Kiwis are struggling to cover the cost of retirement, even with NZ Superannuation. Despite the 3.09% increase to NZ Super in April, the payments continue to fall short of covering all the expenses Kiwis have in retirement, and that gap is widening.

There are a risk people will "struggle to live the lifestyle they want once they stop working," Financial Advice chief executive Katrina Shanks said.

In 2021, the cost of a minimalist lifestyle for single retirees residing in cities has gone up by $22.59 per week and $35.55 per week for a comfortable lifestyle. The rise in expenses for transport, housing and utilities were the highest costs to superannuants.

The lump-sum expected for a couple to enjoy a satisfying retirement living in a major city has grown by $24,000 in just two years, to a total of $809,000. However, those retiring in the provinces need only $511,000, according to research undertaken by Massey University.

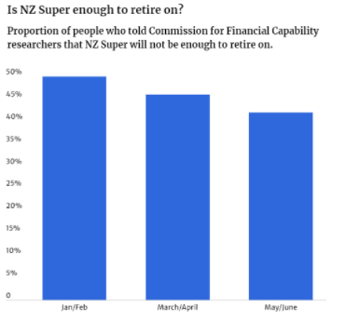

The single, living alone rate for NZ Super is $436.94 a week after-tax, and the rate for couples that both qualified is $672.22. This amount is not enough to retire for many New Zealanders, as shown in the survey results below.

“Retirement is only scary if you go into it in an unplanned, unprepared way. Then it comes as a shock to your system. That's the key message,” Pushpa Wood from Massey University says.

The latest Retirement Expenditure Guidelines produced by Massey’s NZ Fin-Ed Centre suggest that most Kiwis must make arrangements for additional retirement income. To avoid struggling in retirement, Kiwi’s need to be proactive about their preparation. Factors to consider include budgeting, life insurance, health needs, living arrangements, wills, enduring powers of attorney, family trusts and retirement activities. The average age of retirement in New Zealand is 69.8 years for men and 66.4 years for women. Because of the struggle to retire with only super, many people continue working past 65. Working past 65 enables people to draw NZ Super while building up their savings simultaneously.

What you can do to prepare for retirement

NZ KiwiSaver is a voluntary saving scheme to help set you up for your retirement and can assist you in getting you closer to the daunting lump sum. You can start saving for retirement as soon as you start working, putting in as little as 3% of your income by starting a KiwiSaver. Over time this will build up to a larger KiwiSaver balance and prevent or reduce the chance of struggling in retirement. With it becoming harder to live in retirement with only NZ super, having a balance prepared is almost necessary to retire at 65.

Because each individual's retirement savings goals will be different according to their financial situation, those unsure how much they will need for retirement should consult a financial adviser. If you want to see if your savings are with the right provider to set you up for retirement, have a look at our Health Check.