Using the most recent returns from September 2021, we will take a look at SuperLife's recent KiwiSaver Performance.

SuperLife is managed by Smartshares Limited, a wholly-owned subsidiary of NZX Limited. SuperLife believes that a passive approach to investing will deliver better long-term results. They do not think that constantly changing their investments (trading regularly and seeking short-term gains) will always add value to investors.

During September, the share market and, consequently, SuperLife’s KiwiSaver returns decreased. The decrease could be due to Auckland’s lockdown, the market calming down after last year's considerable returns or another external factor. However, the returns are not something to worry about as it is natural for the market to sway, and the fluctuation does not necessarily indicate the performance of these funds in the long term.

Table Of Contents

News about SuperLife

Performance of SuperLife KiwiSaver Funds

SuperLife Income Fund

SuperLife Conservative Fund

SuperLife Balanced Fund

SuperLife Growth Fund

SuperLife High Growth Fund

News about SuperLife

Super Life will become a new KiwiSaver default fund provider as of the 1st December 2021. Super Life has been appointed following a competitive tender process. The applicants were assessed against a set of criteria which included fees, their ability to deliver the investment product, manage transitional arrangements, provide a good customer experience for their members, and the provider’s organisational structure and standing.

Performance of SuperLife KiwiSaver Funds

|

1 month |

1 year |

3 years |

5 years |

|

|

Income |

-0.68% |

-1.73% |

2.45% |

2.19% |

|

Conservative |

-0.17% |

5.79% |

5.26% |

4.77% |

|

Balanced |

0.19% |

13.88% |

8.32% |

7.34% |

|

Growth |

0.45% |

19.06% |

9.77% |

8.80% |

|

High Growth |

0.65% |

24.55% |

11.44% |

10.22% |

*Sourced from SuperLife fund performance report

* These returns are to 30 September 2021 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from SuperLife Monthly Performance updates published on 27th October 2021.

SuperLife Income Fund

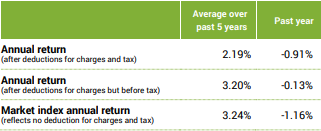

Invests in income assets and designed for investors that want investment in New Zealand and fixed international interest. The Income fund has performed poorly with negative 1-year returns of -1.73%, below the 5-year returns of 2.19%. However, past performance is not always an indication of future returns, and the fund could return to stable returns with its future performance.

*The following is Sourced from SuperLife Income fund update

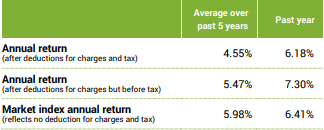

Returns

Fees

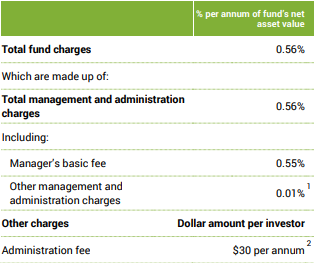

The total annual fees for investors in the SuperLife Income fund are 0.56% per year and a $30 administration fee.

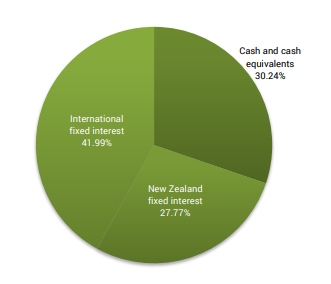

Investment mix

The investment mix shows the type of assets that the fund invests into.

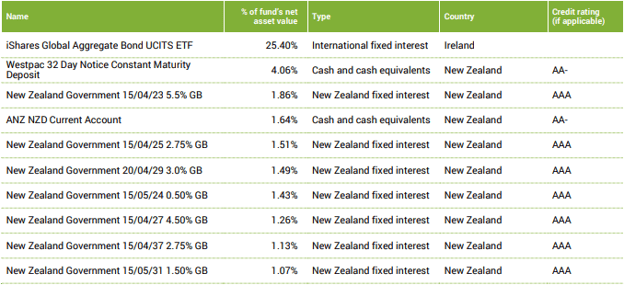

Top ten investments

This table shows SuperLife’s top 10 investments in the Income KiwiSaver fund, which make up 40.86% of the fund.

SuperLife Conservative Fund

The Conservative fund invests primarily in income assets and is proposed for investors that want a conservative investment option. The Conservative fund has had a good performance with a 1-year return of 5.79% higher than the 5-year return of 4.77%.

*The following is Sourced from SuperLife Conservative fund update

Returns

Fees

The total annual fees for investors in the SuperLife Conservative fund are 0.57% per year and a $30 administration fee.

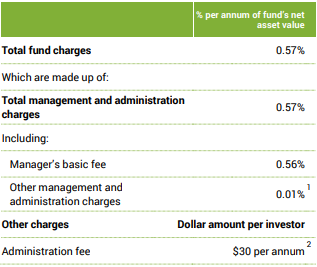

Investment mix

The investment mix shows the type of assets that the fund invests into.

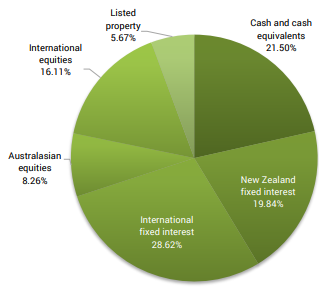

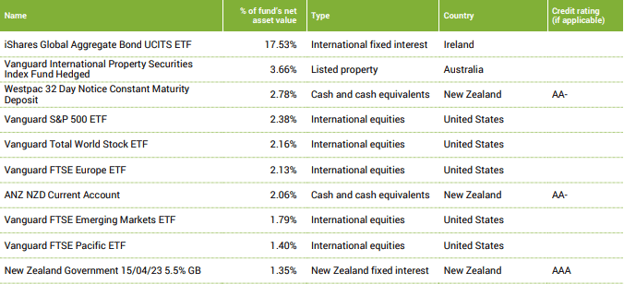

Top ten investments

This table shows SuperLife’s top 10 investments in the Conservative KiwiSaver fund, which make up 37.22% of the fund.

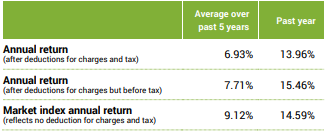

SuperLife Balanced Fund

The fund invests in a mix of income and growth assets and is designed for investors that want an investment option with volatility between a conservative and a growth fund. The 13.88% 1-year return shows a higher than usual return for the balanced fund for KiwiSaver investors and is significantly higher than the 5-year return of 7.34%.

*The following is Sourced from SuperLife Balanced fund update

Returns

Fees

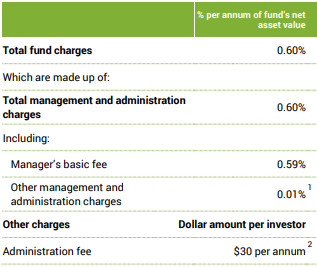

The total annual fees for investors in the SuperLife Balanced fund are 0.60% per year and a $30 administration fee.

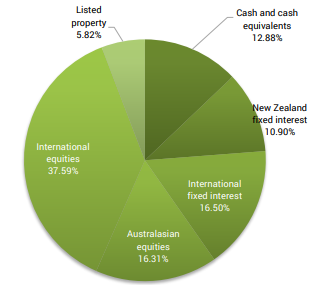

Investment mix

The investment mix shows the type of assets that the fund invests into.

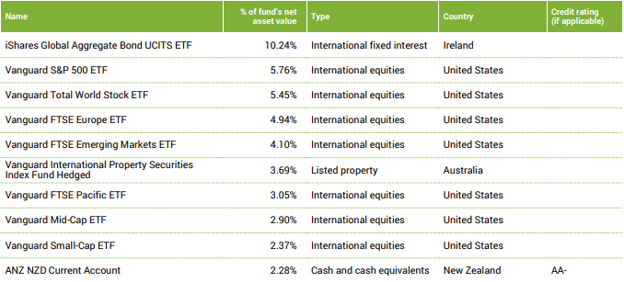

Top ten investments

This table shows SuperLife’s top 10 investments in the Balanced KiwiSaver fund, which make up 44.77% of the fund.

SuperLife Growth Fund

The Growth fund by SuperLife invests mainly in growth assets and is intended for investors with a high volatility tolerance that wants a growth investment option. The Growth fund has had an excellent 1-year return of 19.06% compared to the 5-year return of 8.80%, which was significantly less.

*The following is Sourced from SuperLife Growth fund update

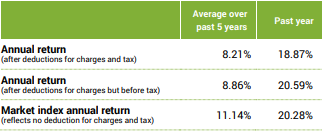

Returns

Fees

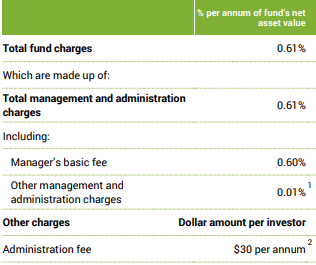

The total annual fees for investors in the SuperLife Growth fund are 0.61% per year and a $30 administration fee.

Investment mix

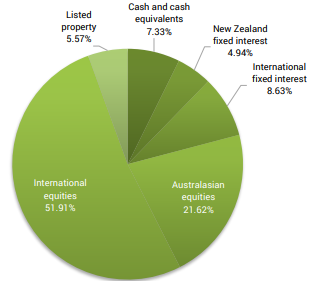

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows SuperLife’s top 10 investments in the Growth KiwiSaver fund, which make up 51.56% of the fund.

SuperLife High Growth Fund

The High Growth fund invests in growth assets and is intended for investors with a high volatility tolerance and desires an aggressive investment option that invests in shares and property. The High Growth fund has had considerable gains during the past year as for the 1-year with 24.55% returns compared to the fund's lower 5-year return of 10.22%. However, we should not give too much importance to short term returns over long term returns.

*The following is Sourced from SuperLife High Growth fund update

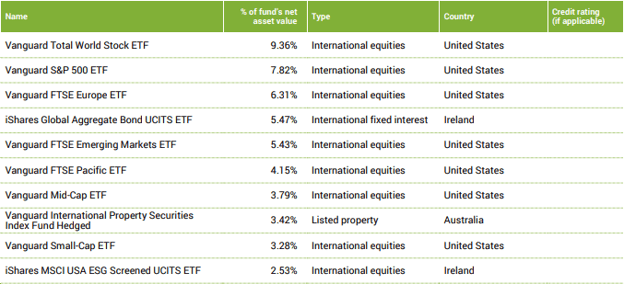

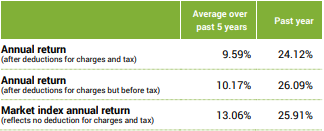

Returns

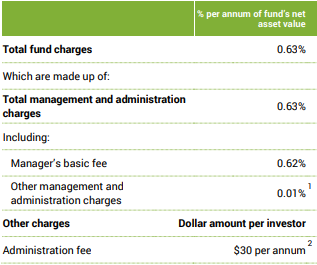

Fees

The total annual fees for investors in the SuperLife High Growth fund are 0.63% per year and a $30 administration fee.

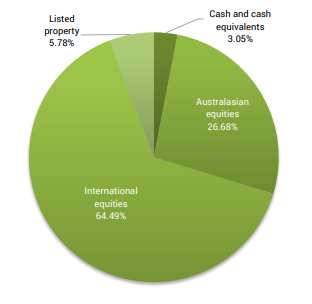

Investment mix

The investment mix shows the type of assets that the fund invests into.

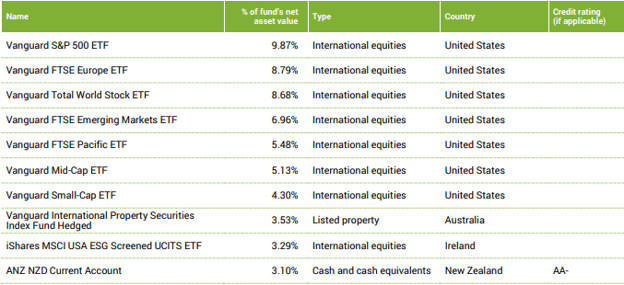

Top ten investments

This table shows SuperLife’s top 10 investments in the Aggressive KiwiSaver fund, which make up 59.12% of the fund.

SuperLife KiwiSaver funds have been sourced from SuperLife KiwiSaver Fund Updates. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if SuperLife has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.