Using the most recent returns from March 2022, we will take a look at SuperLife's recent KiwiSaver Performance.

SuperLife is managed by Smartshares Limited, a wholly-owned subsidiary of NZX Limited. SuperLife has over 50,000 members and offers KiwiSaver, investment, superannuation, and insurance options. The philosophy behind SuperLife is that investing in a more passive manner would provide greater long-term outcomes. They don't believe that investing in and out of the market on a frequent basis is always beneficial to investors.

In March 2022, investors weighed the implications of the invasion war and the accompanying sanctions on Russia on economic growth, energy prices, and global trade. Overall, this had a significant impact on financial markets throughout the globe.

Table Of Contents

Performance of SuperLife KiwiSaver Funds

SuperLife Income Fund

SuperLife Conservative Fund

SuperLife Balanced Fund

SuperLife Growth Fund

SuperLife High Growth Fund

Performance of SuperLife KiwiSaver Funds

|

1 month |

1-year |

3-years |

5-years |

|

|

Income |

-0.94% |

-1.83 |

1.41% |

1.90% |

|

Conservative |

-1.15% |

1.22% |

3.61% |

3.85% |

|

Balanced |

-1.48% |

4.07% |

5.98% |

5.77% |

|

Growth |

-1.71% |

5.75% |

6.98% |

6.78% |

|

High Growth |

-1.86% |

7.42% |

8.22% |

10.22% |

*Sourced from SuperLife fund performance report

* These returns are to 28 February 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from SuperLife Monthly Performance updates published on 14 February 2022.

SuperLife Income Fund

SuperLife Income fund Invests in income assets and is designed for investors that want investment in New Zealand and international fixed interest. The Income fund has had a 1-month and 1-year return of -0.94% and 1.41%, far below the 5-year return of 1.90%. This means the fund is producing returns but not at the expected performance level of the 5-years returns benchmark.

*The following is Sourced from SuperLife Income fund update

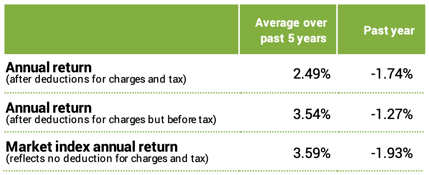

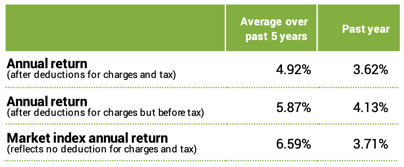

Returns

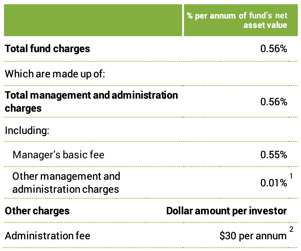

Fees

The total annual fees for investors in the SuperLife Income Fund are 0.56% per year. Although, Investors may also be charged individual action fees for specific actions or decisions (for example, for withdrawing from or switching funds).

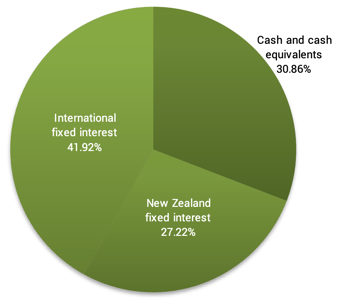

Investment mix

The investment mix shows the type of assets that the fund invests into.

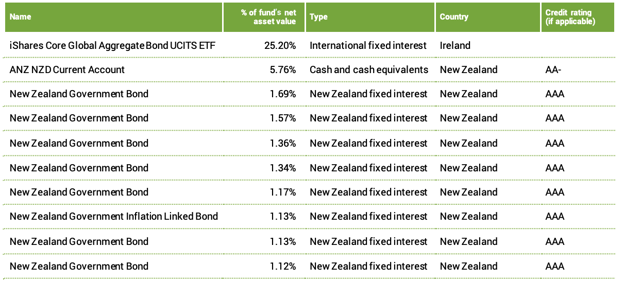

Top ten investments

This table shows SuperLife’s top 10 investments in the Income KiwiSaver fund, which make up 41.49% of the fund.

SuperLife Conservative Fund

SuperLife Conservative fund invests mostly in income assets and is designed for investors that want a conservative investment option. The conservative fund has had a 1-month and 1-year return of -1.15% and 1.22%, far below the 5-year return of 3.85%.This means the fund is producing returns but not at the expected performance level of the 5-years returns benchmark.

*The following is Sourced from SuperLife Conservative fund update

Returns

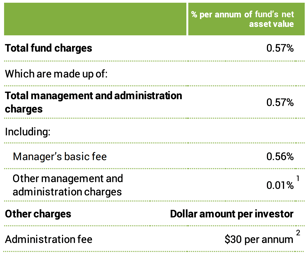

Fees

The total annual fees for investors in the SuperLife Conservative Fund are 0.57% per year. Although, Investors may also be charged individual action fees for specific actions or decisions (for example, for withdrawing from or switching funds).

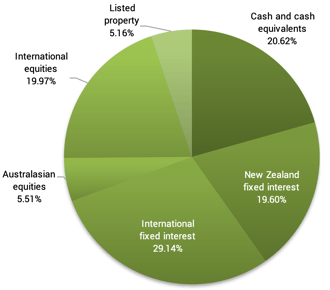

Investment mix

The investment mix shows the type of assets that the fund invests into.

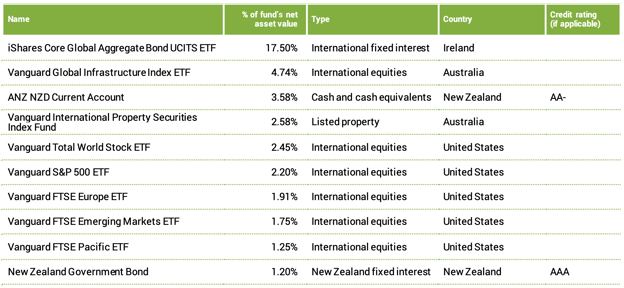

Top ten investments

This table shows SuperLife’s top 10 investments in the Conservative KiwiSaver fund, which make up 39.16% of the fund.

SuperLife Balanced Fund

SuperLife Balanced fund invests in a mix of income and growth assets and is designed for investors that want a balanced investment option. The balanced fund has had a 1-month and 1-year return of -1.48% and 4.07%, far below the 5-year return of 5.77%. This means the fund is producing returns but not at the expected performance level of the 5-years returns benchmark.

*The following is Sourced from SuperLife Balanced fund update

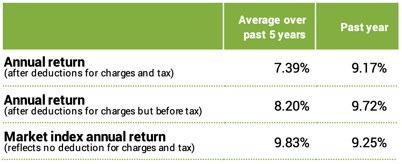

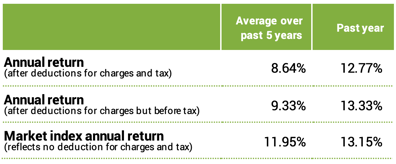

Returns

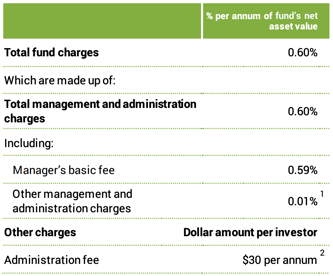

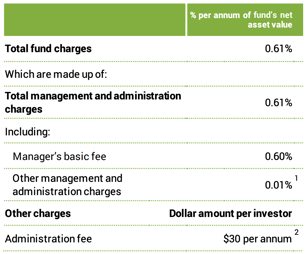

Fees

The total annual fees for investors in the SuperLife Balanced Fund are 0.60% per year. Although, Investors may also be charged individual action fees for specific actions or decisions (for example, for withdrawing from or switching funds).

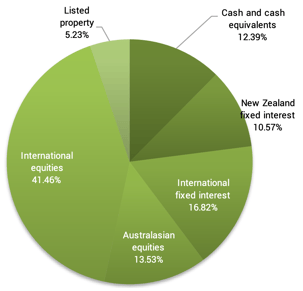

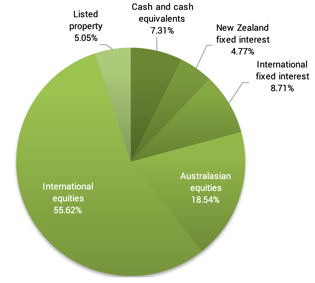

Investment mix

The investment mix shows the type of assets that the fund invests into.

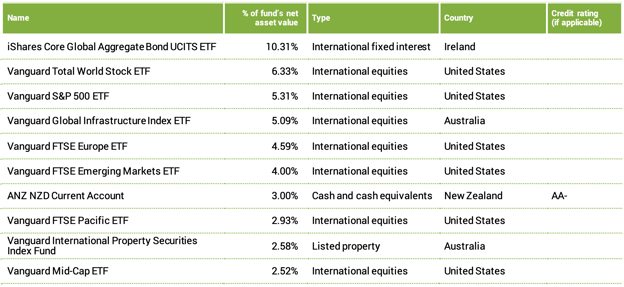

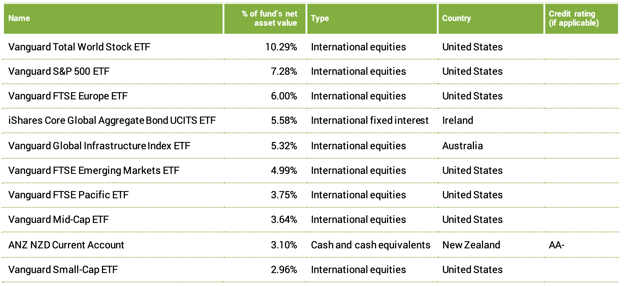

Top ten investments

This table shows SuperLife’s top 10 investments in the Balanced KiwiSaver fund, which make up 46.67% of the fund.

SuperLife Growth Fund

SuperLife Growth fund invests in a mix of income and growth assets and is designed for investors that want a balanced investment option. The growth fund has had a 1-month and 1-year return of -1.71% and 5.75%, far below the 5-year return of 6.78%. This means the fund’s producing returns but not at the expected performance level. This means the fund is producing returns but not at the expected performance level of the 5-years returns benchmark.

*The following is Sourced from SuperLife Growth fund update

Returns

Fees

The total annual fees for investors in the SuperLife Growth Fund are 0.61% per year. Although, investors may also be charged individual action fees for specific actions or decisions (for example, for withdrawing from or switching funds).

Investment mix

The investment mix shows the type of assets that the fund invests into.

Top ten investments

This table shows SuperLife’s top 10 investments in the Growth KiwiSaver fund, which make up 52.92% of the fund.

SuperLife High Growth Fund

SuperLife High Growth fund invests in a mix of income and growth assets and is designed for investors that want a balanced investment option. The high growth fund has had a 1-month and 1-year return of -1.86% and 7.42%, far below the 5-year return of 7.86%. This means the fund is producing returns but not at the expected performance level of the 5-years returns benchmark.

*The following is Sourced from SuperLife High Growth fund update

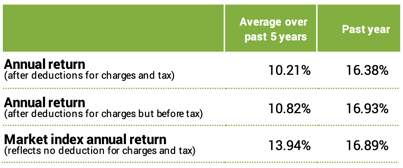

Returns

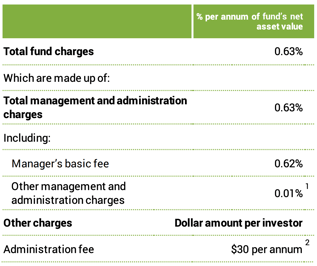

Fees

The total annual fees for investors in the SuperLife High Growth Fund are 0.63% per year. Although, Investors may also be charged individual action fees for specific actions or decisions (for example, for withdrawing from or switching funds).

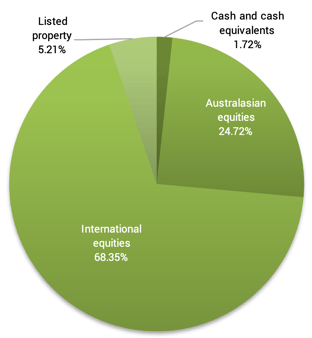

Investment mix

The investment mix shows the type of assets that the fund invests into.

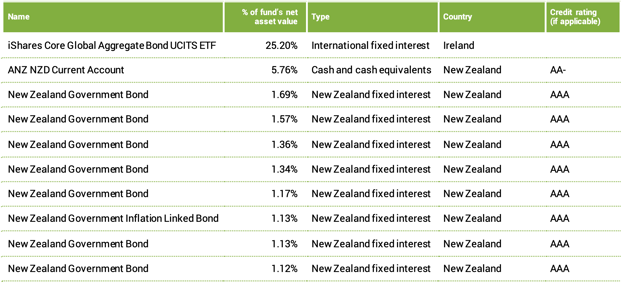

Top ten investments

This table shows SuperLife’s top 10 investments in the High Growth KiwiSaver fund, which make up 59.51% of the fund.

SuperLife KiwiSaver funds have been sourced from SuperLife KiwiSaver Fund Updates. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if SuperLife has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.