiwiSaver so you can earn money on your retirement savings. This will help you make the most of your retirement money in the coming years.

At a time where our interest rates could go negative, you should reassess your income streams as a retiree and look at other possibilities when you feel less confident in your current investment strategy. This is where National Capital can help you find investments suitable for retirees like you.

Before recommending a fund to you, National Capital’s investment team ensures the fund managers’ investment strategies are appropriate for you. There are a wide range of investment choices and KiwiSaver funds available, which can make the selection process quite overwhelming. But by using National Capital’s free advisory service, you can get help selecting the right funds to implement the best strategy for you.

So, let’s start by submitting the KiwiSaver HealthCheck and develop a strategy with a real person for your KiwiSaver savings today.