Civic Financial Services Ltd manages the SuperEasy KiwiSaver scheme to provide retirement benefits for New Zealanders who have connections with the local government. SuperEasy has low fees in exchange for a membership fee of $4.50 per month and has no setup charge or switching fee.

We’ll be looking over SuperEasy’s major funds as per the most recent annual returns from the 31st of October 2021 and SuperEasy’s latest KiwiSaver Performance. This includes their returns, fees, asset allocation, and the investment distribution of each fund. The analysis will give you an idea of how SuperEasy manages their KiwiSaver Funds and their Automatic Fund by examining the 40-year and 60-year funds.

The fund’s investment returns need to be considered in light of the market low caused by COVID-19 in 2020. There have been good returns in 2021 as the market readjusts itself, even with market returns dropping during September because of the lockdown and the economic state.

Table of Contents

Annual Return Performance of SuperEasy’s funds

Annual Return Performance of SuperEasy’s funds

|

31/10/2021 (% p.a) |

31/10/2020(% p.a) |

31/10/2019 (% p.a) |

|

|

Conservative Fund |

0.89% |

3.82% |

8.50% |

|

Balanced Fund |

8.51% |

3.06% |

12.45% |

|

Growth Fund |

12.85% |

2.35% |

15.11% |

|

Aggressive Fund |

18.80% |

2.64% |

16.78% |

|

40 year automatic Fund |

13.42% |

2.60% |

15.44% |

|

60 year automatic Fund |

7.77% |

2.79% |

13.80% |

Note: The returns arise from a single payment made at the start of the year, before investment fees, tax and expenses. Any past performance is no guarantee of future performance.

*Source SuperEasy’s Investment Returns

Conservative Fund

The Conservative Fund target asset allocations are 20% in growth assets and 80% in income assets. Its objective is to reduce the likelihood of negative returns over the short term while still providing an opportunity for positive actual returns by investing a smaller proportion of the Fund in growth assets. The annual return of 0.89% is still providing a stable return, although it is significantly less than the previous year's annual return of 3.82%. This shows the fund is performing well below expectations due to the minimal returns the fund is providing to KiwiSaver investors.

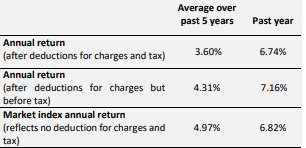

Returns

*Source SuperEasy’s Conservative Fund Update

Fees

The total annual fees for investors in SuperEasy’s Conservative fund are 0.47% per year, along with a $54 administrative charge that accounts for the monthly membership fees.

*Source SuperEasy’s Conservative Fund Update

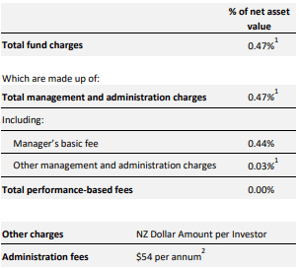

Investment Mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Conservative Fund Update

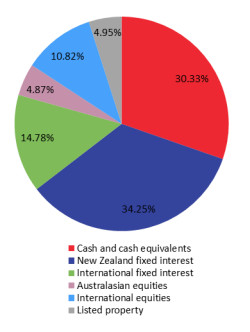

Investment distribution

The following is the distribution of SuperEasy’s eight investments in the Conservative fund, which make up the entirety of the fund.

*Source SuperEasy’s Conservative Fund Update

Balanced Fund

The Balanced Fund target asset allocations are 50% in growth assets and 50% in income assets. It aims to reduce the likelihood of negative returns over the short to medium term while still providing a reasonable opportunity for positive returns over the longer term. The fund has had an annual return of 8.51%, significantly more than last year's annual return of 3.06%, showing a positive performance for KiwiSaver investors.

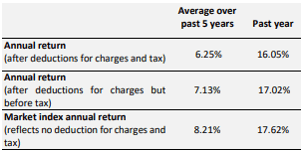

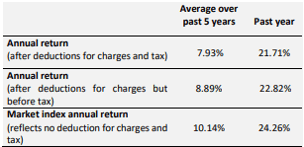

Returns

*Source SuperEasy’s Balanced Fund Update

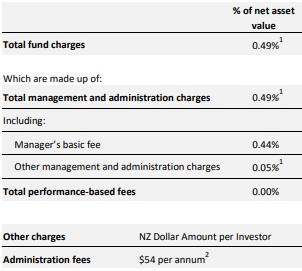

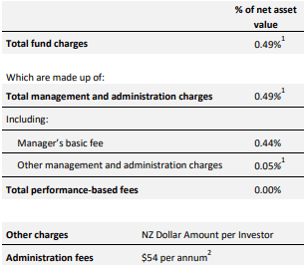

Fees

The total annual fees for investors in SuperEasy’s Balanced fund are 0.49% per year, along with a $54 administrative charge that accounts for the monthly membership fees.

*Source SuperEasy’s Balanced Fund Update

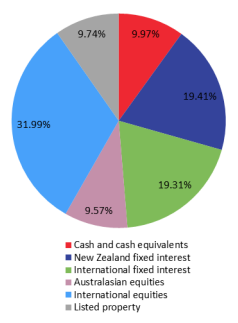

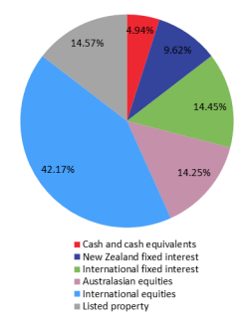

Investment Mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Balanced Fund Update

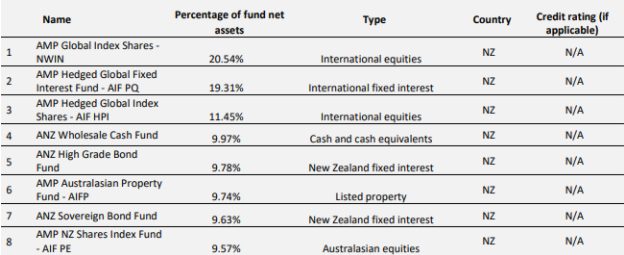

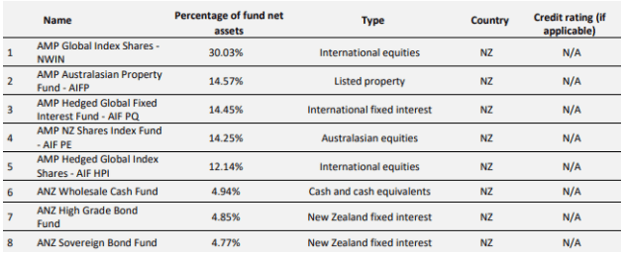

Investment distribution

The following is the distribution of SuperEasy’s eight investments in the Balanced fund, which make up the entirety of the fund.

*Source SuperEasy’s Balanced Fund Update

Growth Fund

The Growth Fund target asset allocations are 70% in growth assets and 30% in income assets. Its purpose is to achieve positive returns over the medium to long term through investment in growth assets while controlling volatility through diversification of the Fund’s assets. The recent annual return of the Growth fund was 12.85% which is considerably higher than the previous year’s annual return of 2.35%, an excellent performance for KiwiSaver investors.

Returns

*Source SuperEasy’s Growth Fund Update

Fees

The total annual fees for investors in SuperEasy’s Growth fund are 0.49% per year, along with a $54 administrative charge that accounts for the monthly membership fees.

*Source SuperEasy’s Growth Fund Update

Investment Mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Growth Fund Update

Investment Distribution

The following is the distribution of SuperEasy’s eight investments in the Growth fund, which make up the entirety of the fund.

*Source SuperEasy’s Growth Fund Update

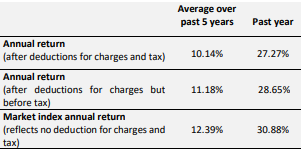

Aggressive Fund

The Aggressive Fund target asset allocations are 90% in growth assets and 10% in income assets. Its objective is to achieve a high level of actual returns over the medium to long term, primarily through investment in equities. The annual return was 18.80% which is remarkable considering last year’s annual return was 2.64%; this is beneficial for KiwiSaver investors.

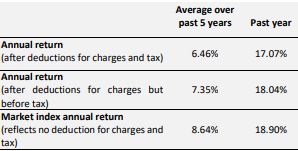

Returns

*Source SuperEasy’s Aggressive Fund Update

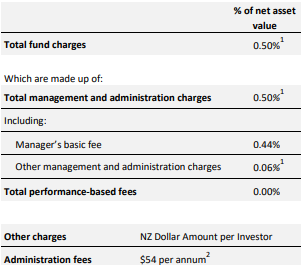

Fees

The total annual fees for investors in SuperEasy’s Aggressive fund are 0.5% per year, along with a $54 administrative charge that accounts for the monthly membership fees.

*Source SuperEasy’s Aggressive Fund Update

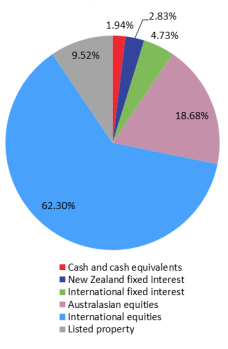

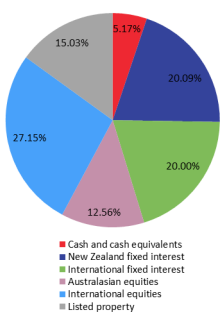

Investment Mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Aggressive Fund Update

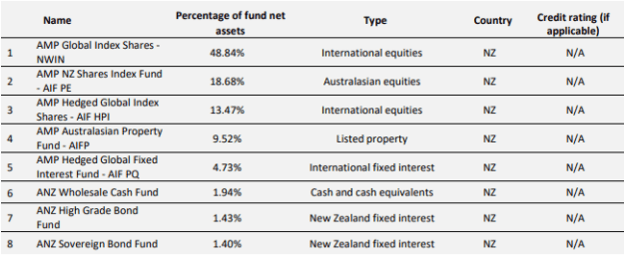

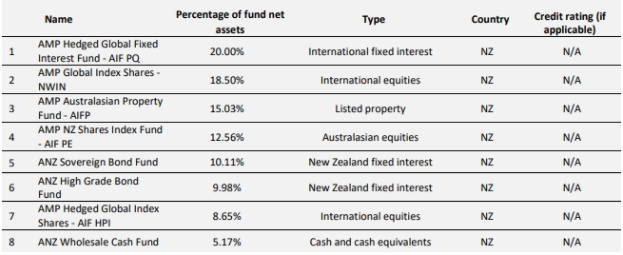

Investment distribution

The following is the distribution of SuperEasy’s eight investments in the Aggressive fund, which make up the entirety of the fund.

*Source SuperEasy’s Aggressive Fund Update

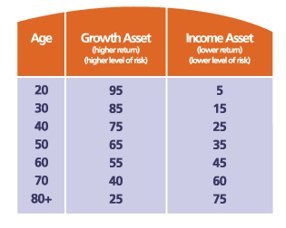

Automatic Fund

The Automatic Fund is a lifecycle investment option designed by SuperEasy so money can be invested, and your age will determine the investment mix of growth and income assets. The Automatic Fund will automatically decrease investment risk as you get older and remove the need to re-evaluate your investment plan. Each month as you get older, the Automatic Fund is designed to lessen your investment risk by reducing your target percentage of investments in growth assets and increasing your target percentage of investments in income assets. This limits the need to recover from any short-term losses and provides more stability as you get closer to retirement age. However, the fund is not designed with first home buying or retirement ages before or after 65. The 40-year and 60-year funds have the same fees (0.49%). However, the 20-year fund fees are slightly bigger(0.50%), and 80-year funds are smaller(0.47%).

*Source SuperEasy’s Automatic Fund

40-Year Fund

The fund had an annual return of 13.42%, which is well above last year’s annual return of 2.60%; this shows that the fund has been performing at a satisfactory level for KiwiSaver investors.

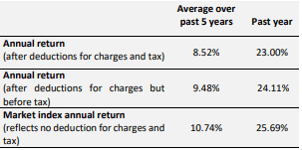

Returns

*Source SuperEasy’s Automatic 40 Year Fund Update

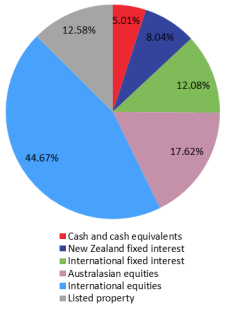

Investment mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Automatic 40 Year Fund Update

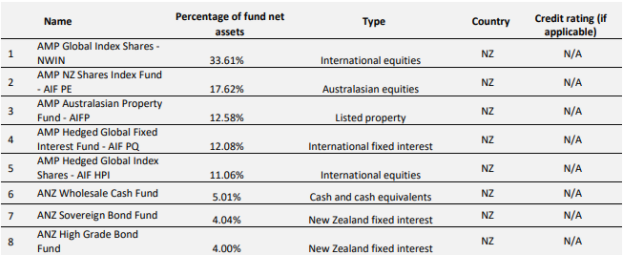

Investment distribution

The following is the distribution of SuperEasy’s eight investments in the Aggressive fund, which make up the entirety of the fund.

*Source SuperEasy’s Automatic 40 Year Fund Update

60-Year Fund

The fund’s annual return for the 31st of October 2021 was 7.77% which is greater than the preceding year’s annual return of 2.79%, displaying to KiwiSaver investors the adequate performance of the Automatic Fund.

Returns

*Source SuperEasy’s Automatic 60 Year Fund Update

Investment mix

The mix shows the type of assets that the fund invests in.

*Source SuperEasy’s Automatic 60 Year Fund Update

Investment distribution

The following is the distribution of SuperEasy’s eight investments in the Aggressive fund, which make up the entirety of the fund.

*Source SuperEasy’s Automatic 60 Year Fund Update

Note: The fees charged include an estimate for in-fund costs, which are fees and expenses recovered from the underlying funds we invest in by the respective fund managers. The in-fund costs are not fixed as these costs will vary slightly from year to year based on average balances. This means that this component of the annual fund charges can only be estimated.

To see if SuperEasy has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver HealthCheck.